Boards and senior management teams must develop risk appetite frameworks that can support risk governance, performance management, and major decisions on an ongoing basis. A clear risk appetite framework encourages companies to be more resilient and to invest wisely, balancing potential returns with associated risks. It is essential for firms considering an ambitious growth strategy or undergoing significant organizational change. The framework is also critical for firms that are facing market or operational vulnerabilities or that are under pressure to turn around financial performance.

In our experience, a risk appetite framework should possess three characteristics to be effective:

- A quantitative and qualitative foundation based on a comprehensive, strategic view of the key drivers of value creation and value destruction in the firm. This includes issues as diverse as the company’s geographic footprint, customer relationships, operational capabilities, capital structure, liquidity, and human capital.

- Relevance to a broad swath of stakeholders at different levels in the organization. The board will use the core provisions of the statement as a governance tool to ensure its risk priorities are adequately monitored and that strategic ambitions are aligned with shareholder interests. Senior management will use it as a lens for considering major strategic decisions and ongoing performance management. Financial Planning & Analysis and Treasury teams will look at the underlying metrics to obtain a more detailed perspective on earnings volatility and rating-dependent metrics.

- A connection to key decision making processes across the firm. The framework needs to increase the value derived from enterprise risk management by applying greater rigor and accuracy to forecasts and strategies. Thus, the risk function is able to act as a true partner of the commercial and finance teams in risk-return management.

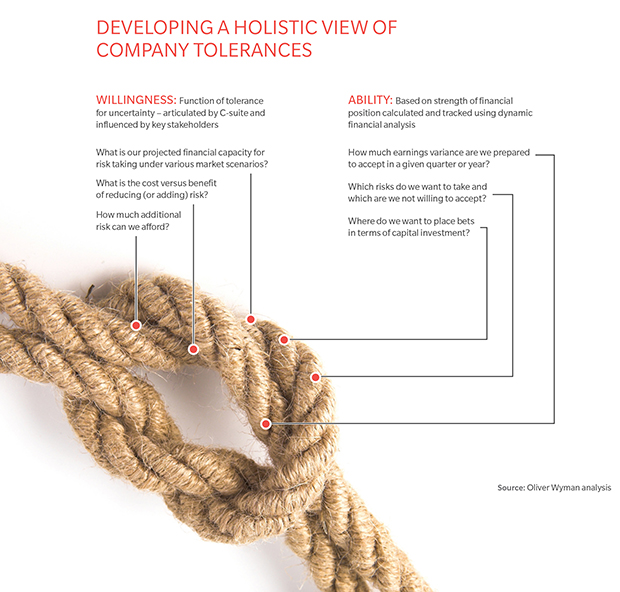

Fundamentally, a risk appetite framework helps senior management to align a company’s willingness to take risks with its ability to do so, exposing and resolving any tensions between the two. It consists of two parts: a crisp statement with clear tolerance thresholds and a financial model that supports the analysis of risk-bearing capacity.

By bringing together the performance of the corporation and its commercial operations in a single framework, a risk appetite statement triggers discussion about key financial drivers and associated risks. Consisting of only a few pages, the statement guides senior management teams toward a consensus with respect to their tolerance for variance and acceptable levels of risk taking. Equally important, it helps management and the board focus on high-level, meaningful targets at the intersection of risk, strategy, and performance.

The statement informs, and is underpinned by, an analytical tool. This is the framework’s engine. It supports reports on critical metrics and models particular scenarios as well as stresses – such as a downturn in revenues, a change in capital structure, or the impact of an acquisition.

For many companies without risk appetite frameworks, taking risks will remain an uncoordinated, sprawling collection of activities. For these boards of directors and management teams, making critical, strategic decisions will continue to be a source of frustration.

For business leaders, however, developing a firm sense of their company’s appetite for risk can represent a critical driver of growth. By quickly assessing if potential opportunities, adverse events, or a combination of both, are in line with a company’s appetite for risk, these senior management teams will outmaneuver competitors in rapidly shifting competitive landscapes and optimize their.