But increasing competition means that operators can’t simply raise prices to pay for this investment, so their margins are getting increasingly squeezed. We think that a risk-based approach to investment prioritization could reduce expenditure by up to 20 percent, boosting profitability while also raising customer satisfaction. The same principle will also aid other parts of telecom operators’ businesses – including network maintenance, marketing, and customer service – making risk-based techniques a powerful, wide-ranging transformative tool.

For investment, the key is to consider the quality of radio access networks in terms of customers’ experiences. In particular, for each potential investment in a site, operators should ask: “Will the customer experience be altered significantly if we don’t upgrade? If yes, how likely is the customer to switch to another operator? And how much would that cost us?”

The answers depend, of course, on the quality of service a network provides. But they also include subjective factors, as customers are sensitive to different aspects of service. Moreover, different customers contribute different amounts of revenue. By measuring the probability that different customers will leave for another operator in certain circumstances and combining this with their respective revenue contributions, operators can calculate the customer value that is at risk at various base station sites. They can then better target their infrastructure spending.

TRADITIONAL VALUE TOOLS

Value-based network optimization, or VBNO, is not a new concept. Typically, operators consider three factors when deciding which parts of their networks to upgrade: each site’s technical performance and its impact on customer experience; the revenue the site generates; and the cost of upgrading it.

However, there are two weaknesses in the way these are combined. First, the weightings given to these three components are often highly subjective, as the operator tries to align them with its strategic objectives. So the overall model often fails to reflect the value generated by different sites.

Second, the indicators used for the technical assessment do not provide enough useful information. They are mostly based on voice calls quality metrics such as dropped calls and setup success. Moreover, they are aggregated for each site: If a customer has a great experience when calling through a particular base station and a frustrating time streaming videos, the company will only see a blended indicator. This will fail to pinpoint the site’s strengths and weaknesses.

FACTORING IN RISK

A better way to maximize value is to consider a metric of value at risk: the value that would be lost if customers leave the operator due to a bad experience at a particular site. One component is the value of the customers using the site, rather than simply the traffic generated by the site. A second is the probability of that value being lost – or churn probability. Key to calculating that accurately is a deep and granular understanding of customers’ experiences of using the network. That requires advanced network probes capable of capturing what truly matters to customers when they use their phones.

A machine-learning algorithm can then translate the technical performance – or the risk of a site not functioning properly for a customer – into a probability that the customer might leave. The combination of the customers’ value and their churn risk are then used to calculate the value at each site that is at risk – and, therefore, the probable return on investment (ROI) there.

