By David Gillespie, Lindsey Naylor, Patrick Hunt, and Lauren Lyons

This article was first published on March 10, 2020

As the number of cases of the Coronavirus (COVID-19) increases, the focus of companies must be on limiting the direct impact on employees and customers while also supporting efforts to limit the spread of the virus. The healthcare sector, airlines, travel firms, and supermarkets are experiencing the immediate impact, and face a huge challenge over the coming weeks to respond effectively to the emerging crisis.

But it is the banking industry that will have the greatest single influence on the United Kingdom economy, and how businesses and consumers are impacted by the emerging crisis. Poorly organized, knee-jerk reactions could lead inadvertently to banks amplifying the impact of the outbreak. Well structured, considered and organized approaches will serve to dampen it.

The outbreak comes at a point when the economy is already fragile with growth, slowing through the second half of 2019 and forecasts for 2020 seeing downgrades. The economy flatlined in the last quarter of 2019 and leading indicators such as business confidence suggest over half of companies see the virus posing a moderate or severe threat to their business.

Against this backdrop, banks are already starting to see early impacts of COVID-19 as individual clients experience cash flow pressures. As the outbreak becomes more severe, banks will see covenant breaches, sharp increases in provisions, and falling investment demand. All on top of the pre-existing commercial challenges for banks brought about by low interest rates.

The question for the banking industry is whether it responds in a way which amplifies or dampens the acute economic challenge. Even at this relatively early stage in the outbreak, our analysis suggests that at a European level, the impact of falling interest rates, reduced economic activity, and increases in loan provisions could be equivalent to a 3-5 percent revenue decline. As the outbreak escalates this will rise, as will the disruption to the operations of banks themselves.

All banks are working on their response to this challenge but, already facing material financial headwinds and low returns on equity, it is not a stretch to imagine a situation where triggers are hit and lead to a curtailment of credit to the economy, particularly small and medium-sized enterprises. We recommend all banks take six actions immediately to navigate this challenging and unprecedented situation:

1. SHIFT FROM BUSINESS CONTINUITY TO CRISIS MANAGEMENT

All banks are revisiting, in detail, their business continuity plans to reassure employees and ensure readiness for supply chain constraints, demand shocks, and impacts to business partners, prioritizing critical business activities and creating contingency plans for disruption. This is well underway, but will be insufficient if the situation continues to develop at the pace of recent weeks. Banks must plan and act on crisis management basis before, not after or if, it becomes a necessity.

Recent investments in business continuity planning and stress-testing provide a powerful starting point for the industry and should provide the basis for a considered response. But after the initial set of actions that these plans prescribe, management needs to steer their response based on the actual situation they face. Existing reporting frameworks and management information tools are necessary but not sufficient.

It is critical that all banks take a "Control Tower" approach and build on business continuity plans. Tailored scenario modelling and contingency planning to continuously ‘run the numbers’ is needed to steer the ship, and 80/20 decisions will be the order of the day. New leading indicators which have more relevance to the outbreak need to be integrated into decision making, and real time judgement calls from client facing, risk, and finance teams need to have a place at the table.

2. SCENARIO PLAN TO ‘LEVEL 5’

Most firms right now are only in the early stages of their response: managing the immediate issues for their own staff, such as announcing travel bans, cancelling large-scale events, and implementing quarantine periods. This is critical but only scratches the surface of where banks need to go.

Rapidly, banks need to consider a range of scenarios of how COVID-19 could impact their clients, financials, and their own operations. Specifically, we believe three should be considered:

1. Worst is over in two to three months: Acute crisis largely resolved within a two- to three-month period, where business gets back to normal quickly after a material "bump" in the road

2. Six months to regain control: More extensive period of disruption over a six-month period leading to a no-growth scenario for the economy or a limited recession

3. 12+ months ongoing pandemic: Virus spreads widely and public remains in heightened state of anxiety triggering a global recession

We make no comment in this note as to which of these is most likely, but we recommend banks consider all such scenarios and plan accordingly. This then needs to be taken to the ‘fifth level’:

- Level 2: Impact on those borrowers and associated sectors immediately and directly affected by COVID-19, with aviation the clearest example and where an updated view of the risk-rating of counterparties will be key

- Level 3: Wider ripple effects for associated industries immediately affected, such as travel-related firms, restaurants/hospitality businesses, firms whose revenue is directly linked to international travel, and tourism, through to those sectors impacted by a sustained period of disruption to international supply chains

- Level 4: Next-stage knock-on effects to key parts of the service industries that are of critical importance to the UK economy — notably banks, insurers, asset managers, lawyers, and accountants, all of which will be materially impacted if investor confidence is shaken and deal flows (and investment flows) dry up in both the public and private markets

- Level 5: Resultant impact on the end consumer, from those already feeling the pain in some sectors (such as reduction in zero-hours contracts by companies pulling back on near-term spend), to more systematic cost reduction (and therefore job losses) across a broad band of sectors, as firms take proactive steps to protect operating margins during a period of demand or supply turmoil

3. BE DECISIVE IN SUPPORT FOR CLIENTS

Every financial institution must do something with the data and insights it has. It must act. However obvious that may sound, the underlying premise of this effort is to take action – not planning for planning’s sake. That means translating those scenarios into clear, supportive steps split by client type, sector, and institution to fortify them through a period of unpredictable and potentially severe disruption.

