As winter bears down across the northern hemisphere, healthcare systems are readying for the tripledemic of flu, COVID-19, and RSV infections, highlighting the need for respiratory vaccine uptake. There will be a massive effort by public health officials, clinicians, and others across the industry to get shots in the arms to avoid a confluence of respiratory viruses once again overwhelming healthcare systems.

In previous winters, health systems have relied on vaccines for flu and, more recently, COVID-19 to help fight infection rates. This year, healthcare systems can leverage a new tool in their armory — two approved adult RSV vaccines, Arexvy and Abrysvo. However, while vaccines and vaccination protocols are well established for flu — and we had a crash course on COVID — creating momentum around RSV will take time.

What is RSV?

Respiratory syncytial virus is a respiratory-borne infectious disease that leads to the inflammation of the smallest lung airways and is estimated to result in more than 3 million hospitalizations and more than 26,000 deaths per year globally, thus carrying a significant burden. The most vulnerable populations include children under the age of 5, people 65 years of age or older, immunosuppressed individuals, or those with lung and heart conditions.

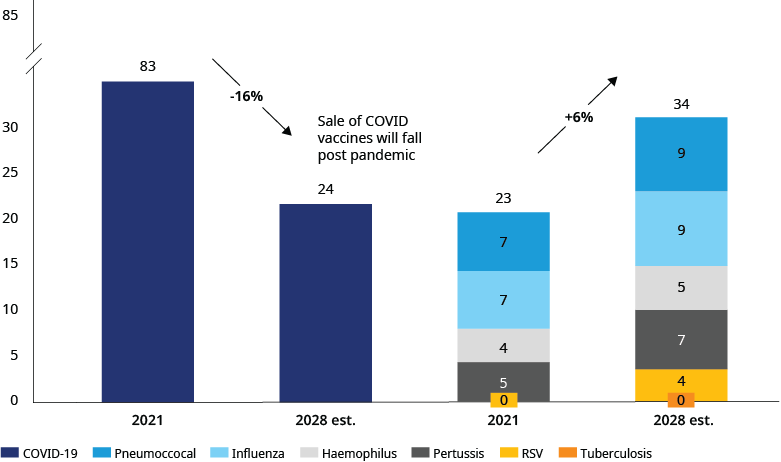

With over 20 clinical trials underway, the RSV vaccine market is expected to be a key driver of the overall respiratory vaccines market over the next five years, growing by an estimated $4 billion (USD) in sales by 2028. In comparison, other vaccine markets such as flu and pneumococcal will grow by an estimated $2 billion.

The marketplace for RSV is diverse and increasingly competitive

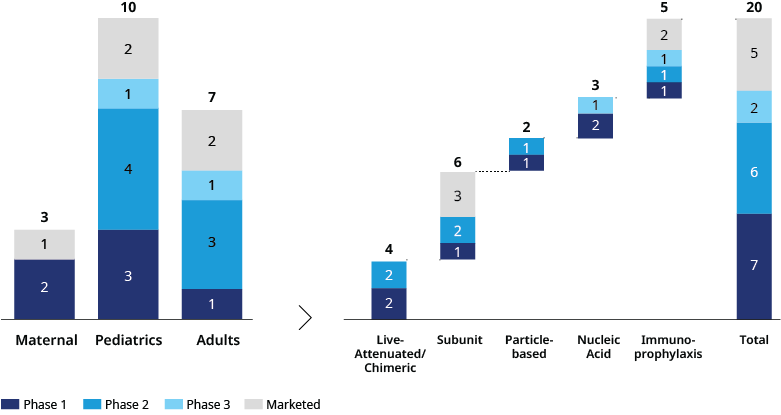

The evolving RSV immunization marketplace is comprised of vaccine and prophylactic solutions that serve three distinct populations: maternal, pediatric, and elderly.

Maternal vaccines intend to pass antibodies on from the mother to the baby and provide protection in the first few weeks of life, with infants being most at risk up to six months. The pediatric population itself has two distinct strategies based on age. Leading strategies for pediatric immunization include passive immunoprophylaxis with monoclonal antibodies for infants six months and younger, and live attenuated vaccines for active immunization of infants over six months. Immunoprophylaxis vaccines Palvizumab and Nirsevimab are approved for use in specific cases for children two years old or younger.

For the elderly population, efforts focus on those above 60. Data from GSK’s Arexvy and Pfizer’s Abrysvo suggest the strongest efficacy in the 60-69- and 70-79-year age groups. With recent regulatory approvals, these adult RSV vaccines should be available in time to protect eligible individuals for the 2023-2024 winter season in the northern hemisphere.

