The new Oliver Wyman publication “EBITDA Improvement X-Ray” describes how to address these challenges. The four modules of the EBITDA Improvement X-Ray are designed for private equity portfolio companies in the manufacturing sector and provide a fast and structured assessment of approximately 90 percent of total cost by leveraging Oliver Wyman´s global expertise.

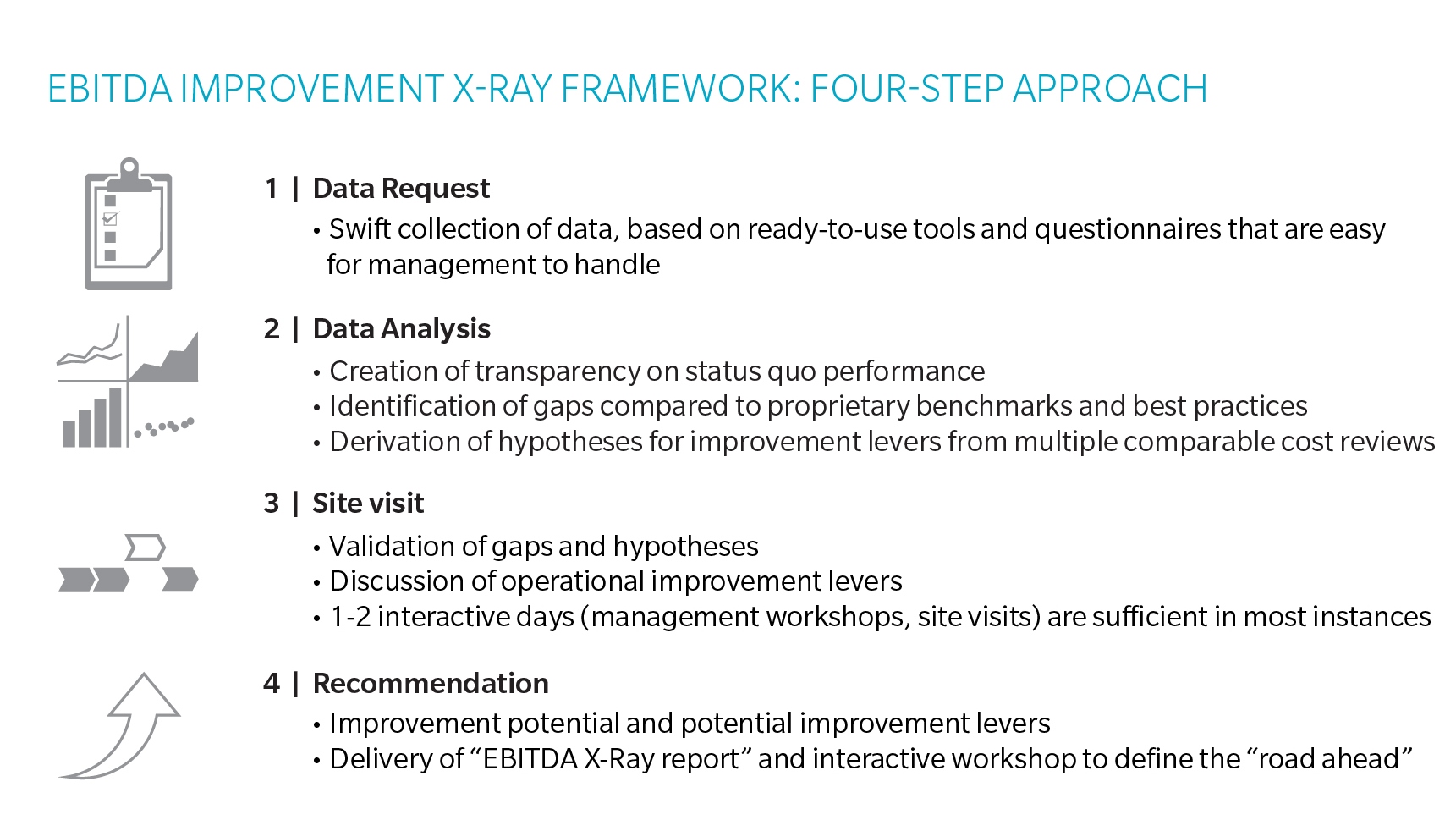

EBITDA Improvement X-Ray Framework: Four-Step Approach

The EBITDA Improvement X-Ray capability is bundled in four modules:

- Sourcing X-Ray

- Plant X-Ray

- Product Cost X-Ray

- Overhead X-Ray

These four modules help to quickly and systematically unveil significant profitability potential, ready for prioritization in an action plan.

Each of the modules follows a proven four-step approach. Thanks to a modular design, each EBITDA Improvement X-Ray module can be deployed independently of the others, depending on the value creation hypothesis to be tested for a specific portfolio asset.