Large Public Companies’ Financial Performance

We reviewed Large Public Companies’ profitability for their insured block of business and noted that margins decreased during Q4 2021 as loss ratios and operating expense ratios increased for all large public companies. A similar pattern was seen in 2019 and 2020.

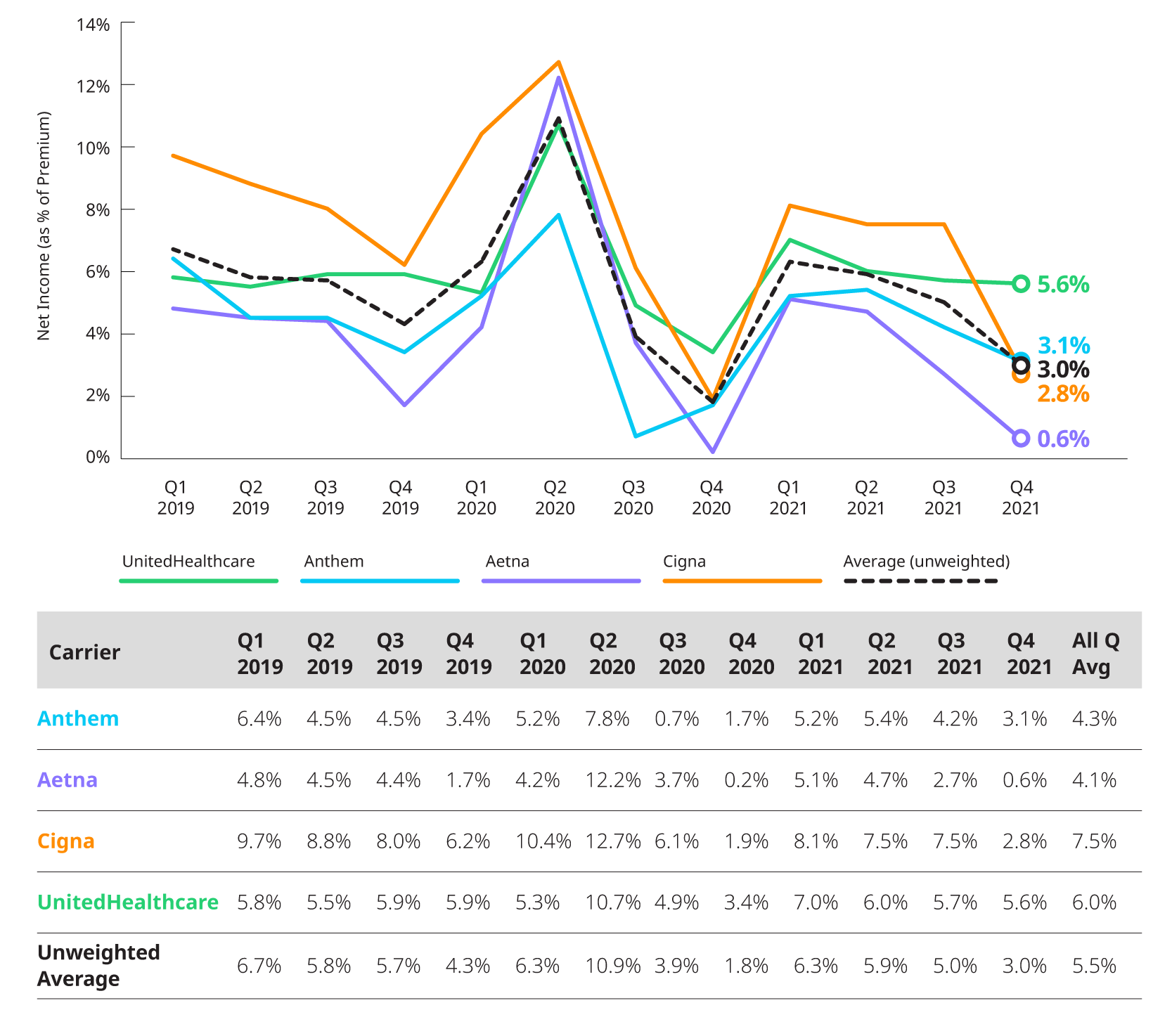

NET INCOME TRENDS – INSURED BUSINESS

During Q4 2021, all companies saw profit margins decrease from Q3 2021 due to a combination of utilization at normal or elevated levels and increases in operating expense ratios across all companies.