Another factor driving differentiation in the vaccine market is the diversity of technologies — protein-based and live attenuated, are the two most studied technologies followed by RNA-based vaccines. GSK and Pfizer’s vaccines are both RSV F protein-based and come with similar cold chain storage requirements, between 35-46°F (2-8°C). Unsurprisingly, the RNA technology-based vaccines are being developed by Moderna, with Sanofi’s portfolio looking at the biggest diversity of technologies, from its mAb-based immunoprophylaxis to a potential RNA and live attenuated vaccine.

Each RSV population has a distinct problem to solve

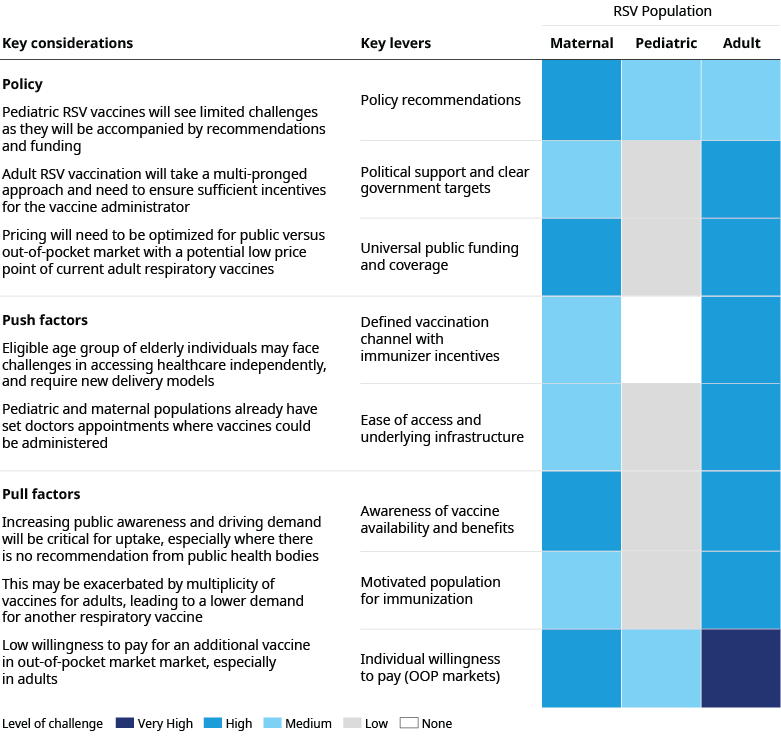

As with all vaccines, the success of RSV vaccine uptake will be multi-factorial, driven by scientific and policy recommendations, healthcare system setup, and the willingness and motivation of the eligible population to be immunized, which will be influenced by self-pay in some cases. Vaccination rates for influenza have highlighted the significant variation in uptake across markets, with often low coverage even in high-income markets. Success factors and challenges for RVS vaccine uptake will differ for each population.

Pediatric RSV vaccines will likely experience the fewest hurdles since they have the strongest set of recommendations and funding, and both pediatric and maternal populations typically have established relationships with a healthcare professional, resulting in clear channels of communication. However, with the potential for immunoprophylaxis solutions, maternal vaccination may face challenges and potentially lower demand, especially given concerns around pre-term birth.

By contrast, adult RSV vaccination will require a more multi-pronged approach that includes primary care physicians, hospitals, and pharmacies. Incentives must be aligned to ensure that vaccine recommendations are not just made but that there is a follow-up to confirm patients got their shots. In markets where influenza vaccine uptake is low, eligible elderly populations for RSV may face additional challenges in accessing healthcare independently and require new delivery models. Increasing public awareness and driving demand for adult vaccines will be critical, especially where there is no recommendation or funding from public health bodies.

Messaging around RSV will also compete with recommendations for other immunizations. Vaccine manufacturers will have to address questions around administration, including whether RSV should be administered at the same time as the flu shot and COVID booster and if it is given annually or every two years.

What’s next?

The real-world uptake of Arexvy and Abrysvo in the elderly population will be an indicator of how well the underlying assumptions of the RSV market hold. Both GSK and Pfizer have had a presence in the adult immunization market, through influenza and shingles vaccines for GSK, and pneumococcal and COVID-19 vaccines for Pfizer. While GSK has been a strong player in infectious diseases, Pfizer is leveraging its recent success earned during the pandemic.

We are close to seeing the benefits of RSV vaccines but the discontinuation of GSK’s maternal population program for Arexvy and Janssen’s RSV vaccine program highlights the uncertainties that continue to be a factor in bringing solutions to market.

There must be continued innovation in vaccine technology and strong ecosystems to enable uptake if we are going to adequately address the burden and challenge of future tripledemics. A new market like RSV remains dynamic and first-to-market entrants will need to continue investing heavily in market shaping and building innovative partnerships with healthcare systems.