KEY TAKEAWAYS

- Innovation in healthcare is often synonymous with greater sophistication and better quality, but often with incremental costs for health systems. Given affordability and/or access challenges across the globe, cost efficiency needs to remain a key part of the value proposition.

- Disruption of the status quo in healthcare will not come in the form of a silver bullet technology solution or a shiny new government regulation. It requires collaboration between the public and private sector, plus a blend of both traditional and non-traditional models.

- There is no one-size-fits-all model for commercial and service innovations, but rather a range of models that are can be customized to health system structures and requirements.

Healthcare has historically focused on science and clinical innovations that enabled the discovery of new drugs, development of new devices, and design of new treatment approaches. What has often been overlooked are commercial and service innovations that enable systems to “do more with less” – or at least “do more with the same.”

Global healthcare spending is expected to increase from $7.2 trillion in 2015 (10 percent of global GDP) to $18.3 trillion in 2040 (12 percent of estimated global GDP). With rapid growth, the age-old health challenges of balancing access, quality, and cost of care are more relevant than ever in both developed and developing global markets. This is evidenced by the continuing gap between the demand and existing supply for care, rising national health budget deficits, medical inflation outpacing overall economic growth, and large variations in clinical outcomes.

By definition, the status quo is not sustainable. Innovation is not only practical, but necessary across all fronts, from policy to care delivery to financing. With healthcare systems globally facing financial and operational pressures, commercial and service delivery innovations are increasingly being used to rethink the “lines” and current operating constructs.

GETTING MORE BANG FOR THE BUCK

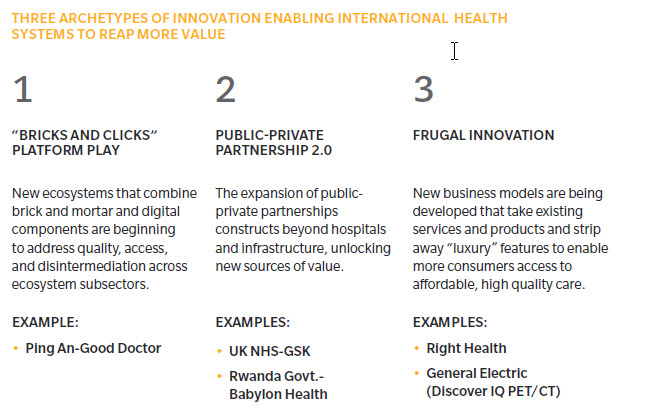

In particular, we see three archetypes of commercial and service innovation enabling international health systems to extract more value from their health spending.

1. “BRICKS AND CLICKS” PLATFORM PLAY

Could the future be a model that combines both “bricks and clicks” to address the dual global challenges of quality access and widespread disintermediation within and amongst subsectors in the ecosystem? The Amazon-JPMorgan-Berkshire Hathaway venture certainly has a flavor of this in the US. On the other side of the pond in China, Ping An has been building out businesses for many years with similar principles.

Ping An has also invested heavily in healthcare, with assets in health insurance (Ping An Insurance), health data (Ping An Health Cloud), and care delivery (such as Good Doctor and WanJia). The differentiation in this healthcare focus and strategy is clear – Good Doctor debuted on the Hong Kong Stock Exchange (HKSE) earlier this year not as tele or virtual doctors, but with an equity story to be the world’s largest health ecosystem. Indeed, while its 193 million registered users have access to virtual consults, it also incorporates Rx delivery and offline network coverage of 3,100 hospitals, 1,100 health check-up centers, and 7,500 pharmacies, and draws on Ping An insurance.

2. PUBLIC-PRIVATE PARTNERSHIP 2.0

The concept of decades-old public-private partnerships (PPP), traditionally focused on infrastructure build-outs with common frameworks around financing, finance-build-operate-transfer, or operating contracts such as concessions. Although these are expected to remain a source of health sector development in many growth markets, the expansion of PPP constructs beyond hospitals and infrastructure is unlocking new sources of value.

For example, big pharma’s shift away from traditional short-term sales maximization to partnerships with government payers could lead the way. The United Kingdom’s National Health Services (NHS) is engaging with select pharma players in new risk sharing, value-for-money arrangements for specific therapies. British pharmaceutical company GlaxoSmithKline (GSK) recently announced a partnership targeted at chronic obstructive pulmonary disease (COPD) with Manchester’s health system, which is enabling faster access to drugs and is building a foundation to redefine clinical guidelines and reimbursement approaches for new therapies and drugs.

Another example of PPP 2.0 is the Rwandan government partnership with UK-based Babylon Health to launch Babyl, a digital health platform that is accessible as part of Rwanda’s Universal Health Coverage Scheme. Rwanda, a nation where almost 70 percent of the population lives in a rural setting, is plagued by doctor shortages; the platform enables registered users to use their mobile phones to book medical appointments, receive prescriptions, and access their medical records. As of May 2018, 2 million Rwandans (or about 16 percent of its 12 million population) signed up for the program. These 2 million people represent the highest penetration of digital delivery of healthcare in the world.

3. FRUGAL INNOVATION

Innovation in healthcare is often synonymous with greater sophistication and better quality, albeit at a higher cost. But given that most nations outside of the Organization for Economic Co-operation and Development (OECD members) are challenged by affordability and access to care, cost containment remains a priority. The concept of “frugal innovation” is more relevant than ever.

Frugal innovation is taking existing products and stripping away non-essential or “luxury” features to enable products to reach more users faster and more economically. While this is common in other industries (such as mobile phones), there is certainly room to apply this more broadly in healthcare. This type of innovation can take the form of smaller pack sizes for pharma, to simpler, more rapid diagnostics – or to rethinking care delivery requirements.

Right Health, a United Arab Emirates-based primary care provider, has developed a business model focused on provision of low cost, high quality primary care for blue-collar workers. Its model is simple: rapidly achieve economies of scale to enable a “no frills” low capex model, that focuses on investments into clinical expertise, technology, and data analytics to improve quality of care. GE Healthcare famously adopted this frugal innovation approach in emerging markets, with more than two dozen such innovations already developed. For example, in 2014, GE launched the Discover IQ Positron Emission Tomography-Computed Tomography (PET/CT) in India that is 40 percent cheaper, provides up to two times improvement in PET quantitative accuracy, and offers two times the improvement in image quality.

GREATER IMPLICATIONS

Innovation has always been central to healthcare, but today’s industry challenges are not only medical. They are also now about value, affordability, and access. Expanding the frames of innovation to include commercial and service innovations, and taking a page from untraditional places, is necessary to disrupt an industry that so badly needs it. However, disruption won’t come in the form of a silver bullet technology solution or a shiny new government regulation. It requires collaboration between the public and private sector, plus a blend of both traditional and non-traditional models. Without innovative and forward-thinking approaches, health markets globally will struggle to keep pace with the care delivery requirements of an aging population that is increasingly plagued with non-communicable diseases, and funding growing health spend that continues to outpace economic growth.

About the Authors

Adeel Kheiri is a principal in Oliver Wyman's Health & Life Sciences practice.

Kitty Lee is a principal in Oliver Wyman's Health & Life Sciences practice.