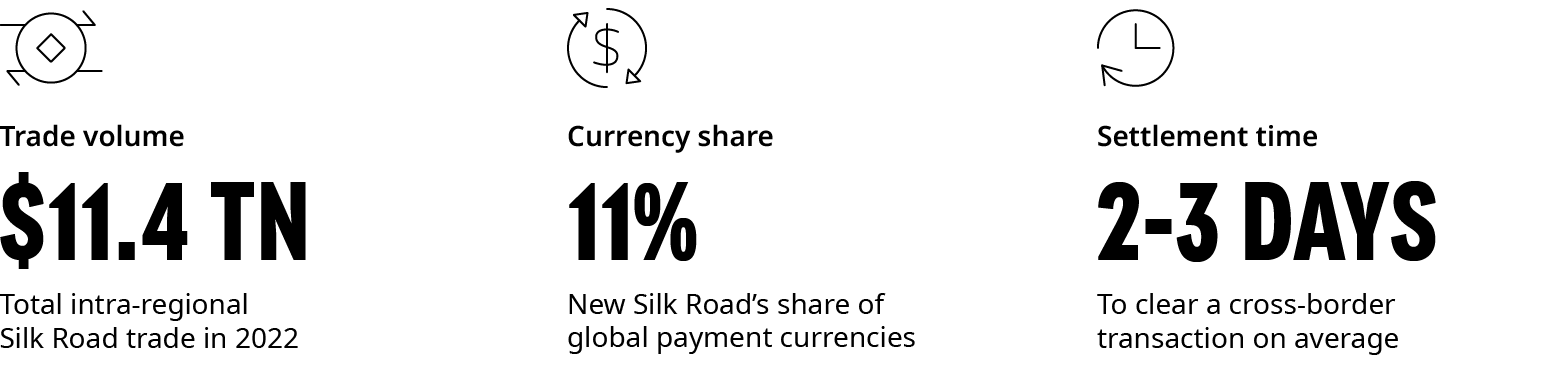

The Silk Road is best known as a major historical trade route connecting East and West. Today, the cross-border flow of people and goods is equally important, and the New Silk Road region (between Asia and the Middle East) is home to 62% of the world’s population spread across more than 50 countries. Unlike Europe or the United States, the region is not part of a customs or monetary union, so cross-border financial transactions are a tax on the region’s efficiency and productivity. Therefore, improving the speed, cost, and reliability of cross-border transactions is important to the New Silk Road’s success.

We see the region’s rising intra-regional trade, cross-border mobility, and geopolitics as forces for change, so long as the region continues to integrate. The New Silk Road is also an innovator in many areas, such as cross-border fast payment networks.

This report, "Next-Gen Payment As Supercharger", recognizes there are multiple pathways to improving digital payment solutions, and that the challenges are not small. However, the New Silk Road is already making progress in this area, and the implications for global payment systems and the US dollar (USD) could be profound.

Four exciting opportunities in digital payment solutions

- Cross-border fast payment connectivity

Southeast Asia is driving connectivity between retail fast payment networks, and we see opportunities for other regions to participate. - Enhanced solutions by banks and payment service providers (PSPs)

Leading financial institutions are already delivering improvements in wholesale multi-currency cross-border settlement. - China’s bilateral flows and the Chinese yuan (CNY)

China is the largest export partner for over half of the countries in the New Silk Road and is trying to grow the volume of CNY settlement. Digital payment solutions will play a role. - Connecting the New Silk Road with central bank digital currencies (CBDC)

The region’s major central banks are well advanced on cross-border CBDC payment options, which are albeit more a long-term bet.

Three scenarios for the future of the Silk Road’s digital payments

1. A supercharged financial bloc

Fast payment connectivity accelerates among ASEAN countries, with a large share of individual cross-border transactions settled instantly and at low fees. The GCC, Hong Kong SAR, and India connect to the ASEAN countries’ fast payment networks. Bank and non-bank PSPs roll out a range of enhanced solutions for connecting liquid and illiquid markets.

The USD remains the region’s major settlement currency, but the CNY is increasingly used between China and its major trade partners as digital platforms improve. At the same time, CBDC pilots identify viable commercial opportunities led by China’s push to expand the use of the CNY, including eCNY, for wholesale trade settlement.

2. Bilateral gains, but winners and losers

Singapore’s fast payment connectivity to other ASEAN markets improves, including Thailand, Malaysia, and Indonesia, as well as the UAE and Saudi Arabia, owing to the latter pair’s greater ambitions. Multi-currency settlement is increasingly used for major bilateral trade corridors, particularly between China, the ASEAN countries, and the GCC.

Hong Kong SAR and mainland China accelerate financial integration, with eCNY increasingly used for cross-border transactions, alongside existing digital wallets. However, CBDCs generally struggle to gain traction, aside from a handful of high-profile transactions between major international hubs, as their business cases fail to generate sufficient appeal.

3. Regulation and inertia kill efforts

Domestic regulators continue to push ahead with improvements to domestic payment solutions but have little appetite to negotiate the complex agreements needed for intra-regional connectivity. Major banks and a handful of larger PSPs are the main drivers of improvement in cross-border payment efficiency, and they do so by tweaking the existing infrastructure.

The USD remains the region’s primary settlement currency in the absence of faster, cheaper, or more secure alternatives. China’s slowing economy and debt challenges constrain the ability of regulators to push ahead with eCNY internationally. There is also limited appetite for CNY financing, not least because China’s import demand remains soft.

This article is part of our New Silk Road series