An annual figure of almost US$2.7 trillion is being invested worldwide each year, in infrastructure which corresponds to just under 4% of global GDP. Despite this, the global funding gap is widening. An estimated annual spend of US$3.7 trillion would be needed to meet the growth in infrastructure demand. The US$1 trillion gap1 represents a 27% shortfall in global infrastructure investments, highlighting an urgent need for new investment sources to be identified.

This increase in demand calls for significant commitments to infrastructure development. In developing economies like the Gulf Cooperation Council (GCC), the most important drivers of the surge in demand for infrastructure are urbanisation, industrialisation, and population growth.

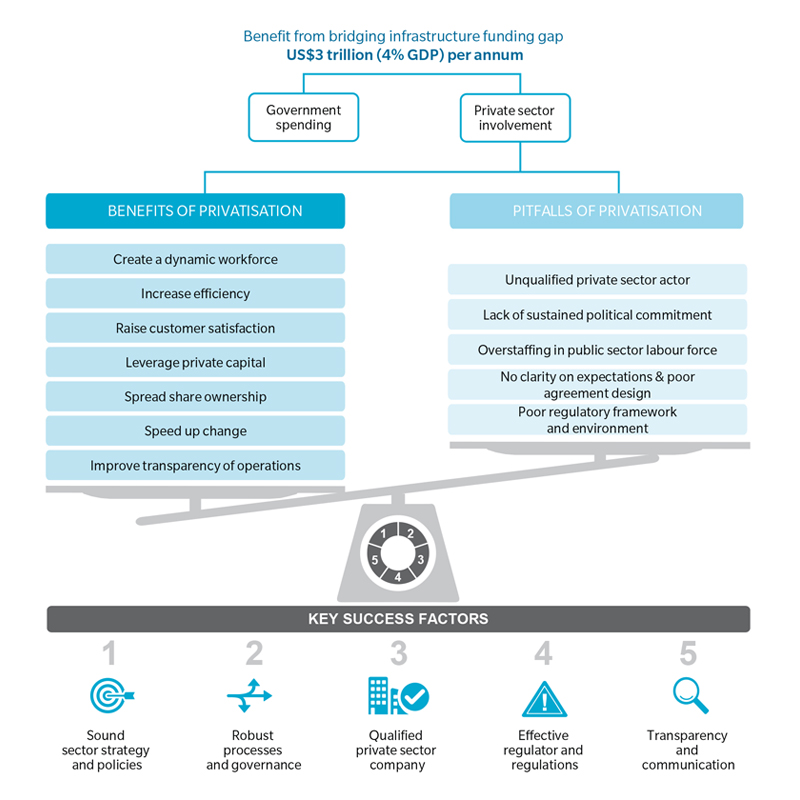

This report, explores the benefits of engaging the private sector in infrastructure development across the Gulf Cooperation Council (GCC) and recommends five action steps for GCC governments to ensure successful public-private partnerships:

- Defining objectives

- Setting up an effective central authority to oversee the program

- Selecting the best fit private investor

- Developing clear and transparent procedures

- Creating clear action steps

Key Factors for Successfully Bridging The Infrastructure Gap