This article is the first in Oliver Wyman's Reset4Value Series, a collection of content to help business leaders transform cost and ignite growth. Our second installment, Re-envision Client Value, and third installment, Power Up Your Capabilities & Culture, can be found here.

COVID-19 has created massive upheaval but also unique opportunities to maximize value and refocus the growth trajectory in insurance.

The crisis has, in many respects, made resetting your business for fast value creation more achievable than it was pre-crisis. Unmet customer needs are clearer, capabilities are easier to build and/or acquire, remote working has required stronger operational resilience, and flatter organizational models have evolved to enhance faster, more collaborative, remote decision-making.

While the environment will remain challenging as the pandemic peters out, economic uncertainty also remains high. Leaders will remain pressured to deal with the twin challenges of sharp, ongoing cost and consolidation pressures, and a need to find new sources of profitable growth against the disruptive headwinds caused by lower for longer interest rates and emerging Insurtech. The key is to keep calm and RESET4Value.

Leaders will remain pressured to deal with the twin challenges of sharp, ongoing cost and consolidation pressures, the key is to keep calm and RESET4Value

Leaders will remain pressured to deal with the twin challenges of sharp, ongoing cost and consolidation pressures, the key is to keep calm and RESET4Value

How can your business best leverage disruption to drive new opportunities? In our insight, we offer four actions insurers can take immediately to accelerate strategy, reset business value and ultimately come out stronger and leaner than before. Below is an excerpt from the report, for the full PDF version of RESET4Value, please click here.

In this perspective, we propose a new approach to resolving today's cost and growth challenges, and showcase examples of recent client successes. Using our RESET4Value approach, benefits typically emerge as early as six weeks.

Insurers need to reset fast to prevent client value from eroding and ensure near-term financial constraints do not compound into more serious long term threats

Insurers need to reset fast to prevent client value from eroding and ensure near-term financial constraints do not compound into more serious long term threats

For those thinking, “I’ve tried multiple cost transformation efforts before, and have rarely achieved sustainable results,” our view is that it’s not that cost programs are unproductive, but rather that the traditional mindset is flawed.

There is a mindset shift that is required for teams today. We feel that “Unconventional times require an Unconventional mindset,” and what follows are “Four Acts of Unconventional Leadership” to help your organization manage costs while fueling business growth.

Looking forward, traditional growth paths will be harder, margins will continue to be pressured, and disruption will continue

Looking forward, traditional growth paths will be harder, margins will continue to be pressured, and disruption will continue

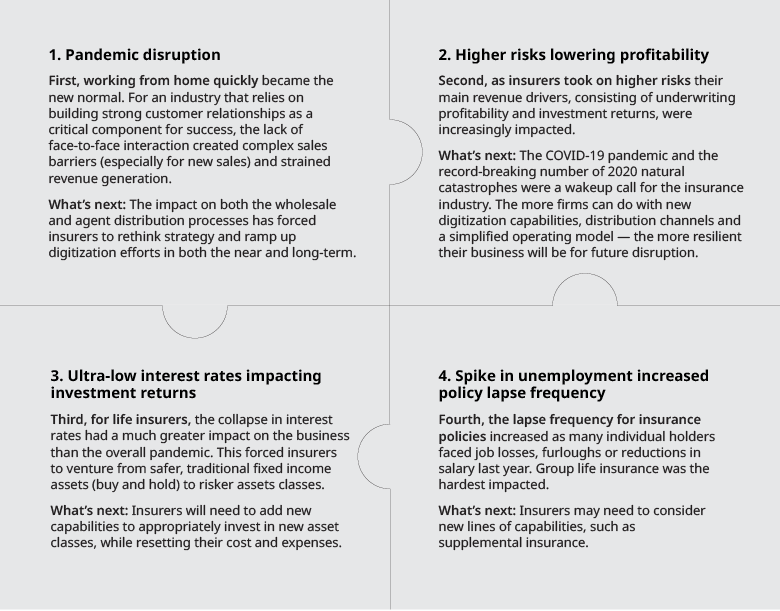

Provocation: Covid-19 has changed insurance

The pandemic catapulted the insurance industry into massive and unexpected disruption across almost all elements of operations. Leadership teams have battled through multiple waves of unforgiving challenges — massive economic instability, record-breaking natural catastrophes, and unprecedented shifts to remote working styles to name a few. Premium growth stalled, net incomes were significantly hit, and even allowing for recovery, businesses will remain challenged in 2021.

