We present the fifth edition of our Health Insurer Financial Insights newsletter as we continue to operate in unprecedented times. This newsletter focuses on statutory profitability, capitalization trends, and claims experience for health insurers, through Q4 2020, and Q1 2021 earnings highlights for public insurers. Our aim is to keep you abreast of key market trends and dynamics that impact health insurer financial results, capitalization, and profitability. We hope you enjoy the newsletter and find it informative.

2020 Statutory Financials – Individual, Group, Medicare, and Medicaid Markets

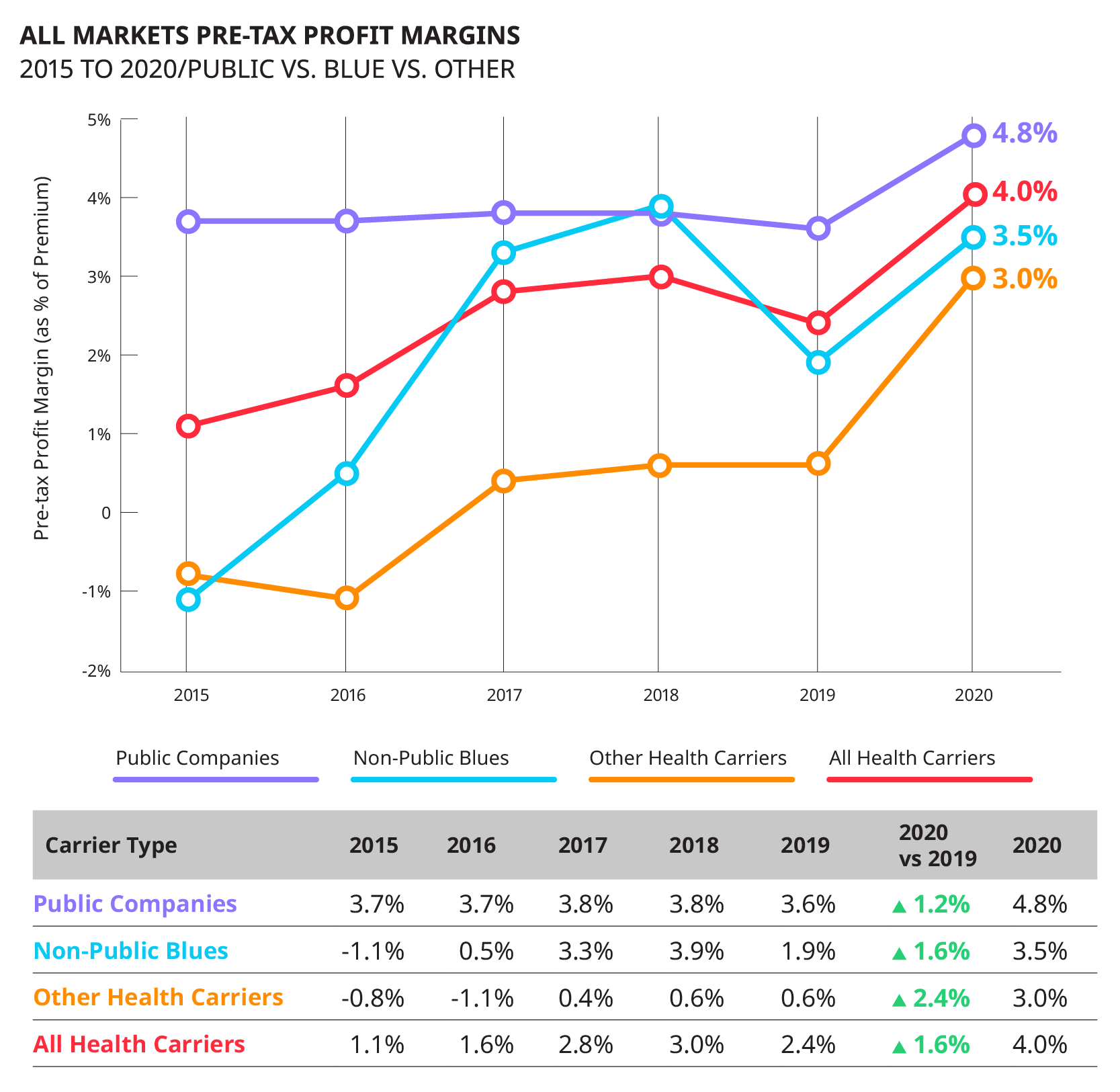

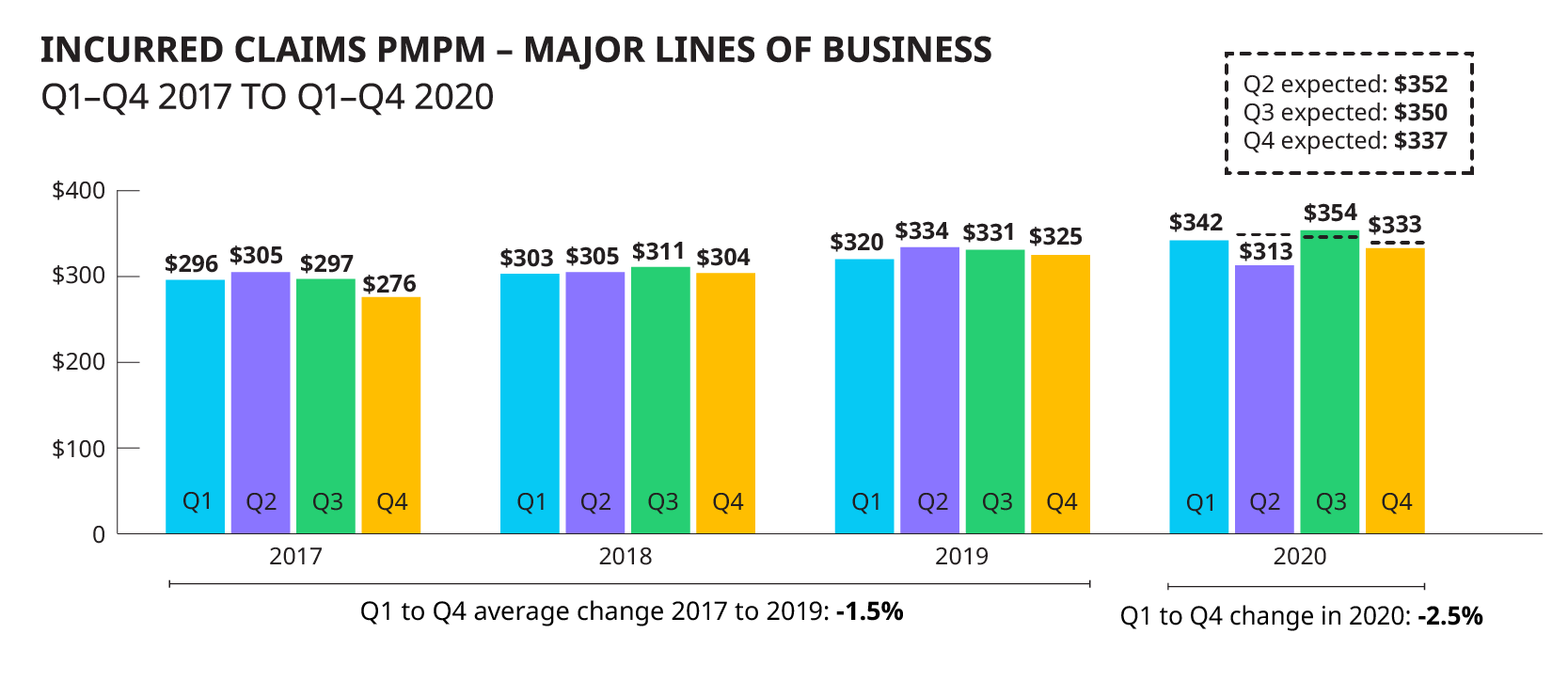

Overall, health insurers reported improved profit margins in 2020. Incurred claims in Q4 2020 were slightly lower than Q3 2020, but were close to normal claims levels following the dip in Q2 2020 caused by COVID-19 reduced utilization. 2020 loss ratios were lower year-over-year, likely due to the overall impact of COVID-19 on claims experience.

