The broad strategy shared by many wealth managers has been clear for some time: deliver financial wellness and goals-based wealth management in an efficient, scalable, and consistent way. Yet, industry progress has been slow, and the vision remains a considerable distance from reality. There are many important reasons for this situation (including both cultural and behavioral challenges), however, none are more significant than a lack of the right technology and tools to serve clients.

With wealth managers, banks and insurers all seeking to become the advisor of choice for "all things financial". Getting it right can improve business economics and cement long-term competitive advantage, but, more importantly, clients need goals-based wealth management now.

Amid the COVID-19 pandemic (and a return to a near zero rate environment), the financial lives of clients are at risk1. To meet this need, wealth managers must increase the speed of cultural and operational transformation, while building greater flexibility and efficiency to rapidly adapt to a changing environment.

Success requires a fundamentally different approach to client experience design and development that incorporates an integrated business and information technology team. Rather than a one-way communication of business requirements followed by delivery, senior business and information technology representatives must commit to an ongoing dialogue that includes:

- Business strategy — Ongoing discussion about strategy, client and advisor needs, business priorities and tradeoffs.

- Capability gaps — Regularly assess gaps — both functional and non-functional to understand strengths and weaknesses as well as an organization’s change capacity.

- Key differentiators — The choice of IT architecture should reflect desired areas of differentiation, internal systems build and integration capabilities, and an informed view of the vendor marketplace.

- Development approach — Adopting a collaborative, agile development approach and ongoing delivery model that provides the front office with increasingly powerful tools rather than ‘big bang’ releases (that often miss the mark).

Below is an excerpt from the report.

Adopt an agile mindset to accelerate time to market and build with conviction

The robo-advisors had it easy — maintain a steadfast focus on a target client persona and deliver a seamless, frictionless end-to-end client experience. Most wealth managers face a far more daunting challenge however. For example, how should they solve for many personas — both client and advisor; should they offer a much more comprehensive advice and services offer; and how should many different programs, products and platforms be managed?

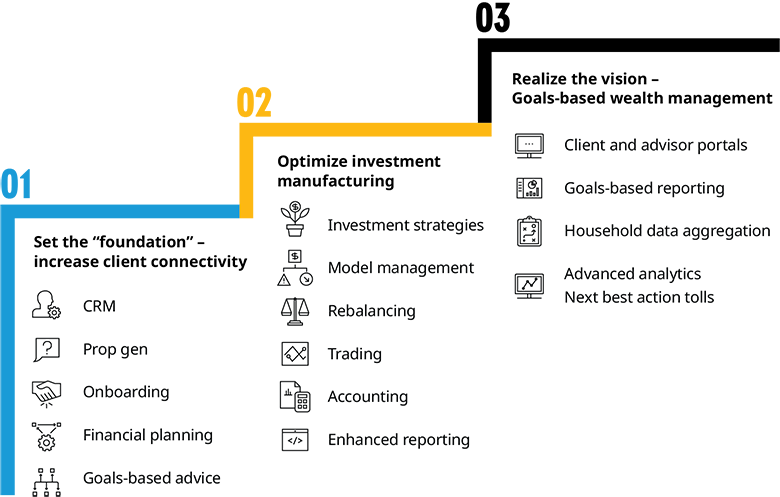

A traditional approach for creating an integrated business and technology roadmap groups projects into a series of initiatives that push out the boundaries of a firm’s capabilities in a logical sequence, recognizing the business, branding and organizational changes that all must take place alongside the platform buildout. The exhibit below shows a typical approach for wealth managers striving to deliver goals-based wealth management.

- The first phase is focused on re-positioning advisor capabilities, deepening client relationships and expanding the firm’s brand for what it can do well.

- The second phase seeks to build upon planning and goals to implement customized client solutions from standardized parts at scale using home office and/or third partydeveloped investment models.

- The third phase delivers goals-based wealth management by integrating all of the capabilities needed to provide ongoing feedback on a client’s progress towards goals and identifying corrective actions.

A key issue with this approach is that it fundamentally takes too long. Many wealth managers are stuck in the third phase and struggling to bring it all together. A better approach is to rapidly put in place a complete set of end-to-end capabilities with Minimum Viable Solutions as needed for the most important clients (and associated Personas) and the most important Client Journeys. Then, systematically make them better and scale. The exhibit below illustrates an alternative, agile-based technology roadmap.

Combining a client-first approach with an agile delivery model affords a number of benefits:

- Get to market sooner.

- Build specialization and expertise around issues that matter for specific target Personas / journeys.

- Rapidly test and learn, making future releases better, and strengthening market positioning.

- Improved ability to react to changes in the market and competitive environment

- Lower overall development cost from increased focus and elimination of throw-away work from missed business requirements.