Citibank’s early forays into the business of information failed. Nevertheless, Wriston was right. Information businesses within financial services will soon be worth more than the rest of the industry. At current growth rates, independent payment networks, credit bureaus, rating agencies, exchanges, data providers, and other information companies linked to American banking will have a higher market value than American banks by 2020.

This need not be a cause for despair at traditional banks and insurers. Despite their sluggish response to the "information revolution," they remain producers of some of the most valuable information in the global economy. And, because they are risk-based businesses, where good decision making drives returns, they can readily convert information into profit.

Financial firms have been slow to embrace information because the rewards for making better use of it have traditionally been modest. When the information revolution took off in the late 90s, leverage was high, interest rates delivered strong deposit and treasury profits, and lending was growing rapidly. Reliance on cash, checks, and paper forms made branches important to customers. Poor access to financial information also made them dependent on advisors. They paid for both through higher interest rates, higher premiums, and lower yields.

Fast forward to today, and the situation is reversed. Economic uncertainty and stagnant collateral values have increased risk and, therefore, the cost of inaccurate decision making. Ultra-low interest rates have destroyed deposit margins. At the same time, increased access to information is giving customers new preferences, favoring price, speed, and digital access over easy access to branches. Wriston’s “money business” is in trouble. Financial firms need an information strategy.

Financial firms’ myriad transactions with households and businesses provide not merely revenue but information. An electronic transfer between a client and another financial institution indicates who the client’s other providers are. Wires can reveal a business client’s suppliers, customers, needs, and exposures. Transactions on a current account are windows into a client’s spending habits and financial health.

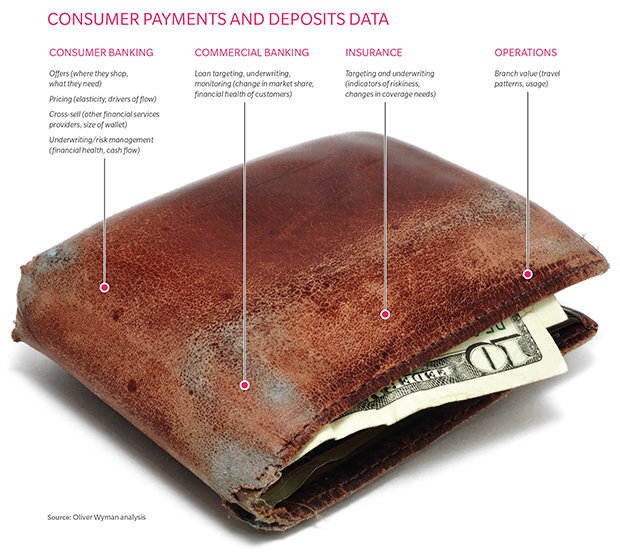

The competitive edge financial firms can derive from such information is limited mostly by their imaginations. Consider just one source of data, the transactions and balances on consumers’ current accounts. As the exhibit shows, this can be used to improve returns well beyond consumer banking in large part because the data can be used to improve decision making.

By the same token, misuse of information can destroy banks’ business models. Consider equity research. Historically, trading desks charged clients a fee for trades that covered not only the cost of execution but also other “valueadded” services, including research by the banks’ analysts. Without credible equity analysts outside of banks or readily available “execution only” services, customers had little alternative to paying for the bundled proposition.

In recent years, however, the digitalization of trading has created desks that sell trade execution without the extra cost of research. And many analysts have left sell-side firms to become independents, creating real competition in research. In short, the information revolution has destroyed banks’ advantages in selling equity research.

These are but two examples, but the message has broad applications. Financial firms will succeed only where they enjoy a sustainable informational lead, and only provided they develop the ability to exploit that advantage. Identifying these areas and diverting resources to them should be a strategic priority.

Aaron Fine is a New York-based partner in Oliver Wyman’s Financial Services practice. This article is adapted from the 16th edition of The State of the Financial Services Industry report.