A growing number of provider organizations is interested in pursuing risk-bearing arrangements, but many are approaching the transition to risk with caution. Hesitant to abandon fee-for-service revenue completely, they adopt a toe-dipping, pilot-based mentality. They may first test the waters by moving a small population to risk, developing a care model to tightly manage that population before diving into partnerships on larger populations with varied needs.

Although this approach can help providers build their population health management expertise and capabilities, our financial modeling shows that this more cautious approach is critically flawed because it does not allow organizations to truly test the financial viability of risk-bearing arrangements. Even if the provider organization gets the clinical transformation part right, a pilot-size market share is not enough to achieve profitable results. Providers need to grow market share if the shift to risk is to be financially accretive.

In other words, you need to go “all in” on a large population to make the economics of risk work.

The balancing act

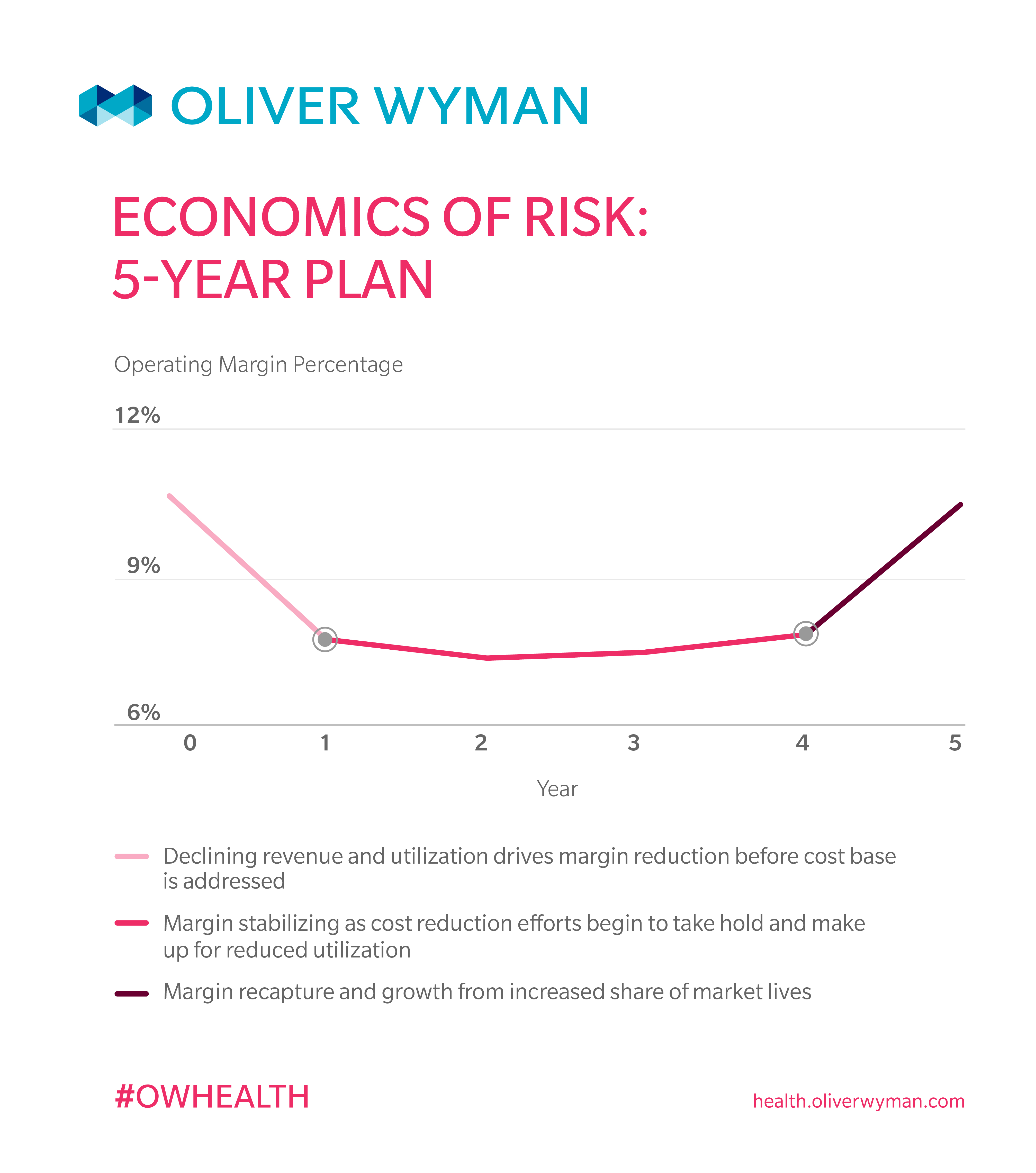

After providers enter into risk-bearing partnerships with payers, there will be an unavoidable downturn in their revenue and profit levels. This is typically due to two factors: (a) most risk arrangements assume a starting point below the FFS equivalent (after all, there should be a net savings when we manage a population), and (b) a shift away from procedure-heavy, fee-for-service lines of business. After the initial decline in revenue, however, most organizations will see margin stabilization between years one and three as the clinical transformation takes hold and providers engage in managing care for patients. Then, between years four and five, an organization focuses on margin recapture and growth from the increased share of market lives.

To balance this inevitable initial downturn and move toward margin recapture, provider organizations need to focus on four key efforts:

- Strong, effective population health management to drive down utilization

- Quickly moving from simple gain-share and risk-share arrangements to full capitation

- A population large enough to make the effort financially accretive

- Increased share of the provider market in the local region

1. Strong, effective population health management

A strong population health management program is, of course, at the heart of any transition to value. It is critical to develop a model that allows the provider to effectively manage the health of the target population. That will drive down utilization and reduce the medical costs associated with those patients.

To be successful at this, providers must start with a population with high health needs that will be easier to manage down. And that usually means Medicare Advantage patients, whose high health needs are easier to impact than other, healthier populations.

