Oliver Wyman forecast in early 2021 that an impending pilot shortage was on the horizon. This was contrary to reality at the time, as COVID-19 was decimating the airline industry and any recovery appeared years away.

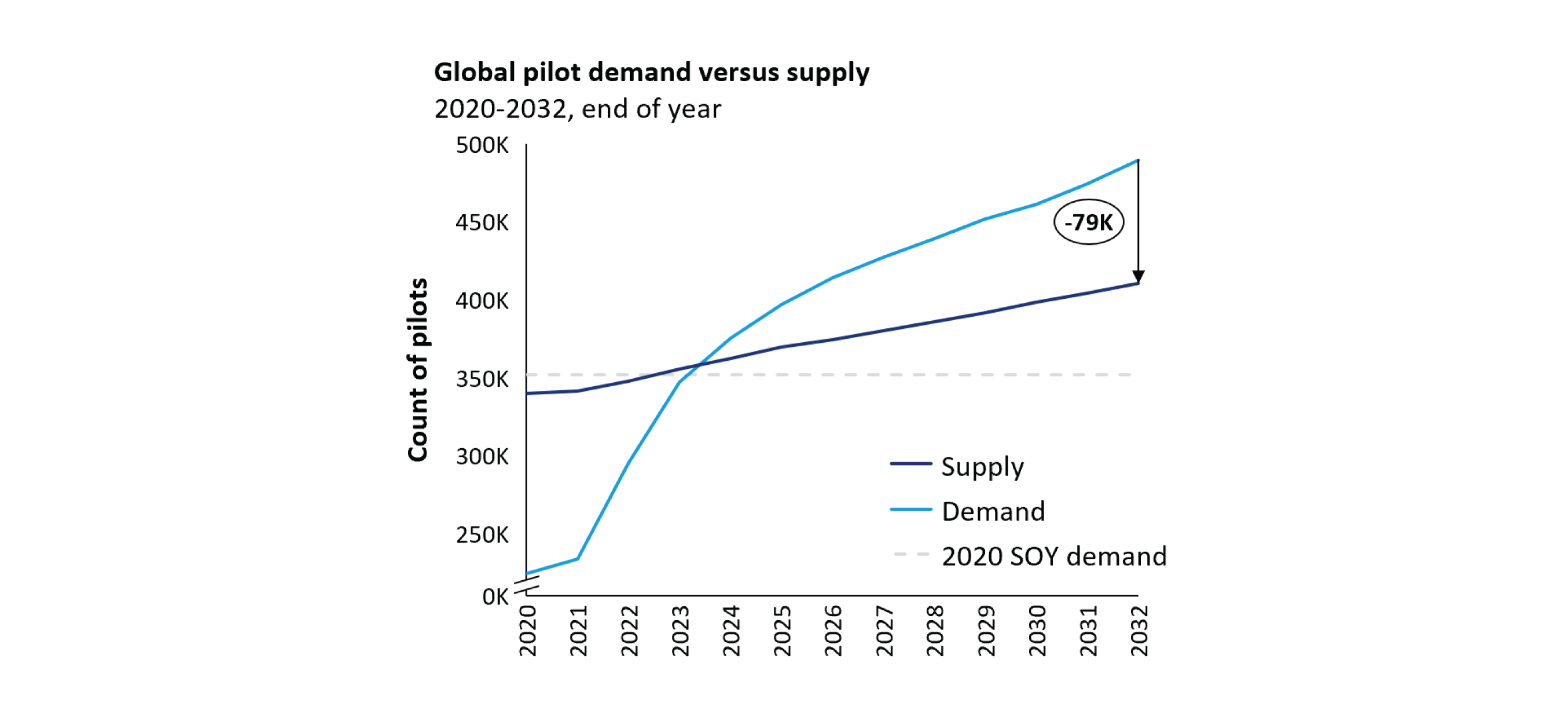

But as air travel demand continues to recover in 2022, our most recent forecast now projects that demand for pilots will outstrip supply in most regions globally between 2022 and 2024 — and continue to worsen over the next decade.

We now expect global aviation to be short nearly 80,000 pilots by 2032, absent a downturn in future demand and/or strenuous efforts by the industry to bolster the supply of pilots.

