KEY TAKEAWAYS

- Despite consumers' generally rosy view of retail and technology organizations, they remain skeptical about these types of companies dipping their toes into the healthcare industry.

- Although pharmacies’ retail positioning has made them more consumer friendly, pharmacies are still widely viewed as part of the legacy healthcare world.

- Although the proliferation of high deductible plans is thought of as a health insurance issue, in truth it affects all types of healthcare incumbents.

Editor's Note: This article was sparked by our 2018 Consumer Survey Of US Healthcare: Waiting For Consumers.

Health consumers see the healthcare world around them changing, but they aren’t always sure if it’s good for them or not. They’re concerned with rising costs, but they’re also concerned with getting a good night’s sleep. They love Amazon, yet say they haven’t yet grown completely comfortable seeking health services from tech giants or other organizations outside the traditional healthcare space. They want cheaper, more intuitive healthcare that not only cures or prevents illness, but also improves their well-being, regardless of how sick or well they are. Consumers, generally unsatisfied with healthcare incumbents, favor technology and retail companies to insurers and providers. They typically trust their physicians to help manage their medical records, but don’t quite trust them to provide apps or tools for independent health management. For traditional healthcare insurers and providers, this isn’t welcome news. Oliver Wyman’s recent consumer survey sheds new light on how healthcare insurers and providers can improve their positioning with consumers.

CONSUMERS’ HEALTHCARE OPINIONS REMAIN COMPLEX AND CONTRADICTORY

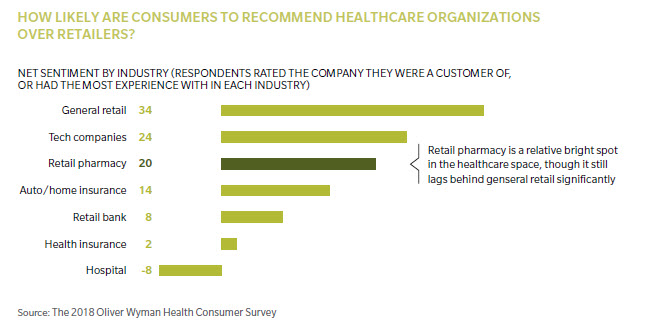

Healthcare insurers and providers, compared to their technology and retail competitors, don’t fare well on critical consumer loyalty measures. When we asked consumers whether they were likely to recommend organizations they had experience with to their friends or family, consumers were far less likely to say they would recommend healthcare organizations (health insurance companies, hospitals, and retail pharmacies) than general retailers (like Walmart and Target) or technology companies (like Apple and Google).

THE 2018 OLIVER WYMAN HEALTH CONSUMER SURVEY

HOW LIKELY ARE CONSUMERS TO RECOMMEND HEALTHCARE ORGANIZATIONS OVER RETAILERS?

- Health insurance companies were rated 30 points lower than retailers, and 20 points lower than tech companies.

- Hospitals scored over 40 points below retailers and 30 points below technology companies.

- Retail pharmacies fared better than other healthcare insurers and providers, scoring 15 points below retailers and 5 points below technology companies. This more positive performance likely reflects that retail pharmacies are hybrids between healthcare and retailers, and have already been working to find ways to serve health needs in consumer-friendly ways.

The message for healthcare organizations is sobering: technology and general retailers are emerging even as their new competitors already have consumer loyalty in ways healthcare organizations do not. However, there are headwinds for disruptors as well. Despite consumers’ generally rosy view of retail and technology organizations, they remain skeptical about retail and tech companies entering the healthcare field. When we asked consumers who they’d prefer to buy healthcare services from, or who they were comfortable giving their personal health information to, healthcare providers and insurance companies still topped the list.

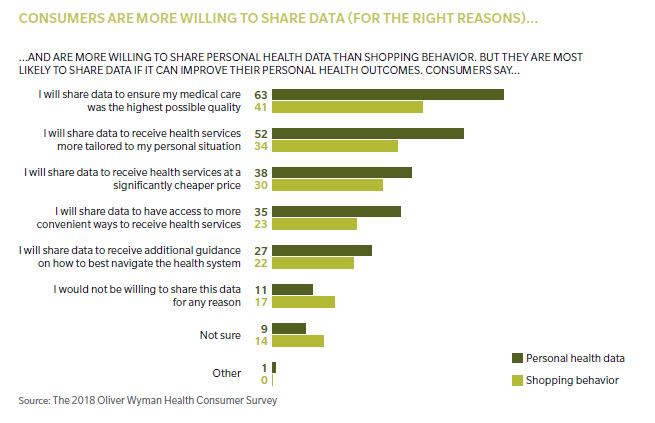

Eighty-two percent of survey respondents would share personal health information with their primary care physicians, 46 percent would share it with their hospitals or health systems, and 30 percent with their health insurers. Far fewer respondents would share this information with non-traditional players: only 5 percent with a mobile app and 3 percent with an online retailer.

