Leaders of banks need to include digital assets fully in their strategic and operational planning. Bank customers are demanding services; new competitors are attacking core bank business lines, fueled by high profit margins and the rapid growth in recent years of digital assets; and there are numerous opportunities for banks to tap efficiencies, reduce risks, provide new services, and potentially even invest. Digital assets also come with substantial risk and uncertainty, requiring careful strategic analysis and operational management. Further, bank leaders need to play their part in educating policymakers and helping them shape solid regulation that works effectively.

Don’t underestimate the potential disruption. One digital asset firm grew from start-up mode to a market cap equal to a US super-regional, or some of the largest European banks, in under a decade. Digital asset firms are working quickly to close the trust gap with banks before banks can close the technology gap. Further, central banks will be issuing their own digital currencies, with strong potential for additional disruptions.

This paper provides a high-level guide for senior bank executives and their Board members as they sharpen their focus on digital assets.

Further down the page is an excerpt from the report. To read the full version of "Time To Engage: Digital Assets For The Banking C-Suite", please see the below PDF.

What are digital assets?

There are four main types of digital assets in a financial services context:

- Cryptoassets, such as bitcoin or Ethereum

- Stablecoins, which are pegged by the issuer to a stable price compared to the dollar or the price of some other asset or basket of assets

- Central bank digital currencies (CBDCs) which are the electronic equivalent of cash in that they are a direct liability of the central bank

- Tokenized assets, such as a digital representation of the ownership of a security.

