We present volume 9 of our Health Insurer Financial Pulse newsletter.

Our aim is to keep you abreast of key market trends and dynamics that impact health insurer financial results and profitability. We hope you enjoy the newsletter and find it informative.

Large Public Companies’ Financial Performance

We reviewed Large Public Companies’ profitability for their insured block of business and noted that margins increased during Q2 2022 as loss ratios and operating expense ratios decreased for all large public companies.

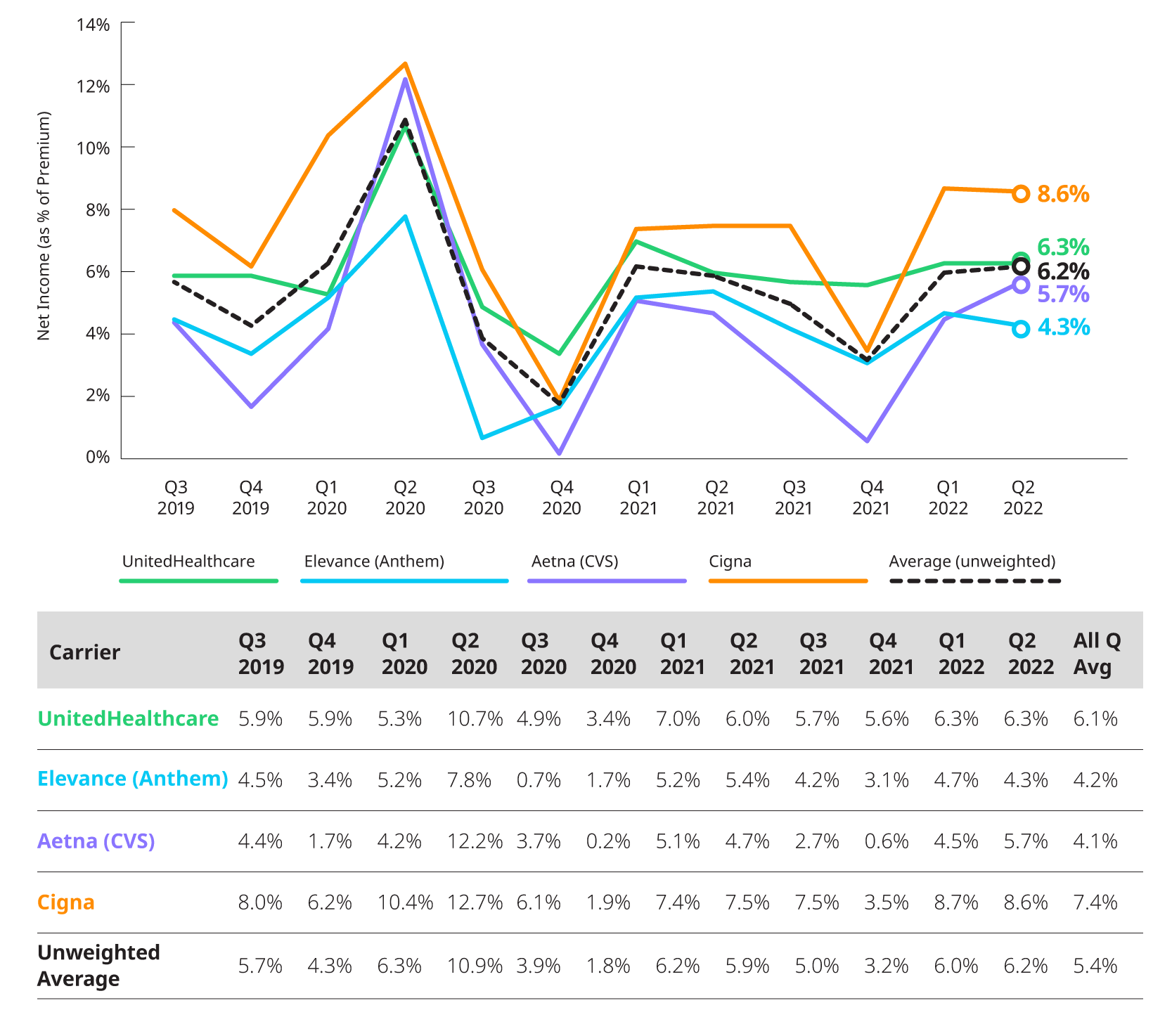

Net Income Trends - Insurance Business

Profit margins were relatively flat from Q1 2022 to Q2 2022, although Aetna saw a 1.3% increase in profit margin due to a slightly decreased loss ratio and lower administrative expense ratio.

