This article was first published on August 11, 2021, and was written in collaboration with Lippincott, the brand and innovation expert of Oliver Wyman. This is part of Oliver Wyman's Reinventing Insurance Series, a collection of content on realigning corporate strategy with investments that are deeply tied to customers’ needs.

We need to think differently. We need to transition from an Operator’s Mindset to an Innovator’s Mindset.

We need to think differently. We need to transition from an Operator’s Mindset to an Innovator’s Mindset.

The Fundamental Mindset Shift

It has become a well-worn refrain: in an era of accelerating change, flagship brands of the 20th century risk becoming ghost ships of the 21st century — steadily losing relevance, growth, and viability.

Demise can be postponed through mixtures of sustaining innovations and efficiency cuts, but too many firms are playing “not to lose,” rather than playing for the win.

We believe how you frame the problem you're trying to solve matters. In this Reinventing Insurance installment, we build on our Think CustomerFirst paper and center on market-creating business innovation. Here, we share ways insurers can evolve their mindset by shifting away from selling products and moving toward solving problems. And not just any problems — the ones that spark real energy for progress. We invite leaders into a world of new possibilities, and share first-hand experiences on how insurers can succeed at market-creating innovation, and create breakthrough solutions for their customers. Below is an excerpt from the report. The full PDF version of Playing to Win is at the top of this page.

Seeing the world through the lens of current economics will artificially limit your managerial toolset to cost cutting and incremental improvements.

Instead — better outcomes require better ideas and mental models. Stronger results can be achieved by simplifying complexities, and shaping connections to what customers want — ultimately opening new worlds of opportunity.

Shifting or allocating marginal dollars to create new markets always returns an unappealing answer when compared to the quick relief of trimming expenses or investments, but this leaves many smart managers in a doom loop of optimizing a glide path.

We need to move from a focus on product to a focus on the desired experience of struggling customers, and from taking out cost to putting in client value.

We need to move from a focus on product to a focus on the desired experience of struggling customers, and from taking out cost to putting in client value.

This is materially different from customer-centricity. The customer is not the essential unit of a growth strategy and successful innovation. The relevant unit of analysis for growth is the desired experience a customer seeks in a specific circumstance. It’s not the product. It’s not the customer.

The key to unlocking growth is understanding the customer’s high priority in a specific situation, the job to be done. What does the customer want to accomplish and what problem do they need a solution for?

Focusing on problems, not products is the essence of CustomerFirst. By doing so, leaders make the most valuable shift of all: from a model of correlation to a model of causality.

Focusing on problems, not products is the essence of CustomerFirst. By doing so, leaders make the most valuable shift of all: from a model of correlation to a model of causality.

Consumer goods provide some of the most tangible examples of the benefits gained from a model of causality. Shifting from an Operator’s Mindset to an Innovator’s Mindset can greatly benefit the insurance industry because of the progress consumers are trying to make in their lives, for example progress to reduce risk, protect their families or prepare for the long term.

