Atlas by Oliver Wyman is a global leader for annuity modeling

Atlas by Oliver Wyman is a global leader for annuity modeling

The world’s largest insurers are using Atlas for financial management of their annuity portfolios. Our modeling suite provides powerful process automation for hedging and financial reporting — ultimately unlocking valuable actuarial time for analysis.

Modeling for the stochastic world

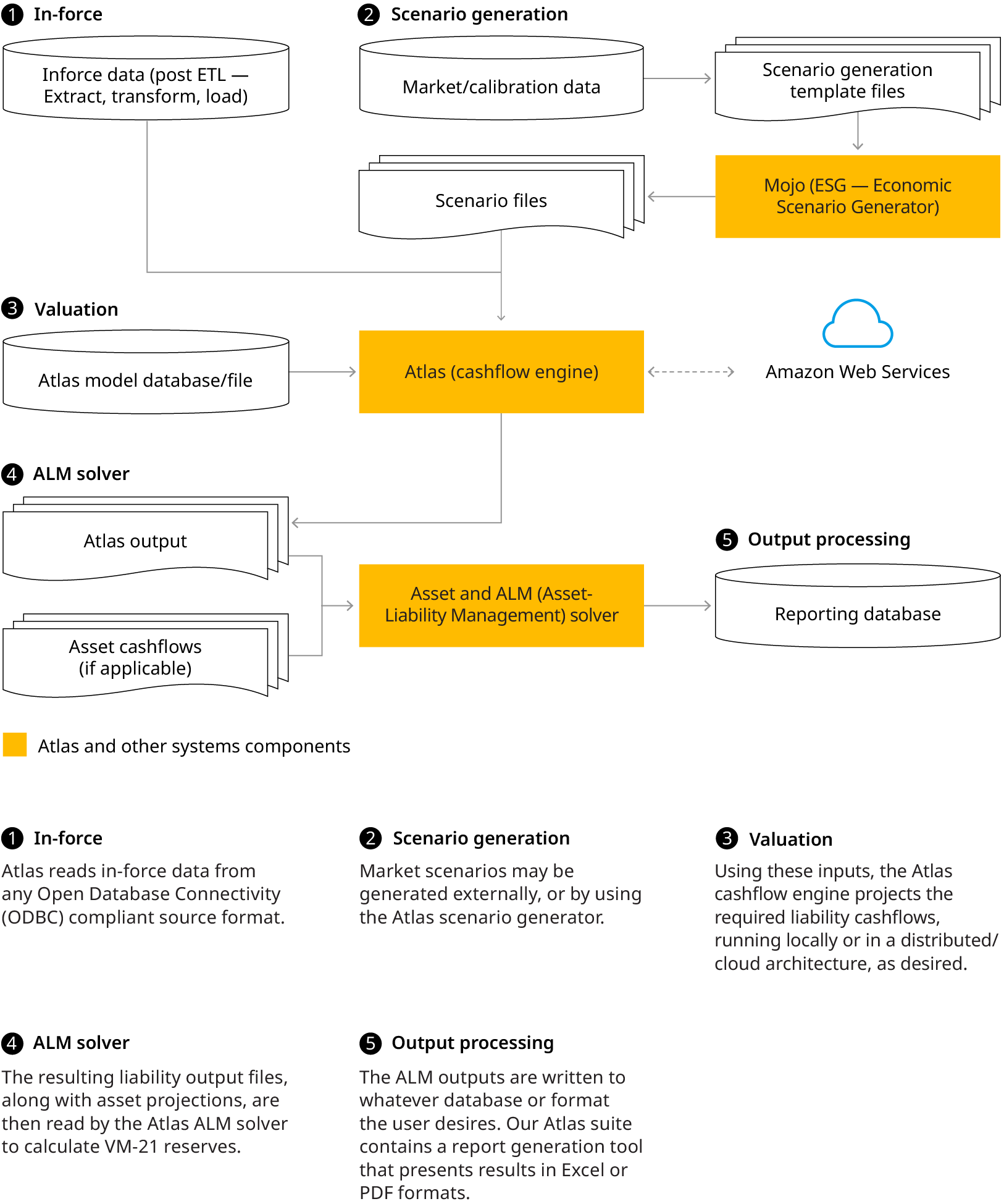

US GAAP LDTI, VM-21, Principles-Based Reserving and IFRS 17 are all pushing models towards more complex and often stochastic projections. We have solutions which can augment existing systems as well as options to modernize, re-envision and automate the financial reporting and risk management processes within your organization.

Our industry-leading modeling can achieve faster runtimes by 90% — ultimately lowering computing costs

Our industry-leading modeling can achieve faster runtimes by 90% — ultimately lowering computing costs

