We present volume 10 of our Health Insurer Financial Pulse newsletter.

Our aim is to keep you abreast of key market trends and dynamics that impact health insurer financial results and profitability. We hope you enjoy the newsletter and find it informative.

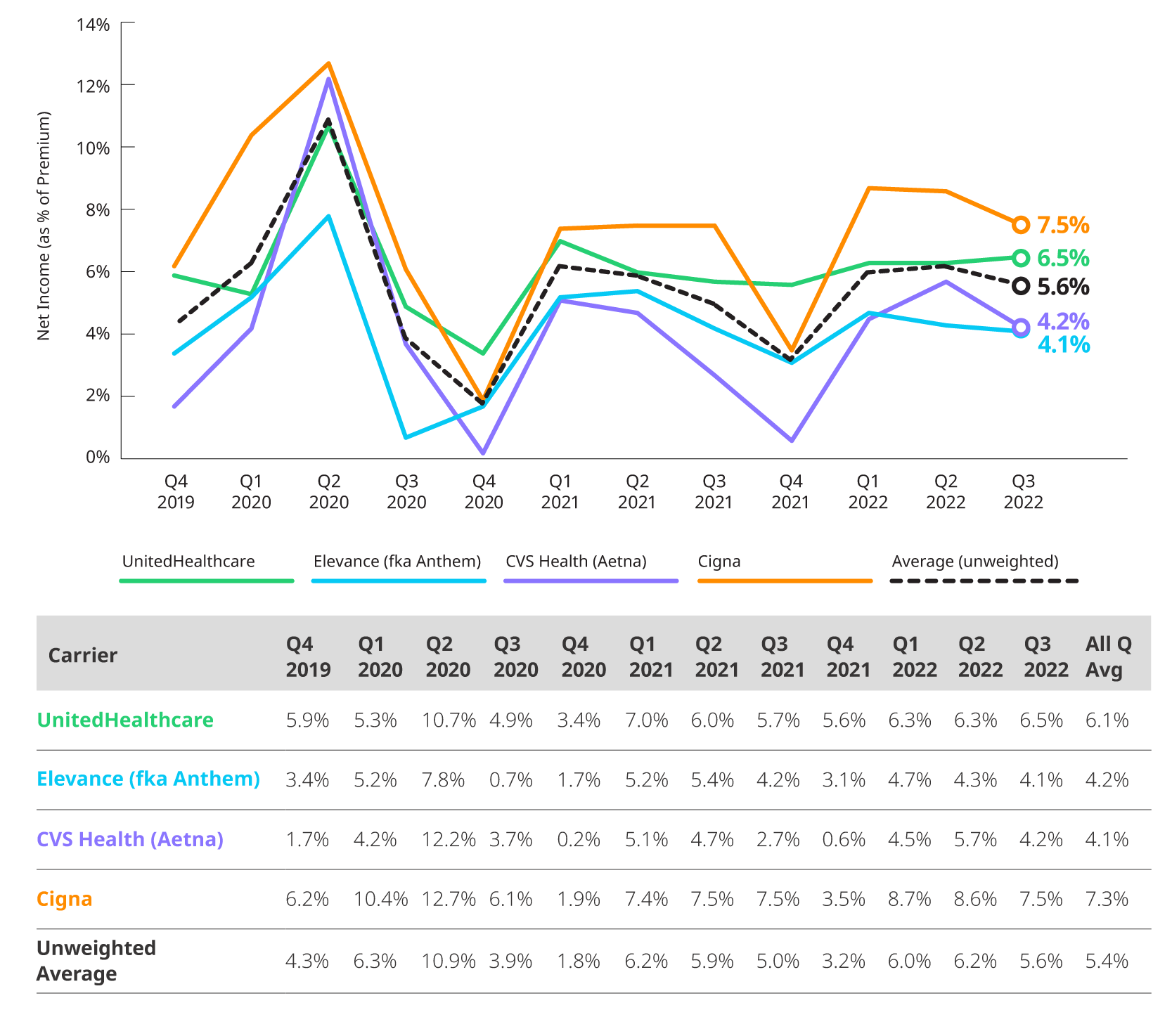

Large Public Companies’ Financial Performance

We reviewed Large Public Companies’ profitability for their insured block of business and noted that margins decreased slightly during Q3 2022 except for UnitedHealthcare, which had a small 0.2% increase. This decrease in margin loss is partly attributable to increased operating expenses during Q3 2022.

