A version of this article was published on the World Economic Forum Blog on July 10, 2020.

China’s financial services industry is transforming at a rapid pace. Chinese policymakers have committed to opening domestic capital markets, which will create opportunities for Chinese individuals and investors as well as domestic and global financial institutions.

Chinese individuals have historically saved more than any other nation, with the majority of savings ending up in bank deposits or housing investments. As China’s population continues to age – and economic growth continues to slow due to COVID-19 – it is critical that Chinese investors can access safe and sustainable investment options to plan for retirement and other major life expenditures in a sophisticated way.

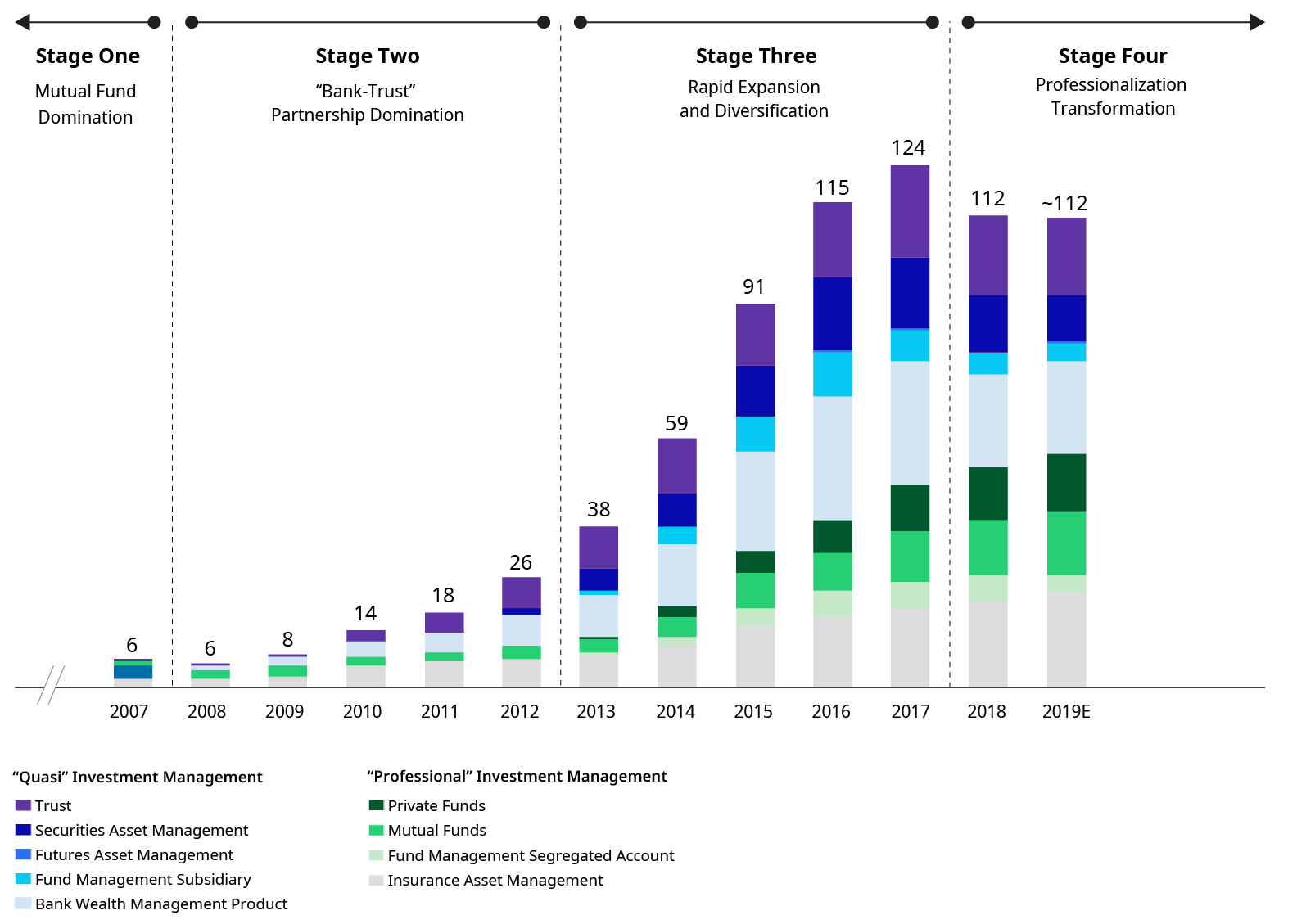

This is where asset managers come in. Asset managers, who match savings and retirement money with investment opportunities, are particularly important in this transformation. Within the past decade, the industry’s total assets under management (AuM) have grown ten-fold, reaching ~RMB 110 trillion (~$16 trillion) by the end of 2019.

The World Economic Forum, together with its knowledge partner Oliver Wyman, convened Chinese and global leaders from the financial industry, regulatory organizations, central banks and academia to explore how this transformation must be shaped to create a stable and accessible industry best positioned to contribute to economic growth and prosperity. We just published the findings in the report ‘China Asset Management at an Inflection Point’.

We learned that evolving regulation and the overhaul of China’s pension system will impact the direction of industry development. But there is also an additional, sometimes less understood, dynamic in play: the role of financial technology (Fintechs) in China.

Fintech will fundamentally reshape how customers interact with financial institutions, and how financial institutions create new sources of differentiation. As just one example, innovations in selling investment products, such as Yu’e Bao – using funds deposited in Alipay e-wallet to invest in money market funds – is unheard of outside of China. But since emerging in 2013, it is now managing trillions of investors’ funds.

Here’s how we got here – and where Fintech will lead the industry.

Total assets under management of China’s asset management industry (RMB trillion) [1]

Image: Asset Management Association of China (AMAC), China Banking and Insurance Regulatory Commission (CBIRC), and China Securities Regulatory Commission (CSRC), China Trust Association (CTA), WIND, Oliver Wyman Analysis

What happened in the past?

Historically, the industry has been fixated on selling the most profitable products rather than necessarily the best products for customers.

