Fulcrum is where strategy and execution meet. We can help your insurance company with the Section 7702 interest rate change — immediately and going forward.

Fulcrum is where strategy and execution meet. We can help your insurance company with the Section 7702 interest rate change — immediately and going forward.

Congress passed a federal spending bill last December that amended Section 7702 of the Internal Revenue Code (IRC). With this change, life insurance companies may face immediate operations and technology challenges to meet the new requirements, including an interest rate modification that impacts life insurance policies issued after January 1, 2021 (see notes 1).

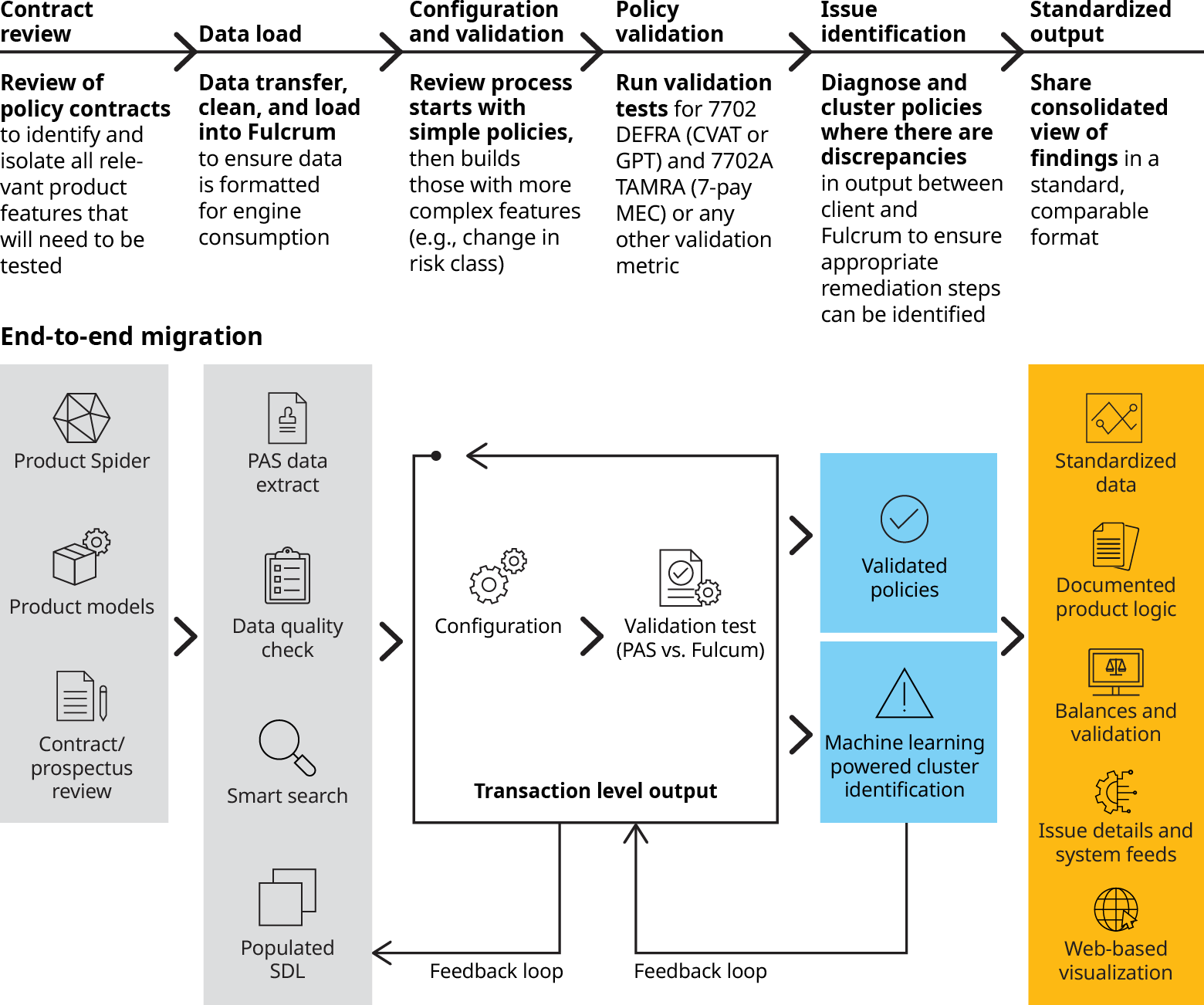

Oliver Wyman’s Fulcrum can help insurance operations and technology leaders to manage the required changes and ensure policyholders stay compliant with this new provision. Fulcrum brings together our deep life insurance, actuarial, data transformation and processing expertise to manage 7702 required changes. The service can help your business review your portfolio of existing policy contracts with independent calculation replication and/or perform an ongoing compliance assessment review for both new and existing policies.

Given the rapid onset of these regulatory changes, this paper explains Section 7702 provisions; the compound effect to your operations, technology, business and policyholders; and suggests ways we can help.

What’s happening with Section 7702?

