This article was first published on July 15, 2020.

Editor's note: Oliver Wyman is monitoring the COVID-19 events in real time, and we have compiled resources to help our clients and the industries they serve. Please continue to monitor the Responding To Coronavirus Hub for updates.

Every major crisis has proven to shift the competitive landscape of corporate banking, with quick mobilization to meet changing client needs the key to expanding wallet share and boosting forward momentum. The coronavirus (COVID-19) pandemic is no different.

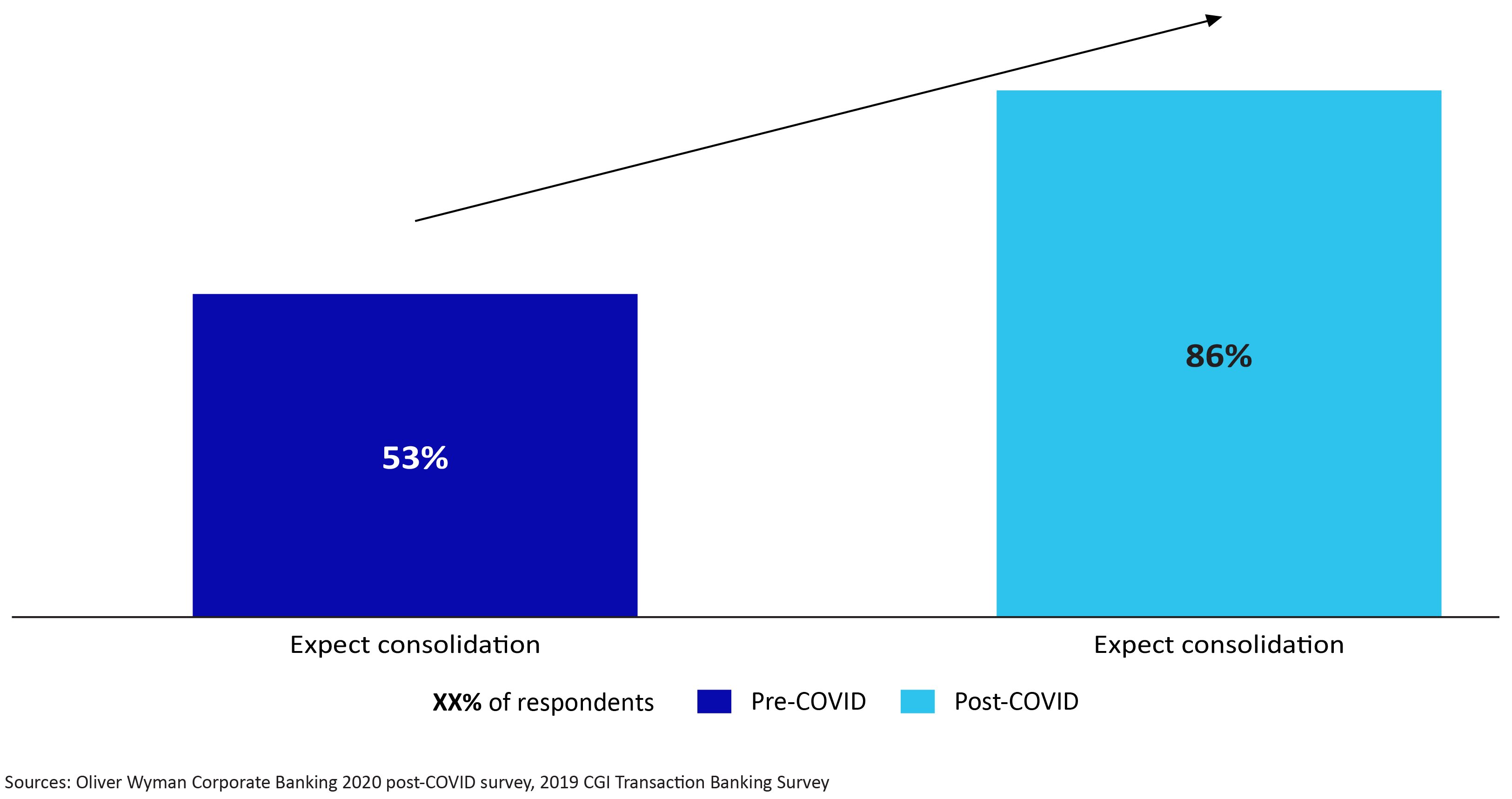

We recently surveyed close to 30 corporate banking heads at top global, regional, and local banks in Asia about how they expect the banking landscape to evolve post-pandemic. The findings show that banks are already seeing clients signaling stronger than ever intentions to consolidate banking relationships, with an increase to 86 percent from 53 percent of banks expecting consolidation in the next few months.

EXHIBIT 1: WILL CLIENTS CONSOLIDATE THEIR RELATIONSHIPS?

The survey also found that COVID-19 has accelerated disruptive trends and opportunities in the following areas for corporate banks:

Digital advisory

Delivering digital end-to-end transactional experience across products will be table stakes; banks need to unlock channels and insights to create differentiated propositions, including digital sales and advisory (identified as an emerging need post-COVID by 65 percent of respondents) and sector insights and advisory (46 percent of respondents).

Talent management

Although bank employees’ productivity has increased during the crisis, massive productivity skews still exist – 69 percent of bank respondents say that less than a third of their sales force generates 80 percent of revenues. While most global banks feel confident they have the talent and skills to perform, just over a third of regional and local banks feel the same way.

Rethinking coverage models

In order to meet clients’ needs and deliver more value, banks need to rethink coverage models; all surveyed banks expect changes to organizational and team management, and more than half agree that their coverage model is not fit to drive digital delivery and more tailored insights and advisory.

Leveraging partnerships

Nearly 90 percent of banks agreed that partnerships will be core to gain new capabilities, but they often fail in partnering with fintechs due to a highly siloed organization, cultural mismatch, and lack of involvement from senior leadership. Banks will need to rethink their approach if they are to maximize the opportunities to collaborate to accelerate and build new capabilities.

EXHIBIT 2: COVID-19 HAS ACCELERATED DISRUPTIVE TRENDS IN ADVISORY, INVESTING IN TALENT, RETHINKING COVERAGE MODELS, AND PARTNERSHIPS

Building back better

This is an opportunity for banks to build back better, with a change in ways of working inevitable. Banks must therefore redefine how they deliver value and pursue new channels to drive richer client engagement and longer-lasting relationships.

Beng How Toh, Fay Pauly and Wan Ting Tan also contributed to this article.