The Atlas advantage

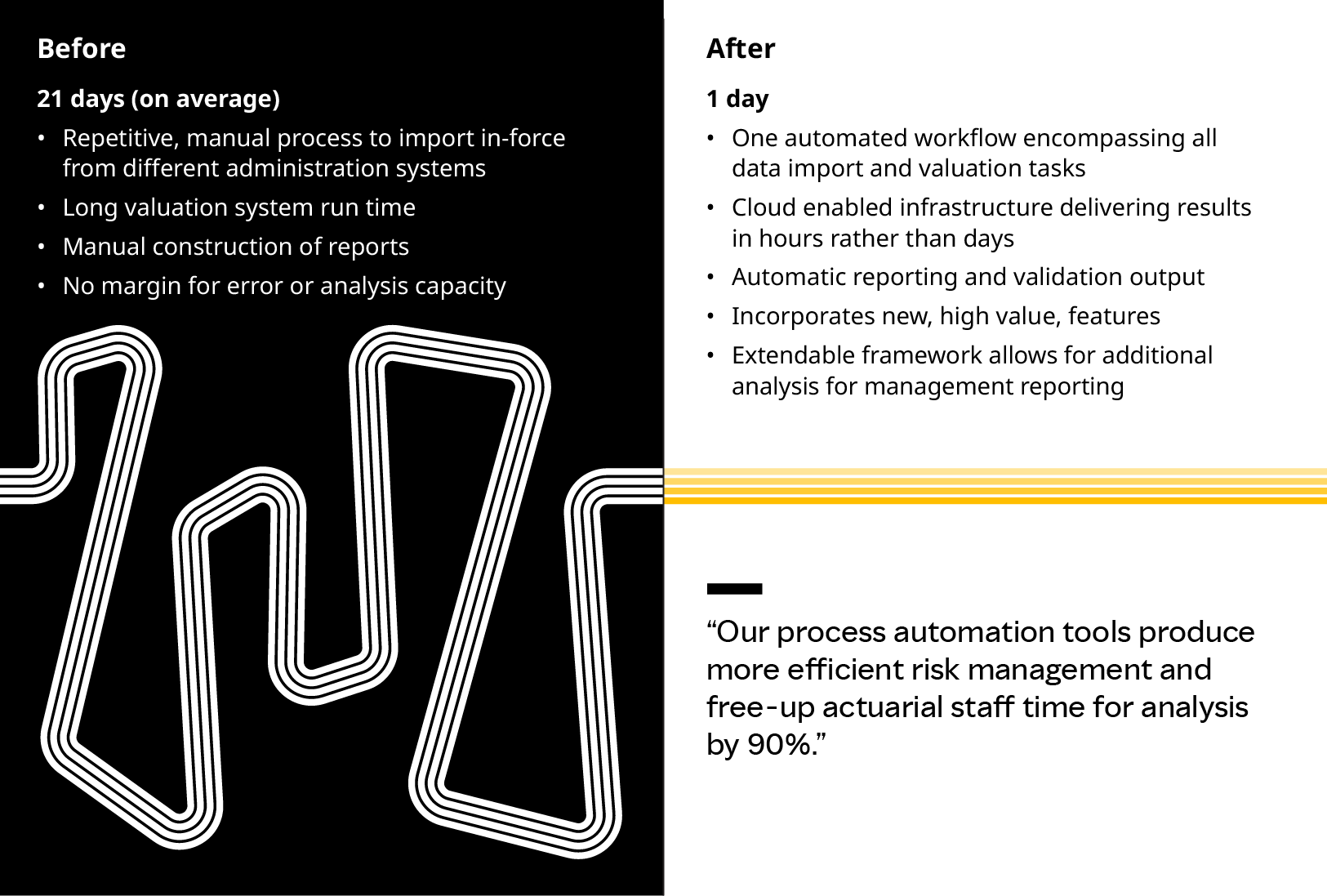

Teams using Oliver Wyman software and services have achieved faster runtimes (by 90%), lower computing costs, reporting and analytic agility and operational efficiency across their business.

Additionally, Atlas uses Oliver Wyman’s proprietary in force compression algorithms, which can reduce the size of the liability in force — and therefore computational burden — by over a hundred-times with minimal loss of modeling fidelity.

Atlas, coupled with Oliver Wyman’s regulatory and actuarial expertise, can get your organization started quickly.

1. High performance computing

Our Atlas modeling suite meets your annuity valuation challenges. It is purpose-built for stochastic valuation, whether in hedging, statutory valuation, GAAP valuation, pricing, or ad hoc analysis and development. Accordingly, it is dramatically faster than legacy models.

Our high-performance systems can be run from your workstation, or efficiently distributed to the cloud. Fully and seamlessly integrated cloud workflows mean the necessary computing resources are always accessible at the user’s fingertips such that cycle times can be managed in your desired range. And with Atlas’s unmatched computational efficiency, processes scale cost-effectively — in a cloud-based world, runtime savings translate directly to cloud cost savings.

2. Powerful process automation

Atlas’s workflow automation capabilities can revolutionize your production processes. By removing manual touchpoints, Atlas can simultaneously reduce operational risk and free up actuarial staff for analysis (instead of looking after model runs or executing manual copy-paste steps). Our clients find that their production processes are streamlined from days or weeks into only hours.

3. Intergrated controls and governance

Atlas’s integrated control features prevent accidental or unauthorized model changes. Permissions for individual elements can be set at the individual or group level through active directory.

