E-Commerce abandonment rates across all industries have been estimated to average around 70 percent of all transactions, and a sizable chunk of the drops are attributed to checkout issues. This is increasingly relevant for Telcos, as more services are being digitized. As Telcos aim to offer a unified retail experience, selection of a payment gateway should be made in the context of relationships with other online retailers. How can service providers select and on-board the right virtual point-of-sale terminal/payment gateway (PG)?

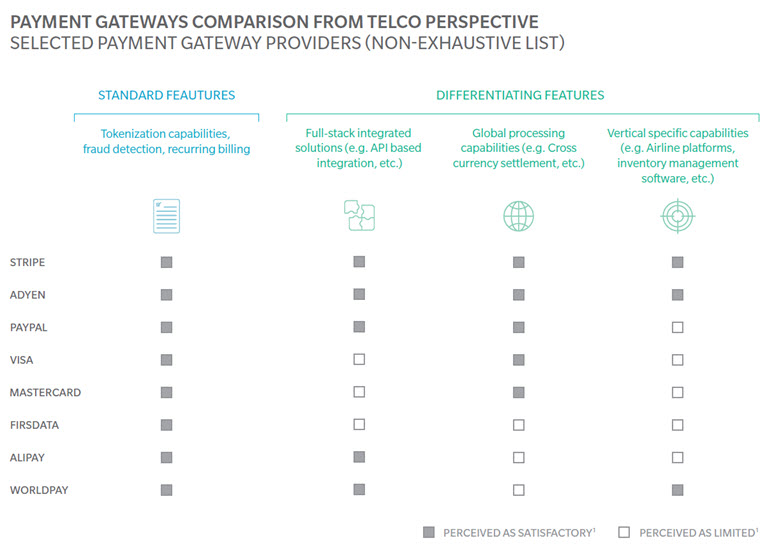

As Telcos seek to meet the needs of digital customers, they expect more advanced and full-stack solutions from PG partners. Features such as breadth of payment options (across credit cards and online wallets such as PayPal) and tokenization are perceived as standard, while global-processing capability and vertical specific offerings such as inventory-management software features are valuable add-ons (see “Payment Gateways Comparison”).

Traditionally, the selection criteria largely comprised of two factors—customer experience (checkout process, payment options) and financial considerations (payment schemes.) Telcos now realize that PG selection must include factors such as advanced analytics and post-implementation support. In addition, the decision should involve inputs from multiple parties—commercial (sales and marketing), technical (development), and finance (accounting and financial reconciliation) to ensure all business functions can benefit from data captured by a PG.

Enabling a successful long-term PG implementation requires consideration of several key success factors.

Key Success Factors for Payment-Gateway ImplementationApplication process and “build” phase integration. Cumbersome application process, drawn-out setup of a merchant account, and technical integration with merchant stack have been highlighted as key pain points by various merchants, and small and medium businesses. Increasingly, merchants are looking towards full-stack, integrated solution partners who can be seamlessly onboarded and quickly integrated through APIs.

Payment Gateway advanced capabilities. A PG must do more than simply process payments; capturing valuable data (such as geographic and card-type breakdowns) is a key asset. PGs are increasingly distinguishing themselves by providing advanced analytical tools, user-friendly dashboards, and innovative agent-tool capabilities. These capabilities add tremendous value to Telcos as they seek more insights about customer behavior and want to provide superior customer-care services.

Customer support. Customer complaints attributed to declined credit cards could result in millions of dollars of lost sales, but the unquantifiable effects of bad PR are more worrisome for Telcos. They expect 24x7 support from PGs across channels to quickly fix issues and avoid recurrence.

Settlement timeframe and commission. Telcos increasingly realize that getting cash faster from PGs could have a material impact on how they run their business and manage inventories and cash flows. Yesterday’s PGs could take weeks to pay out, but today’s providers are able to settle payouts in T+3 days, where T refers to the transaction day. Additionally, card transactions can cost up to 3 percent or more of the transaction. For low-margin services, this can eat a significant portion of the benefit. The good news is those fees are negotiable provided the Telco brings a significant volume of monthly transactions to the gateway. Payouts can be negotiated down to 0.5-1 percent, making online payments a much more viable option.

Security, compliance, and fraud. Modern PGs offer robust fraud detection, rule-based AI, and monitoring capabilities, along with standard tokenization, 3D-secure (3DS) authentication of cards, and authorization tools. 3DS is an efficient way to shift the liability of a transaction to the bank, relieving Telcos from the financial risk of a dispute; however, 3DS drastically raises the number of failed transactions. It’s important to ensure that the PG provider is PCI–DSS certified and eliminates the need for merchants to ensure additional compliance.

In sum, Telcos should recognize that PGs are a key enabler for the overall eCommerce customer experience and revenue acceleration. As such, selection criteria are not just a matter of product features, but requires input from multiple stakeholders. And post-implementation areas (such as advanced capabilities and settlement timeframe) are key to overall success.