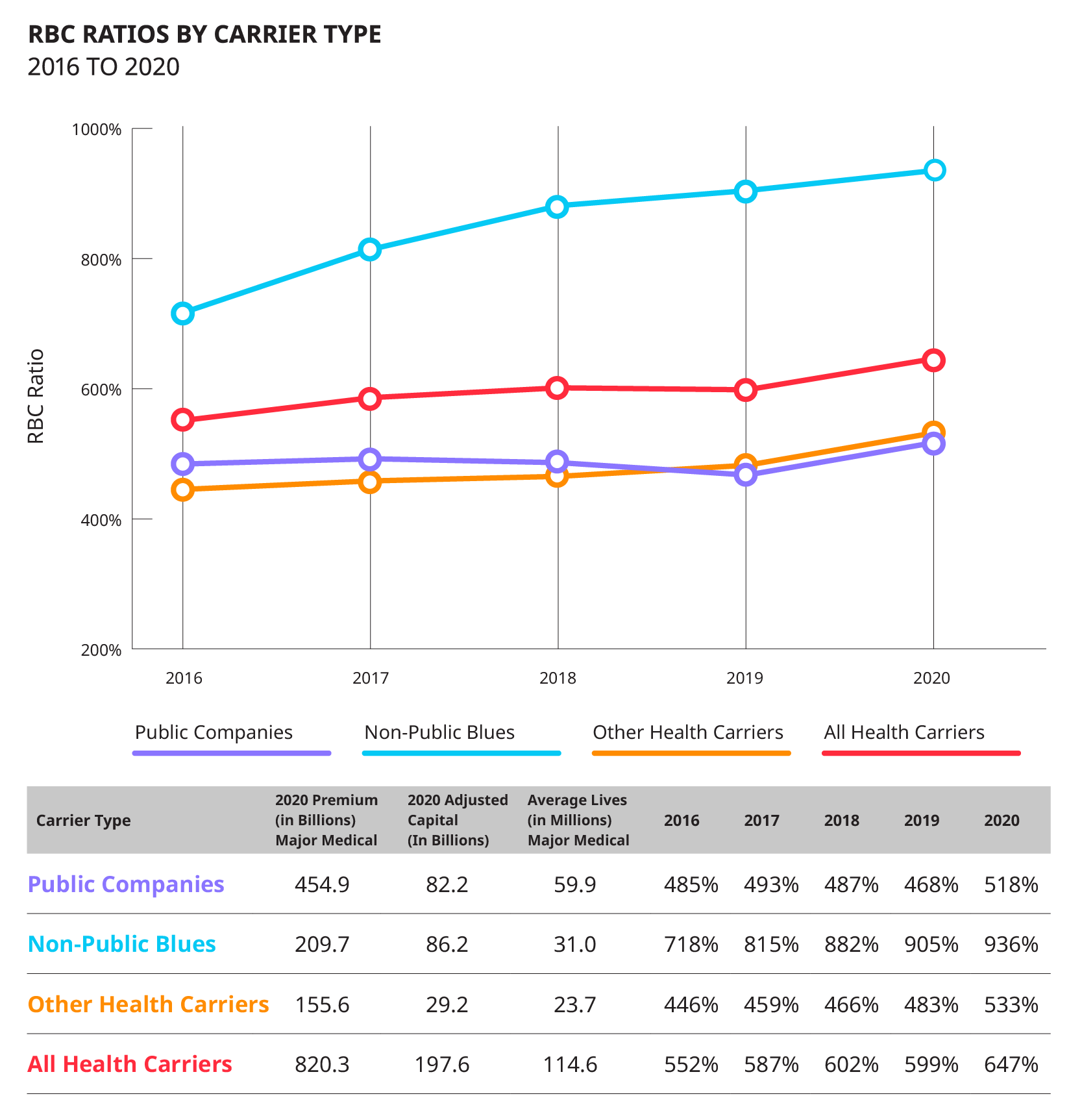

2020 Market Capitalization: Statutory Capital/Rate Based Capital (RBC) Trends

Market capitalization measured by Total Adjusted Capital (TAC) continued to increase in 2020 at a similar rate as in the prior years with public and other health insurers growing at a slightly higher rate in 2020 due to improved underwriting gains. Risk Based Capital ratios increased in 2020 with TAC increases growing more than Authorized Control Level (ACL) RBC.

