Since 2007, the profitability of US deposits has substantially declined. The dramatic fall of base interest rates coupled with post-crisis debit interchange and consumer overdraft regulation have severely hampered earnings creation for one of the foundations of US banking.

But with the recent rise in long-term rates, many are beginning to consider the value potential of deposits in a more favorable environment. However, in order to prosper in this environment, banks will need to navigate five critical and interwoven challenges:

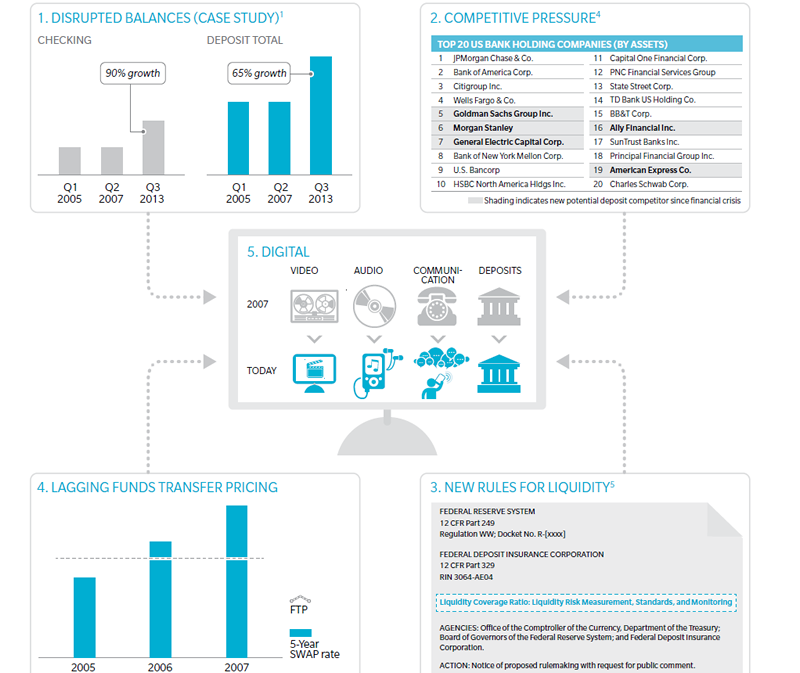

- The instability of balance growth since the crisis

- New deposit competitors

- Basel III and the Liquidity Coverage Ratio

- Lagging and distorted FTP rates

- The great unknown: the digital revolution

In this executive brief, Deposits: A Return to Value?, we focus on providing an overview of each of these five challenges and what needs to be done to address them. We also introduce our strategic relationship with Nomis Solutions to bring industry-leading deposit product management tools to our clients.

Five Factors That Will Complicate The Return to Value