We present the November 2022 edition of our Health Insurer Financial Pulse newsletter as we continue to operate in unprecedented times. This newsletter includes reported statutory claims experience for health insurers through Q2 2022, our 2021 RBC analysis, highlights from public companies’ Q2 2022 financial statements, and a summary of recent health plan M&A activity.

Our aim is to keep you abreast of key market trends and dynamics that impact health insurer financial results and profitability. We hope you enjoy the newsletter and find it informative. Please look for our next full edition in 2023 and some insights in the interim.

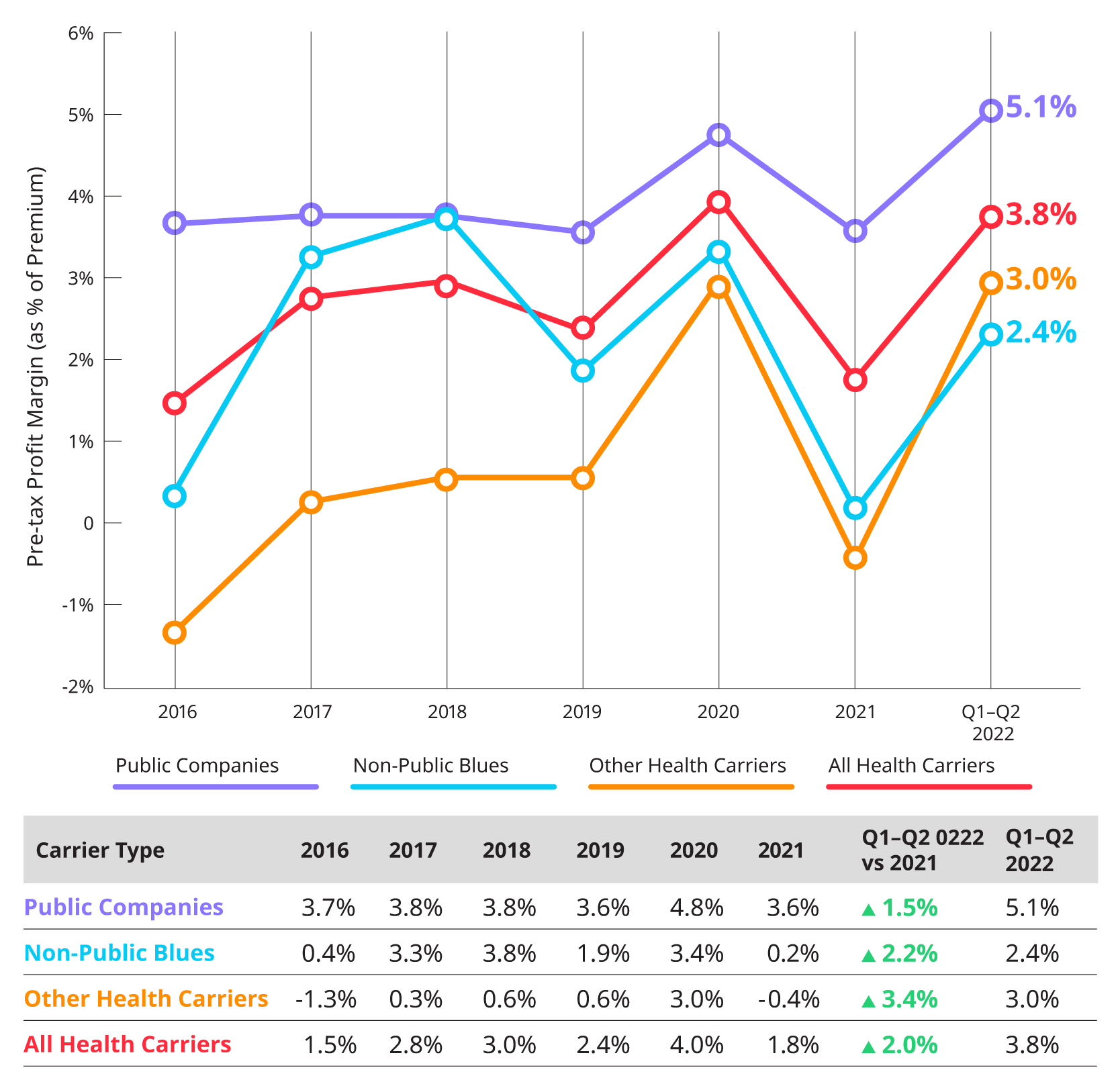

Q1–Q2 2022 YTD Statutory Financials – Individual, Group, Medicare, and Medicaid Markets

Overall, pre-tax margins increased in Q1–Q2 2022 to 3.8% with decreased loss ratios compared to full year 2021.