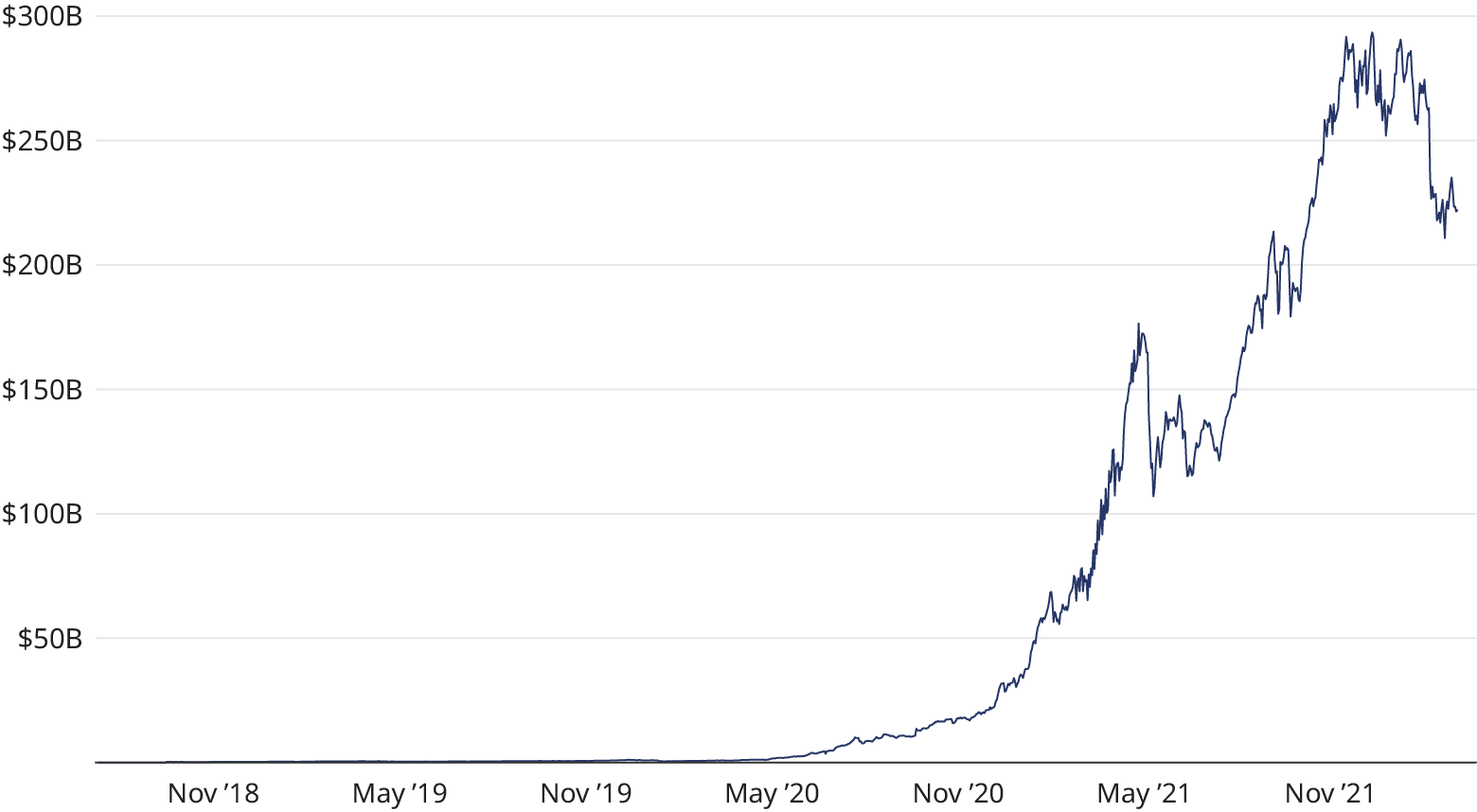

Decentralized Finance (DeFi) builds on the base of cryptoassets and stablecoins. DeFi is an umbrella term for a new wave of highly automated financial services innovations usually tied to digital assets. For example, individuals can buy or sell cryptoassets nearly instantaneously using automated exchanges to match them with counterparties. Similarly, they can lend or borrow cryptoassets on automated exchanges. DeFi is deeply connected with blockchain which offers faster, cheaper and transparent data and process management to make a fundamental change on its own, especially through the use of stablecoins and/or CBDCs for existing banking products such as mortgages and securitization.