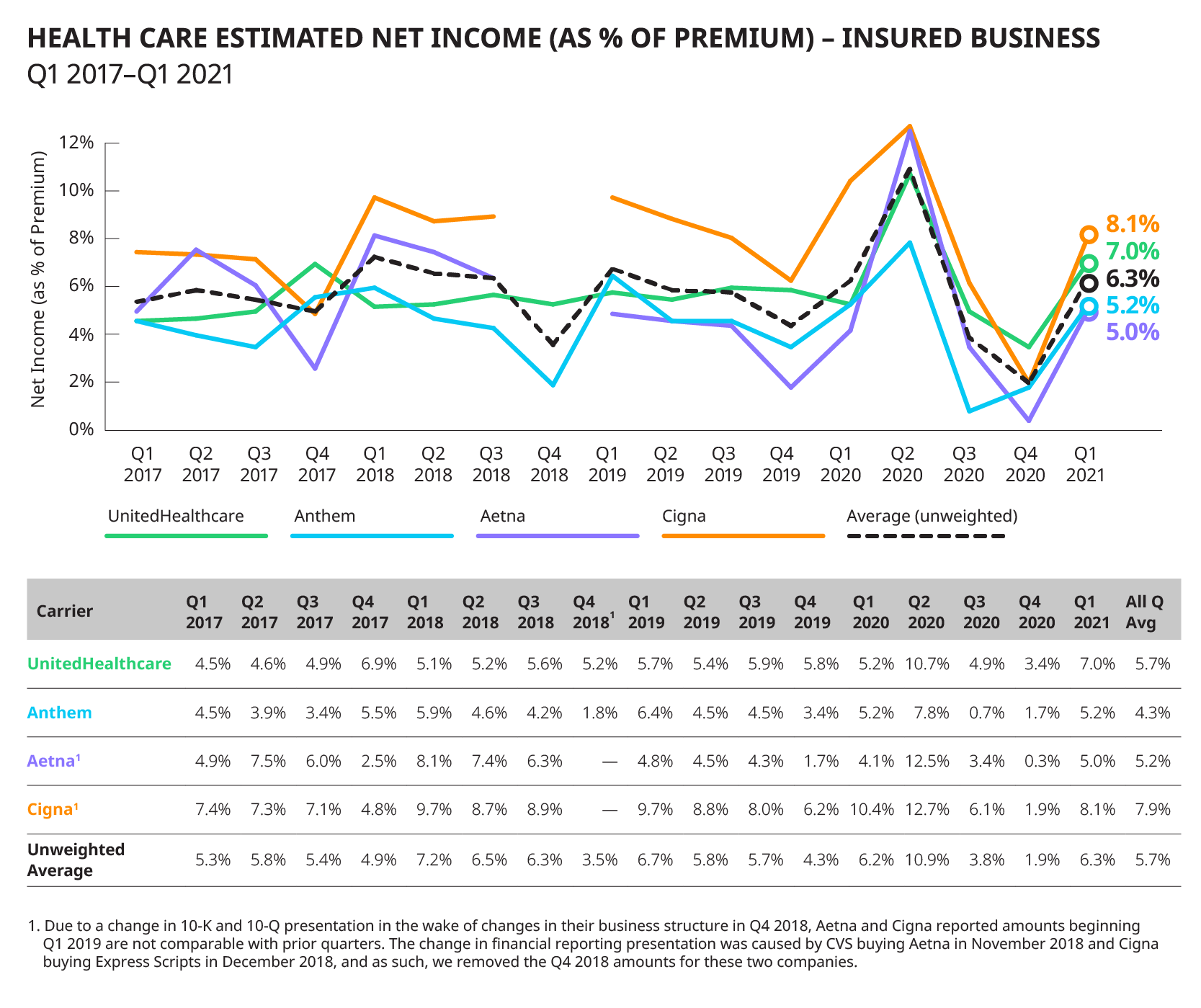

Q1 2021 Public Companies Reported Earnings

Public Companies reported margins in Q4 2020 lower than historical fourth quarter levels due to increased utilization. Generally, profitability improved to be in line with typical levels in Q1 2021 as loss ratios and operating expenses declined relative to Q4 2020.

