Profitability is one of the hardest topics for US private banks. At the core, the problem is finding the right balance among conflicting needs, such as serving legacy relationships, customizing the offering, and scaling the business. While private banks achieve varying levels of profitability depending on their ability to balance these needs, we have observed that 35-50% of individual client relationships are not profitable. This issue is exacerbated now due to macroeconomic headwinds and slower wealth growth in the US.

For banks to maintain a content and profitable client base in this environment, it will be important to understand individual client profitability, and establish a concrete pricing and cost discipline based on real data analysis. In our experience, private banks that pursued these efforts were able to grow their revenue basis by around 15% on average and, in selective cases, grow their profits by over 50%, without material client attrition. Here, we unpack why profitability is difficult to master and how private banks can improve their ability to manage it.

How US private banks can maintain profitability

In 2022, US private banks have come to an inflection point. North America household financial wealth peaked at $57 trillion1 in 2021, with annual growth rates above 10% in many years. While we expect financial wealth to keep its growth path and reach $68 trillion in 2026, we also expect a lower wealth growth rate of around 3.5%. In addition, higher inflation has added cost pressure from increasing salary costs, and higher interest rates are forcing banks to increase deposit rates for clients to maintain their balances.

While the outlook for private banks remains positive given the resilience observed in US wealth creation, banks should nonetheless take conscious efforts to control costs and keep profit margins healthy.

