Editor’s Note: Following the completion of the Hang Seng Bank’s real-life simulations on hypothetical e-HKD programmable payment use cases as part of the Phase 1 e-HKD pilot program led by the HKMA, Hang Seng and Oliver Wyman collaborated to publish a report titled “Envisioning Programmable Payments in Hong Kong” in December 2023. The report aims to summarize the observations, insights, and recommendations derived from the Hang Seng use cases.

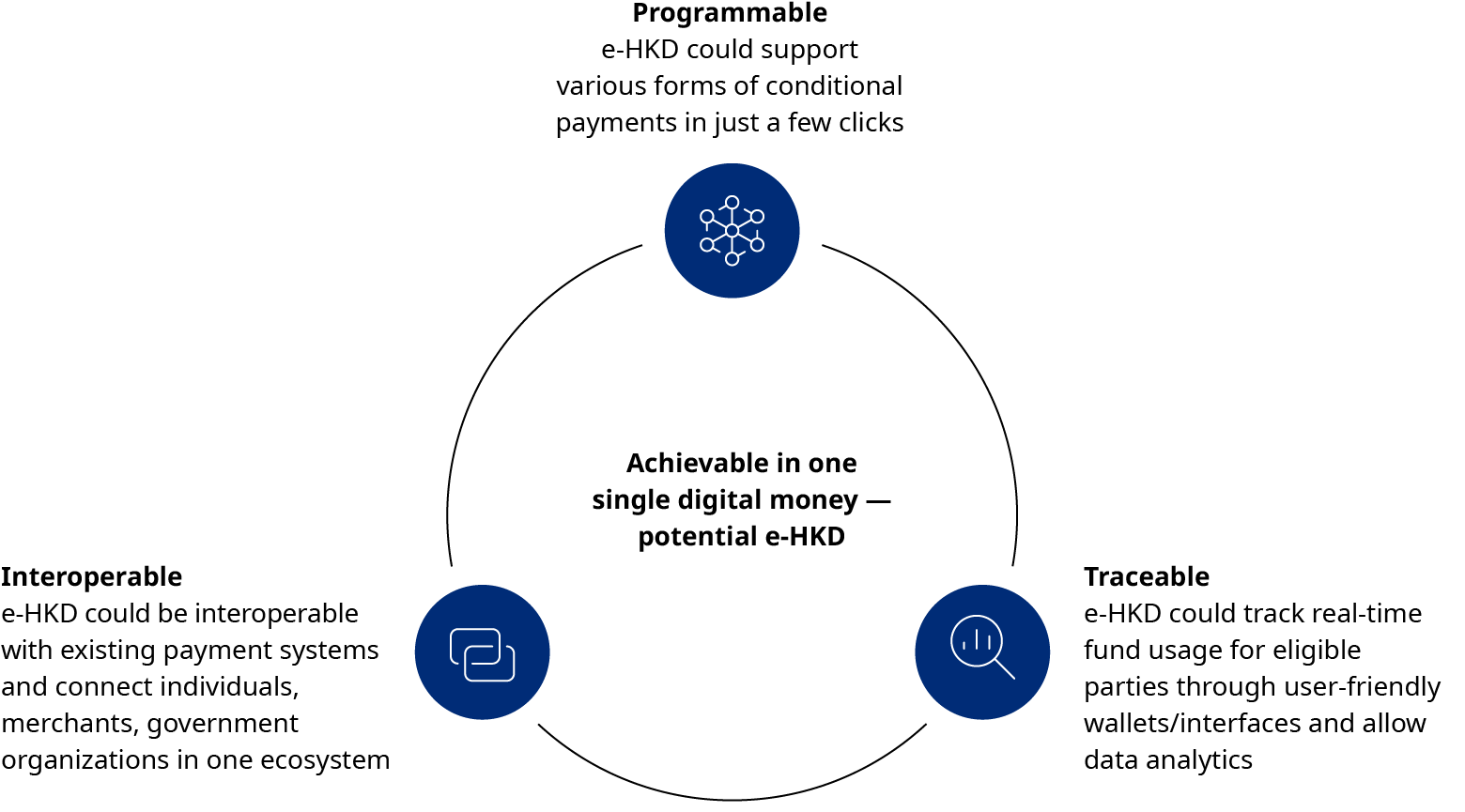

Central bank digital currencies (CBDCs) have gained widespread interest worldwide. A CBDC is a digital form of fiat currency issued by a central banking institution. Some countries, like China and the Bahamas, are running advanced pilots, such as e-CNY and Sand Dollar, while others, such as the United Kingdom and Europe, are in the design stage (digital pound and digital euro). CBDCs come with exciting potential — they may unlock additional economic value by facilitating new types of transactions and enhancing their efficiency and transparency.

In Hong Kong, the Hong Kong Monetary Authority (HKMA) has been researching CBDCs as part of its Fintech 2025 strategy. Under the umbrella of HKMA’s three-rail approach to pave the way for the potential implementation of an e-HKD, being a retail CBDC in Hong Kong, the HKMA launched the e-HKD Pilot Program in November 2022 to explore commercially viable use cases for an e-HKD in collaboration with the industry.

Sixteen participants, including Hang Seng Bank, were involved in Phase 1 of the program, which commenced in May 2023. Hang Seng developed three use cases – government grant disbursement, merchant reward program, and Peer-to-Peer (P2P) transfer to assess the potential of hypothetical e-HKD on programmable payments and smart contracts.

Strategic implications of the e-HKD Pilot Program

Enable broader adoption of retail payments

With the rise of various retail business models, the demand for conditional payments has become ubiquitous, such as long-term service subscriptions that necessitate payment over a period and peer-to-peer marketplaces where payments are required upon receiving goods. As a retail CBDC, an e-HKD could be linked to various digital payment methods, allowing conditional payments to be applied regardless of the users’ selected payment methods.

Empower small businesses to use digital payment and programmability features

Due to ingrained business norms and the lack of technology capabilities of many small businesses, they tend to embrace retail digitalization at a slower pace. An e-HKD can potentially reduce technology barriers and enable small businesses to set specific transaction conditions, such as customized rewards and payments in installments.