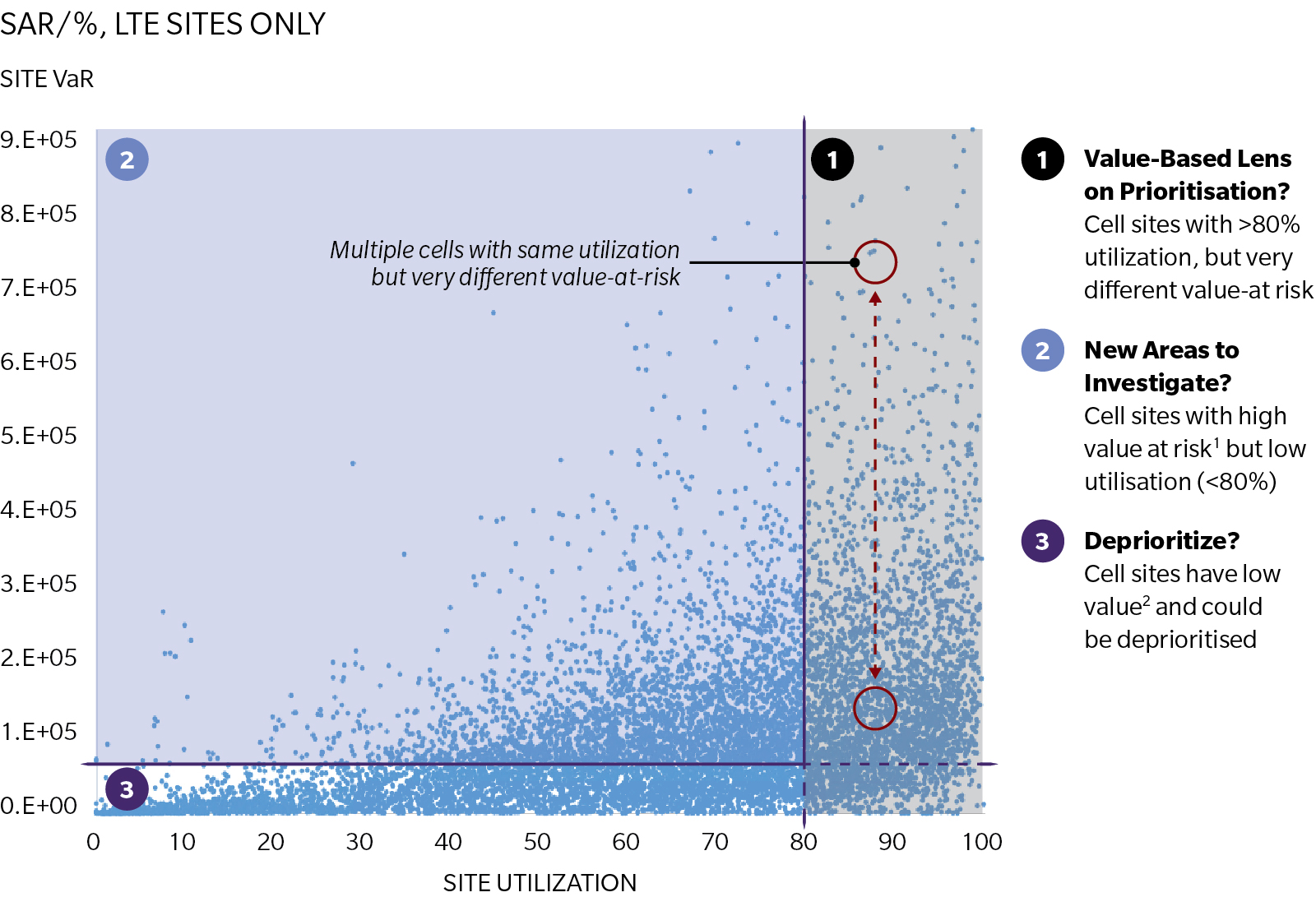

Value-at-risk data can be used in two main ways. First, operators can prioritize their network investments – both for upgrades and site maintenance. Among sites with heavy utilization that have been selected for upgrade, the return on investment will be greater for those with higher value at risk. Some sites have relatively low utilization, so would traditionally have been low priority for upgrades – but they might be used by high-value customers, resulting in a high value at risk. These should be given greater priority than they had been. In contrast, sites with low value at risk can be deprioritized.

