Intra-regional flows in capital and wealth are emerging as one of the most exciting developments in the latest renaissance of the New Silk Road. Wealth pools, investment opportunities, and geopolitics are colliding and resonating with one another to reshape the landscape of its financial sector.

A mixture of world-class financial hubs, a rising middle class, sovereign wealth funds (SWFs), and fast-growing markets is creating the right conditions for stronger financial flows across the region, catching up to the robust flow of goods.

Global banks are currently in a strong position. However, regional financial institutions, payment service providers (PSPs), and fintech firms all have room to play by offering differentiated solutions, particularly at a time when interest rates are heightened globally. The race to compete has only just begun.

Four exciting opportunities in financial services ecosystem

Wealth management taps private markets

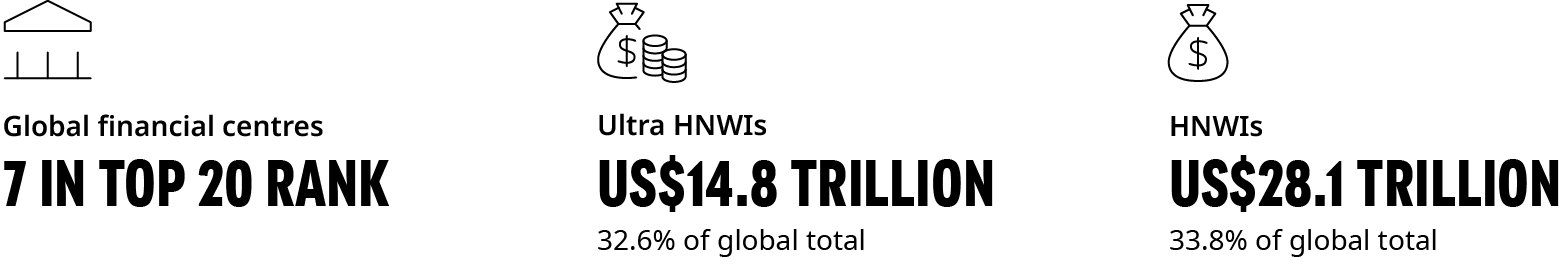

The region’s high-net-worth individuals (HNWIs) will increasingly look to invest in its private market opportunities, but education is key.

Global private banks already have large footprints offering a range of investment funds and public securities. To this end, a more interesting space for asset managers and regional banks is leveraging their local networks to bring private market assets to HNWIs in both markets. Chinese banks have greater access to the types of private equity deals that might be unavailable to global investment banks, and these deals might still be attractive to HNWI investors from the Middle East.

To win clients, asset managers will need to decide on the right coverage model, as the region’s investors may be more familiar with opportunities in Europe or North America, rather than, for example, China or India. With this in mind, it would be better to have a higher share of in-person coverage rather than via digital means. Equally, regional asset managers looking to enter new markets may need to partner with local peers who have existing trusted relationships and the ability to bridge the experience or cultural gap.

The rapid rise of institutional investors

The region is both a wealth pool and investment destination for a rapidly expanding institutional investment industry.

The Silk Road region is already a growing pool of wealth for institutional investors, owing to the region’s rising affluence and positive demographics. Mutual funds, pension funds, and insurers, among other institutional investors, have seen assets under management (AUM) grow to US$44 trillion by 2022, and their cumulative AUM will continue to rise. Global asset managers have a key role to play in driving growth and innovation. Leading regional players are also going to be increasingly competitive.

The region is already a growing investment opportunity for institutional investors. However, there is still significant room for growth. The region’s debt and equity markets are undersized relative to bank financing, with non-bank financing accounting for just 70% of private credit at present. Regulators in the region’s financial hubs are working hard to develop their debt markets. Higher interest rates may also push companies to seek more creative sources of nonbank financing.

Fintechs, digital banking, and financial inclusion

Fintech providers, particularly ones from China, have opportunities to service overlooked customers across the region.

The New Silk Road is a source of affluence, especially in the Gulf Cooperation Council (GCC) and North Asia, but it is also home to 30 countries that have a GDP per capita of less than US$10,000. Most of these countries are underserved by financial players. Fintech providers, allied with established financial institutions, have an opportunity to service this market demographic, thereby tapping into new sources of demand. It helps that many of the world’s most exciting start-ups that are focused on this area are found within the region.

China's digital banking and micro-credit technology firms, for example, have opportunities to grow in the lower-income markets of the Middle East and North Africa. Tie-ups with established financial institutions in the Middle East would assist stakeholder management and provide local funding. Alibaba and Tencent are already making moves into markets such as Iraq, applying the lessons learned in China over the past 15 years.

Cross-regional financing platforms

Joint-investment platforms for the financing of infrastructure or capital goods could become more prevalent, given the region’s continued capital-intensive growth.

The New Silk Road region will continue to be a major investor in infrastructure and other capital goods, from railways to aircraft. Financing such big-ticket investments will grow more complex as interest rates normalize globally. New cross-regional funds or platforms would bring together a mix of investors, including commercial banks, asset managers, and SWFs across different geographies, such as China and the UAE, or Japan and Saudi Arabia.

We see a range of cross-regional opportunities. One example could be a joint-infrastructure platform with Chinese and GCC investors funding projects in sub-Saharan Africa. Others could be an aviation leasing platform, given the region’s rapidly expanding aviation business, or an SWF-led fund for investments in renewables, especially hydrogen, given the already-strong energy ties between Asia and the Middle East, and the shared national interests in the expansion of renewables infrastructure.

This article is part of our New Silk Road series