This worked well in the past as investments are practically “implicitly guaranteed” by asset managers. Institutions guarantee a certain return regardless of performance, and customers pocket 10%+ yield without much deliberation on suitability.

As the macroeconomy continues to slow and investment yield continues to decline, however, the “product push” model is no longer sustainable.

What’s next?

Far-sighted Fintechs anticipated the change and proactively managed the transition.

As an example, players are increasingly moving away from “cold data,” such as customer demographic surveys, to “hot data,” which are continuously generated from every single customer touch point. This facilitates better matches between customers and products and delivers personalized solutions (e.g. robo advisory). Some providers go one step further with Know Your Intention (KYI), to get an intimate understanding of how customers are making decisions.

Chinese policymakers have also been actively pushing for “customer centricity”. One example is the mutual fund advisory pilot program (基金投顾试点) announced in late 2019, which encouraged the industry to tailor investment options to customers’ financial goals. A joint venture between Ant Financial and Vanguard has rolled out robo-advisory offerings since April 2020.

Whilst the timing of profitability is uncertain, this is a long-term game and players are competing to capture the “lifetime” share of customers’ wallets. More importantly, this will ensure customers are investing in the most suitable products and accumulating wealth – which will be ever more important as the Chinese population continues to age and the pension system remains severely underfunded.

How to further accelerate the transformation?

Despite the industry’s impressive growth and positive outlook, Fintechs need to resolve a few challenges to unleash their full potential. The most pertinent include:

Data and technology are increasingly important in shaping access to and interaction with financial products. The ability of Chinese service providers to leverage technology to help small businesses and individuals access loans and digital services during the COVID-19 emergency demonstrated the importance of digital finance.

As the asset management industry is helping to ensure that individuals in China have sufficient financial resources to retire, pay for their children’s education or cover unexpected expenses, it is critical the industry continues to embrace technology. If it does so responsibly, and if it carefully guards against misuse or abuse, China’s asset management industry and financial system will continue to transform rapidly – and convey valuable lessons to other countries just beginning to embrace digital finance.

This article was also authored by Kai Keller, Platform Curator, The Future of Financial Services in China, World Economic Forum.