The world once was simpler: Gradual product technology improvements over time with the odd innovative leap, but often or luckily not overlapping in its timing. This combined with the mostly stable way consumers acquired and consumed the product “auto” fed by the kaizen-driven way of production improvements.

Yes, consumer demand was changing, new markets where opening, legislations changed, trade barriers lowered and cost pressure was and is ever present. However, overall it was a predictable industry with clear roles between auto manufacturers and the tiers of suppliers, more or less interchangeable product development, production and distribution processes. Logic of where and when to allocate budgets was established, ways of attracting talent and continuously innovating, designing and bringing new vehicles for every niche to the customers were a given.

Fast forward to today and into the next decade. Not only is the industry dealing with significant product technology challenges with globally varying regulatory constraints/freedoms impacting the fundamental design of vehicles, but also how the products are created and finally consumed. The questions on where to set priorities, what to fund and what to define as a future differentiators are difficult to answer, especially if you don’t see the full picture.

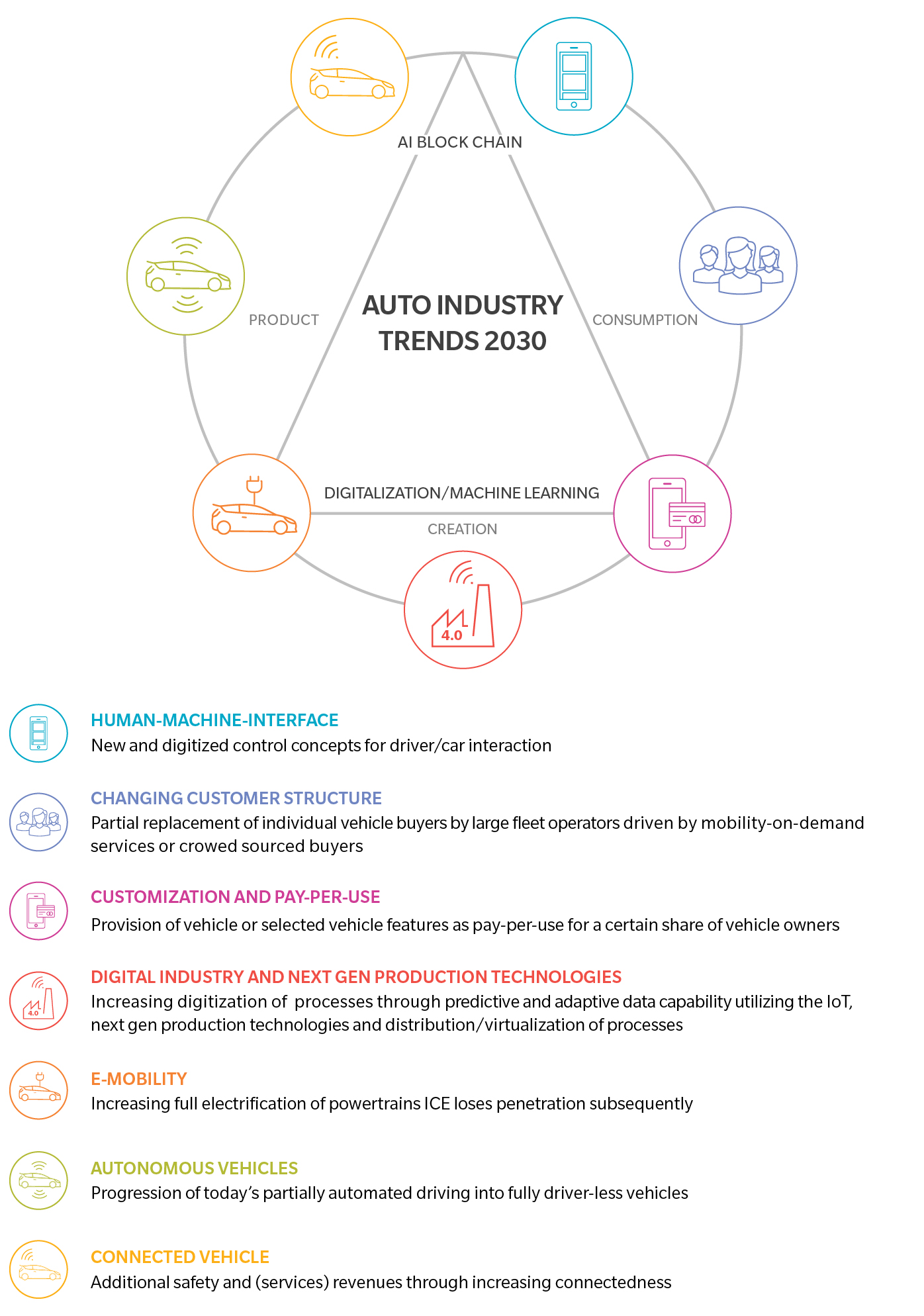

The Mighty Seven - Automotive Industry Trends Until 2030

Innovations that will propel the automotive industry, enabled & accelerated by Digitalization, Artifical Intelligence/Machine Learning and Blockchain technology

Product

The industry is clearly working on the obvious and often quoted E-mobility and Autonomous Driving Technologies. However, the question needs to be raised, are players truly optimizing the fundamental ways to master those and address other parallel technology innovations.