*Based on 10Q and 10K segment reporting, and revenue and expense allocation estimates between insured and self-insured business. Results are indicative, but may not tie directly to other internal or external financial reports.

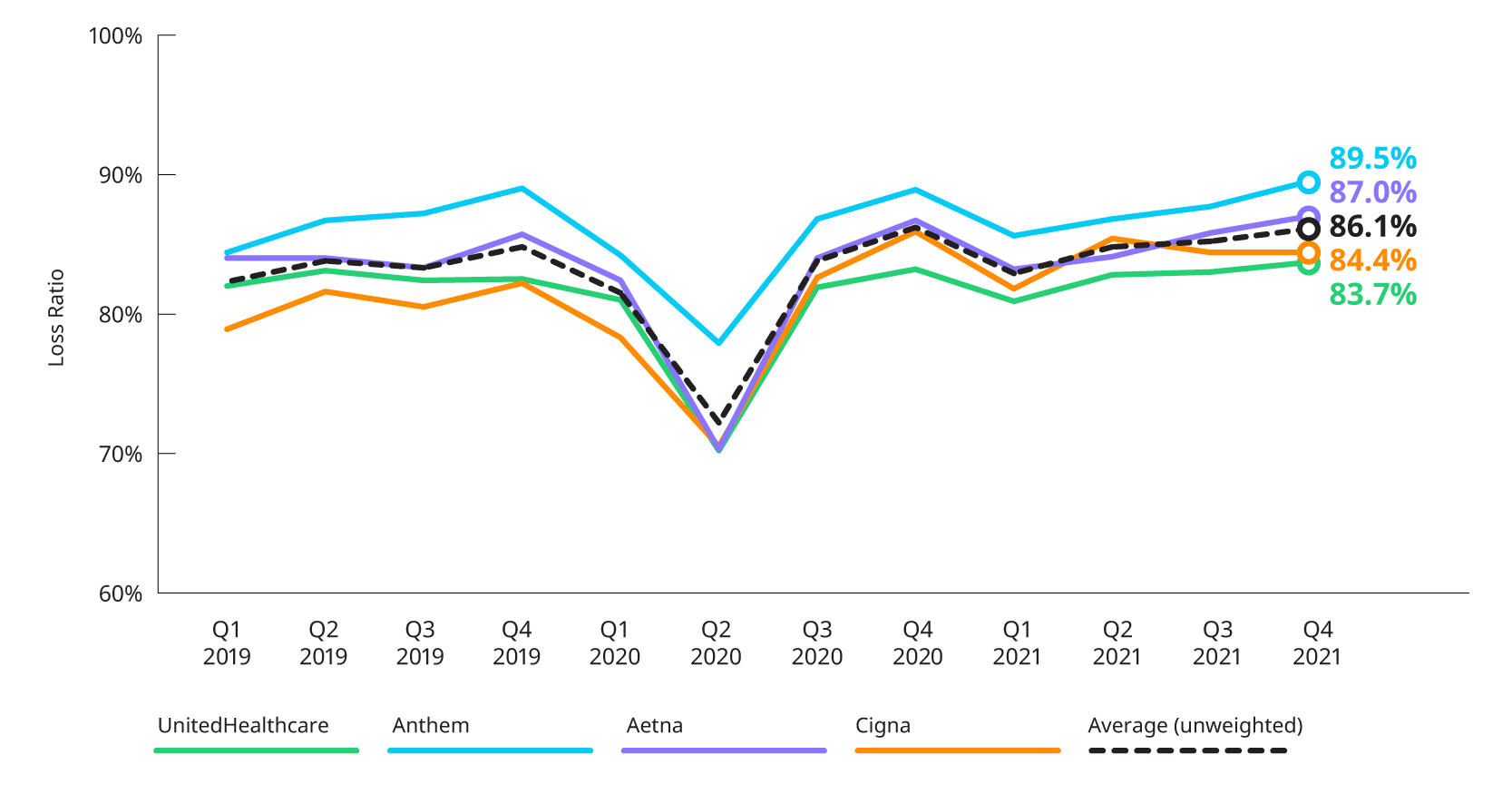

MEDICAL LOSS RATIO

Reported loss ratios increased to around 90% for Anthem, 87% for Aetna, and 84% for UnitedHealthcare as a result of seasonal patterns and the increasing overall costs of non-COVID and COVID related utilization. Cigna was the only company with level loss ratio at 84% in both Q3 2021 and Q4 2021.

