While the possibility of an aviation mechanics’ shortage has been discussed for years, the industry in North America is finally expected to face one in 2023. The wave of aging baby boomers and not enough Generation Z workers are being felt in yet another labor sector.

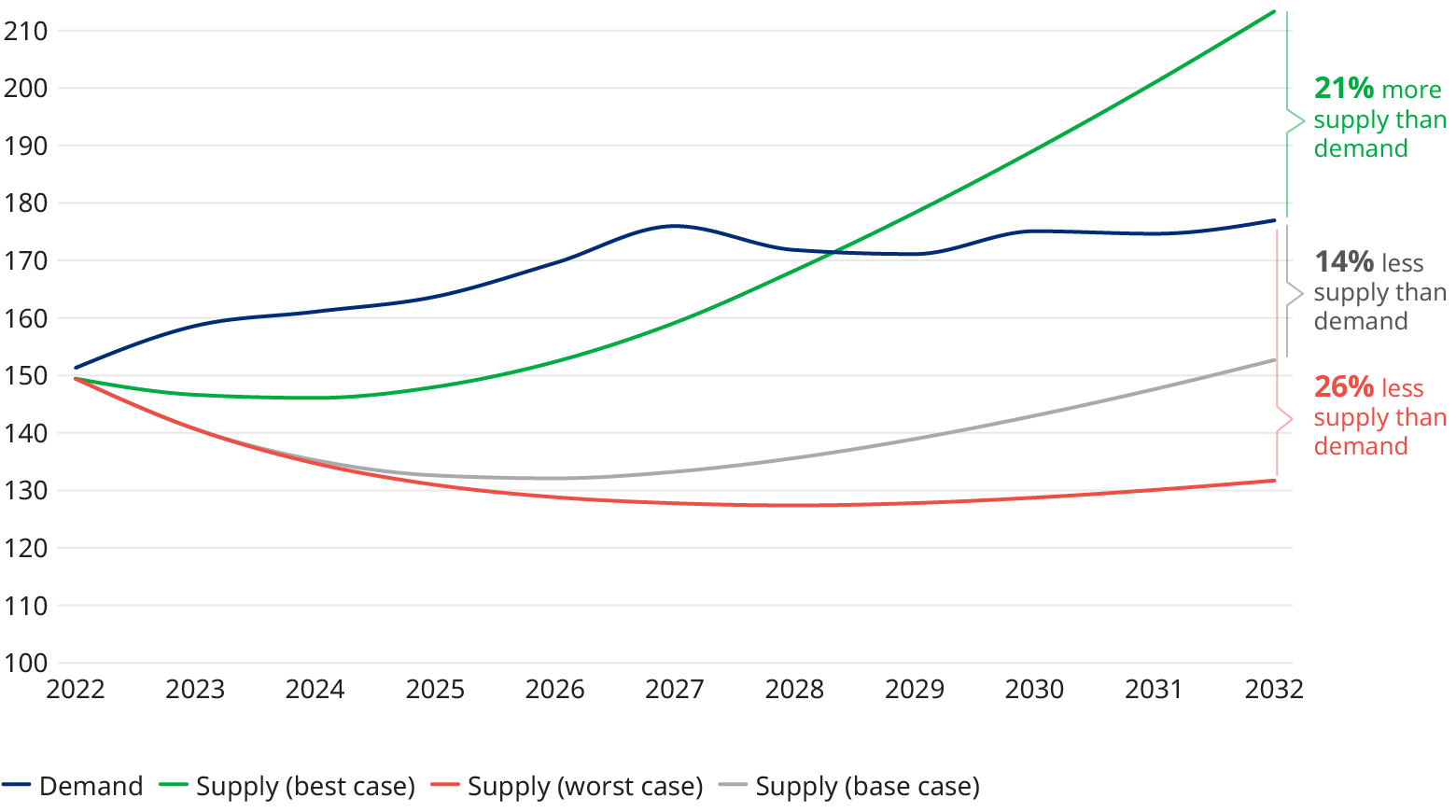

Looking at licensed and unlicensed labor working on aircraft and in the backshops and the anticipated demand for maintenance, repair, and overhaul services, we anticipate a shortfall of somewhere between 12,000 and 18,000 aviation maintenance workers. The imbalance between supply and demand will persist and even worsen over the next 10 years. It is likely to result in fewer flights and delays and cancellations, or airlines having to compensate by keeping more spare aircraft and parts on hand.

By 2027 — projected to be the worst year for the shortage — the bleakest scenario has the supply deficit at more than 48,000 aircraft maintenance workers, or a shortfall of about 27%. Our more likely scenario predicts a gap of almost 43,000, or more than 24%.

The projected shortage is based on responses to an Oliver Wyman survey from companies in the maintenance, repair, and overhaul (MRO) segment of aviation. The survey included questions about the age demographics, expected retirements, and hiring trends for their workforces. We also used government data from the Federal Aviation Administration (FAA) in the United States and Transport Canada. The data was then leveraged to create multiple forecast scenarios of how the industry might look over the next decade. Additionally, we incorporated analysis on growth in the size of the fleet and MRO spending from Oliver Wyman’s Global Fleet and MRO Forecast 2022-2032.

The impact of aviation staff shortages

The pain from the shortage will affect everyone in the industry from the smallest MRO to the largest airline. Still, no matter the size of the shortage, independent MROs and regional airlines will likely feel the effects the most. Historically, independent MROs and regionals serve as an entry point for mechanics, many of whom eventually move on to work for major airlines.

The shortage is already pushing up wages and will likely continue to put upward pressure on them, which will ultimately make the profession more appealing. While airlines and independent MROs can’t do much more over the short run to avert a shortfall entirely, there are some changes in the way mechanics are trained, employers provide support to wannabe mechanics, and the overall industry culture that could help attract more younger candidates now.

One of the most promising options for employers over the decade is to nurture an expansion in the pool of mechanic candidates. Currently, most mechanics are white and male. For instance, only 2.6% are women. The aviation industry needs more outreach to female and minority populations, even as young as those still in middle school, to educate them on the career possibilities.

Modernizing aviation professions is a must

In addition to diversity, the industry also needs to work with the FAA to incorporate more cutting edge technology into the training, including artificial intelligence, virtual reality, and drones to make the profession more engaging for Gen Z workers.

Bottom line: Mitigating the labor shortage may require companies to go a little outside their comfort zone and essentially establish a new working relationship with mechanics. Read the full report to get details on the various shortfall scenarios and potential solutions available to the industry.