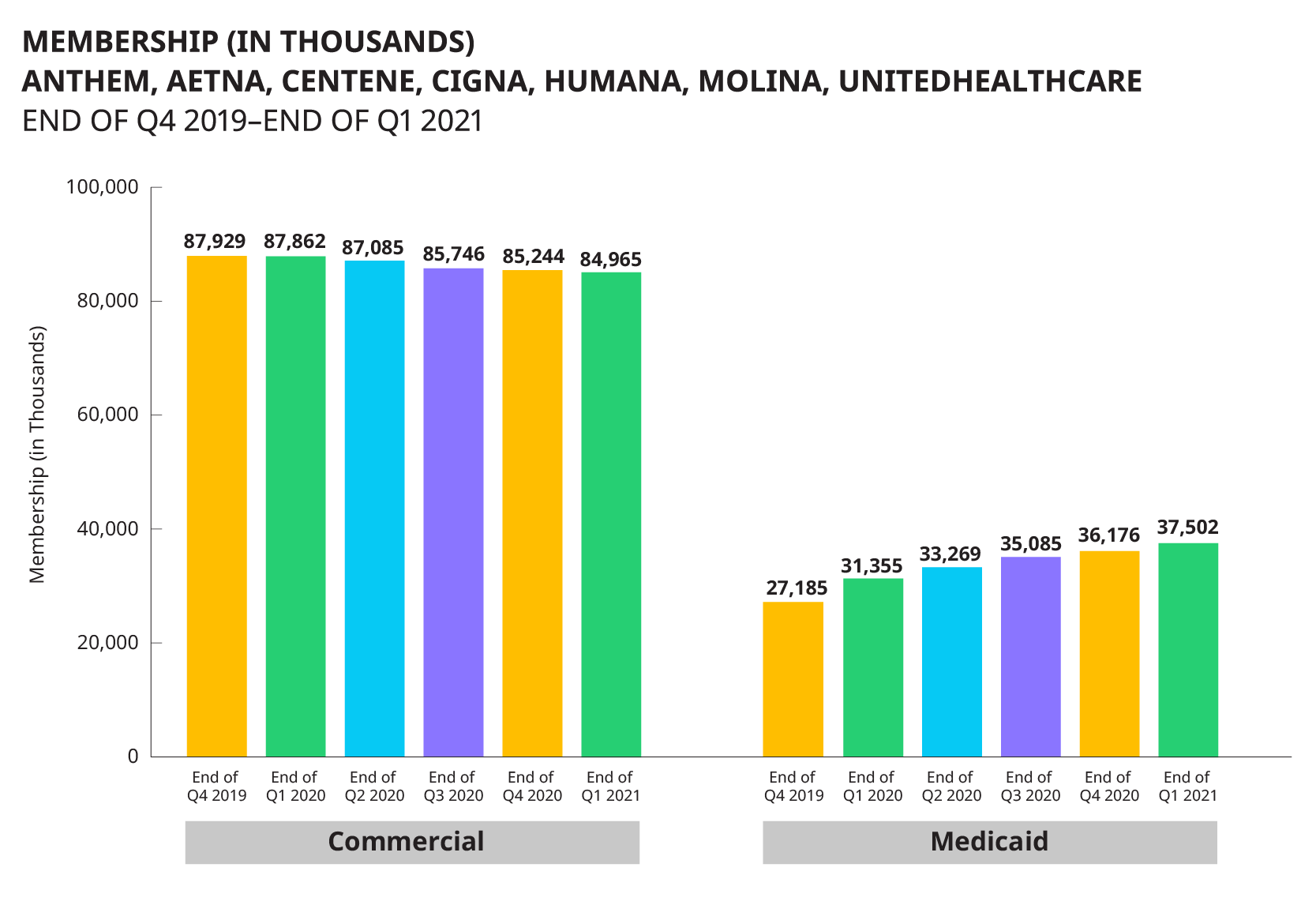

Many carriers continue to see substantial increases in their Medicaid membership driven by the pause in reverification of Medicaid eligibility.

Download our full report to read more.