It’s safe to say that China’s digital currency project is the world’s most advanced of its kind, and has been setting the pace for other countries.

As we outlined in our recent paper, A New Dawn For Digital Currency, China’s digital yuan (eCNY) has already conducted successful trial runs in four major Chinese cities, with a nationwide roll-out planned for the Beijing Winter Olympics next year. eCNY, just like the paper yuan, will serve as a legal tender issued by the Chinese central bank and is circulated to the public via commercial banks. Supported by liberalization policy, the currency allows China to transfer money seamlessly across border, enabling users to avoid going through dollar-based international payment SWIFT system.

The Asia-Pacific (APAC) region is the growth engine for global wholesale payments revenue with compound annual growth rate (CAGR) of 11 percent in wholesale payments and cash management revenue from 2015-2017. China is accelerating the extensive use of eCNY in Asia and, in doing so, facilitating any cross-border money transfer given cost savings and efficiencies. This is advancing the country’s effort to internationalize the yuan, which currently accounts for only 2 percent of the world’s FX reserves.

For example, use of eCNY between Singapore and China could drive estimated savings of $16-24 BN SGD. This is 3-5 percent of Singapore’s GDP due to fee savings from lower transaction costs, liquidity savings to real-time treasury, and incremental volumes from lower fees or more liquidity.1 It is imperative that the Association of Southeast Asian Nations (ASEAN region), being China’s largest trading partner, react. But the bigger question is how ASEAN countries can keep up.

Estimated savings driven by use of eCNY between Singapore and China can lead to $16 – 24 BN SGD, 3-5% of Singapore’s GDP

Estimated savings driven by use of eCNY between Singapore and China can lead to $16 – 24 BN SGD, 3-5% of Singapore’s GDP

As countries are unlikely to cede control over their own national currencies and economies, most central banks are at least exploring CBDCs. Monetary policy implementation, financial stability, payment efficiency, and financial inclusion are all catalysts that accelerate a country’s desire for development of their own CBDC. Given that emerging economies have less developed banking and payment systems, a report conducted by the Bank for International Settlement suggests that emerging markets have stronger motivations for issuing CBDC when compared to more advanced economies.