We see executives having to fell far-reaching decisions within a large area of conflict between different technology and product options in a talent starved industry while trying to use “traditional” innovation and product development processes. Trends of powertrain electrification, autonomous, Connected and Digital Vehicles as well as a revolution in the Human-Machine-Interface lead to continuous horizontal shifts between vehicle systems and vertical shifts between the player archetypes in the automotive value creation – also towards areas outside current core capabilities of manufacturers and suppliers. Rather limited development capacities and financial funds don’t make their life any easier.

Creation

Not only the products, but also the process behind creation is changing drastically as Digitalization i.e. Digital Industry conquers the automotive value chain from the idea-to-produce over sales-to-delivery till operations and services. The resulting value and profit creation is huge, but also the necessary investment for a complete digital transformation utilizing Next Generation Production Technologies. In order to not lose ground, car manufacturers and suppliers need to invest strategically and holistically align along the value/supply chain to implement new technologies successively.

Consumption

New customer archetypes and a change in preferences towards individualized (“on-the-fly”) product offerings/usage and complementary mobility concepts shift the market dominance between the traditional players and a need for innovative ways to work the market successfully in the long-term. Consumers truly start to question the way the product “auto” is consumed, from the traditional car ownership to its maintenance. Ultimately, these questions may challenge the survival of the traditional dealer/car manufacturer relationship, especially in light of longer lasting vehicles and declining maintenance requirements when moving to the future electric/digital vehicle.

AI and Blockchain technology allows an acceleration of speed of digitalization…affecting all trends

Across all trends the usage of Artificial Intelligence, Machine Learning and Blockchain technology, will further accelerate the digitalization of the whole industry. Building-up expertise in those fields across all trends is unavoidable and essential to succeed in this hyper-dynamic, fast-changing industry environment.

Artificial Intelligence and Blockchain Technology would address the V2X security concerns (many senders, many receivers) without leaving the vehicle vulnerable to hackers. It enables distributed and accelerated product development processes between suppliers and manufacturers. It likely will reduce costs by streamlining operations through simplification of the coordination between different stakeholder in all aspects of the value & supply chain. It might set up new revenue streams through connected and digital services touching areas such as shared mobility.

These advanced digital platforms can make middlemen redundant and revolutionize the maintenance, spare parts and warranty business.

The subsequent speed of transformation is bringing enormous challenges for all players who need to perform deep interventions across the whole organization and adjust their own business models to ensure future competitiveness and survival.

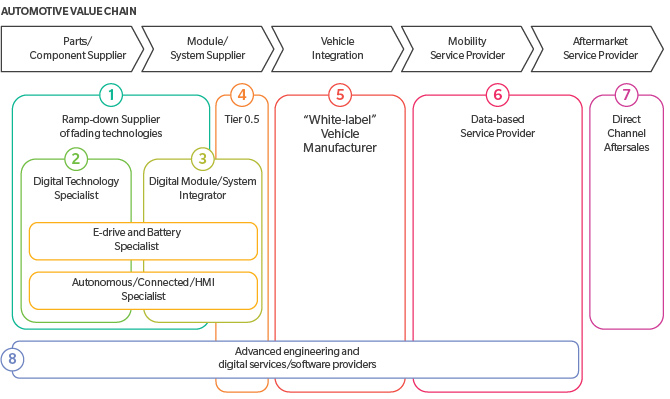

New Automotive Business Models

Driven by the current and emerging trends, new supplier business models are appearing along the automotive value chain

Today’s suppliers have to ask themselves how their roles are evolving and changing, competing with car manufacturers for talents and where to position themselves in this multifaceted trend driven and changing industry set-up.

Will one become a Digital Technology Specialist that focuses on individual parts or a bit broader, a Digital Module/System Integrator covering whole modules / systems of digitally enhanced software and hardware? Maybe be a derivate of those two and truly be the go-to for integrated E-drive, Power Electronic and Battery solutions specialist or the parts and systems partner for the auto manufacturers around Autonomous/Connected/HMI.

Todays already larger players might find their sweet spot in the evolving Tier-0.5 role becoming an irreplaceable strategic partner of the auto firms, reversing, but redefining some of the outsourcing trends of the 1990s. Or even more extreme, in this possible crowed sourced, consumer empowered new future and be a “White Label” vehicle manufacturer, possibly competing against OEMs that need to fill open capacities.

With new consumption models new revenues streams will appear and with the IT empowered expected streamlining of the supply & value chain, middleman – like vehicle & parts dealers will find their roles challenged, even when currently protected by legislations.

Emerging Data-based Service Providers would aim to dip into the new usage and solutions revenue streams while parts and component suppliers could aggressively embrace additional Direct Channels Aftersales business revenues, if they can establish professional B2C organizational set-ups in parallel to their B2B business.

All these new and evolving business models would be complemented by a new generation of overarching advanced engineering and digital services/software providers, who would aid the transition of the industry, being the conduit as well as gap filler for today’s car manufacturers and suppliers around software, Artificial Intelligence and digitalization.

At last and for sure not least would be those suppliers or spin-outs that reap the final revenues of the fading technologies until the ramp-down is completed.

While the future is hard to predict, one thing is clear, many underestimate the changes and challenges the industry is facing; an industry that will be hard pressed to deal with additional difficulties like trade hurdles or globally unaligned regulations.