*Based on 10Q and 10K segment reporting, and revenue and expense allocation estimates between insured and self-insured business. Results are indicative, but may not tie directly to other internal or external financial reports.

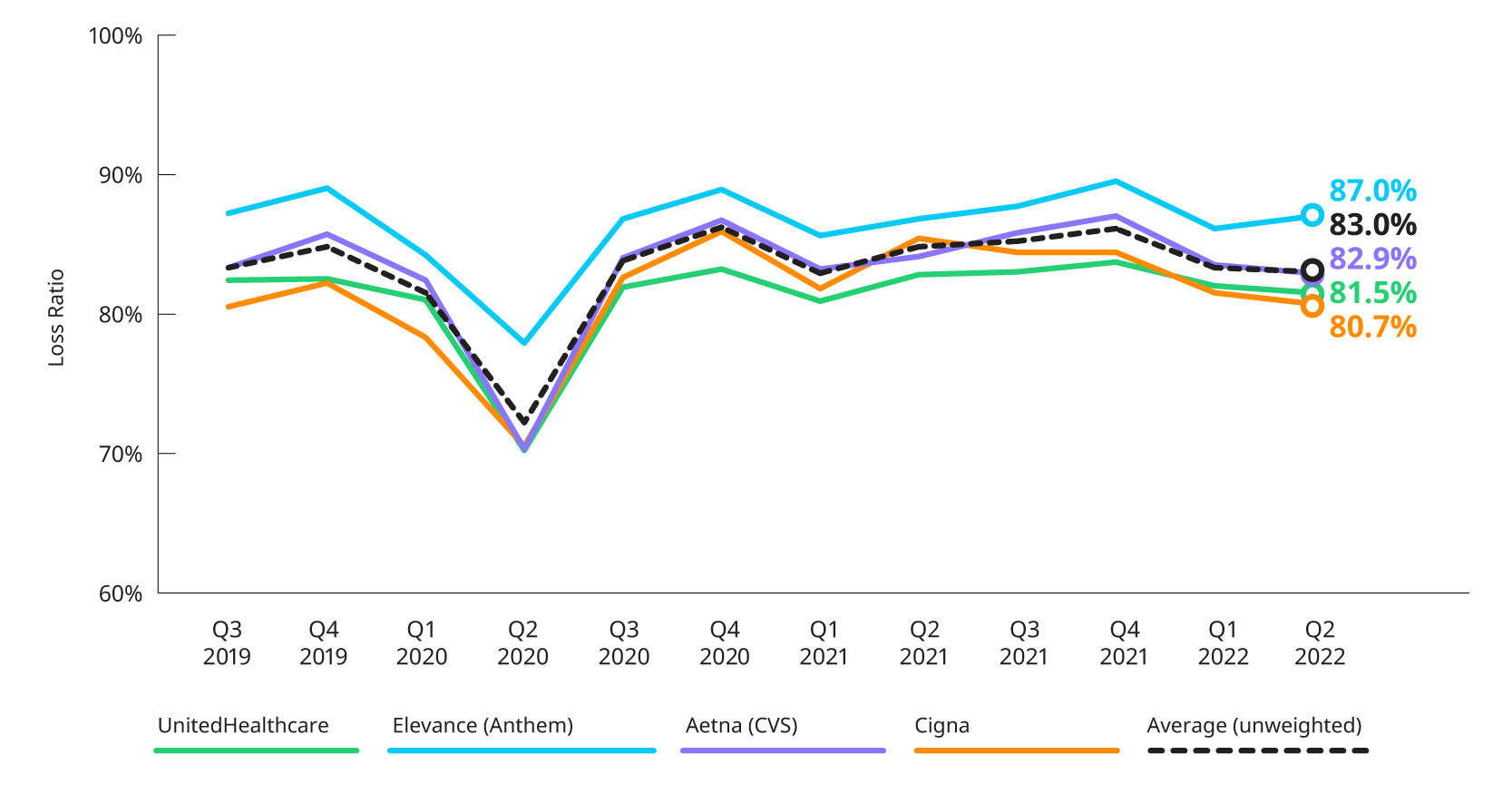

Medical Loss Ratio

Reported loss ratios are around 87.0% for Elevance (fka Anthem), 82.9% for Aetna, and 80.7% for Cigna and 81.5% for UnitedHealthcare. Loss ratios are impacted by seasonal patterns and overall costs of non-COVID and COVID related utilization.

*Based on 10Q and 10K segment reporting, and revenue and expense allocation estimates between insured and self-insured business. Results are indicative, but may not tie directly to other internal or external financial reports.