Digital assets market size and trends

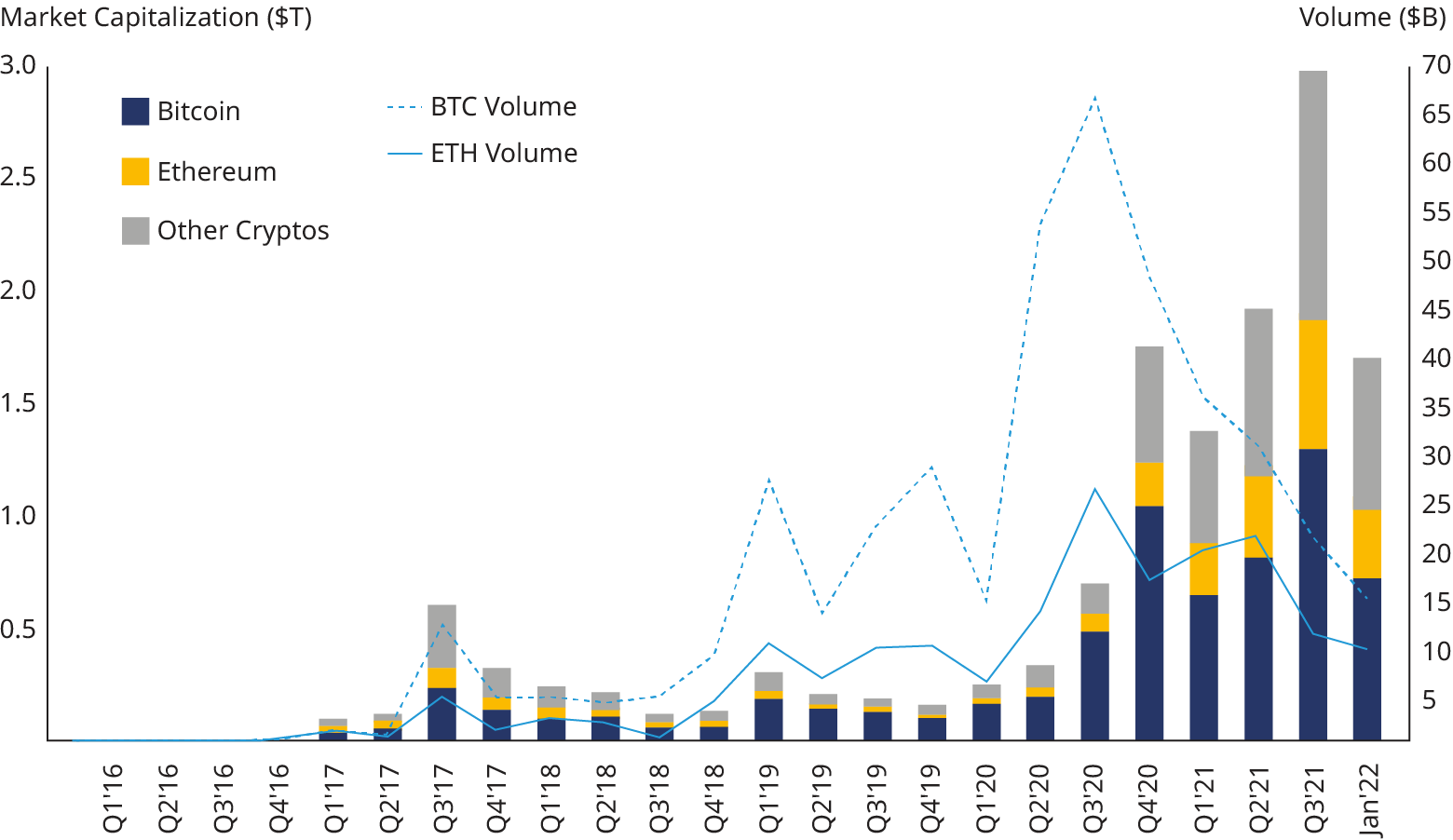

Digital assets are expanding rapidly. At the beginning of 2021, there were an estimated 100 million users of cryptoassets, increasing to over 200 million by mid-year and 300 million by the end of 2021. To put this in historical context, it was around mid-1997 that there were an estimated 100 million internet users rising to 300 million by March 2000.

Skeptics have reasonable grounds to doubt that the very rapid growth of digital assets will continue. After all, there is a high level of speculation, market prices are volatile, and there are a number of uncertainties about the future of regulation. Don’t assume, though, that price volatility will permanently drive away users. Bitcoin’s market price has fallen very sharply multiple times, by over 80% in one case, yet it has so far bounced back each time to new heights in terms of price and numbers of users. Some of the major digital asset firms are, in fact, planning for another “crypto winter”, but with high confidence that these setbacks will be temporary. We cannot predict future cryptoasset prices, but we believe that digital assets broadly are here to stay and will drive fundamental industry change based on the combination of blockchains, smart contracts creating programmable money transfers, coins and tokens, and decentralized business models.

Note: Total value locked (TVL) represents the sum of all assets deposited in decentralized finance(DeFi) protocols earning rewards, interest, new coins and tokens, fixed income, etc.

Banks need to actively participate

There are five basic reasons for banks to engage in the digital assets space.

Customer demand

A survey revealed that 14% of American adults have invested in, traded or used Cryptocurrencies (see Notes 1). Another survey found that 20% of American adults own bitcoin (see Notes 2). The same survey finds that 71% of bitcoin owners would consider switching to a bank that offers bitcoin services. Whatever the exact numbers, a substantial portion of retail customers trust their banks to handle their finances and would like the convenience and safety banks can bring to their digital asset holdings and transactions.

Further, wholesale customers are seeking to benefit from efficiencies from new technologies for existing business processes, and also would like the custodial and especially cross border transactions services for digital assets that they have with their other investments and businesses.

