The 2021 edition of our annual report with Morgan Stanley offers an overview of industry trends and analysis in wholesale banking.

The industry’s impressive returns reflect a decade of repositioning in Markets and investment banking divisions (IBD). We think improved returns are sustainable. A constructive macro and policy environment is just one driver. To lift returns even higher, wholesale banks need to unlock the value of Transaction Banking with a shift to recurring fees, services-based business models, and enhanced disclosure.

Sustainably higher returns for corporate and investment banks (CIB), but with a shift in focus to Transaction Banking

Wholesale banking businesses demonstrated resilience in the pandemic, delivering the best year in a decade. The benefits of a diversified model were clear, as Markets and IBD franchises benefited from structural changes that have reduced dependency on balance sheet and asset prices, with these gains more than offsetting weaknesses in rate-sensitive businesses. While policy during the pandemic helped, 2020 returns are sustainable in our view due to a constructive macro and policy environment, and the potential to unlock hidden value in Transaction Banking.

First, the macro backdrop is constructive with 7-10% Nominal GDP growth in 2021-22, and the expectation of a stable regulatory environment after a decade of reform. Second, banks can push even higher by unlocking hidden value in Transaction Banking. The fundamentals of this business remain strong, delivering through the cycle ROE of 30-45%. Yet there has been a vast transfer of value to non-bank players in this space over the past three years – banks can narrow the value gap, and reassert their current leading position in the midst of market disruption, by doubling down on Transaction Banking.

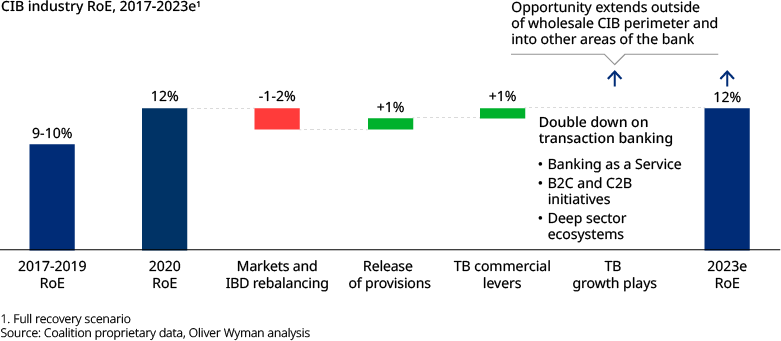

CIB industry ROEs of ~12% in our central case

Without the volatility and policy boost of 2020, wholesale revenues will decline. Yet revenues should remain in range or above 2017-2019 levels in all but the downside scenario, with a constructive macro and policy outlook and upside potential in the Transaction Banking business. Our report estimates a range of through-the-cycle ROE of 8-13% across our three scenarios, with returns improved from the pre-pandemic range of 9-10% in all but our most pessimistic scenario. With this growth outlook in mind, there is value upside for CIBs.

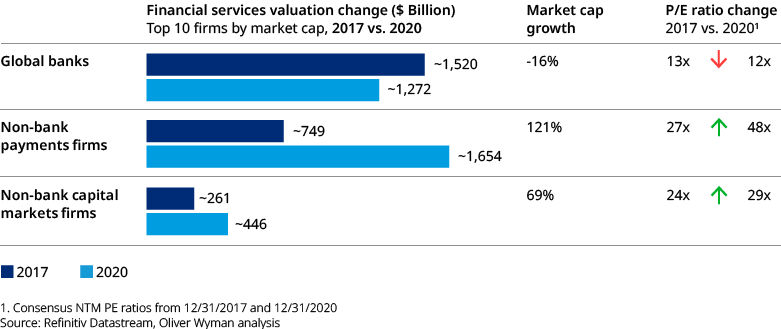

Narrowing the valuation gulf with non-banks

Wholesale banking businesses get a lower multiple from investors than adjacent non-bank players. A large part of this valuation gap can be explained by how these firms are assessed – with non-banks valued for fast revenue growth while banks are valued for earnings and returns – and by the regulatory capital requirements that impact banks.