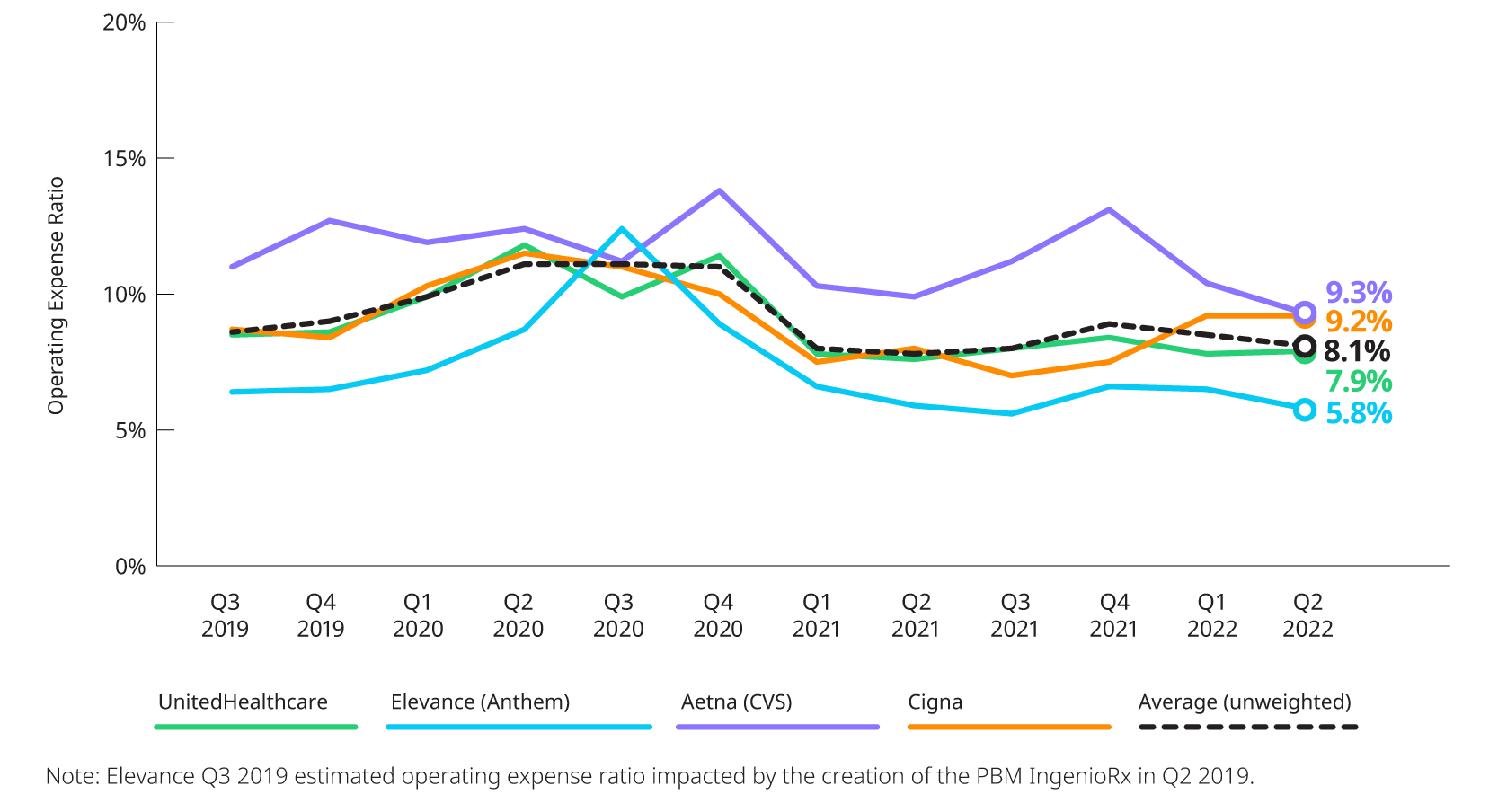

Estimated Operating Expense Ratio

Operating expenses decreased for Aetna and Elevance (Anthem) in Q2 2022 compared to Q1 2022 and remained level for Cigna and UnitedHealthcare. Operation ratios remain below pre-COVID levels.

*Based on 10Q and 10K segment reporting, and revenue and expense allocation estimates between insured and self-insured business. Results are indicative, but may not tie directly to other internal or external financial reports

Earnings Highlights: Q2 2022 Earnings Releases and Call Transcripts

COVID-19: Impact on Year-to-Date 2022 Utilization

COVID-related care started off high in the beginning of the year due to the Omicron surge but has since leveled off in Q2 2022. Generally, in Q2 2022, the combination of COVID and non-COVID care resulted in costs generally aligned with expectations for most carriers.

- Centene: While not commenting on their experience relative to baseline in Q2 2022, Centene did indicate that COVID costs were down about two-thirds in Q2 2022 relative to Q1 2022 which was impacted by the Omicron surge. In addition, they noted while many areas of care have returned to baseline levels, non-emergent ER visits still appeared suppressed relative to 2019.

- Cigna: Non-COVID costs in the quarter were lower than expected for most service categories with inpatient, emergency room care, and surgeries being most notable. They are also reporting that preventative care utilization, including annual exams, colonoscopies, and mammograms, is in line with pre-pandemic levels.

- Elevance (formerly Anthem): Overall cost of care was above baseline levels. The Commercial line of business was highest relative to baseline whereas Medicare and Medicaid were near baseline and somewhat below baseline, respectively.

- Humana: Throughout the year, Humana has seen lower inpatient utilization for non-COVID related admissions. They specifically mentioned that a major driver of this has been lower instances of influenza hospitalizations.

- Molina: Reporting by line of business, Molina provided estimated impacts to their medical cost ratio. Their Medicaid line of business saw an adjusted MCR of 87.4%, which is about 20 basis points higher than otherwise expected due to COVID. Medicare has been more heavily impacted by COVID, seeing a 370 basis point increase to its MCR of 86.9%. Finally, their Marketplace experienced a net MCR of 85.7% which includes a 50 basis point increase due to COVID.

- UnitedHealth Group: Throughout the year, UnitedHealth is seeing a less balanced relationship between COVID and non-COVID where non-COVID care is not returning as quickly as COVID-related utilization decreases. They also specifically mentioned that some areas of care still remain below historical levels – specifically pediatrics and the emergency department. Interestingly, annual wellness visits for Medicare patients are back at the pre-pandemic baseline.