Why profitability is difficult for private banks

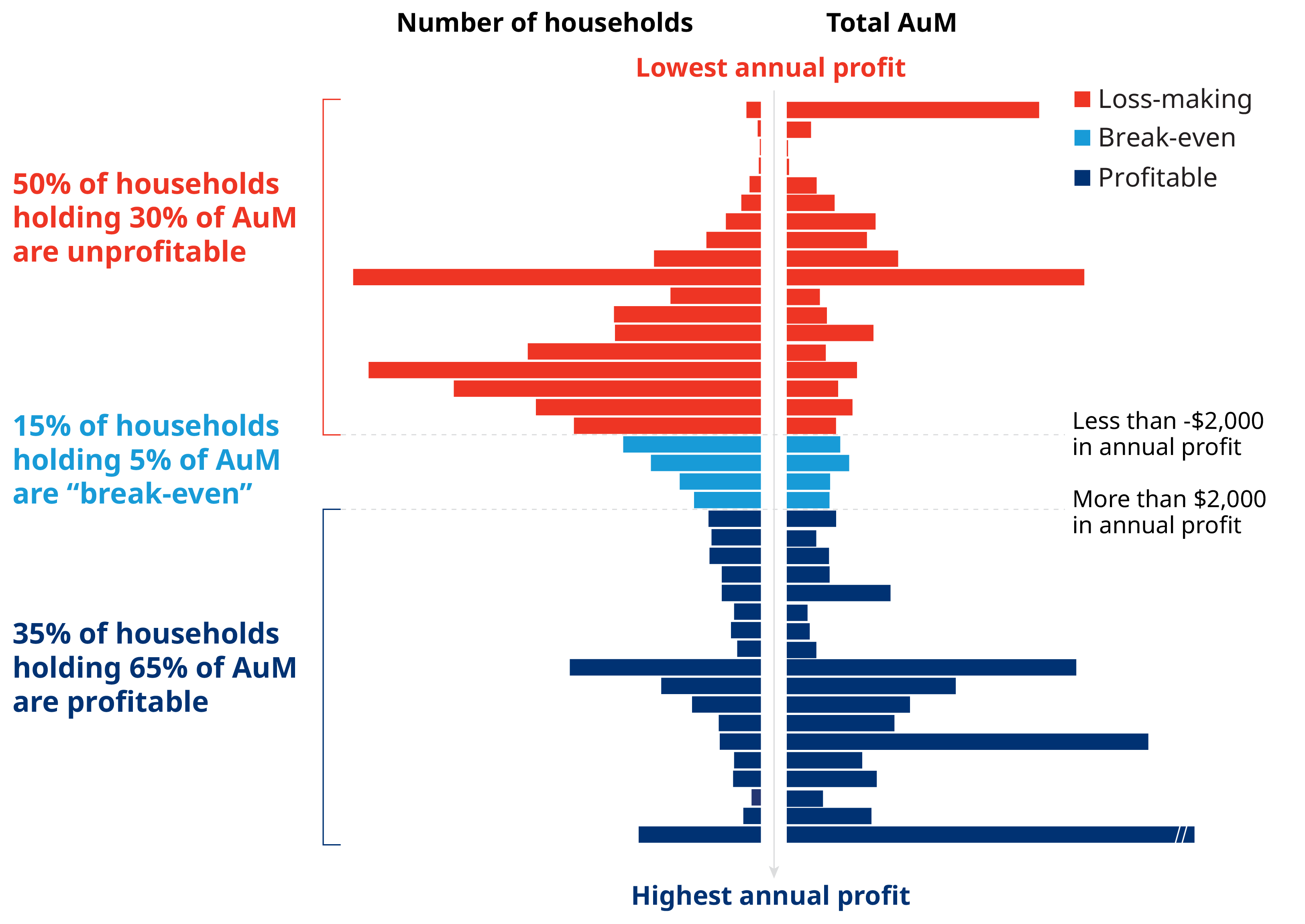

Even in times of prosperity, profitability can be a challenge for private banks. Through our experience with private banks in the US and abroad, we have observed that: 35-50% of all client relationships are not profitable; over 20% of large clients, and most small clients, are not profitable; 25-45% of all relationship managers (RMs) are not profitable, and RM payout is not correlated with RM profitability.

How private banks can improve profit margins

Understanding profitability at the client level can materially change the way the business is managed, and decisions are made. Oliver Wyman has developed a proprietary approach for sustainable profitability management and supported numerous private banks on their transformation path. Private banks following our approach have been able to grow their revenue basis by more than 15% on average and, in selective cases, profits by more than 50%, without material client attrition. Our approach consists of four major pillars:

Deeper understanding of the bank’s client base and what clients value

While most private banking leaders claim they understand what clients value, we found this to be true at a very high level. A deeper, more granular understanding is needed to clearly articulate what clients value in terms of products, channels, and services, which will enable the organization to correctly understand client willingness to pay and the necessary service standards. Areas of investigation should cover client segments, discretionary and advisory offerings, revenue streams and drivers, and channels leveraged for different client bases.

Granular understanding of cost to serve and client level profitability

A cost allocation exercise is essential to understand and appreciate different client situations and individual activities (including trading activities, banker visits, reporting, etc.). The appropriate cost allocation methodology can vary from bottom-up, activity-based cost allocation, to top-down cost allocation using keys at the business unit level. Besides the approach, it is essential to find a balance between accuracy and efficiency. Individual client profitability needs to become a central element in active business management and decision making. Individual client profitability brings transparency on client-level economics and can help private banks improve resource allocation, such as better coverage models or calibrated RM compensation.

Pricing discipline and enablers

Developing a pricing discipline that fits the organization’s needs is paramount. For the new pricing discipline to stick, the rules and room for flexibility should be transparently explained, the drivers of price should be clearly laid out, and complying with the pricing discipline should be tied to incentive mechanisms.

Concrete commercial initiatives to address unprofitable clients

Being able to assess client-level profitability and implementing key enablers will allow private banks to take specific actions based on the individual profitability level of clients. For client-level economics to be translated into concrete actions, it will be important to implement some of the following levers:

Tactical levers, which aim to fix profitability by creating additional value and revenues with existing clients in the short-term. These levers can be automated and governed under a system that measures and reports client-level profitability, proposes a set of short-term actions (such as additional product penetration) and tracks actions taken by advisors.

Strategic levers, which yield medium-term impact and address more fundamental profitability issues with both existing and new clients. These levers may vary from revisiting the bank value proposition and pricing strategy, restructuring the operating model and client segmentation, and enhancing incentive mechanisms.