Thirty-nine percent would manage their health with an app or online tool from their primary care physician, compared to 13 percent from a hospital, and 9 percent from a health insurance company. Only 1 percent would do so from an online retailer.

This data suggests players leading healthcare’s value chain consolidation (such as CVS-Aetna and Walmart-Humana) recognize data as a foundation of economic value. Nonetheless, these results highlight several key concepts:

- Data will be a key point of strategic control in the healthcare landscape, and consumers still express more confidence in sharing data with healthcare providers and insurers than with emerging tech and retail competitors.

- Consumer relationships are another critical point of strategic control. Retail and technology organizations have those relationships, on one level, but they don’t yet have full consumer trust when it comes to healthcare applications of those relationships.

- The recent vertical consolidation we see across the industry (such as CVS-Aetna and Walmart-Humana) reflects the value of these strategic control points and of associating more traditional healthcare brands with retailers as a way to secure those points.

Consumers don’t like their healthcare services options, but they don’t seem to trust anyone but healthcare insurers and providers to do the job. One way to view this is as a contest between incumbents and new entrants (often with significant capital and funding behind them). Will healthcare insurers and providers build more magnetic, consumer-friendly offers and service models? Or will new entrants build necessary trust and credibility with consumers?

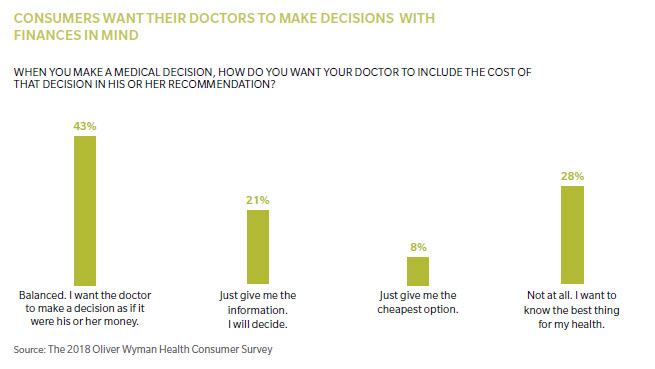

Another way to view this is as an argument for various forms of engagement between traditional healthcare insurers, providers, and new entrants. For instance, although healthcare consumers generally don’t trust healthcare institutions, they do trust their physicians. Eighty-three percent of consumers say they either completely trust their doctors’ opinions without question, or are fairly confident in their recommendations (41 percent say the latter). This trust factor is a point traditional healthcare insurers and providers must take advantage of.

CONSUMER PREFERENCES DEPEND (SOMEWHAT) ON GENERATION

While your birthday doesn’t dictate your healthcare preferences, let’s explore what we learned about how your birth year (really, birth decade) determines what you value along your health journey. Let’s take millennials – often perceived negatively – as avocado toast loving, social media obsessed – but also positively – as pushing innovation, driving social and political change, and thinking and acting globally. A more realistic view is they are well into their adulthoods (some are approaching 40), saving for college tuition for their children, caring for elderly parents, and managing their own growing aches and pains. Millennial attitudes are the future of healthcare.

Millennials tend to perceive technology companies more favorably than baby boomers do. Regarding net sentiment, millennials rated health insurance companies 20 points lower, hospitals 22 points lower, and pharmacies 17 points lower than did boomers. While both generations tend to view retail companies similarly, millennials rated technology companies 15 points higher. Our data suggests pharmacies’ retail positioning has made them more consumer friendly, but they’re still viewed as part of the legacy healthcare world.

If millennial views like these represent healthcare’s future, there is cause for concern among healthcare insurers and providers. The more millennials take the reins on healthcare decision making, the more traditional healthcare insurers and providers will be disfavored for the innovation disruptors promise. It’s a mistake for healthcare insurers and providers to think they can milk (more conservative) baby boomers, as boomers often follow trends started by younger generations. (Your mom probably has a smartphone.)