Exhibit 1: COMPARISON OF CELL SITE VALUE AT RISK AND CELL SITE UTILIZATION

Source: Oliver Wyman analysis

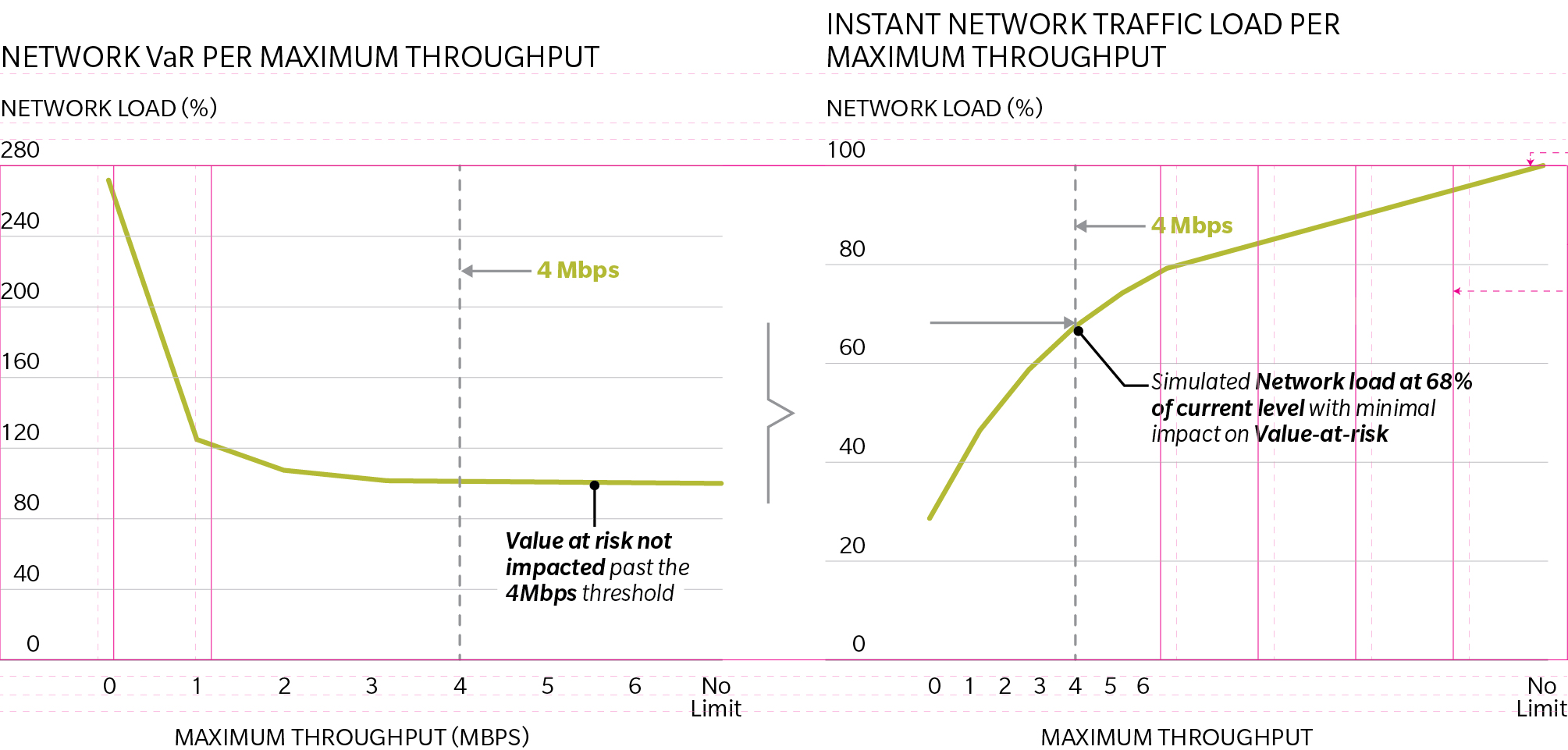

THE SPREAD OF RISK-BASED METHODS

These tools can make telecom operators more efficient and more effective elsewhere in their organizations – both in network operations and in other business units. To reduce network congestion, for instance, they can apply selective data throttling – the intentional slowing of the network. Much traffic is often driven by a small portion of customers and applications, and the value-at-risk tools can be used to measure the sensitivity of customers to data throttling. In tests we conducted on one operator, when throttling data at around 4 Mbps in a particular market resulted in almost no decrease in customer experience or increase in value at risk. In one case, such throttling achieved a reduction in network load of up to 30 percent during peak times. This can be directly translated into a deferral of expenditure on site upgrades.

Exhibit 2: THROTTLING IMPACT

Source: Oliver Wyman analysis

For maintenance work when a number of transmission sites are not working properly, those that generate the most value can be prioritized. Advertising and other communications can be focused better when the telecom company understands more about the kind of experience different customers are getting in different places. For example, it can tell potential customers that it has the fastest (or most-stable) network in a particular neighborhood, sure in the knowledge that it is speed (or stability) – and not, say, security – that high-value customers in the area care about most.

A deep understanding of customers’ experiences also fuels artificial intelligence-based algorithms to maximize revenues. If a telecom operator can tell a customer is likely to leave, it can offer them an incentive to stay, tailored to their profile – for one a discount, for another a promotional Internet offer, and for someone else a deal with free calls to selected friends or family members. Triggers based on the concerns of individual customers can be built for proactive customer-care calls, increasing the value these calls generate and reducing the number of call-center staff.

A granular view of communications traffic can feed models to forecast demand in the months to come. Based on such forecasts, a telecom operator can negotiate optimal terms in its dealings with others – such as roaming contracts with overseas and national operators.

These risk-based techniques require several enablers, starting with network probes to capture experience data at the most granular level: who is downloading how much data, and what is the quality of the service offered. To avoid the accumulation of excess data, they must be selected for relevance and stored at the right level of detail for a sufficient period. This needs a big-data environment with advanced analytics that can sift through the data and make the right decisions about what to do with them. These tasks should be overseen by a proper data governance structure, which ensures efficient investment in data systems and access to them by the relevant teams throughout the organization. These all demand investment, but soon telecom operators won’t be able to risk working without risk.