The Consolidated Appropriations Act, 2021 amends interest rates that are used to define life insurance policies. The rate determines whether policies: can qualify as (1) insurance contracts (with beneficial tax treatment); (2) become life insurance modified endowment contracts — MECs (and lose some tax advantages); or (3) are no longer life insurance contracts, such as becoming investment vehicles (with no tax advantages). The changes to 7702 will require insurers to rapidly make changes to how they administer certain products on an ongoing basis, as well as inform policyholders of tax status changes to their policies.

What operations and technology changes are needed?

Insurers’ administrative systems must now be equipped to handle variable rates, which were previously fixed or static. Actuarial calculation approaches that were originally pre-defined, pre-loaded, or hard-coded, may now require a more dynamic approach. The rates update to insurers’ systems and processes will have to be made quickly to meet the grace transition period of December 31, 2021.

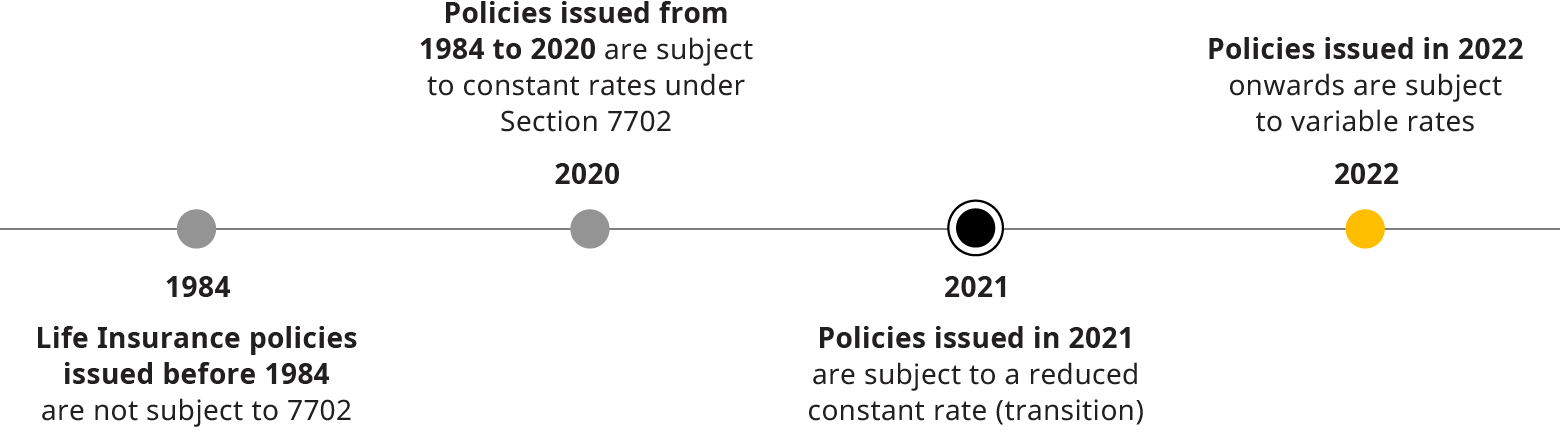

The amendment to Section 7702 impacts contracts sold on January 1, 2021 and after; there is a transition period for 2021 whereby the ‘accumulation test minimum’ rate is a fixed 2 percent. Insurers must make changes to their systems and processes quickly, to handle both fixed and variable rates. See the interest rate modification in the exhibit below. Thereafter, the rate is expected to be set annually.