There are no perfect rules to achieve this and decisions need to be made with imperfect information. But institutions that are successful will be those that display the necessary levels of mental agility to take decisive actions and focus on meaningful areas of support (for example, offering extension of credit terms, credit holidays, and more without knowing the ultimate profit and loss and balance sheet consequences). Banks will have to do so in a way that allows them to react to events and drive everything through the lens of what can help the customer and be sustainable.

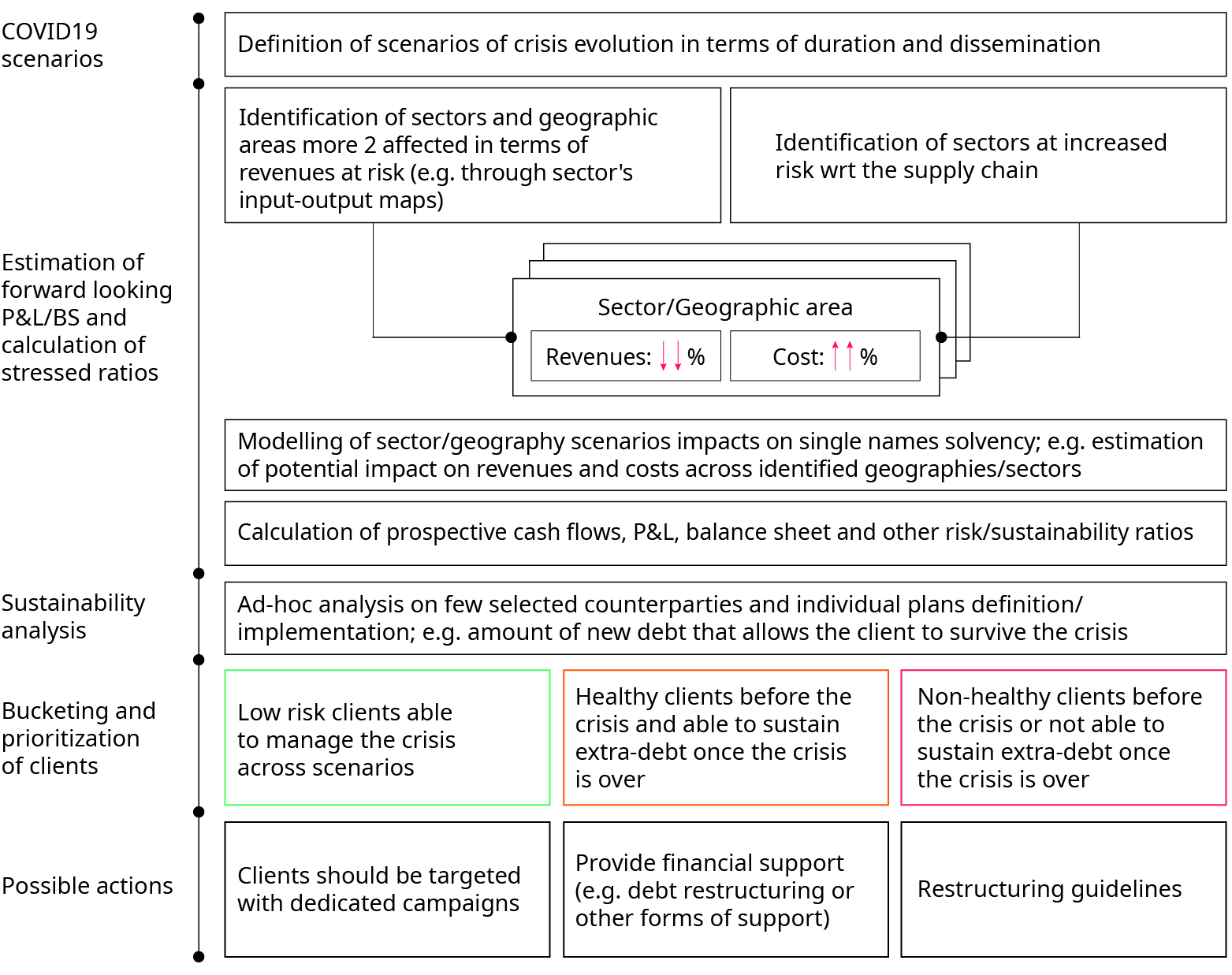

We recommend a rapid ‘triage’ approach based on an assessment of the sustainability of clients in the most impacted sectors and regions, as outlined in figure 1 below.

