This article was first published on March 30, 2020.

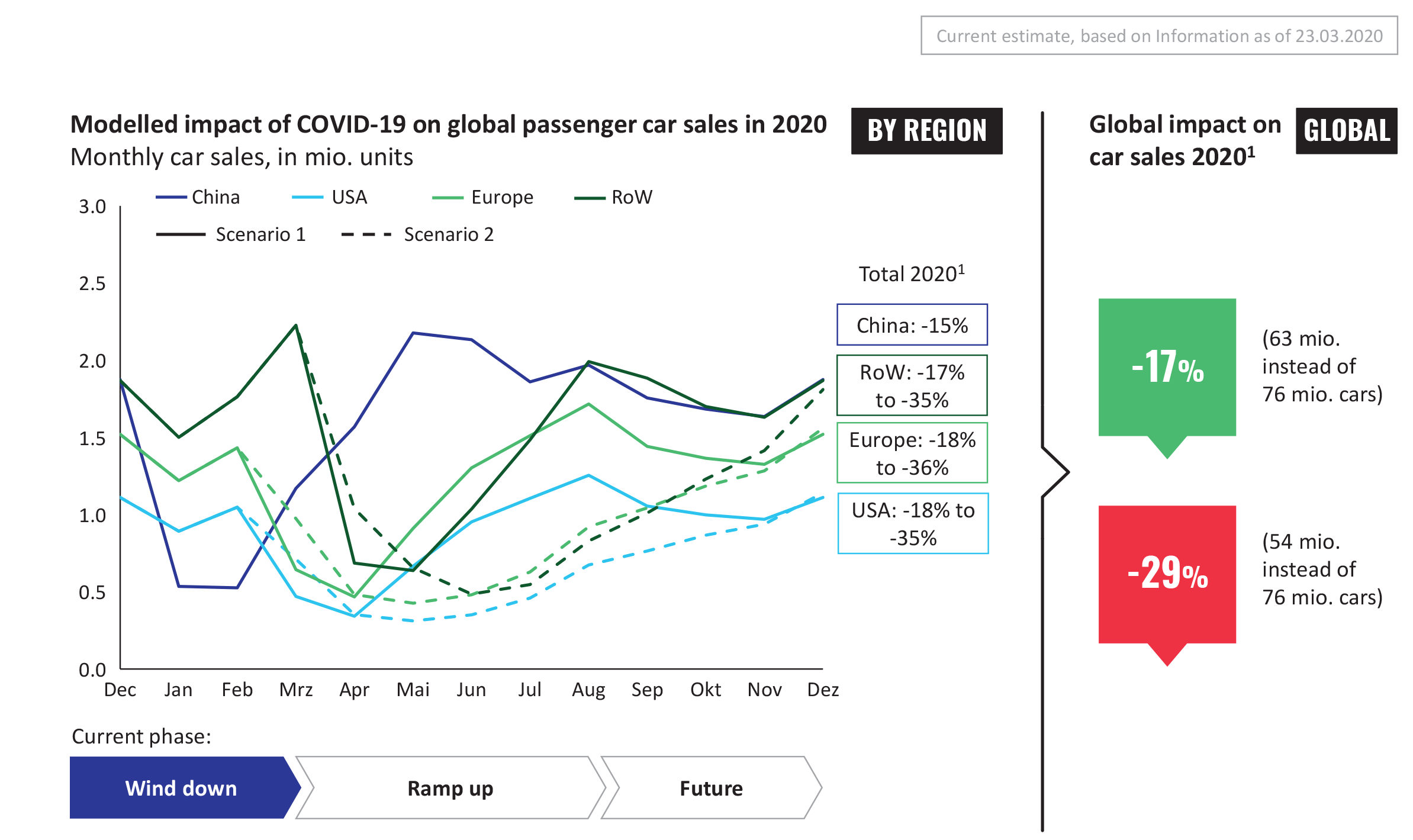

How will COVID-19 affect vehicle demand across the globe? Already we can see a significant impact of the pandemic to the industry: Production freezes, but also shrinking GDP and consumer uncertainty will lead to a double-digit decrease in global sales in 2020. Our current scenario foresees a drop in the range of -15 till -30 percent in global sales versus the previous year. As of now, we estimate a drop of -18 till -36 percent in Europe compared to last year, China will have -15 percent and the US will see a drop between -18 and -35 percent. These are huge and frightening numbers, but every crisis has an opportunity. The upswing is already underway in China, and manufacturers should get prepared for the ramp-up. COVID-19 puts the globe in front of a huge health challenge with highest priority but even more so now is the time to focus on the period after the crisis and find measurements on how to save jobs and navigate through these turbulent times in the best possible way.

First and immediately, stabilization plans for dealers and wholesalers need to be developed during the wind-down. The front line is facing forced shut-downs of sales operations, consumers are delaying their purchase decisions. The longer the shutdown, liquidity will be an issue. Many dealers reach a critical situation within weeks. OEMs need to develop support schemes to ensure contingency.

Secondly, during ramp-up, every country will have individual incentives and aid schemes to revitalize demand. Preceding crises show, that Europe typically takes longer to re-bounce to pre-crisis volumes than in the US. In Europe, it took more than eight years to return to the pre-2008 financial crisis state of the economy. Also, the southern European countries typically need longer to recover. OEMs need to be wary around national incentive plans and rebound patterns, each type will require a specific, fit-for-purpose set of sales actions. To what extent will European governments have to delay their support of alternative powertrains? Elaborated volume planning and allocation will be a key success factor.

Further on, customer communication and offers need to be tailored to the rising uncertainty amongst customers. Adjusting messages and shifting channels will be of great importance. There will be an increased need for short-term arrangements and flexibility to step-out, for new ways of financing and accessing mobility. Sales functions should be agile enough to be able to respond fast and absorb new offerings, e.g. through advancing the remarketing system.

Exhibit 1: The impact of COVID-19 on auto sales

We are still in first phase of epidemic crisis with high uncertainty in prognoses but our current estimated impact is a 17% to 29% decline in 2020 global car sales

Source: Oliver Wyman analysis. Baseline: LMC Automotive – 1) In % of original LMC Automotive global forecast for 2020 annual passenger car sales (before COVID-19)

Comparison: RBC Capital Markets estimate on coronavirus impact on global auto production down (as of March 16, 2020), vs. adjusted forecast of -9% by LMC Automotive (as of March 19, 2020)

The opportunity in this situation lies in accelerating the long-overdue transformation towards a much leaner, online-led sales model. The vehicle sales system is accounting for as much as 30 percent of the gross vehicle price; at the same time, it does not allow for a 360-degree customer view, neither does it render price stability with lots of intra-brand competition. Now is the time for an accelerated shift towards an online-led, customer-centric sales model. The recent COVID-19-developments in China have shown that during shut-down online channels have experienced a growth of between 100-900%. The transformation also entails further consolidation on the retail level, but also along the entire sales chain.

In essence, there is a great deal of preparation needed to be successful in the long term.