European wholesale banks are entering a promising era after 15 years of challenges. The current positive interest rate environment and potential divergence in capital rules present new opportunities for European firms to increase earnings and gain a competitive edge over their US counterparts in the dynamic financial sector.

Having undergone a decade of strategic restructuring, European wholesale banks now stand as leaner, more focused, and higher returning entities. Since 2019, European wholesale banking revenue pools have experienced an impressive 20% growth, driven by volatility-driven trading and rising interest rates. European banks have benefited from a greater presence in these growth areas, showcasing adaptability in the evolving landscape.

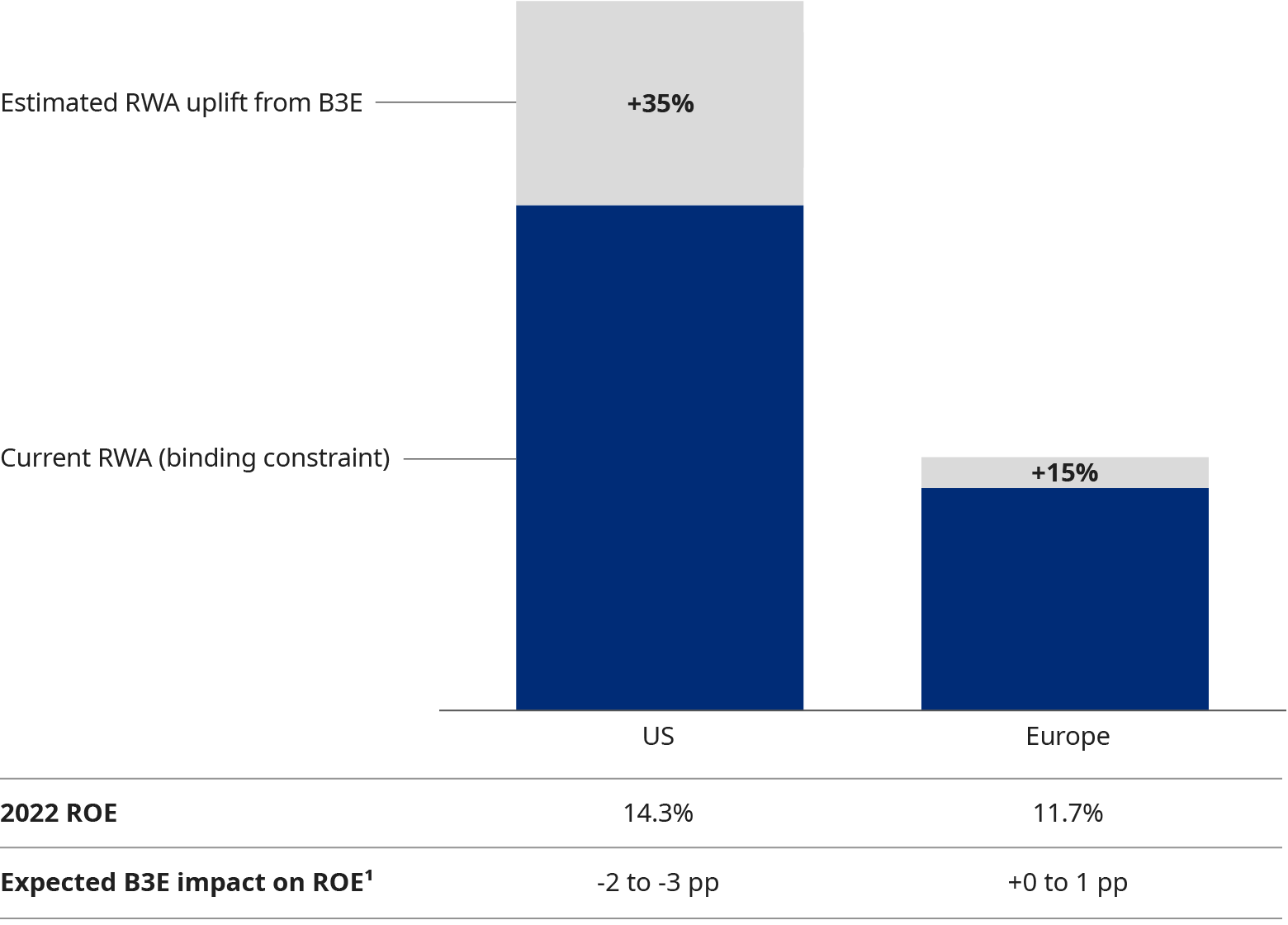

The outlook for revenues over the next few years is stable, sustaining a larger revenue pool than the pre-COVID-19 era. However, the imminent implementation of Basel 3 endgame capital rules could significantly impact the competitive landscape and returns of global wholesale banking. These proposed rules could lead to a more substantial increase in risk-weighted assets for US banks, potentially narrowing the return gap between them and their European counterparts.

European banks will need to adapt their business models to accommodate Basel 3, but the headwinds should be manageable. There is an opportunity for European banks to recover market share lost to US banks, potentially adding up to 0.8 percentage points of return on tangible common equity.

To succeed in this environment, European wholesale banks should focus on areas of advantage, scale-up partnerships and balance-sheet-light structures, deepen linkages with high-returning group businesses, and take structural action on cost. By taking these actions, European wholesale banks can protect their gains, deliver solid returns, and demonstrate their value to investors.