Competitive threats

Digital assets are driving competition for banks from three directions: crypto-native firms with big ambitions in finance, supported by high profits; DeFi, promising blinding speed and lower costs to financial services; and central banks creating their own digital currencies.

The big players in digital assets have the ambition for rapid growth built into their techy DNA and scalable business processes. They are constantly on the lookout for related business lines to tackle. Some of them are extremely profitable and can easily obtain equity or other financing to supplement their own resources for growth. (Coinbase, for example, currently has a market cap of $42 billion, larger than some super-regional US banks and equivalent to the fifth-largest bank in Europe.) As noted, they are determined to close the trust gap with banks before the banks can close the technology gap. Part of this is by preparing for, and encouraging, a considerably more regulated digital asset ecosystem.

The most radical potential change probably comes from DeFi, in which conventional financial institutions and human processes are largely replaced by streamlined automated processes and new software-based financial intermediaries. DeFi for crypto remains a very small part of the financial system and faces major regulatory challenges, but cannot be ignored given its breathtaking growth rate and the sheer potential for efficiencies. A number of developers in this space are considering how they can adapt their models to meet regulatory requirements and bridge the gap. These often blend some form of centralized control function with their ability to handle digital assets.

Central banks are entering the field with their own digital currencies. China already has the e-yuan pilot, Europe is actively studying a digital euro and shows every sign of carrying through with implementation, and many other central banks and governments are in the process of studying their own digital currencies. CBDCs will change the payments ecosystem and, depending on a number of design choices and have the potential to siphon off a significant amount of bank deposits. Further, CBDCs will bring more opportunities for Big Tech and fintech players to grow in financial services, using digital wallets as a bridgehead. (Most central banks will use banks and other intermediaries like the tech firms as providers of digital wallet services to customers.)

Opportunities for efficiencies and risk reduction

Despite improvements, the financial system remains rife with complexities, operational risks, credit risks, liquidity and capital requirements, and other costly features created by the need to coordinate multiple parties and the time required to do so. This is especially evident in cross-border payments and settlement of securities transactions. Digital assets, including central bank digital currencies and stablecoins, offer the potential to dramatically reduce such costs through much faster and more automated processes and settlement.

Opportunities to design new products

New business ecosystems bring myriad opportunities to design new products to meet new needs or take advantage of new possibilities. Some of these are simply the transposition of existing products, like saving and investment products, derivatives or custody, to the new environment. However, there will be a raft of more innovative products. For example, DeFi may evolve from the current situation where funds must be locked into place, in case they are needed, to an approach where certain financial institutions are trusted to supply the funds as needed to execute a smart contract. Other interesting potential products could aid treasurers with liquidity management, allow the liquification of real assets such as water rights, not to mention possible tie-ins to climate-related financial products such as carbon credits.

Opportunities to invest

Increasing numbers of financial institutions and other institutional investors are choosing to put a portion of their investments into bitcoin and other digital assets, because they believe there is a favorable combination of high returns, despite risk, with some level of diversification compared to their other holdings. Further, there are new yield opportunities through “staking” in a number of cryptoassets. We are not offering an opinion on whether digital assets are a good investment in general or for a particular bank, but some financial institutions have dipped their toes in the water with small investments and bank leaders should carefully consider their views on the topic. Client demand to post digital asset investments as collateral for fiat currency loans is also growing, and banks should be ready to assess eligibility and valuation haircuts for lending with digital assets collateral. All of this will be influenced, of course, by the evolving shape of regulation.

Banks will also have the opportunity for purchases or joint ventures of crypto-native firms. Again, regulation will heavily influence what is possible in a particular jurisdiction, but there will almost certainly be ways to take stakes or create partnerships.

Notes

1. Pew Research Center, November January 2021

2. NYDIG Banking and Bitcoin Survey, January 2021