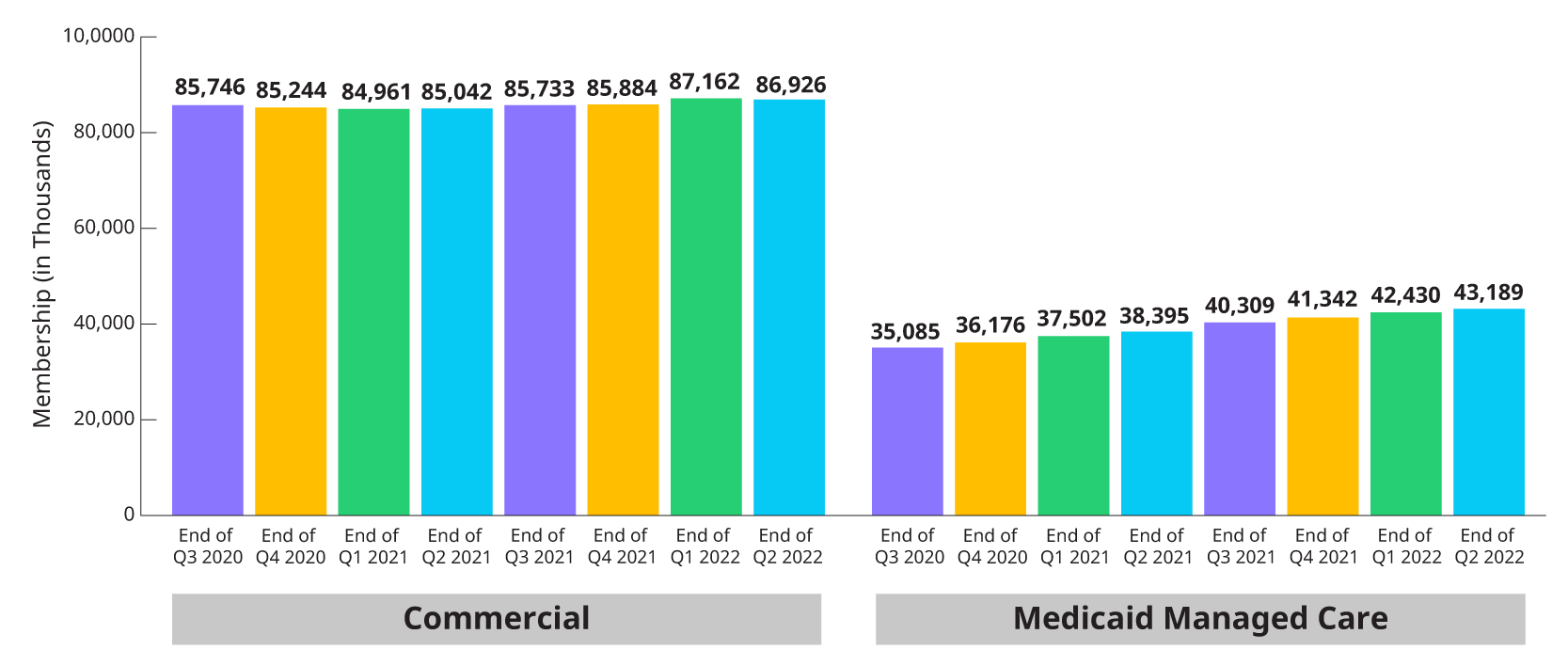

Membership: Commercial and Medicaid, Including Impact of Medicaid Redeterminations

Carriers continue to see increases in their Medicaid membership driven by the pause in redetermination of Medicaid eligibility. Total Commercial membership declined quarter-over-quarter for the first time since Q1 2021 though it is still above where it was at the end of 2020.

The timing of the return of Medicaid eligibility redetermination requirements will have significant impact on Medicaid enrollment. While the Public Health Emergency is currently scheduled to end October 13, 2022, both UnitedHealth and Elevance expect it to be extended until January 2023. These expectations would mean redeterminations would be unlikely to occur until at least 2023. Molina was the only carrier to state their expected member attrition due to the reinstatement of Medicaid redeterminations. They believe they will lose about half of the 750,000 members they gained throughout the pandemic.

The chart below displays the changes in reported enrollment for the eight most recent quarters for Commercial and Medicaid.

*Combines enrollment data for subset of Public companies from 10Qs and 10K for individual, group fully insured and Medicaid.