The Actuarial Practice of Oliver Wyman surveyed its clients regarding discounting of casualty reserves for financial reporting. This survey is intended to answer the following questions:

- What percentage of companies booked a discounted reserve for unpaid losses in 2020 in financial statements?

- If booking a discounted reserve, is the interest rate tied to market rates or set to some fixed percentage not market-driven?

- What interest rate do companies use to discount, and how has that changed from last year?

In 2020, 25% of our clients surveyed booked a discounted reserve.

Of those, 71% tied their interest rate to a market rate.

Of our survey participants, the average interest rate used to discount was 2.26%. The average discount rate in our prior study was 3.04%. As a point of reference, the yields on three-year U.S. Treasury Securities decreased 1.55 percentage points during the same time period.

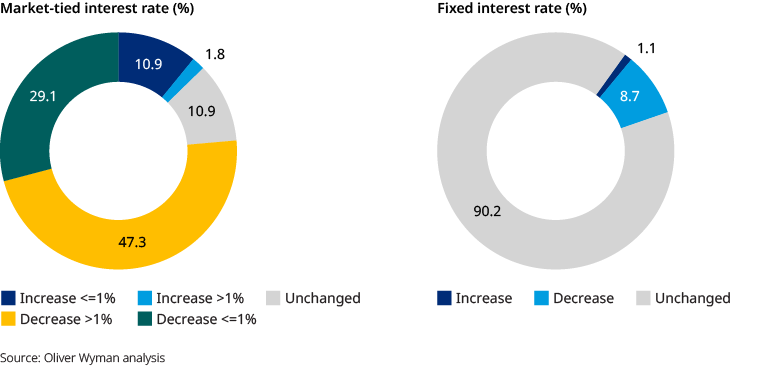

Change in interest rate since prior

Market-tied interest rate and fixed interest rate

Distribution of interest rates for 2019 and 2020 - market-tied interest rate

Distribution of interest rates for 2019 and 2020 - fixed interest rate

Please note that the survey above is intended for informational purposes only. Moreover, this survey is not intended as a recommendation on the part of Oliver Wyman as to the appropriate rate to discount casualty insurance unpaid losses.