*Based on 10Q and 10K segment reporting, and revenue and expense allocation estimates between insured and self-insured business. Results are indicative, but may not tie directly to other internal or external financial reports.

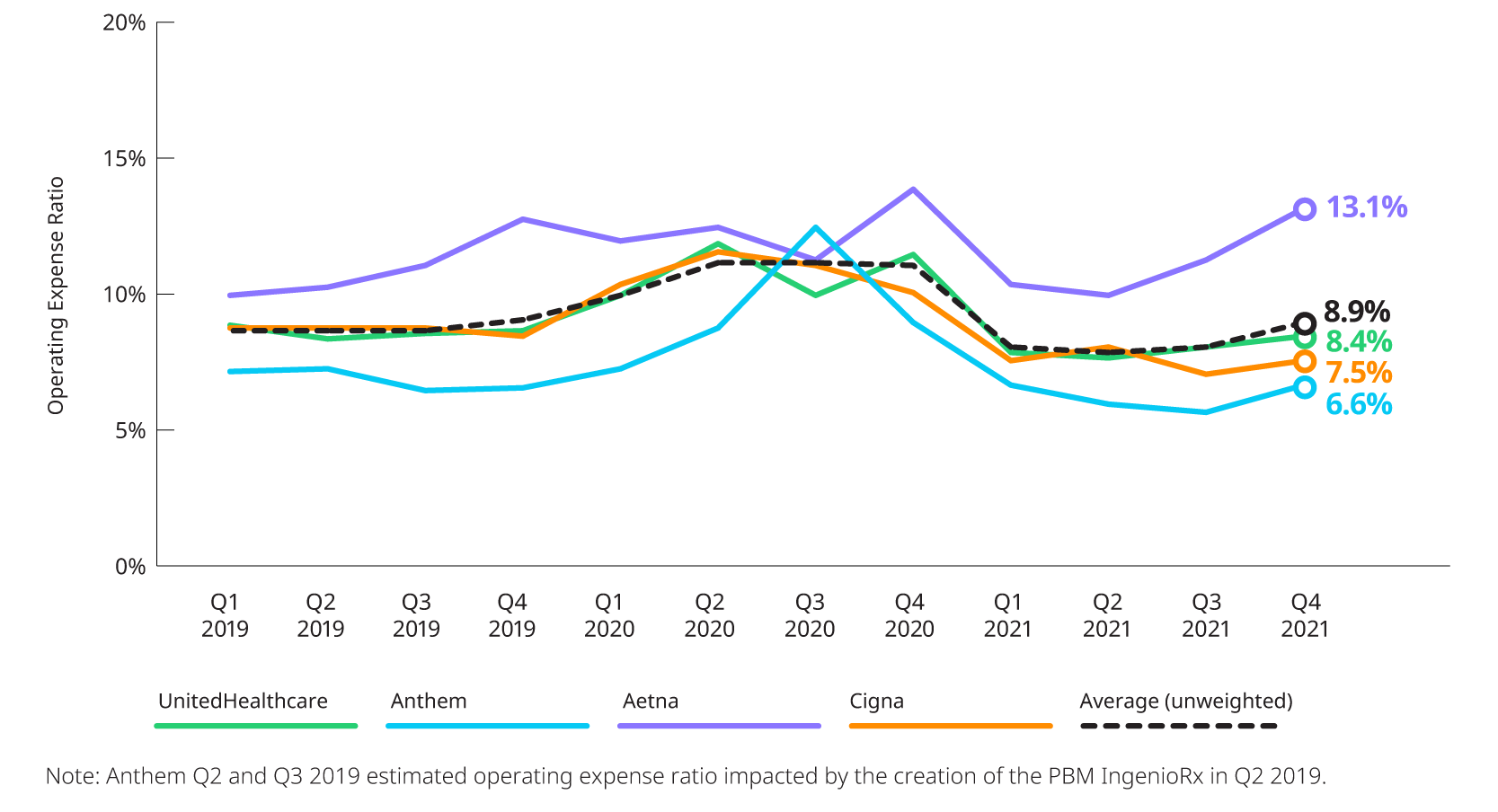

ESTIMATED OPERATING EXPENSE RATIO

All companies in this study experienced an increase in operating expense ratios in Q4 2021 compared to Q3 2021. Aetna had the second highest operating expense ratio since the beginning of 2019 and Anthem’s and UnitedHealthcare’s ratio is returning to pre-COVID levels.