Triage approach

Guardrails must be set based on top-down assessments and judgements. Business and risk must be involved in this, and this thinking needs to be integrated with distress test planning. But implementation needs to be driven from the place where the information is greatest. Trust the front line and empower teams, within pre-set guidelines, to support the customer directly, and build feedback loops to drive best-practice solutions.

4. DELIVER ON THE DEMAND FOR DIGITAL

If China is any indication, there will be a massive acceleration in customer demand for digital channels in the coming days. China’s financial services sector experienced 100-900 percent traffic spikes in key digital channels during the outbreak. Customers are unlikely to return to analog channels. Most UK banks have a strong digital presence but may need to educate some segments around how best to access this. To achieve this, we recommend:

- Scenario plan around spikes in digital channel usage to ensure that the systems will remain online if they experience a 100-900 percent increase in traffic

- Rapidly develop and roll out an awareness/education campaign around digital capabilities and ramp up call-center support for less tech-savvy clients as they transition to digital channels

- Fill any gaps in the scope of services that can be delivered through online channels, for example large transfers, changing of names, probate

- Plan for changes to physical branch infrastructure if required to support vulnerable customers through a protracted outbreak and period of quarantine

5. PREPARE FOR THE LONG HAUL

Banks can only continue to support the economy while they themselves remain financially robust. The need to support the economy must be balanced against prudent institution-specific financial management. Business continuity plans will get companies through the next two to four weeks, and after a decade of stress testing and capital rebuilds, most institutions have sufficient financial resources to weather a downturn. However, after the initial scramble to respond, banks will need to look at the long-term impacts on their business. In the face of any prolonged downturn renewed management strategies will be needed.

In a scenario where the worst is over in two to three months, economic growth appears likely to flatline or reverse and central banks are likely to cut interest rates. Under this scenario our analysis points to revenues declines of 3-5 percent across European banking. If it takes six months to regain control, revenue losses could reach double figures and the threat of credit losses will rise considerably. We have not modelled through our third, most severe scenario due to unchartered territory in which we would be in at that stage.

Given the level of impact in the more extreme scenarios we believe it is prudent that banks start to build on existing recession readiness plans with the actions needed including:

- Building off the financial scenarios to determine the level of action that may be required on the cost base of the organization in each of the outcomes

- Based on this, develop an actionable view of the short and medium-term cost levers that can be pulled to hold up economics in the event of a prolonged downturn, without damaging the customer proposition or underlying competitiveness of the organization

- Working backward from implementation timeframes, determine an action plan that balances the need to continue to support the UK economy with prudent financial management

- Revisit and update inorganic options including partnerships, joint ventures and mergers and acquisitions

6. CONVENE THE INDUSTRY

A pro-cyclical response from banks to these pressures will deepen any downturn and flatten the recovery. The UK banks can and are taking action, but we believe the effort has to go further and the industry needs to look at ways it works in partnership with government and regulators, to help all industry participants support the wider economy. UK banks should develop a set of policy or regulatory requests that will support the ability of the banking industry to minimise the impact of this crisis on its customers, for example:

- Monetary and Fiscal interventions to support the economy (recognizing power of monetary policy may be muted due to already low interest rates)

- Social policy changes (statutory sick pay, for example) to support the cash flow of those taking time off work due to their own illness or to care for sick relatives

- Tax policy changes to give relief to business with cash flow challenges. For example, tax payment deadline extensions or relief on business rates

- Support of additional lending to business either via the banking sector, through mechanisms similar to the Enterprise Finance Guarantee scheme or directly to business and leveraging the role of institutions such as the British Business Bank

- Regulatory measures such as authorization for firms to use their countercyclical buffer as part of the response or, with regard to liquidity, changes to collateral policy, short-term repos, longer-term lending instruments for banks, additional quantitative easing programs

- Accelerate payments from government procurement procedures, specifically targeted at SMEs

- Customer forbearance programs: Lenders volunteering or being forced to suspending or reducing credit payments, waiving late fees, suspending reporting or foreclosures

The evolving COVID-19 situation is complex and a considered, well managed and coordinated response by the banking sector will have a major bearing on how well consumers and businesses weather the storm and, in turn, the economy as a whole performs.

There is already extensive work underway across all institutions on this issue, and we hope the six steps outlined ihere are helpful in making a difference in the weeks ahead.