This article was originally published by Informa Connect under the title “Energy Crisis, Inflation And Interest Rates: Increasing Visibility To Navigate The New Credit Cycle” on November 16, 2022.

The Organisation for Economic Co-operation and Development (OECD), International Monetary Fund (IMF), European Central Bank (ECB), and European Systemic Risk Board (ESRB) are some of the public voices forecasting a worsening macroeconomic outlook, characterized by a slowing world economy, declining consumer confidence, and lower momentum in business activity, particularly in Europe.

Following a cycle of exceptionally low cost of credit, generally benign impacts of the pandemic on banks’ asset quality, and the positive headwinds of rising interest rates on profits, banking executives are facing a growing dilemma regarding the right level of conservatism to adopt in their cost of credit projections for 2023-24.

Core to the debate is the reliability of existing credit analytics and their ability to account for today’s particular configuration of risks, namely:

Extraordinarily high inflation — persistently high and volatile energy prices fueling broader inflation, with asymmetrical impacts across sectors based on their cost and revenue structures.

Increasing interest rates — faster-than-expected monetary tightening in an environment of historically high debt levels, particularly affecting highly indebted companies post-COVID-19.

Lower likelihood of public support — broad-based monetary and fiscal support provided extraordinary credit risk mitigation during the pandemic but seems less likely this time around.

Outlook uncertainty — in a very volatile environment, the funnel of plausible scenarios is wider, including risks to the downside characterized by further energy disruption and interest rate rises.

Trained on historical data reflecting very different macro conditions from today, banks’ credit decisioning engines, as well as broader IFRS 9 and stress-testing infrastructures are struggling to accurately create visibility on key portfolio vulnerabilities and opportunities.

What are emerging best practices we observe across the industry?

- Enriching scenario intelligence

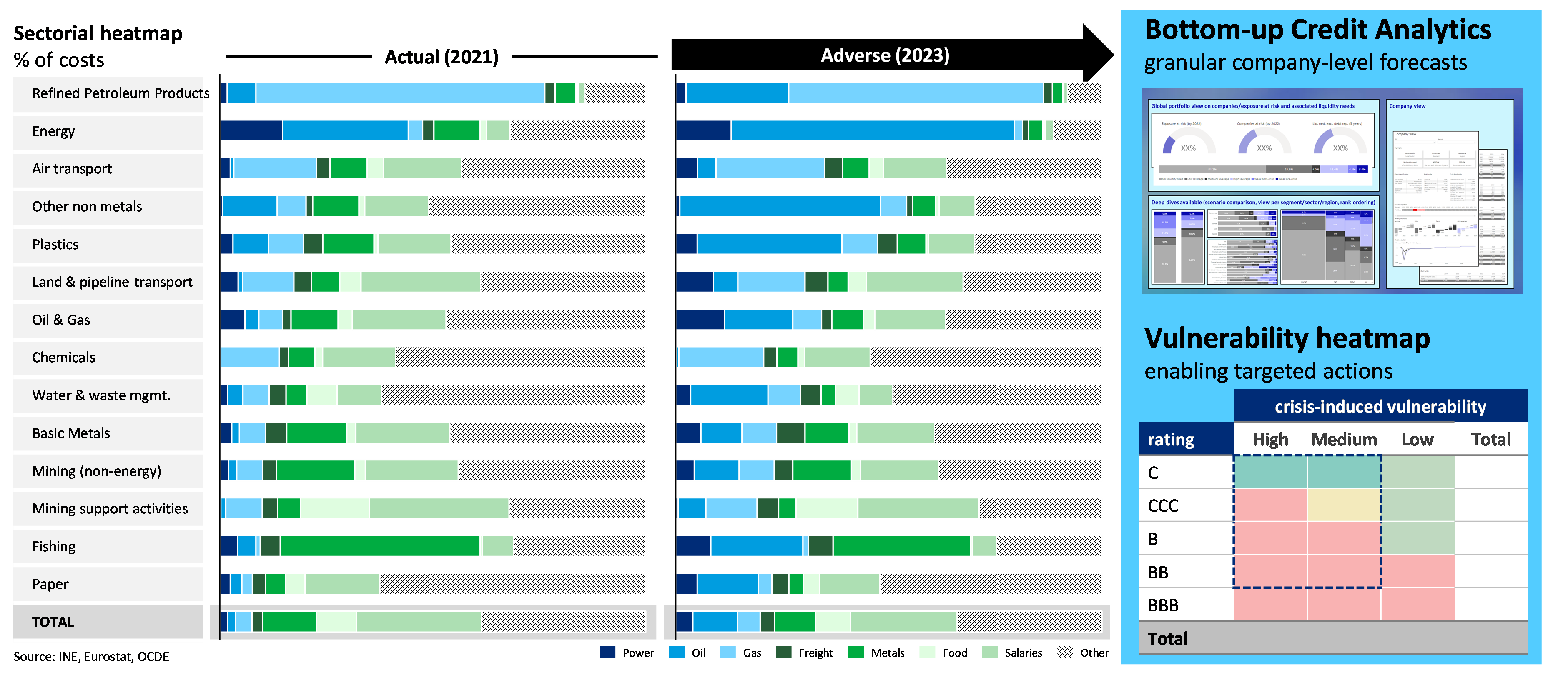

This should start from a strong understanding of geopolitical dynamics to develop plausible narratives of potential energy/inflation/interest rate scenarios, including an agile scenario updating frequency and governance and granular scenario parameters across key areas of concern, together with a public policy radar that keeps track of the latest policy measures. - Granular impact heatmaps

Impact heatmaps are a helpful tool to improve visibility on key portfolio vulnerabilities across sectors and geographies, enable better targeting of key crisis response actions, and prioritize subsequent drilldowns.

In their most basic form, heatmaps start from static risk indicators such as today’s rating, overlayed with basic sector or segment vulnerability clusters such as energy intensity or affordability. More sophisticated approaches often consider advanced forward-looking rating simulations under alternative crisis-induced scenarios as the key vulnerability indicator. - Bottom-up customer dynamics

Understanding the combined sensitivity of individual customers to higher energy prices, as well as potential energy rationing, higher overall inflation, revenue pass-through, and rising interest rates is key to enhancing the discrimination between healthy and vulnerable clients.

In the SME and corporate space these analyses frequently get executed manually. We see however high value in industrializing these in order to achieve a broad portfolio coverage and provide credit analysts with a fast and objective ex-ante view that they can then refine and override based on their knowledge of the client. Innovative data sources can enrich these techniques even further by leveraging signals from transactional data or news alerts to better detect and project individual patterns and company archetypes. - Credit risk decision and risk appetite embedding

A better identification of vulnerable clients should ultimately enable better credit decisioning across the entire credit value chain. This starts by improving risk anticipation and early warning processes.

Credit risk appetite and policies are the formal vehicle leading institutions use to entrench the targeting, design, and embedding of differentiated client response strategies and offerings based on their level of vulnerability, supported by clear playbooks informed by the forward-looking bottom-up credit analytics described above.

Furthermore, managing the impacts on ratings, provisioning levels, and capital requirements of the expected deterioration of company financials throughout 2023 is a connected application that a handful of banks are starting to focus on, and increasingly reflecting in their post-model adjustments. - Supervisory dialogue

Supervisors are increasing their scrutiny of banks’ asset quality and overall resilience, requiring institutions to create a strong traceability and set of supporting analytics that help them navigate through this environment and evidence sound risk management today.