This article was first published on April 9, 2020.

The COVID-19 pandemic has had a major impact on almost all economic sectors, and insurers are no exception. While governments are limiting the damage by stepping in as insurers of last resort, Asian insurers’ market valuations have suffered in line with broader markets. As the pandemic is still unfolding, customers are currently focused on preserving their health rather than actively lodging claims. But, as the health and social environments improve, we expect the underlying impact on insurers’ underwriting performances to become clearer.

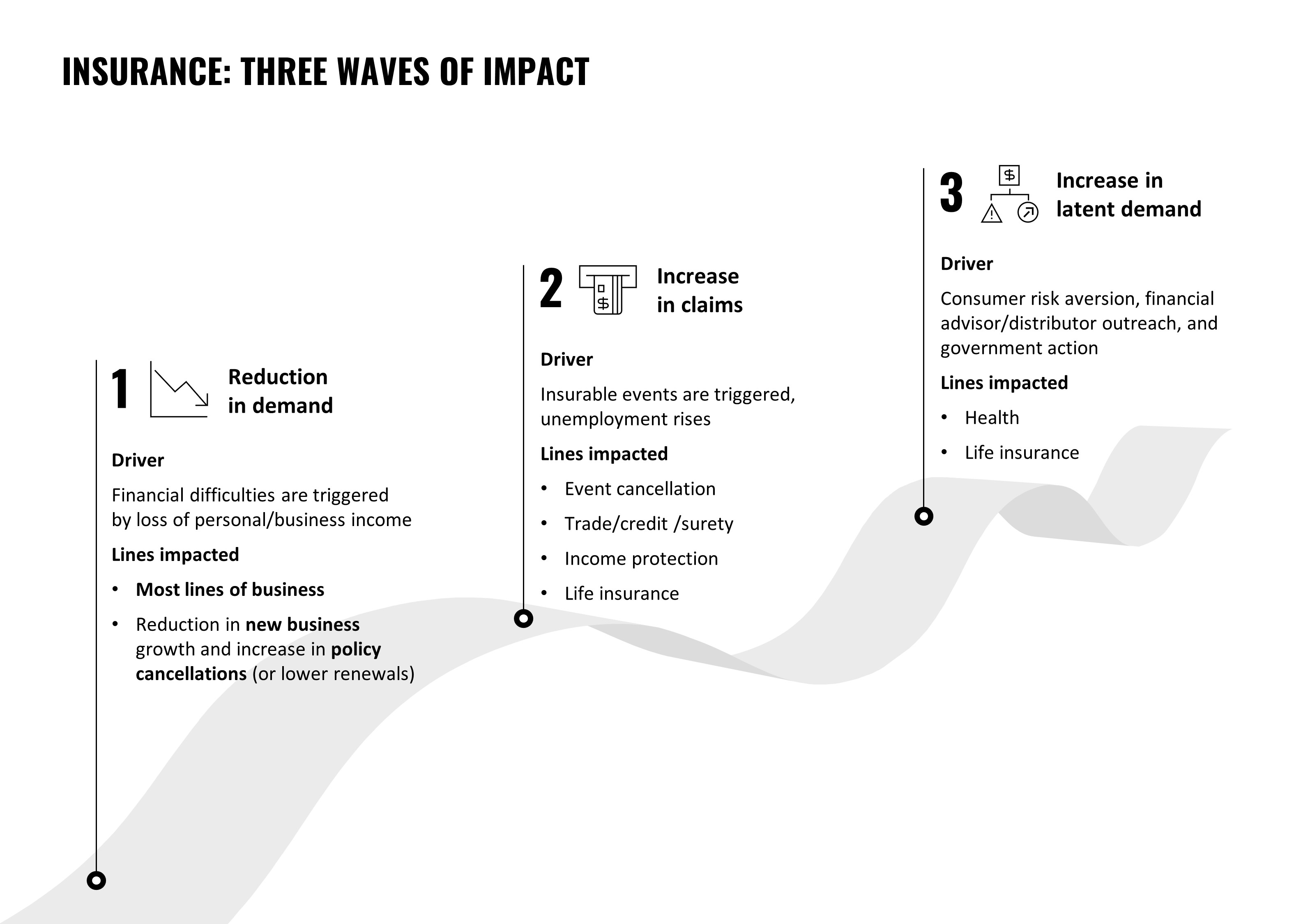

While the consequences unfold, insurers should start to prepare for the future, by accelerating the digitization of their operations and planning for business opportunities ahead. To do this effectively, they first have to understand the likely impact of the pandemic. We expect different lines of business to be impacted to varying degrees over time and the direct impact to be experienced largely in three waves. In the first, new business in most lines will decline, as potential customers lose income and are hit by financial difficulties. In the second, claims will increase following insurable events that follow from the pandemic. This will have an impact on lines including trade / credit / surety, life insurance and event cancelation. That said, claims in some personal lines, will likely decline. The third wave could consist of an increase in demand for insurance products: After the pandemic, people will likely become averse to risks and take out insurance to protect themselves. (See Exhibit Below)

Here is how we think the pandemic will impact different segments of the Asia-Pacific insurance sector – and how we think insurers should react.