Net Income Trends - Insurance Business

Profit margins were relatively flat from Q2 2022 to Q3 2022 for Elevance (fka Anthem) and UnitedHealthcare. However, CVS Health (Aetna) and Cigna saw declines of 1.5% and 1.1% in profit margin, respectively, due to slightly increased loss ratios and increased administrative expense ratios.

*Based on 10Q and 10K segment reporting, and revenue and expense allocation estimates between insured and self-insured business. Results are indicative, but may not tie directly to other internal or external financial reports.

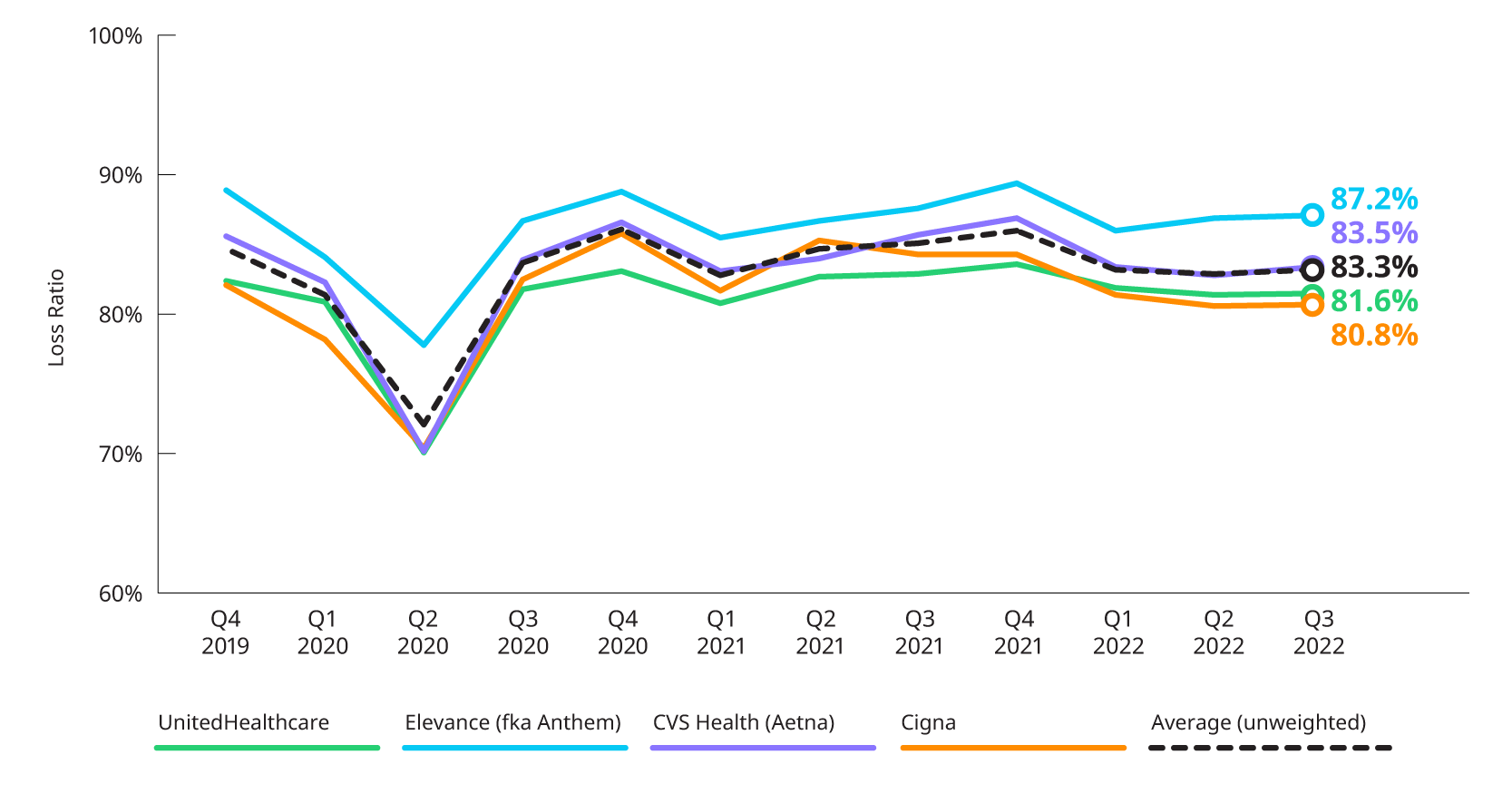

Medical Loss Ratio

Reported loss ratios are 87.2% for Elevance (fka Anthem), 83.5% for CVS Health (Aetna), 80.8% for Cigna and 81.6% for UnitedHealthcare. Loss ratios are impacted by seasonal patterns and overall costs of non-COVID and COVID related utilization.