CONSUMER LOYALTY IS NOT CREATED EQUAL

Another worrying sign for traditional healthcare insurers and providers: Consumer loyalty toward incumbent healthcare organizations often depends on out-of-pocket medical costs. For example, those with high deductible plans perceived both health insurers and hospitals in significantly lower regard compared to industries like retail, technology, and retail pharmacy – two times more negatively than general retail, for example. But all categories of consumers trust their personal doctor more than any other entity to provide a variety of healthcare services, everything from monitoring health through a wearable device to providing access to a health guide who would help them make healthcare decisions.

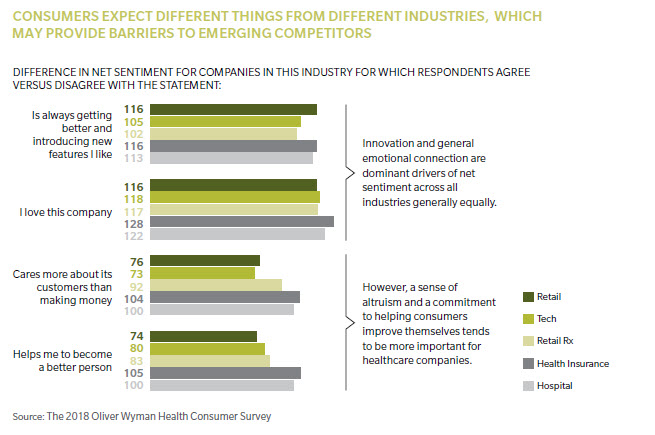

We asked survey respondents whether they agreed with a variety of positive statements about the companies to which they pledged loyalty, such as “I love this company,” “This company is clearly better than its competitors,” “This company cares more about its customers than making money,” or “This company makes me a better person.” Predictably, agreement with positive statements drove higher net sentiment across all industries. Individuals who said, “I love this company,” about an organization were far more likely to recommend it than those who did not, regardless of what industry that company was in. However, certain attributes drove loyalty more strongly in healthcare than in other industries. In particular, when consumers gave healthcare companies attributes associated with altruism (“This company cares more about its customers than making money” or “This company helps me become a better person”), they expressed far higher net sentiment. When consumers assigned those attributes to companies in tech and retail, the net likelihood effect to recommend was less dramatic. Put another way, loyalty drivers are different inside the healthcare industry. An expectation of selflessness and commitment to the greater good exists there that does not exist as strongly in retail or technology industries. As disruptors move into the healthcare space, that cultural difference will be critical.

TODAY’S CARE DELIVERY MODEL: OUTWARDLY TRADITIONAL, YET RIPE FOR DISRUPTION

Traditional healthcare insurers and providers can enhance their reputations as altruistic community members and create services to satisfy exasperated consumers. Traditional healthcare insurers and providers don’t have to become Amazon. But they must make consumer interaction easier. The trick is in how. It has to feel genuine and authentic. (Healthcare insurers and providers today often sponsor community activities and charitable events, yet consumers can feel like incumbents have ulterior motives.) This means redesigning service models and products, and expanding their reach so consumers achieve greater well-being daily. This includes creating new channels – digital and otherwise – for consumers to access healthcare, including those that come right to the home. Indeed, we know consumers are even growing more comfortable with home-based care. For instance, 33 percent of respondents said they’d consider having a doctor or nurse visit their home to perform an annual physical, and 30 percent would be open to minor medical events being addressed in the home.

For innovators, moving into core healthcare services may be tough, but many services are adjacent to core healthcare/health insurance. Those include physical fitness and mental well-being, which emerging players may have permission to enter. These adjacent services are often on consumers’ minds daily, in contrast to core healthcare services. Disruptors have an opportunity to engage consumers around their health more consistently and holistically than traditional healthcare players can. As consumers seek solutions not just to their acute problems, but also to broader issues (How do I get enough sleep, anyway?), the organizations that can provide those solutions will win consumer loyalty.

About the Authors

John Rudoy is a principal in Oliver Wyman's Health & Life Sciences practice.

Helen Leis is a partner in Oliver Wyman's Health & Life Sciences practice.

Chris Bernene is a partner in Oliver Wyman's Health & Life Sciences practice.