In 2020, generating income from traditional businesses was difficult. While recovery is occurring, profitability will remain challenged in 2021 as interest rates remain low, losses remain elevated, and expenses stay close to pre-pandemic levels.

The key to a successful cost transformation is to make the program sustainable

The key to a successful cost transformation is to make the program sustainable

Opportunity for insurers

The good news is that creating long-term value is more achievable now than ever, due to a once-in-a-generation chance to accelerate change. The issues stated above are well understood; what’s difficult is modulating the response. The natural reaction for executives is to launch cost-cutting efforts, but our view is that traditional cost transformations are fraught with challenges and often will not generate sustainable results. The answer must be to treat costs as investments to accelerate growth around a clear business narrative and to reinforce this through an intuitive execution framework.

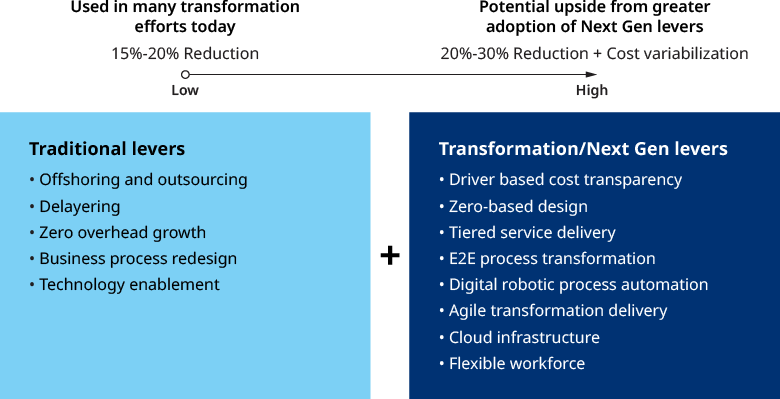

Insurance leaders need to pull both "Traditional" and "Next Gen" levers at the same time to get to significant, sustainable cost reductions

Insurance leaders need to pull both "Traditional" and "Next Gen" levers at the same time to get to significant, sustainable cost reductions

It’s not enough to make this process a one-time effort or to only reduce the largest expenses of the business. Leaders should use cost exercises as opportunities to increase growth ambitions and drive new value and service quality for clients.

In our work with insurance leaders, we observed that most have come close to exhausting traditional cost levers such as outsourcing, business process redesign, digitization, etc. (see "Next Gen" exhibit above), while selectively choosing next generation levers such as cloud infrastructures, robotic process automation, etc., but not necessarily changing how they work. Disruption has accelerated the need for some of these levers. Far reaching business goals and longstanding “nice-to-haves” are now priorities. For example, COVID-19 has shown that it’s essential to have digital and contactless client experiences. Customers want options for dynamic coverage that adjusts over their lifetime; solutions that are socially responsible and meet Environmental, Social, and Corporate Governance (ESG) efforts; and they are looking for improved customer experiences to process claims or buy supplemental insurance coverage.