*Based on 10Q and 10K segment reporting, and revenue and expense allocation estimates between insured and self-insured business. Results are indicative, but may not tie directly to other internal or external financial reports.

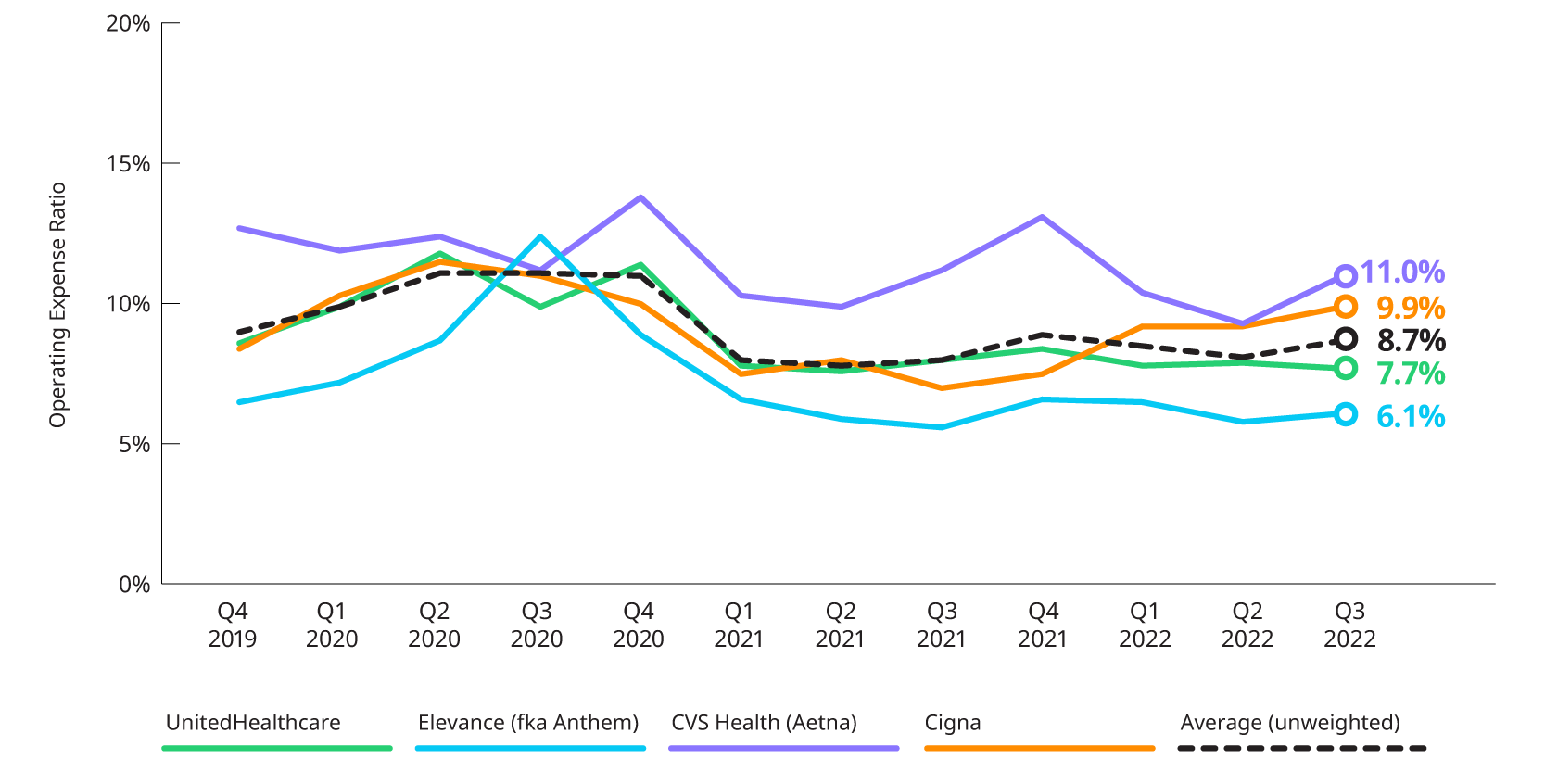

Estimated Operating Expense Ratio

Operating expenses remained level from Q2 2022 to Q3 2022 for Elevance (fka Anthem) and UnitedHealthcare. However, CVS Health (Aetna) and Cigna’s operating expenses increased by 1.7% and 0.7% respectively during this period. Cigna returned to pre-COVID operational ratios while UnitedHealthcare still remains below its pre-COVID levels.