Nevertheless, we think there are steps CIB management teams can take to narrow the gap. Together these actions are equivalent to 15% or >$200BN of market capitalization for the largest banks:

Better disclosure now on Transaction Banking. Investors have not rewarded banks for the strong fundamentals of this business. Transaction Banking offers stable revenues, sticky client relationships, a source of funding for the bank and a clear link to the real economy. We think more transparency in reporting can drive average valuation uplifts of 8% (up to 20% for some Global banks).

Actions to drive sustainable returns over the longer term. The market is missing the fundamental value and outlook for the wholesale business model: we project sustainably higher industry returns whereas current market valuations imply that returns will revert to pre-pandemic levels. Credible actions throughout the cycle to sustain 2020-level returns can drive average valuation uplift of 7%.

C-Suite strategies to sustain returns

We see at least four levers management teams can pull to drive sustainable returns and narrow the value gap:

Maintain investment in scale while managing risks in Markets and IBD. The last five years have reinforced the earnings power of first-tier Markets and IBD businesses, as the model has shifted away from risk warehousing and towards less capital-intensive activities. While there will always be risk in the business and exposure to losses from idiosyncratic events, the dynamics of the business have changed considerably as a result of post-Global Financial Crisis reforms.

We estimate that a dollar of revenue now uses 21% less balance sheet and attracts 34% less value at risk (VaR) than 10 years ago. This structural shift was evident in the strength of these businesses during the heightened volatility of 2020 – although banks also benefited from the extraordinary policy response to shore up credit markets. Yet we continue to see a valuation gap relative to non-banks in this space. But banks that can successfully emphasize to investors the value of network effects, countercyclical revenues, and reduced exposure to asset prices should be able to escape the valuation trap. Sustainable revenue upside will be driven by those that can maintain their investment in scale, while also efficiently allocating capital toward growth areas like electronic trading, private markets, ESG and digital assets.

Optimize Transaction Banking to recoup losses of 2020. The sharp downturn in interest rates in 2020 led to a collapse of Net Interest Income on deposits, and effectively wiped out growth from the prior three years with $12BN in lost revenues. These lost revenues can be recouped over the next cycle through optimization of the existing business – reorienting the commercial model toward recurring fee income, increasing discipline in liability management and deposit pricing, and strengthening cross-selling. Management teams who move quickly will grow now while preserving an option on the significant upside from a macro recovery when rates rise later in the cycle, when banks should see a 15-20bps increase in Net Interest Margin – equating to ~$4BN of revenues for global banks – for each 100bps increase in interest rates.

Position to capture >$400BN from services-based models. Leading banks are shifting from transactional to services-based models through the development of Banking as a Service (BaaS) offerings, business to consumer (B2C) and consumer to business (C2B) initiatives, and deep sector ecosystems. These longer-term value creation plays address changing client expectations and needs, adapt to the growing ecosystem of financial service providers, and target the areas of greatest payments growth. In many instances, such offerings target clients and require capabilities that are typically outside the Transaction Bank perimeter – requiring banks to look beyond traditional wholesale models and manage across internal silos and/or work with partner networks. The optimal participation strategies for individual banks will vary based on the starting point, but banks can either play for scale or focus on deep specialization. Those who succeed can bolster the value of the wholesale model and defend against disintermediation over the next 5-10 years.

Integrate embedded payments assets. The past decade has seen substantial value creation in the payments ecosystem, but banks have largely missed out on this growth to date. Non-bank payments providers have benefited from exposure to high growth (and capital light) payments business, and high levels of investment into capabilities necessary to serve client needs. But even as non-banks become more competitive, banks have valuable payments assets that exist across the group: many banks have legacy merchant services businesses and scale payments processing factories, and most have extensive wholesale and retail customer networks and rich customer data. But few are maximizing the shareholder value of these assets by managing across siloes. We argue that banks should “use or lose” these assets – by either better integrating to drive growth and scale or divesting.