*Based on 10Q and 10K segment reporting, and revenue and expense allocation estimates between insured and self-insured business. Results are indicative, but may not tie directly to other internal or external financial reports.

Earnings Highlights: Q4 2021 Earnings Releases and Call Transcripts

COVID-19: IMPACT ON Q4 2021 UTILIZATION AND OUTLOOK FOR 2022

Generally, non-COVID utilization run rates were above normal levels during Q4 2021 with higher levels of COVID-related care driven by the onset of the Omicron variant in December.

- Anthem: Cost of care was above baseline levels driven by higher COVID costs in December, though total medical costs were better than expected for the quarter overall as lower non-COVID utilization helped offset the higher-than-expected COVID-related costs.

- Centene: While not commenting on their experience relative to baseline in Q4 2021, Centene did provide interesting information on the severity of the Omicron variant, noting that measures such as average length of stay and cost per admit were lower for Omicron variant than those seen from the Delta variant.

- Cigna: Costs during Q4 2021 were higher than expected driven by: higher stop-loss claims, particularly in policies with lower attachment points that were triggered by the cumulative impact of COVID and non-COVID costs throughout the year; continued pressure on Individual business, particularly the special enrollment period customers who were added in mid-2021; and higher claim costs in the commercial insured book. Expects full year 2022 medical costs to run higher than previous expectations.

- Humana: Total utilization was 1% below the baseline during Q4 2021. While COVID utilization remained higher than initially expected due to the Omicron variant surge, Humana continued to see a corresponding reduction in non-COVID utilization. For 2022, Humana is assuming medical costs return to baseline levels and that costs related to COVID continue to be offset by the depressed non-COVID utilization.

- Molina: The net effect of COVID increased the full year consolidated medical care ratio by 150 basis points. The net effect of COVID accounts for: the direct cost of COVID-related care, the effect of utilization curtailment due to the pandemic, and the effects of the Medicaid risk-sharing corridor. Noted that during Q4 2021, their Marketplace business was hit especially hard by COVID, experiencing a medical cost ratio of 92.1%. This was impacted by special enrollment period membership which made up 40% of their Marketplace enrollment in the quarter.

- UnitedHealth Group: During Q4 2021, Commercial was right at baseline while both Medicaid and Medicare were below baseline with Medicaid coming in slightly lower than Medicare. The company saw non-COVID impacts of the Omicron surge similar to prior variants – double-digit declines in both physician and specialist visits. Mentioned in reference to experience emerging in January 2022, inpatient hospitalization levels are similar to the January 2021 levels, even with national COVID case rates about 4x higher. It appears that the severity of the virus in regard to those who need inpatient care was lower as they saw shorter lengths of stay compared to prior variants.

- HCA: COVID patients accounted for 5% of total admissions in the quarter. This is significantly lower than the 13% seen in Q3 2021, but slightly higher than the 3% seen in Q2 2021.

- Tenet: COVID admissions made up about 7% of total admissions for the quarter.