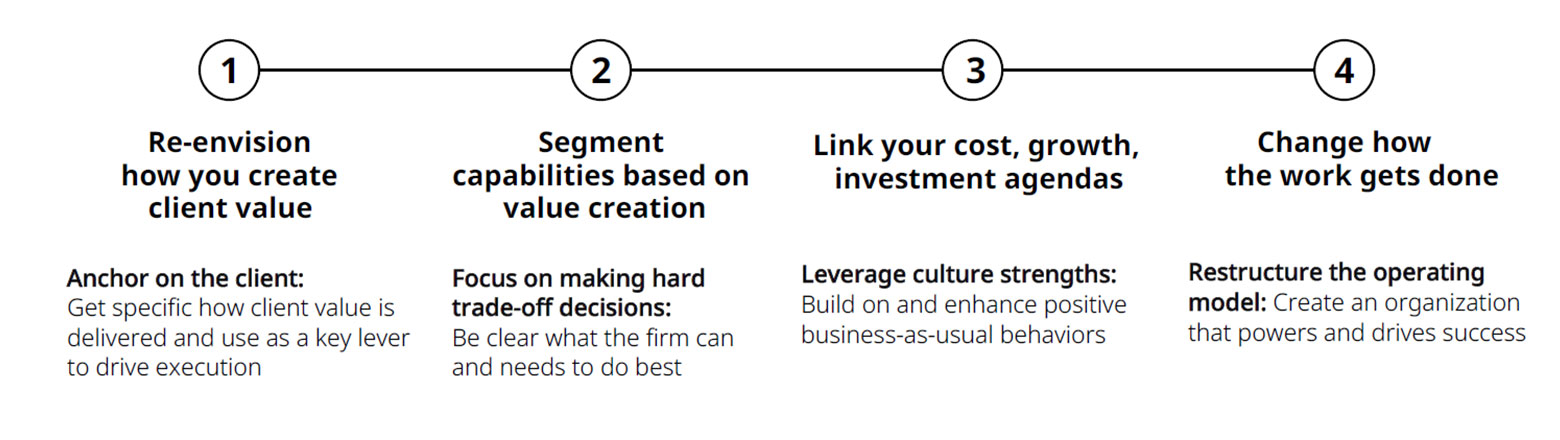

It’s easy to say and hard to do, of course, which is why we’ve developed an approach through our work with executive teams which we call “Four Acts of Unconventional Leadership.”

Unconventional times require an unconventional mindset

Unconventional times require an unconventional mindset

RESET4Value

In our view, “Unconventional times require an unconventional mindset.” So, what does this mean? With ongoing COVID-19 disruption, performing one-time cost-cutting initiatives is destined to be difficult and will ultimately hurt the future profitability of your business. Rather than performing a one-time slash of expenses (that often trickles back in), leaders need to change their mindset and view cost programs as a way to fuel growth.

Act 1: Re-envision how you create value

Start with customer value and focus on future growth. Cost cutting alone will not solve all the challenges. Leadership teams need to have a holistic transformative mindset, starting with consensus on what customers’ need and value and use this to prioritize growth initiatives. Top-line growth is a key driver of sustainable earnings expansion and reduces the need for and negative effects of perpetual cost-cutting.

Resetting customer value. Leaders should be very clear and specific when considering, “Why are clients coming to us?” Are clients coming for first-rate customer service or the convenience of our experience? Do they want higher premiums for greater coverage or a lower risk profile? And this exercise is not to select your most profitable product or service. Value drivers may be different depending on the segment or offering and should be defined specifically for each, bringing in the voice of the customer. The key here is to is to consider, “What do my clients value?” and "What value can my business provide to them?"

Driving growth. After getting specific on the value you are delivering to clients, use this as an opportunity to accelerate growth and consider which capabilities to invest more or less in. Look beyond where you have traditionally played and consider the specific value customers are expecting from both traditional and non-traditional competitors, as well as the unmet customer needs not yet fulfilled by players in your market. This will allow you to choose capabilities that truly differentiate and are unique, while reducing spend on capabilities that matter less to customers.

Act 2: Segment costs and align to customer value

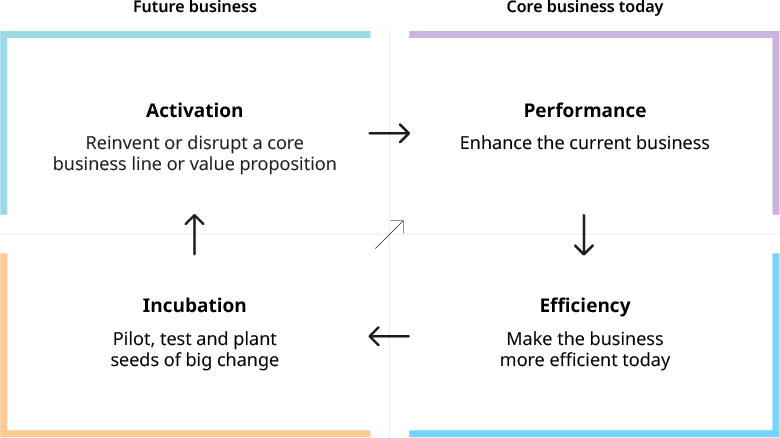

Use the Four Zone approach to make hard trade-off decisions. Leadership teams often get trapped on a treadmill, chasing multiple opportunities and investment initiatives without a clear ‘right to win.’ The twin cost-growth challenges we now face require that this problem be addressed directly. Executives must ask themselves: What does my business do best? Are our products and services addressing the most urgent needs of my clients? Am I efficiently allocating resources across a portfolio of today’s businesses and bets that will drive me into the future in 3 to 5 to 10 years’ time?