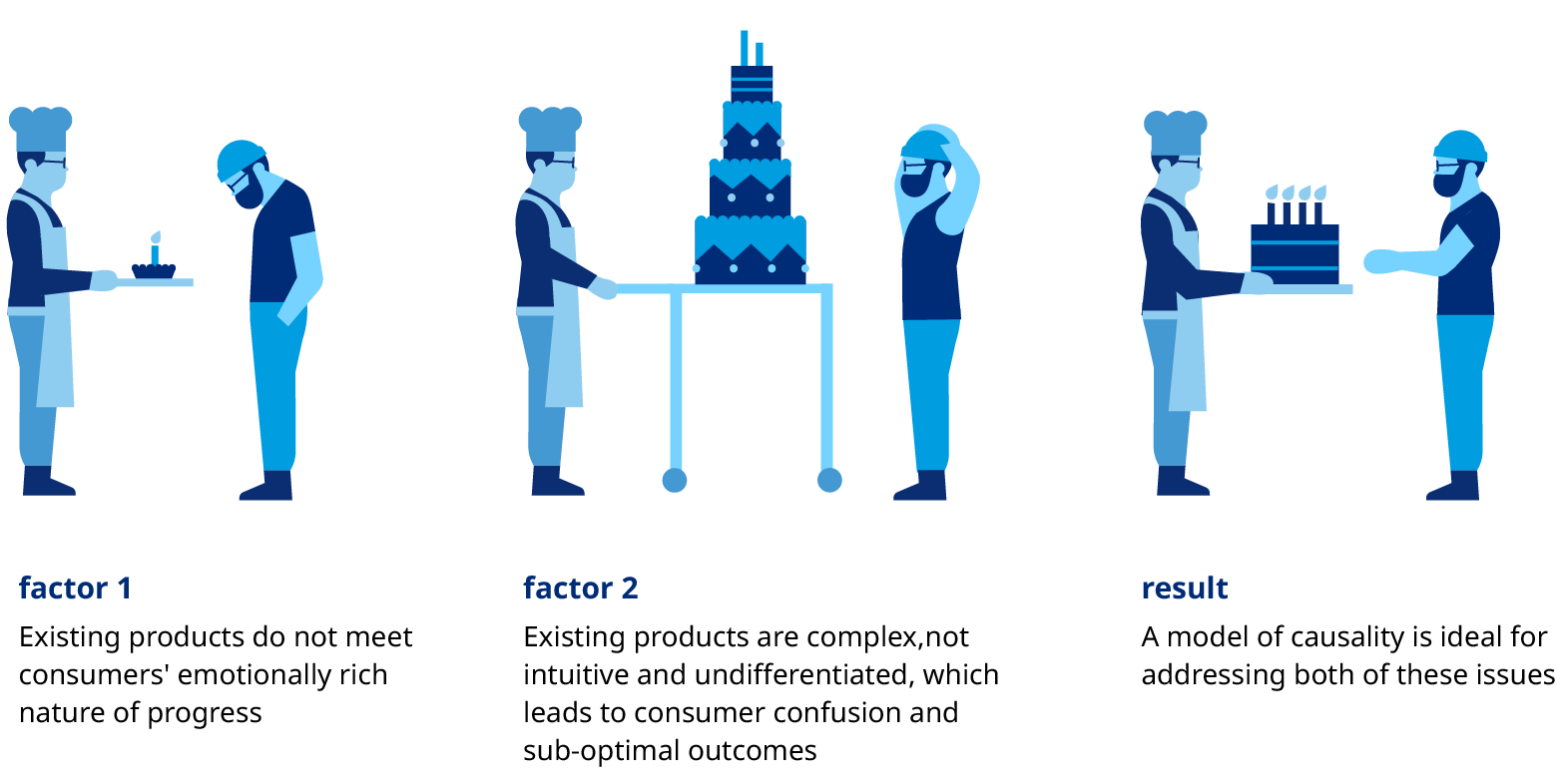

As we outlined in our inaugural Reinventing Insurance paper, there is a significant mismatch in consumer demand and market supply across financial services, leading to an extraordinary opportunity for future growth. We believe that this mismatch is driven by two factors:

Reorienting around customers’ circumstances of struggle and energy for progress expands categories, revealing previously hidden dimensions of value creation; enables leaders to change the basis of competition; and illuminates the path to growth. It is a critical ingredient to successful market-creating innovation.

Market-Creating Innovation Starts with your Customers' Energy for Progress

Established companies are often proficient at efficiency innovation and sustaining innovation. However, when it comes to pursuing market-creating innovation, companies are often challenged.

Three innovation types to unlock growth

The relevant unit of analysis when it comes to innovation work is the progress a customer seeks — their job to be done — in either a personal or professional context.

The relevant unit of analysis when it comes to innovation work is the progress a customer seeks — their job to be done — in either a personal or professional context.

From Correlation to Causality — Jobs to Be Done Approach

To identify market-creating opportunities, we need to understand beyond the “what” of customer characteristics (for example, age, demographic, psychographic information) — and we need to get to the “why” of their motivations or what the consumer wants to accomplish.

That’s where jobs to be done comes in. Jobs to Be Done is an approach to market-creating innovation that helps companies uncover opportunities that are systematically overlooked.

