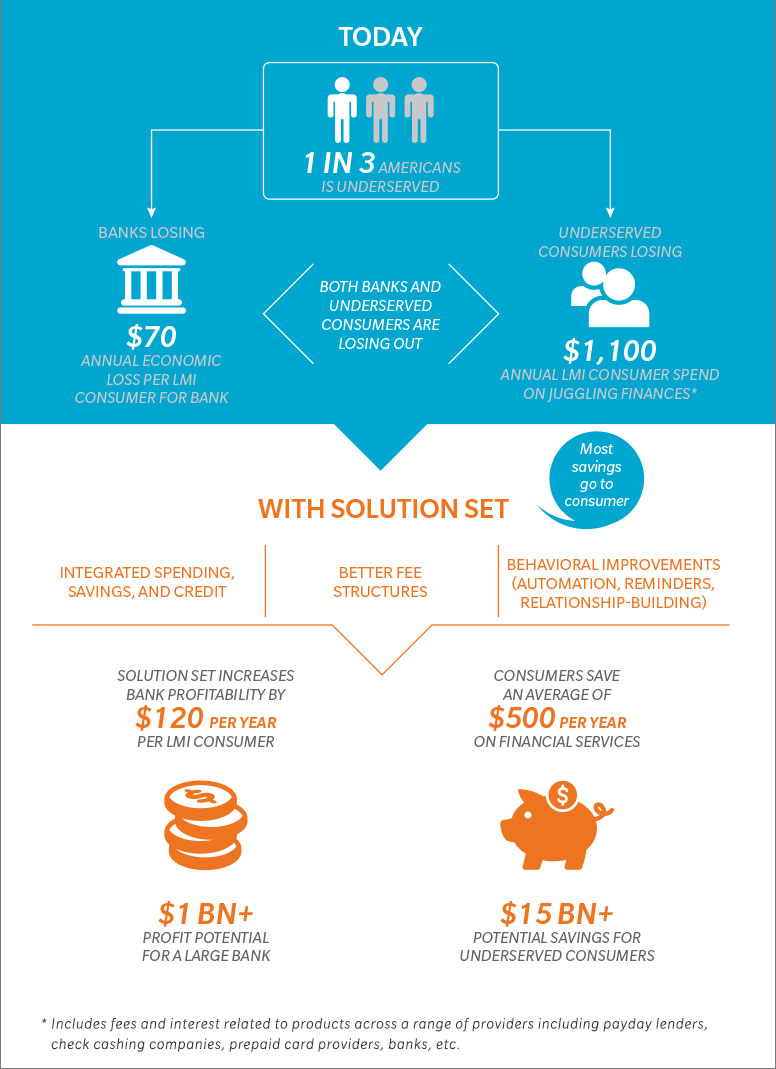

This report, Reimagining Financial Inclusion, written in conjunction with ideas42, tackles the problem by combining behavioral principles and microeconomic analysis to move beyond traditional financial access solutions. It explores the economic factors that drive existing financial products and why the status quo fails to meet the financial needs of lower-income consumers with scarce resources and unstable cash flows.

Serving as a call-to-action, the paper outlines an innovative product concept with the potential to better meet the needs of underbanked consumers while offering an attractive return for financial services providers.

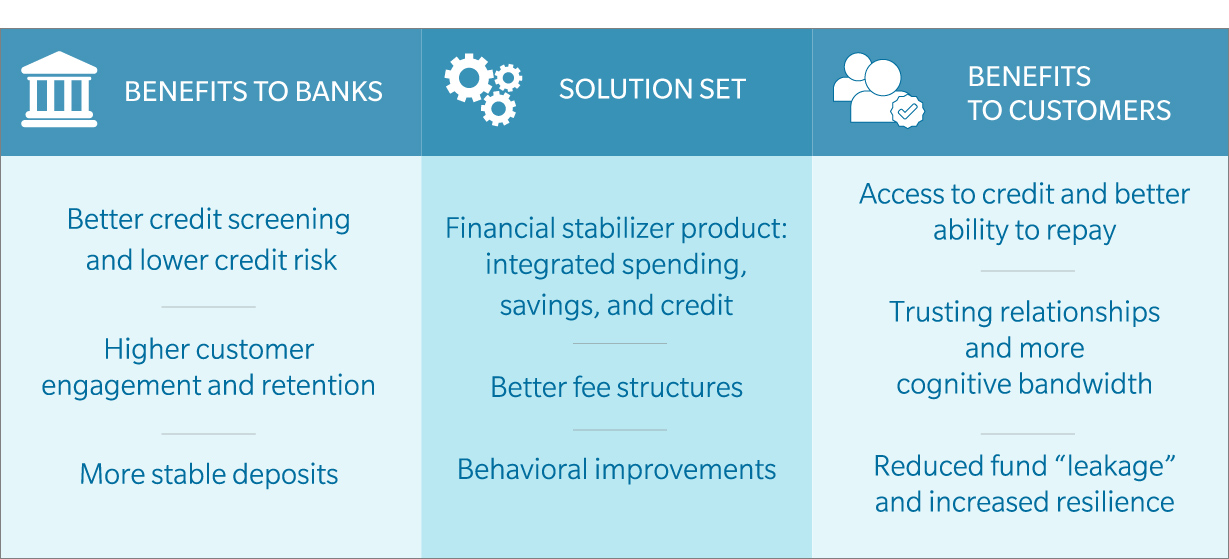

A New Integrated Banking Solution Set That Benefits Both Banks and Low-to-Moderate-Income Consumers

Reimagining Financial Inclusion

Check back for interactive Web Tool...