Require clear incentives to drive adoption for both individuals and businesses

The pilot study has shown that certain criteria must be met to drive adoption of e-HKD. For individuals, the adoption could be driven by improved user experience and a certain level of payment incentives. Conversely, the main incentives for merchants and government organizations are cost efficiency and ease of implementation.

Three key enablers to realize the full potential of an e-HKD

Collaborative participation model

Private sector participation is critical for continuing the current e-HKD experiment and for future implementation and promotion if an e-HKD is to be launched. A participation model that defines who and to what extent the private sector could participate would become a key design question. A model that allows active private sector participation could encourage competition among intermediaries, leading to customer-oriented innovation, improved services, and lower prices.

Accessible and user-friendly programmability features

To incentivize small merchants and government organizations to adopt e-HKD, the most significant challenges are the conditions that need to be made available to make it easier to deploy transactions with conditional payments. However, providing innovative programmability features on a large scale might also cause implementation issues. The design of these features should therefore consider user experiences, system performance, and risk management.

An innovation-friendly platform

This refers to a platform that is easy for eligible intermediaries to innovate and implement use cases. Based on Hang Seng Bank’s experience in the pilot, a private blockchain-based platform with APIs and interoperable standards to connect different intermediaries would appear ideal to foster innovation.

We acknowledge that an e-HKD may not necessarily solve certain non-technical factors such as ingrained business norms and preferences, which can influence e-HKD’s uptake should it be issued. The pilot nonetheless proves that e-HKD could potentially deliver other substantial and equally important benefits to individuals, merchants, and government organizations. These valuable insights would hold significance for Hong Kong and provide some reference for other advanced economies currently exploring the implementation of retail CBDCs.

Now is an opportune moment for collaboration between the public and private sectors. By working together, we can deepen the examination of the critical benefits of an e-HKD to Hong Kong and set out the necessary framework and architecture to fully realize its potential benefits.

Additional contributors: Chantel Tse, consultant, and Adeline Mak, consultant. This report is co-authored by Hang Seng Bank.