*Based on 10Q and 10K segment reporting, and revenue and expense allocation estimates between insured and self-insured business. Results are indicative, but may not tie directly to other internal or external financial reports

Earnings Highlights: Q3 2022 Earnings Releases And Call Transcripts

COVID-19: Impact on Year-to-Date 2022 Utilization and insights into 2023

COVID-related care started off high in the beginning of the year due to the Omicron surge before leveling off in Q2 2022. Generally, Q3 2022 continues this trend as carriers experienced a combination of COVID and non-COVID care that was mostly in line with their expectations

- Centene: While not commenting on their experience relative to baseline in Q3 2022, Centene did indicate that COVID costs were slightly higher in Q3 2022 relative to Q2 2022. In addition, they noted that while most non-COVID costs were generally in line with normal seasonality, some services, including non-emergent ER visits, still appeared suppressed relative to 2019. Going into 2023, they no longer expect any impacts due to pent-up demand.

- Cigna: Both COVID and non-COVID costs in the quarter were favorable to expectations. COVID costs were comparable to the levels experienced in Q2 2022. They also noted that non-COVID favorability was driven by inpatient and emergency room service categories.

- Elevance (fka Anthem): Overall claims costs were still higher than what would have been expected without COVID. The Commercial line of business was highest relative to baseline as the higher outpatient costs outweighed the impact of lower inpatient costs. Medicare and Medicaid were near baseline and somewhat below baseline, respectively.

- Humana: Total medical costs in Individual Medicare Advantage were lower than expectations for the quarter as they saw favorable trends for inpatient services. Non-inpatient utilization is lower than experienced in Q2 2022, and they believe that the heightened utilization in Q2 2022 may have been driven by some pent-up demand. Looking at the rest of the year, they believe that COVID utilization in Q4 2022 will be similar to Q3 2022, and that flu-related utilization will be lower than what it was in 2019 but higher than the levels seen in the past two years.

- Molina: Reporting by line of business, Molina provided estimated impacts to their medical cost ratio. Their Medicaid line of business experienced an adjusted MCR of 88.2%, which is about 10 basis points higher than would otherwise be expected without the influence of COVID. Medicare has been more heavily impacted by COVID, experiencing a 350 basis point increase to its MCR of 88.7%. Finally, their Marketplace business experienced a net MCR of 86.3%, which includes a 90 basis point increase due to COVID. Considering the flu season, they expect that flu-related utilization will return to levels experienced pre-pandemic. They noted that flu was almost non-existent in 2020, and about half of what is typically experienced in 2021.

- UnitedHealth Group: Care patterns were consistent with those experienced in Q2 2022. Breaking it down by line of business, they noted that for Commercial business, all services exhibited fairly normal care patterns except inpatient which saw utilization below baseline. In Medicare, urgent care utilization was higher than baseline while both emergency room and inpatient services were slightly lower than baseline. Medicaid is i

