In the UK life and pensions industry, significant progress has been made in modernizing customer interactions across the policy lifecycle — from streamlining the origination and processing of applications to deploying advanced modelling techniques to better understand customer behavior. However, despite this progress, issues persist around core data and processing efficiency, primarily due to the amount of legacy infrastructure that exists. This is preventing insurers from improving their customer propositions and from delivering cost base savings. Below is an excerpt and our full Fulcrum product overview on legacy migration can be viewed here.

Fulcrum breaks the legacy technology trap

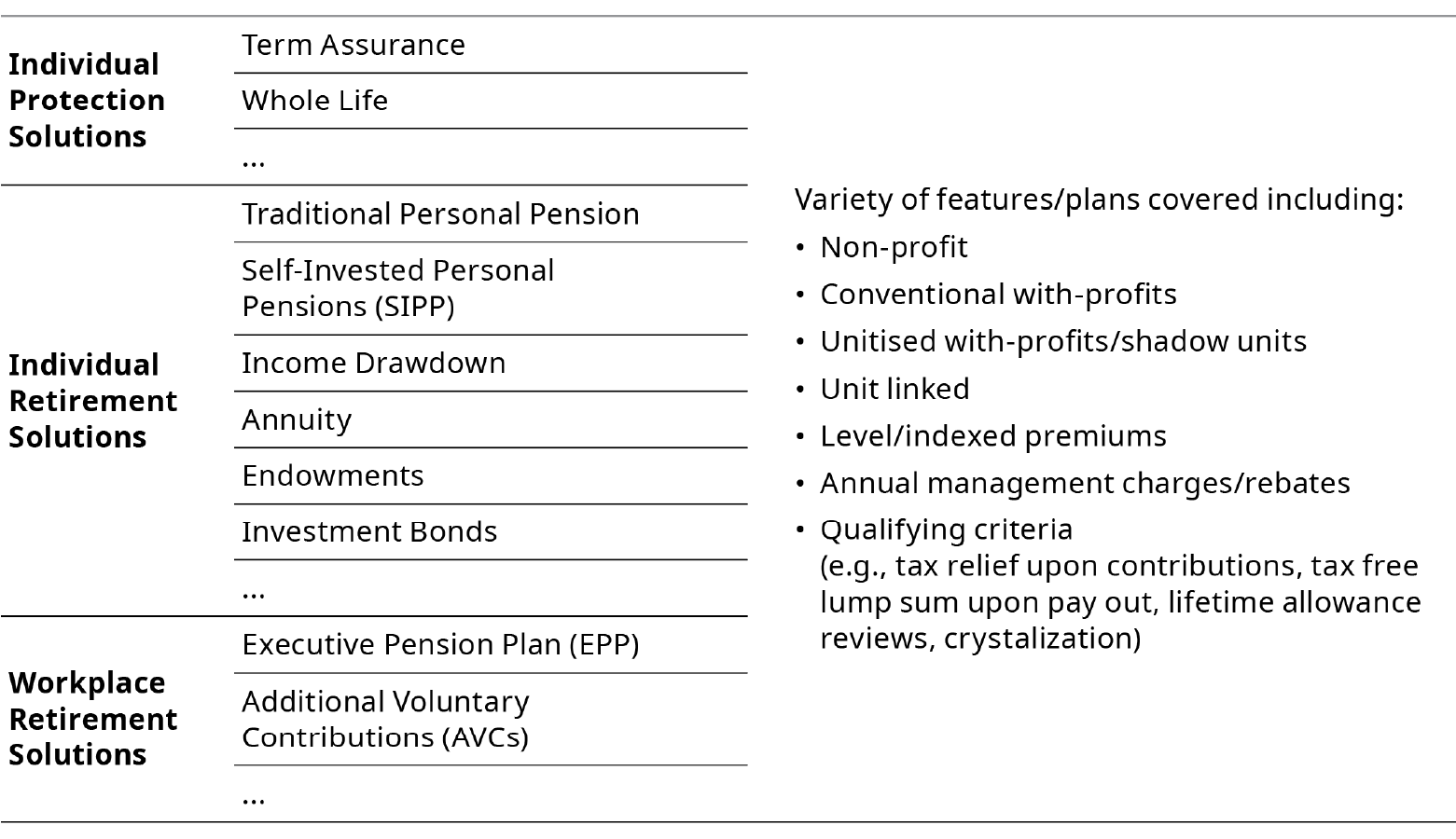

With Fulcrum, our proprietary platform, Oliver Wyman has partnered with 20-plus insurers and the largest third-party administrators (TPAs) in North American and the UK to accelerate and de-risk migration programs, achieving dramatically different results. Our set of proprietary tools leverage modern capabilities including artificial intelligence (AI), machine learning (ML), and the cloud. This, combined with Oliver Wyman product and industry expertise, allows clients to address migration complexities.