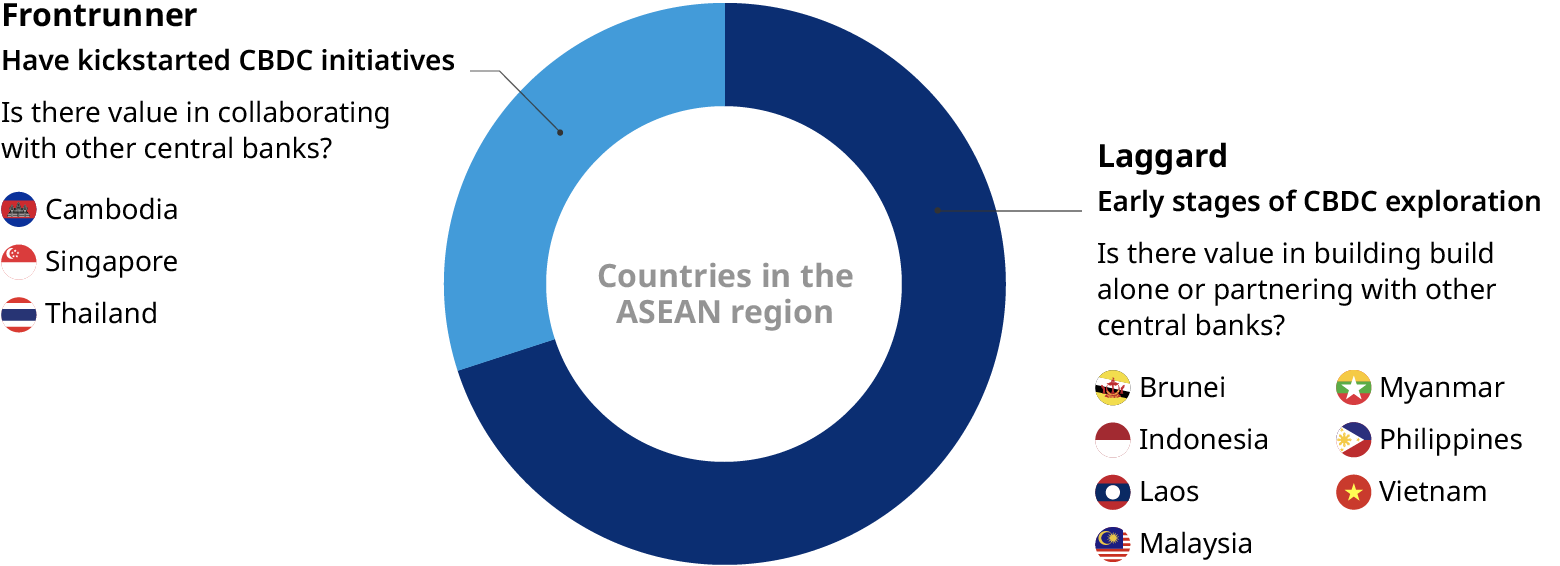

For ASEAN countries in the early stages of CBDC exploration, the dilemma is whether to build alone or partner with other central banks. As an IMF analysis explains, “Launching a CBDC is a multidimensional undertaking that extends beyond the central bank’s normal information technology project management framework.”2

Launching a CBDC is a multidimensional undertaking that extends beyond the central bank’s normal information technology project management framework.IMF analysis

Launching a CBDC is a multidimensional undertaking that extends beyond the central bank’s normal information technology project management framework.IMF analysis

Cost associated with developing and operating CBDC includes labor, infrastructure, software, cyber security, and support costs. Issuing CBDC is a complex national project that will involve multiple dedicated stakeholders, legal and institution preconditions (e.g. data privacy protection legislation, strong central bank cyber resilience) and adequately developed technology infrastructure. For example, the potential cost savings and financial inclusion benefits could be offset by infrastructure upgrade cost.

As outlined in our recent paper, Central Bank Digital Currencies: Six Policy Mistakes to Avoid, central banks should avoid committing the following mistakes: siloed decision making, putting off hard choices about policy objectives, ignoring other policy tools to reach these objectives, creating “Swiss Army Knife” of digital currencies, downplaying political constrains and forces, and muddled communications.

Evidently, issuing CBDC is an arduous task and it is no surprise that central banks would need to evaluate whether the scale of the investment justifies the do-it-yourself endeavor, or there is value in teaming up with other central banks.

On the other hand, for other ASEAN countries that have kickstarted CBDC initiatives, the question is whether there is value in collaborating with other central banks. From Singapore’s Project Ubin, it was clear that a common platform for multi-digital currency settlement is inherently more efficient than connecting multiple digital currency platforms.

Monetary Authority Singapore (MAS) spokesperson highlighted the importance of Singapore’s Project Ubin being a great collaborative journey as “MAS and industry leaders learnt from each other , created new knowledge, and strengthened relationships, and we created a strong ecosystem that is willing to collaborate to build better together.”3

MAS and industry leaders learnt from each other, created new knowledge, and strengthened relationships, and we created a strong ecosystem that is willing to collaborate to build better togetherMonetary Authority Singapore (MAS) spokesperson

MAS and industry leaders learnt from each other, created new knowledge, and strengthened relationships, and we created a strong ecosystem that is willing to collaborate to build better togetherMonetary Authority Singapore (MAS) spokesperson

However, governance and ownership remain the key challenges and it is unlikely that the world will achieve one common international platform for cross-border payments. Instead, there is global interest pointing towards the viability of using multiple-CBDC arrangements, with the hub and spoke model applied regionally as requirements and payment policies are already similar.

Ultimately, it is important that ASEAN countries adopt a team-up strategy and scale-up collaboration among its members. A coordinated design effort would create a unique opportunity for easier cross border transactions and promote the interoperability of digital currencies.

Incorporating cross-country compatibility into early CBDC development stages can help avoid longer time frames of post-hoc reconciliation exercises. At the same time, teaming out creates a counter – balance to the scale and influence of China; net there is power in numbers and scale. Continued discussions, exchanges of domain knowledge and collaboration different central banks would be necessary.

Spurred by China’s CBDC efforts, ASEAN should consider establishing a region-wide platform encompassing common global standards and protocols that will enable ASEAN to interface effectively with other digital currencies.

1 Monetary Authority Singapore, Sing Stats, Expert input, Oliver Wyman analysis

2 See Kiff et al. “IMF Working Paper WP/20/104)” International Monetary Fund at 19 (2020)

3 Remarks by Ms Jacqueline Loh, Deputy Managing Director of the Monetary Authority of Singapore, at the BIS Innovation Summit, 25 March 2021.