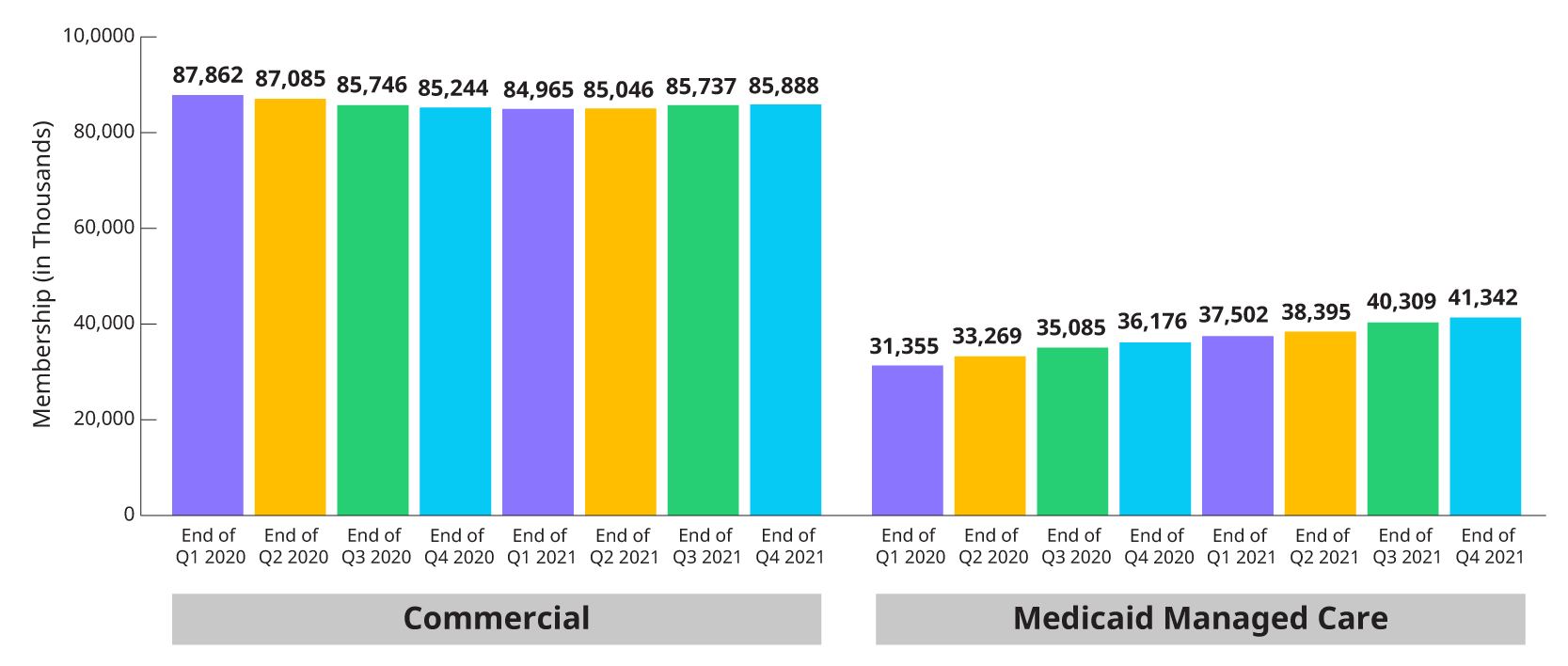

MEMBERSHIP: COMMERCIAL AND MEDICAID, INCLUDING IMPACT OF MEDICAID REDETERMINATIONS

Carriers continue to see substantial increases in their Medicaid membership driven by the pause in redetermination of Medicaid eligibility. Total Commercial membership has seen slight increases in each of the three quarters since hitting a low at the end of Q1 2021.

The timing of the return of Medicaid eligibility redetermination requirements will impact Medicaid enrollment in 2022. The views regarding when this will happen and its impact varied amongst the carriers that explicitly called it out during their respective earnings releases, but generally carriers expect to see reductions in Medicaid enrollment due to the return of redetermination requirements around the middle of 2022.

The chart below displays the changes in reported enrollment for the eight most recent quarters for Commercial and Medicaid.

*Combines enrollment data for subset of Public companies from 10Qs and 10K for individual, group fully insured and Medicaid.

MEDICAL LOSS RATIOS: 2022 OUTLOOK

Of the carriers who included comments related to 2022 medical loss ratios, all are expecting 2022 medical loss ratios in line with their experience in 2021.

- Anthem: 2022 benefit expense ratio between 87.5% and 88.5%, meaning that Anthem expects costs in line with 2021 which saw a benefit expense ratio of 87.5%.

- Centene: 2022 health benefit ratio between 87.6% and 88.2% which is in line with the full year 2021 health benefit ratio of 87.8%.

- Cigna: 2022 medical care ratio between 82.0% and 83.5%. This assumes that total medical costs will be below 2021, which saw a medical care ratio of 84.0%.

- Molina: 2022 medical care ratio of 88.0%, which is similar to the full year 2021 medical care ratio of 88.3%.