Fulcrum modernizes life insurance migration challenges, leveraging artificial intelligence, machine learning, and the cloud

Fulcrum modernizes life insurance migration challenges, leveraging artificial intelligence, machine learning, and the cloud

Fulcrum allows life insurers and pension providers to migrate data on time and within budget

Traditional approaches to systems migration often use a process of limited and repeated policy sampling with late-stage validation processes, resulting in lengthy and costly programs. These methods focus on conducting product configuration and data extraction separately — with validation only initiated after the product configuration is completed.

This can lead to critical issues being discovered months or years into the process, with errors taking months to resolve, and a seemingly “green” project suddenly turns into months behind schedule. The scarcity of legacy system experts and the difficulty in pinpointing value discrepancies further complicate matters. Resetting systems for multiple testing cycles drain insurers' time and resources, emphasizing the inadequacy of conventional migration strategies.

For most insurers and pension providers, successfully completing a policy administration system (PAS) migration on time and within budget is a seemingly impossible task. However, Fulcrum disrupts this paradigm by combining specifically designed software and processes with our insurance domain experts.

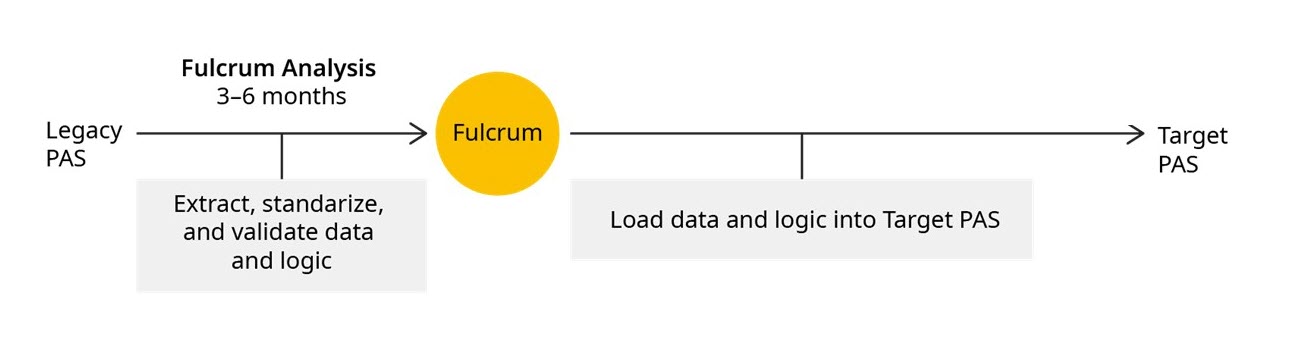

Exhibit 1: Fulcrum solves aging policy administration systems (PAS) migration challenges

Oliver Wyman analysis

Drive significant speed, efficiency, cost savings and modernize your legacy system

With Oliver Wyman's Fulcrum platform, we take a different approach to drive significant speed, efficiency, and cost savings. Within three to six months, Fulcrum extracts raw data from your legacy system and structures it into a standard data layer (SDL) format and, in parallel, replicates the product logic, shaving months and potentially years from the overall conversion timeline. Acting as a bridge between legacy and target systems, Fulcrum facilitates the configuration and iteration of products and data, slashing the 36-to-48-month average conversion timeframe to under 24 months.

Fulcrum offers innovative features that accelerate, automate, and de-risk migrations

Fulcrum has a distinctive value proposition that leverages the latest modern tools and offers insurers:

Oliver Wyman has partnered with 20-plus insurers and the largest third-party administrators (TPAs) in North America and UK to accelerate and de-risk migration programs, achieving dramatically different results

Oliver Wyman has partnered with 20-plus insurers and the largest third-party administrators (TPAs) in North America and UK to accelerate and de-risk migration programs, achieving dramatically different results

Unlock the power of Fulcrum and maximize operational efficiency

Fulcrum is Oliver Wyman’s proprietary platform where strategy and execution meet. Fulcrum offers solutions across many areas of insurance including data management, new product development, policy compliance, platform migrations, portfolio compression, hedging and analytics. Our set of proprietary tools combined with Oliver Wyman product and industry expertise allows clients to maximize operational efficiency.