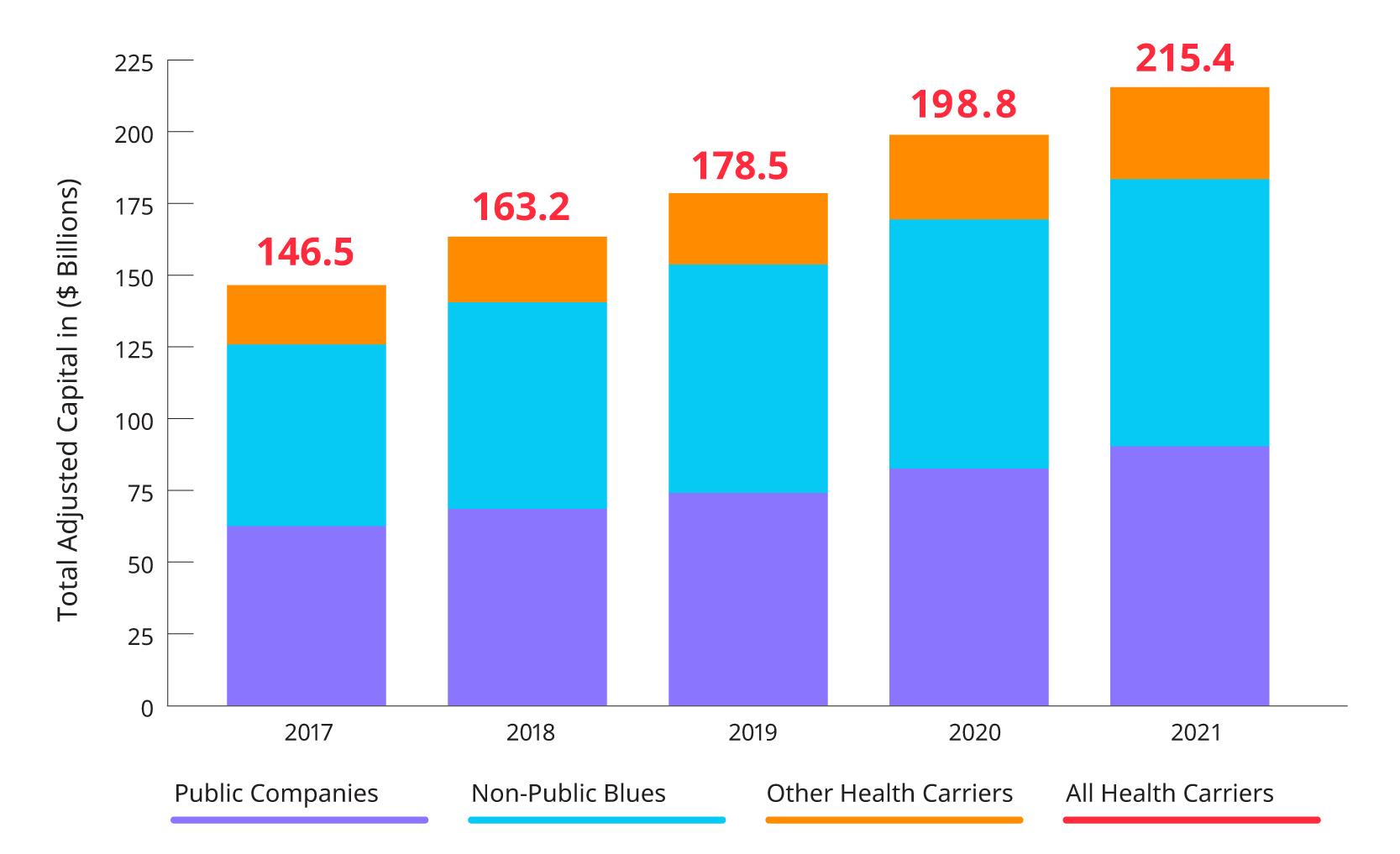

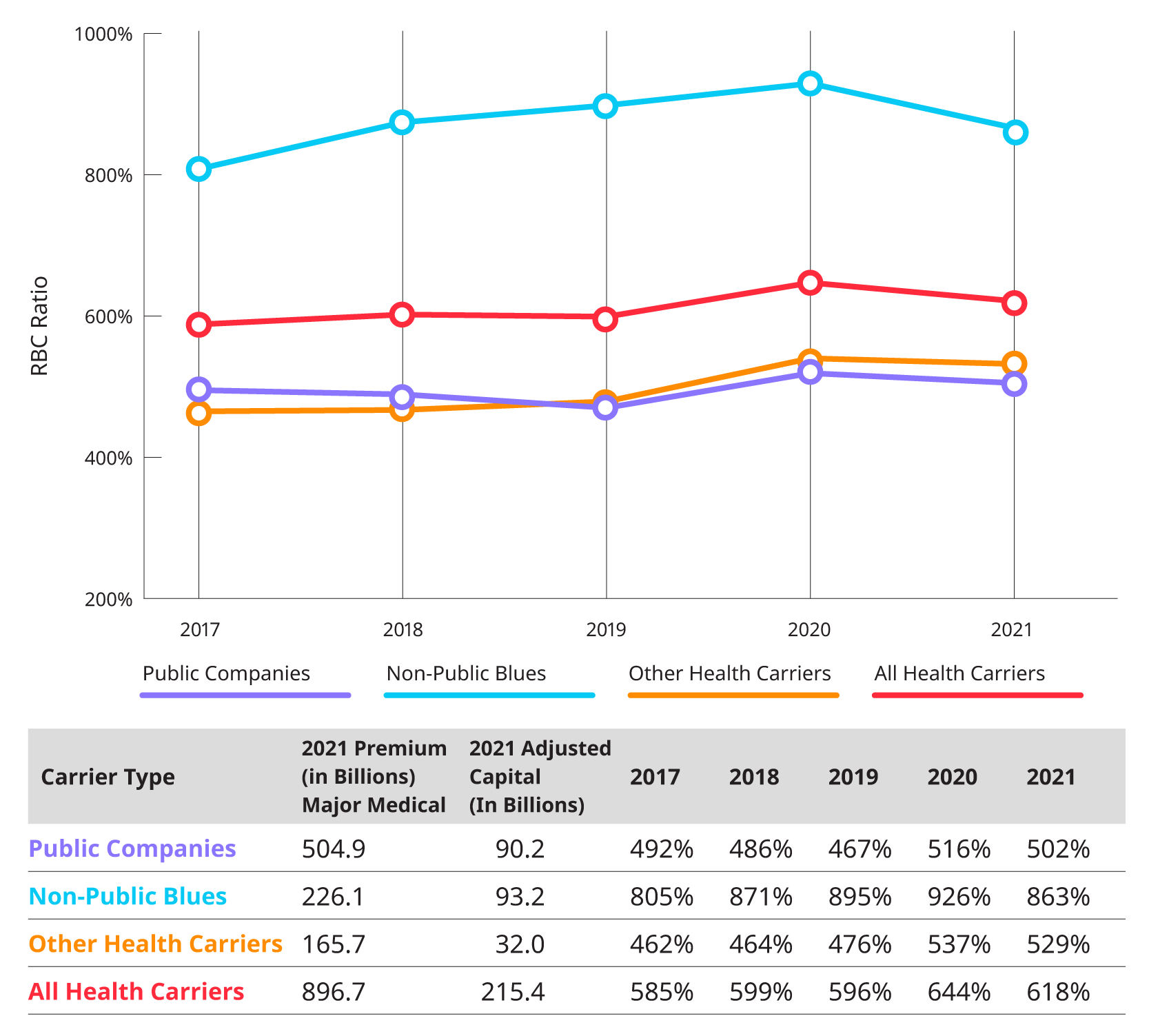

2021 RBC Trends

RBC ratios for Non-Public Blues saw fairly significant decreases in 2021 compared to all other carriers whose ratios remained relatively unchanged from 2020. Non-Public Blue carriers still consistently had the highest RBC ratios, reflecting their desire to retain more capital due to their limited availability to raise capital outside of business operations.

Download our full report to read more.