Significant operations and technology process changes may be required to meet the requirements of the rule change.

Significant operations and technology process changes may be required to meet the requirements of the rule change.

The impact to life insurers and policyholders

Section 7702 regulation requires life insurance contracts (issued from 1984 forward) to pass either the cash value accumulation test (CVAT) or the guideline level premium and corridor test (GPT); and Section 7702A contracts are required to pass the 7-pay test. If insurance contracts fail these calculation tests, policyholders will lose tax advantages and will be exposed to immediate tax(es) on gains and losses.

In this prolonged low interest rate environment, Section 7702’s provision and reduction in interest rates would allow policyholders to accumulate higher cash values and apply more premiums to their policy, while maintaining the status and tax advantages of a life insurance policy. As a result of the changes, life insurers will need to change processes and systems, as well as communications to policyholders.

Fulcrum ran validation of every policy (not samples), and the platform was capable of running the full history of ONE MILLION policies in less than an hour.

Fulcrum ran validation of every policy (not samples), and the platform was capable of running the full history of ONE MILLION policies in less than an hour.

How Fulcrum can help insurers

Fulcrum is Oliver Wyman’s proprietary platform where strategy and execution meet. We designed the platform to provide the necessary tooling and intelligence to get your organization unstuck.

Fulcrum offers solutions across many areas of insurance including data management new product development, policy compliance, platform migrations, portfolio compression, hedging and analytics. Our set of proprietary tools combined with Oliver Wyman product and industry expertise allows clients to rapidly standardize policy system data, validate processing logic and policy values.

We can help your organization with Section 7702 compliance, both with implementation of the new changes as well as going forward. Our Section 7702 module reviews every policy and provides an independent calculation replication. This can be coupled with Oliver Wyman’s actuarial expertise to provide insurers with ongoing compliance assessment and review.

We have already used Fulcrum with clients on Section 7702 and are ready to assist you on your journey. RESULTS:We worked with a client who needed an independent assessment of their policies. Our team used Fulcrum to perform a complete compliance assessment to verify the correct tax status for all of their policies. We identified issues (calculation, data and processing) within Section 7702 calculations that impacted their active policies. Our actuarial experts provided customized analysis to support remediation. We helped the insurer correctly tag life insurance policies and accurately inform policyholders when their tax status changed. The Section 7702 module also automatically generated tax status notifications to send to policyholders.

A powerful module to meet Section 7702

Oliver Wyman can help implement an action plan across your business. Our Section 7702 module helps you quickly handle both fixed and variable calculation rates — within your policy admin system.

Independent policy review

The module independently reviews every insurance policy for tax compliance tests (for example CVAT, GPT and 7-pay tests). It can help your organization accurately calculate the amended interest rates and confidently know you are meeting Section 7702 requirements.

We have worked with insurers using multiple systems and reviewed large numbers of policies.

Transparent compliance system

Fulcrum helps insurers meet their legal obligations to monitor and inform policyholders on changes in tax status. With the Section 7702 changes, existing processes, which are not yet updated from January 1, 2021 forward, may already be incorrectly processing tax status notifications and creating customer-facing issues. For example, processes which automatically “force-out” or require policyholder confirmation prior to applying a MEC status. These tax notifications may not be triggering appropriately in insurers’ systems if the incorrect rates are applied. Fulcrum helps your organization prevent this, while accurately notifying customers of changes to their tax status.

Get started with Fulcrum

We can help your insurance company and policyholders with the Section 7702 interest rate change — immediately and going forward. Whether your organization needs an independent policy review, customized analysis, policy rate validation or support with generating customer notifications — our Fulcrum solution, coupled with our regulatory and actuarial expertise, can get your organization started quickly.

The time to start is now.

NOTES

1. The Consolidated Appropriations Act, 2021 was passed by the U.S. Congress in December 2020, to help insurance companies respond to the economic impact of Covid-19 and a prolonged period of ultra-low interest rates.