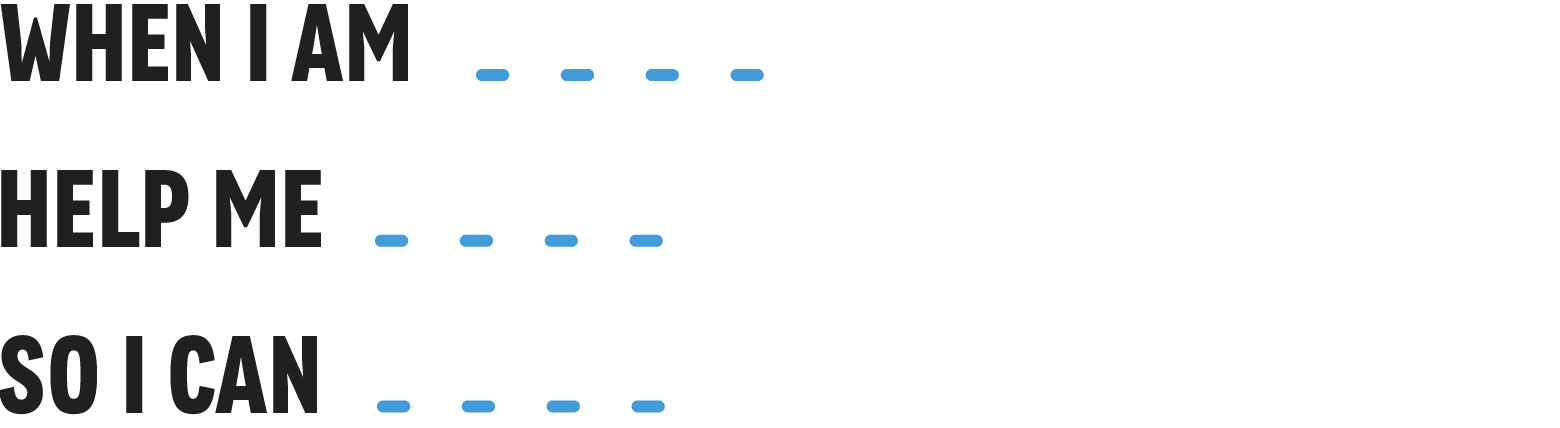

A job is the progress that an individual seeks in a given circumstance of struggle. It is articulated in the form:

At the core of any job to be done is energy for progress — to achieve a goal, resolve a problem, create an experience — but there is palpable energy expended in pursuit of the objective. Jobs to Be Done are fundamentally different than “needs.” For example, a consumer may “need” to save more, work out more, eat better, drive slower, and floss daily, but they have the free will or power to make a different choice to address the challenge. In short, jobs are predictive while needs are not.

Jobs in Practice for Insurers

In the insurance industry, way too often, we view the marketplace through the lens of our products —“we’re in the life insurance business”— rather than through the customer’s jobs lens — “I have to care for and protect my family if something happens to me.”

Too often, innovation focuses on functional improvements to the product but fails to facilitate the real progress consumers are looking for. While this mindset can be widely successful for creating sustaining or efficiency-focused innovation, it fails to deliver on market-creating innovation, which is critical for the industry to unlock growth (and to survive) in the coming decade.

What does Jobs to Be Done mean in insurance? Our PDF version (starting on page 14) offers three illustrative provocations on Financial Wellness, Cyber Risk, and Financial Advisors. Below we give a preview of the Financial Wellness example.

Financial Wellness Provocation

Job Articulation

Job Dimensions

Embracing Jobs to Be Done is easier said than done. It requires leaders to change the way they think in fundamental ways.

Embracing Jobs to Be Done is easier said than done. It requires leaders to change the way they think in fundamental ways.

A Cautionary Conclusion

Managers, often with extreme attachment to large sample sizes and the magic of Big Data, conveniently forget that analytical outputs can be highly-filtered, subjective abstractions of the messy, underlying reality through which consumers go about their daily lives.

As uncomfortable as it may be, jobs to be done productively pushes us to examine the raw data that is useful for innovation: the unmodeled, narrative structure of daily life — in all of its functional and emotional nuance and layers.

Successful innovators are great storytellers — or at least story builders — and it is the stories of the situations within recurring customers’ struggles that illuminate the path to successful innovation. Innovation insights, in short, take the shape of a story not a statistic. Stories are the data behind numbers.

By taking a CustomerFirst approach and applying a Jobs lens to really understand consumers' moments of struggle, you will identify the real progress your customers are looking to achieve. This will transform your view of customer preferences and category boundaries, and of the actual business that you’re in — revealing compelling growth opportunities — hidden where you’ve been looking all along.