Moreover, all model edits — including assumption changes — are tracked in a transparent and auditable model revision history. The revision history can be used to generate a model “patch,” similar to a source code merge. This enables the promotion of model revisions from desktop to test to production in accordance with your organization’s specific model and assumption governance procedures.

4. Intuitive user experience

Atlas provides complete flexibility in product behavior, assumptions and liability metrics. Typically, 95% or more of a model is configured through built-in point and click features. Where augmentation is required, Atlas offers advanced programming interfaces to accommodate proprietary behaviors and event handling.

Atlas’s inheritance tree is key to its usability. Assumptions are inherited from purpose-to-purpose, subject to node-specific overrides. This makes it easy to set up and run sensitivity analyses, nested stochastic projections, financial planning runs, Clearly Defined Hedging Strategies (CDHS), modeling, and other model variants — and creates a single source of truth across pricing, hedging, financial reporting, and enterprise risk management (ERM).

5. Oliver Wyman insurance and actuarial expertise

Atlas, coupled with Oliver Wyman’s regulatory and actuarial expertise, can get your organization started quickly.

Connect with our team to arrange a demo. Connect with our team to arrange a demo.

Get started with Fulcrum

Atlas is a suite within Oliver Wyman Fulcrum, a proprietary platform where strategy and execution meet.

Fulcrum offers solutions across many areas of insurance including data management, new product development, policy compliance, platform migrations, portfolio compression, hedging and analytics. Our set of proprietary tools combined with Oliver Wyman product and industry expertise allows clients to maximize operational efficiency.