Act 2 of the approach allows leaders to build on re-envisioning customer value from Act 1. Here we segment and align costs and investments across four zones: Performance, Efficiency, Incubation and Activation. This allows you as a leader and your team to systematically reallocate resources to areas that will drive future growth, extracting from low-growth businesses and non-strategic programs.

The Four Zone model systematically enables focus and hard trade-off discussions. Oliver Wyman collaborated with Geoffrey A. Moore, author of Zone to Win to develop the Four Zone model. Leaders can synthesize the business portfolio and ensure that they are spending the appropriate amount of time, money, resources and attention to the right areas and priorities. As new lines of business and capabilities are piloted, integrated and scaled, careful attention is paid to moving between zones and managing on an ongoing basis (see the Four Zone Model exhibit below).

It’s important to understand that this is an active, ongoing, cyclical process. Business capabilities and portfolio activities move through the zones over time. Each organization continually decides where to reallocate or invest more or less.

Act 3: Link your cost, growth, investment agendas

Force the discussion on where to invest less and fund the future. With uncertainty and disruption, the natural reaction for many leaders is to drive efficiency by reducing the largest costs. However, this does not prime the organization for long-term growth and ultimately leads to disadvantage. We believe in powering your business for sustainable growth. The third act links cost, growth and the investment agenda. Following this approach, leaders treat costs as investments — ruthlessly trimming offerings that are non-differentiating and investing more in what creates value. Margins are sustainably managed while proactively managing reinvestment to enable growth. Resources and money can be quickly and flexibly reallocated to improve business performance and scale disruption.

Act 3 also creates capacity for a portfolio of smaller, more focused bets to pilot, test or fund new ideas (Incubation Zone). This also sets up the business with a robust investor narrative on future trajectory with demonstrable, credible proof points based on innovation zone outcomes.

Results: We recently worked with the CEO of an insurance holding company to link their cost, growth and investment agenda. Using the Four Zone framework, we quickly realigned cost structure and trimmed non-differentiating offerings to match the relevant performance zone. We helped the business adopt both traditional and next gen levers and successfully unlocked 20 to 30 percent in savings. This savings was then reallocated across a portfolio of 10 organic and inorganic growth ‘bets’ facilitating a robust board and investor narrative.

Act 4: Change the business culture and behaviors

Change how the work gets done. Act four is the key ingredient to successful cost transformation — culture and organizational behavior. Leaders can spend resources on the most innovative, expensive technology, but if they do not retool their workforce or change how the work is performed, they will not generate the returns originally envisioned.

Success is powered and driven by the entire organization. Empower your employees to drive change in their everyday jobs. Listen to your team, allow them to make decisions and be a part of the transformation. When needed, retool their skill sets and enhance work-life balance to make your organization an attractive place to work.

Reimagine how business activities get done through launching new digitization efforts and using greater speed and data quality to manage P&L accountability. Consider moving to a flatter organizational model, with fewer layers, to enhance collaborative decision making, accountability and the ability to tap into employee talents.

Overall, leaders need to embed elasticity or operating leverage into their organization. For example, keep resources flowing to “good” costs, such as taking on new customers or adding new services, and away from activities that do not add value. This allows the business to handle future growth in a more profitable and sustainable way.

Get started with our playbook

Successful cost leadership in this new normal is possible and attainable. Using the “Four Acts of Unconventional Leadership,” we have worked with multiple CEOs and their leadership teams to come out of this crisis stronger and poise their business for accelerated growth.

At Oliver Wyman, we can help your business achieve the same. Whether your organization wants to lower operating costs or uplift revenues, we can support you with making the right types of decisions to thrive today and in the post-COVID world.

Our practical and actionable playbook offers a fast, structured approach to bring large opportunities into plain sight and allow a true view of your firm’s differentiation. Putting this into practice builds collaboration within your teams and helps elevate discussions to the right level.

Leaders can pick their spots for quick wins, reallocate resources to the highest priority areas, and accelerate self-funding to monetize new capabilities. Overall, the playbook encourages innovation and provides a sustainable way to embed cost transformation and growth into your current business activities.

Performing the “Four Acts” in a cohesive, self-reinforcing whole is key. Many times, leaders may re-envision customer value and segment their costs, but do not take further steps to link their cost, growth and investment agendas or ultimately change the organization’s behaviors.

As we’ve said, these “unconventional times require an unconventional mindset.” Building courage in your convictions and allowing time for the reset to take shape makes a difference. Oliver Wyman can help your business execute these challenges and fuse your cost transformation together.

The time to get started is now.