Commercial Lines

Trade, credit, bond, and surety insurance. Liability lines across Asia are likely to be hit hard by widespread trade settlement delays, the drying-up of credit facilities, and insolvencies. Several lines will suffer a particularly hard impact: trade and credit policies, under which insurers pay up when the holder’s customer doesn’t because of events such as bankruptcy; bond insurance guarantees, which repay bondholders’ principal and interest payments in the event of default; and surety policies, which take effect if a party fails to fulfil an obligation, such as a construction project. Despite widespread interventions by most governments, banks, and credit institutions to limit or delay the stress to the financial systems, we expect a material impact on this class of insurance.

Event cancellation. The cancellation or postponement of numerous events, such the Tokyo Olympics and the Shanghai and Vietnam Grands Prix, are likely to trigger event cancellation claims. Not all events, especially the smaller ones, are insured, and some policies carry pandemic exclusions. So there may be relatively few claims. But those claims that are made could be significantly large: The Olympics, for example, has a total of $2 billion of insurance cover, analysts estimate.

Business interruption. Though a lot of businesses are directly impacted by the pandemic, business interruption (BI) claims are expected to be limited. BI policies often exclude “extraordinary events”, “forced business closures imposed by authorities”, and “infectious diseases”, and there are strong legal arguments that BI insurance is intended to cover property losses but not disease outbreaks. During the SARS outbreak, for example, BI claims were hotly contested in the courts. So legal challenges are likely to arise again in this instance. Typically, the ability to file BI claims depends on the policy wordings and would be evaluated on a case-by-case basis.

Workers’ injury. Employees infected by a virus while at work might file workers’ injury claims to cover loss of income or medical expenses. Organisations providing essential services – such as medical facilities, airports, and utilities – are particularly vulnerable to such claims. Presently, most governments in Asia are funding COVID-related treatment costs. But there is a chance that claims costs will surge over time.

Personal Lines

Personal insurance claims are expected to be significantly lower until lockdown restrictions are lifted, as people reduce the activities that typically trigger such claims. The widespread drop in car usage will mean fewer accidents, for example, while confining people to their homes could reduce the amount of property theft. However, this short-term upside is likely to be offset by an adverse impact on revenues, caused by lower (or delayed) renewals and limited new business.

While European insurers are expecting record claims due to flight cancellations,1 most Asian insurers were quick to announce COVID-related claims exclusions. Airlines and hotels have allowed customers to cancel or postpone trips with limited penalties. Accordingly, travel insurance claims are expected to be limited. However, as virtually all travel comes to a halt, insurers are expecting a significant hit to the volume of new business, compounded by premium refunds on cancelled travel policies.

Life And Health Insurance

A spike in COVID-related life insurance (mortality) claims will impact most life insurers across the region. Some have quickly changed the coverage provisions on new business, but that will have a minimal impact relative to their existing business. Rising unemployment may increase claims from income protection insurance, subject to policy limitations. For both lines of insurance in each market, the severity of the claims increases will be directly linked to the pandemic’s health and economic impact.

In several Asian markets – notably China, Japan, Korea, and Singapore – most of the medical expenses from COVID-related treatment are currently being borne by governments. The impact on private health insurers in those markets is therefore likely to be limited. However, in emerging countries with large vulnerable populations – such as India and Indonesia – the impact on private health insurers could be higher. Though the penetration of private health insurance is relatively low, a volume-driven spike in medical claims could be a significant cost for private insurers.

In future, the heightened awareness of mortality and health risks should result in a surge in demand for health and protection products in several markets. During the six months after the SARS outbreak in China,2 total health insurance premiums more than doubled.

The Way Forward: Shifting Priorities

Insurers’ priority during the COVID-19 pandemic has been to respond to customer and employee needs. So they are still assessing the impact, and many have been unable to provide updated earnings guidance.

Even before they know the probable fallout, they should take the following steps:

1. Consider a range of scenarios and the impact these will have on their businesses. Then formulate response plans.

2. Increase client outreach by using digital distribution channels and working with partners. Remind customers – actual and potential – of the importance of insurance in challenging times.

3. Accelerate their own digital transformations.

The insurers that emerge from this crisis successfully will be those that serve their customers in their time of need, while revising their business model for the post COVID-19 world.

References:

1. Insurance industry publication

2. SARS and its Impact on Insurance, July 2003, Asia Insurance Review