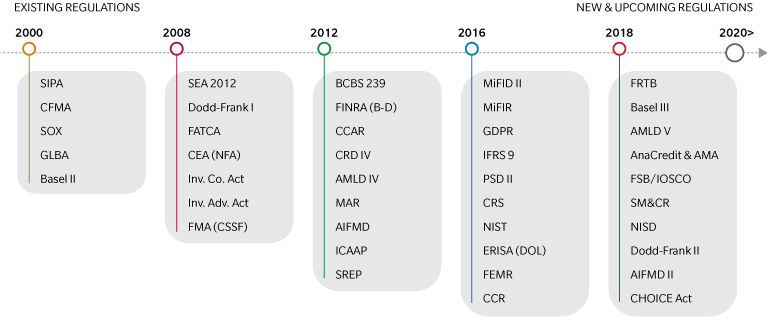

The financial-services sector faces the daunting task of complying with several distinct regulatory obligations that address financial crime, money laundering, and privacy. More regulations are in the pipeline, addressing capital liquidity, personal accountability, and conduct. Different regulations in different jurisdictions add to the complexity of compliance.

And failing to comply has a huge price. In the last 10 years, the sector has paid $321 billion in fines and penalties. And that doesn’t count the negative impact the fines have on an organization’s reputation and stakeholder confidence.

We are a technology company with a banking licenseCEO of a leading global bank

Meanwhile, between 2008 and 2016, the global investment-banking sector saw a three-fold increase in the cost of compliance and control. This is mostly because of the tactical, one-regulation-at-a-time approach to remediating compliance issues. This vicious circle of remediation programs makes it difficult to achieve real, progressive change. It is no surprise that banks have therefore looked to technology as a way to reinvigorate business models that have seen margins compressed by low interest rates and increasing costs.

Current practices around regulatory compliance clearly need to change. Fortunately, RegTech, or Regulatory Technology, is developing digital solutions that more and more large financial firms are deploying. Here we look at four ways RegTech can help redefine the future of regulatory compliance in the financial sector.

Network analytics uses data to learn more about customers and their connections. Many of today’s regulatory issues originate from transactions or behaviors that remain undetected by existing risk-and-controls frameworks. Network analytics allows banks to build customer profiles highlighting social liaisons, buying habits, lifestyle—and risk potential.

AI and machine-learning can help perform regulatory-compliance activities—including scanning for new or revised regulations, risk reporting, and sharing the impact of such changes with relevant stakeholders. AI algorithms can be trained to automatically perform these tasks, with appropriate review at key decision points by the compliance-process owners.

Patterns recognition requires using natural-language processing capabilities in combination with information retrieved from biometric and facial-recognition data, voice data, and also information generated by social media and electronic communications, to uncover risks that may not be identified by only having insights into one data source. Data collection (all sorts and all forms), storage in a lake-like architecture, and deploying a powerful, real-time analytics engine are precursors to building a good patterns-recognition solution that is capable of tracing hidden risk signals. Benefits are far reaching, as this technology could be used to comply with a number of regulations on financial crime, money laundering, and market conduct (such as AMLD, FinCEN, and MiFID II), since these regulations demand proactive surveillance.

Virtual-assistance robots automate and accelerate the speed of risk-identification, controls monitoring, and residual risk mitigation by using a set of pre-defined, standardised, risk-management processes. Automating the risk-management process makes it easier to deal with different regulations in different jurisdictions that cater to similar risk profiles. For example, as both the Dodd-Frank Act in the United States and the MiFID II regulation in Europe cover consumer protection as a primary objective, virtual assistants could be used to monitor controls and report outcomes against both of these regulations at the same time.

Overall, benefits of these RegTech solutions to the financial-services sector will be huge. A recent Financial Times article estimates that differences in various global regulations pushes compliance costs to a whopping $780 billion annually, which could be invested to generate a further $5 trillion of capital.