The challenges facing the European banking sector are significant. The issues of regulatory intensity, cost excesses and troubled assets are serious. And the required restructuring path for the industry remains a complex one.

In this context the underlying profitability of many European retail and small business banking markets looks surprisingly solid. And in some of the larger markets outside the EU (e.g. Turkey, Russia), RoEs are also strong, driven by a mix of stronger growth, wider margins and in some cases notable innovations in distribution and customer management.

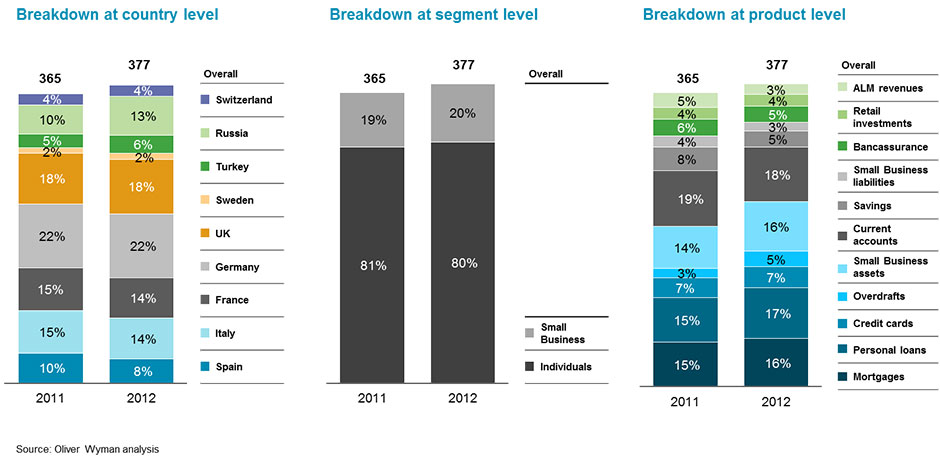

European Retail Banking Revenues €BN, 2011-2012

This graph represents the single largest segment of the European banking market as a whole – over 50% of overall aggregate banking revenues across the countries analysed.