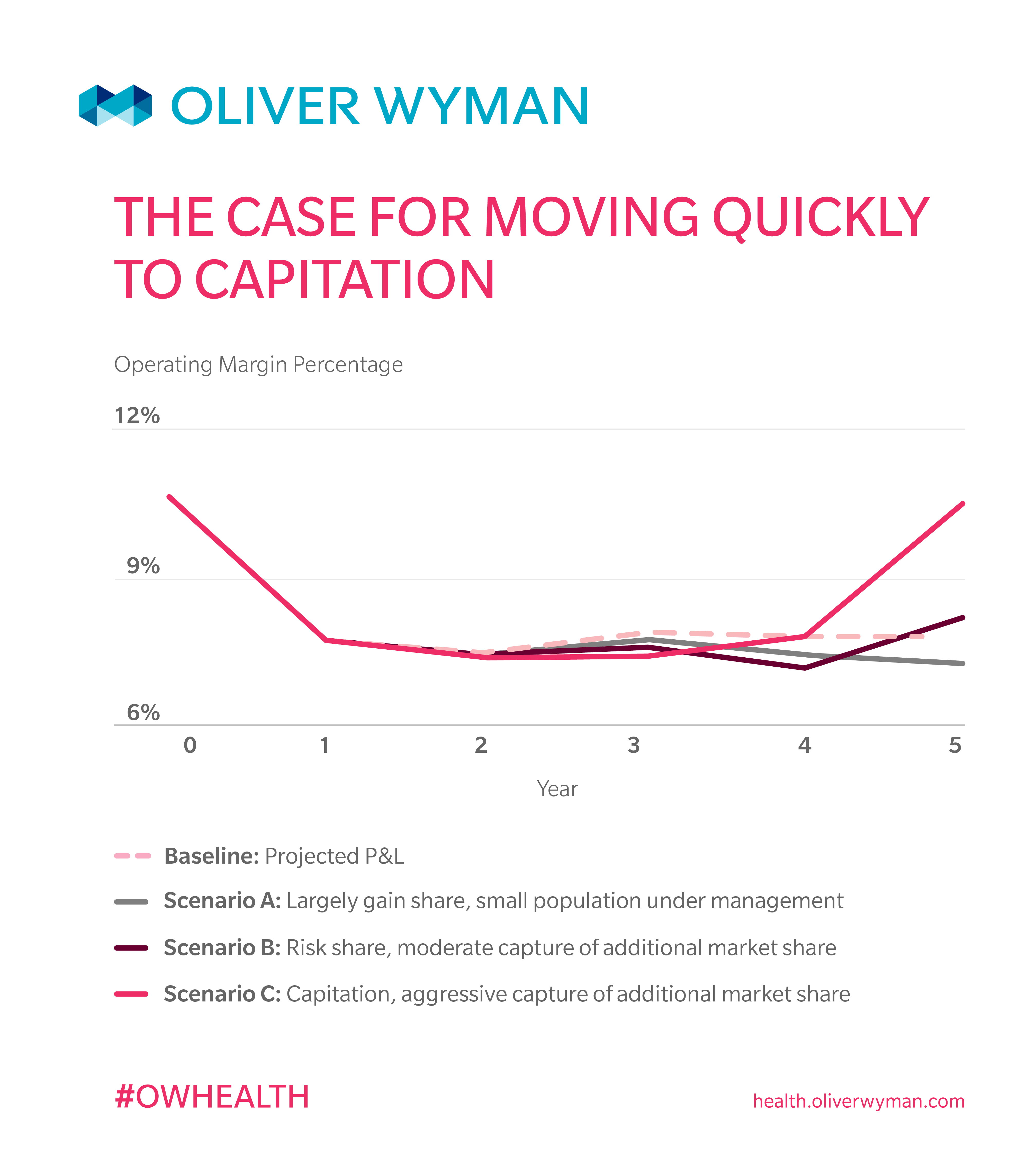

2. Quickly moving to capitation

Reducing the direct costs of a target population typically results in lower provider revenue in both gain-share and risk-share arrangements. As utilization decreases, the gain-share and risk-share payments may increase the profit margins on these patients; however, the original levels of profitability can be difficult to attain and organizations need to think about moving to full-capitation arrangements sooner rather than later. In fact, our analysis shows that a full-capitation arrangement is necessary to minimize revenue loss while improving profitability through better management of the population. In this transition to value, it is critical that medical cost reduction outpace revenue decline, or the profit trajectory will not stabilize.

Provider organizations moving to capitation should make provider relations a top priority. That’s because being fully at risk under capitation requires significant efforts to keep the patients’ care within the system, and that necessitates strong physicians.

3. Large population

Despite the advantages of full-capitation arrangements, they do raise the risk that a few outliers with extremely high medical costs can ruin the economics in a given year. An actuarially credible, large population base can help counter that and offers more predictability for financial projections.

On the flip side, as the population under capitation arrangement is increased and utilization declines, the underlying fixed-cost base is allocated across fewer and fewer procedures. That can drive up per-patient costs and trend in the remaining traditional fee-for-service part of the business. This leaves a provider with a choice between reducing their fixed cost base (very difficult to do) and growing their market share to spread the fixed costs more widely.

4. Increased share

We have seen that simply moving existing patient populations to capitation arrangements is not enough to materially impact a provider’s margins. Absent the ability or willingness to make significant reductions in infrastructure and staffing levels, a provider needs to look at growing its share of patients in the market; and that comes at the expense of other local providers. This can be a very challenging goal, and success depends on a number of factors, including the market dynamics, competitiveness of other providers, the readiness of the provider to take on the task of managing patients’ care holistically, and making hard decisions around resource levels and allocations.

Worth the risk?

In our experience, providers must think carefully about when they should make the move to value – if at all. The challenges are significant and many of the capabilities required to effectively implement a value-based solution are outside the comfort zone of even the largest provider systems. But a provider that believes fee-for-service business in their markets is on the decline, or sees competitors pushing to value, has no choice but to position themselves for a future built on assuming risk.