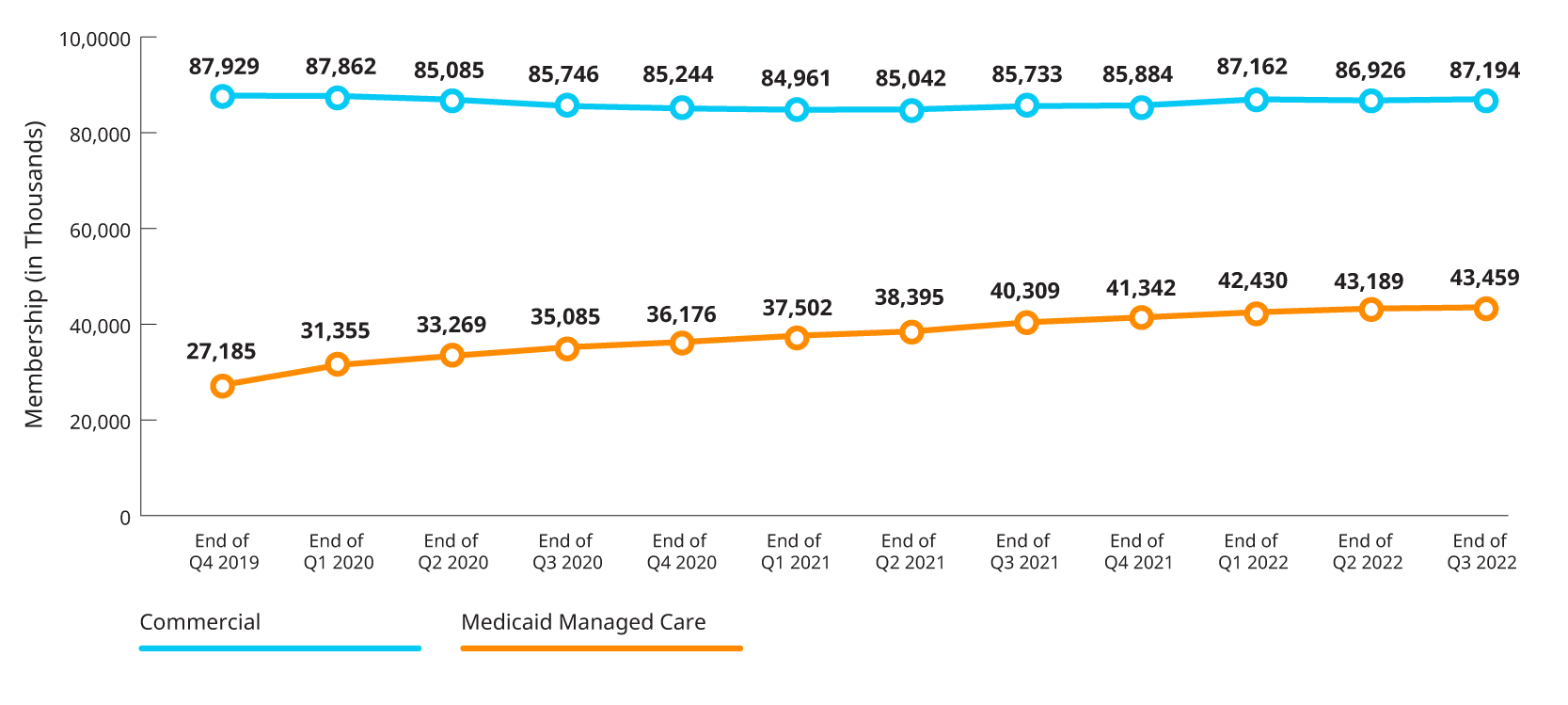

MEMBERSHIP: COMMERCIAL AND MEDICAID, INCLUDING IMPACT OF MEDICAID REDETERMINATIONS

Carriers continue to see increases in their Medicaid membership driven by the pause in redetermination of Medicaid eligibility. Total Commercial membership increased during the quarter after a slight decline in Q2 2022.

The timing of the return of Medicaid eligibility redetermination requirements will have significant impact on Medicaid enrollment. Currently the Public Health Emergency is scheduled to end on January 11, 2023. During the earnings calls, carriers provided insights on how the end of the PHE will impact their Medicaid enrollment and revenue.

- Centene: Medicaid enrollment has increased by over 3 million members since the beginning of the pandemic, which equates to about $12.5 billion in annual revenue. They expect to lose between $7.5 and $8 billion in annual revenue after redeterminations resume, noting that about half of this is expected to be lost during 2023.

- Elevance (fka Anthem): Medicaid enrollment has increased by about 3.7 million members since the start of the pandemic; however, they did not indicate what portion of the membership they expect to keep after redeterminations resume.

- Molina: Medicaid enrollment has increased by 750,000 due to the suspension of redeterminations. They expect to keep about 50% of that membership once redeterminations resume.

- UnitedHealth Group: Expect redeterminations to resume during Q1 2023, however, they did not provide details on the impacts to enrollment and revenue.

The chart below displays the changes in reported enrollment for the twelve most recent quarters for Commercial and Medicaid.

*Combines enrollment data for subset of Public companies from 10Qs and 10K for individual, group fully insured and Medicaid.