Welcome to Customer Insights, Oliver Wyman’s quarterly newsletter on consumer and small business banking customers. This newsletter will highlight interesting insights based on Oliver Wyman primary research and analytics. This quarter we focus on consumer buying behavior for mortgages and its implications for banks.

How do different consumers shop for mortgages?

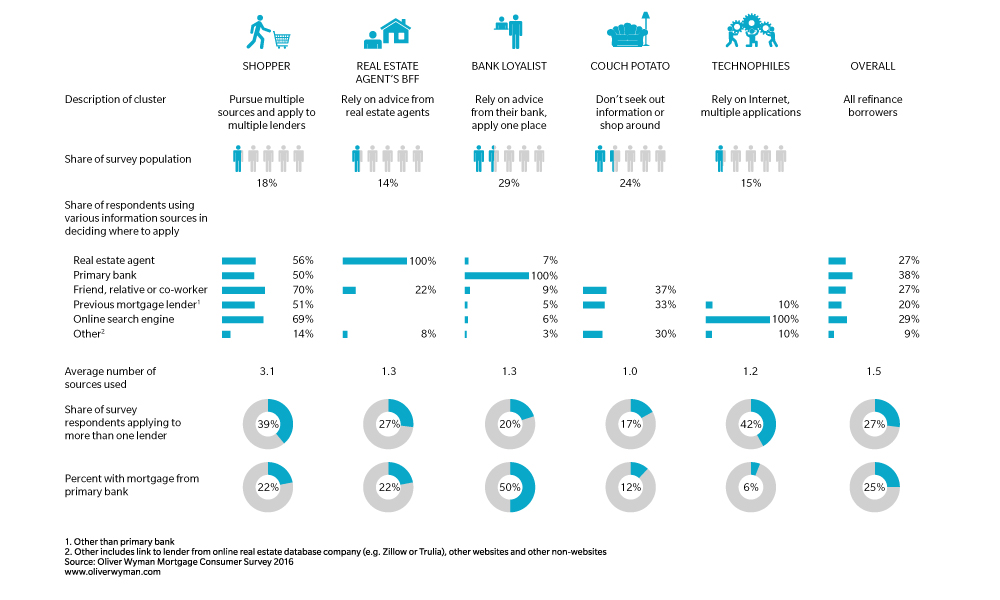

Different strokes for different folks. We surveyed borrowers and asked about the information sources they used to decide which lender to apply to. The results show significant differences across consumers, and differences across purchase and refi borrowers.

Almost 50% of all Purchase borrowers rely predominantly on one source of information – the real estate agent, their bank or friends and family. Only 28% compare information from multiple sources, including the Internet. The key takeaway here is that most borrowers do not shop around at all.

Cluster analysis for purchase borrowers

In our research, 70% of borrowers said they applied to only one lender, which is consistent with the findings above. Most consumers do not shop around for the best deal, and instead rely on trusted sources of information.

Implication for banks: How to develop winning relationships with realtors

Getting a foot in the door. Given the importance of real-estate agents in the home-buying and mortgage process, it pays for lenders to build relationships with them, particularly in a purchase market. Purchase volume accounts for two-thirds of the mortgage market and is projected to increase in 2018 and 2019. As seen above, more than half of purchase borrowers consider the recommendation of their agents as they make a mortgage decision and almost 90% of home sales involve a real estate agent.

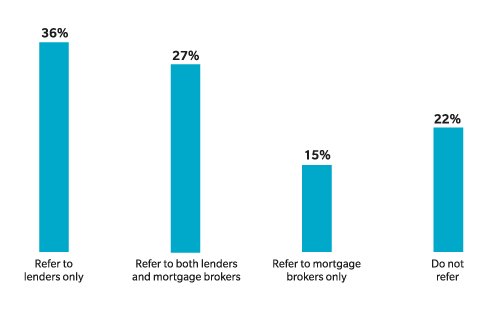

Forging a connection between lenders and agents is difficult, though. We surveyed real estate agents and saw that two thirds of agents either referred customers to brokers, a combination of brokers and lenders, or did not refer them to any mortgage source at all.

Distribution of agents by referral decision

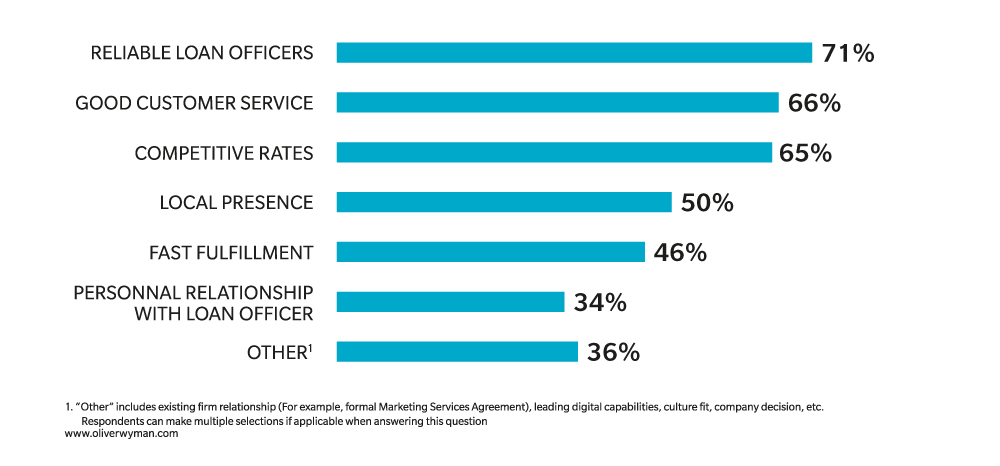

So how can lenders build relationships with agents? Great customer experience and competitive rates are table stakes in gaining an agent’s trust as a preferred lender. Other important advantages include fulfillment speed and a local presence, which is perceived to correlate with an understanding of the local real estate market and an ability to deliver mortgages with better terms. |

Reasons why agents refer business to their preferred lender

More Information

Readers interested in learning more about these insights can refer to Oliver Wyman’s publications - “Different Strokes for Different Folks” and “Winning Mortgage Volume with Real Estate Agents”. If you would like to discuss this, have feedback you’d like to share, or have requests for insights you’d like to see, please contact CustomerInsights@oliverwyman.com