North America’s Big Gap

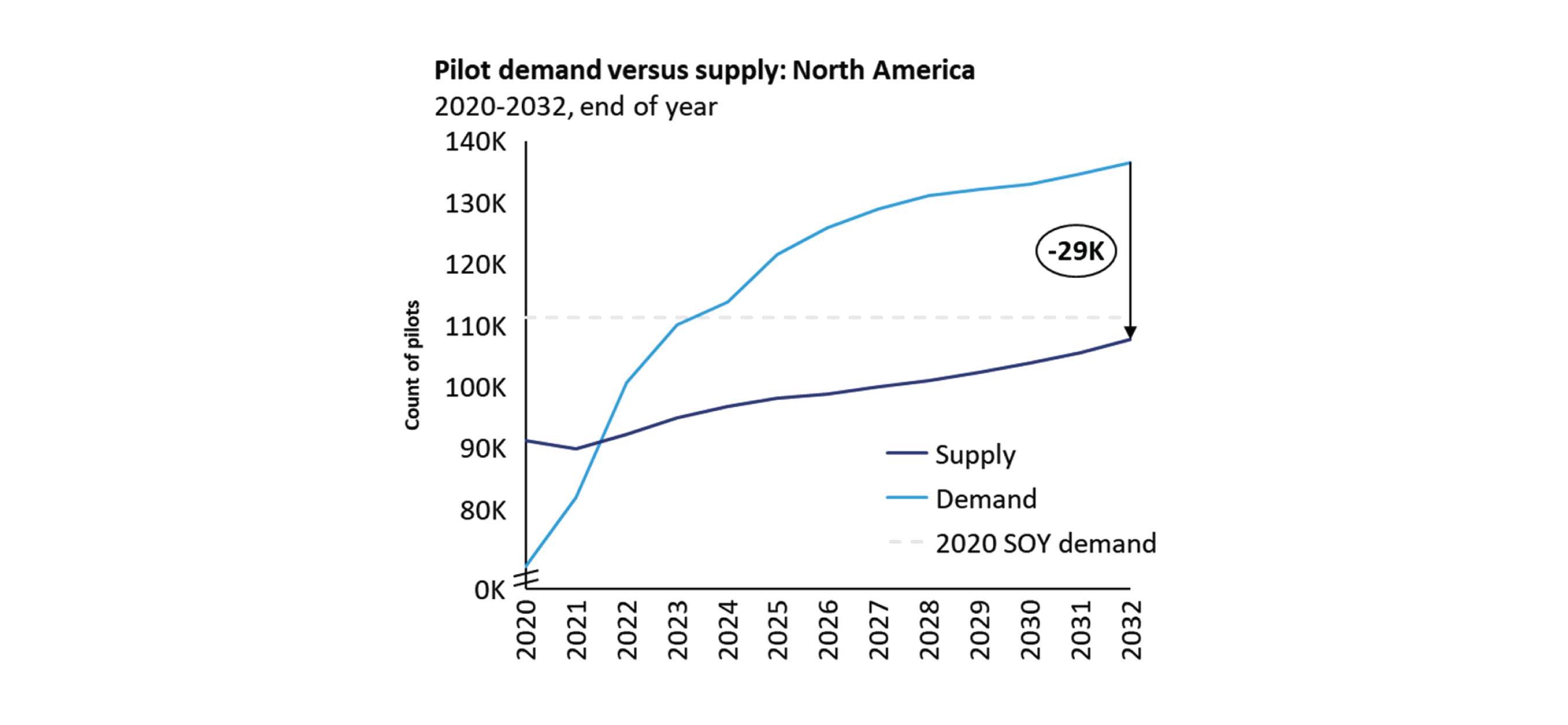

With the lifting of COVID-19-related sanctions on air travel, demand rebounded more quickly in North America than elsewhere. As a result, the region already has an acute pilot shortage, equivalent to 11% of pilot supply, or about 8,000 pilots, and this gap will only widen throughout the decade.

As the recovery continues to expand, the supply of pilots is being challenged by multiple factors, including a wave of early retirements at the height of the pandemic, a mandatory retirement age of 65 for a workforce that is older than the broader workforce, a shrinking pool of potential pilots from the military, and a tough value proposition for perspective candidates outside the military. In addition, a significant training bottleneck is hampering recovery efforts, as the number of pilots that airlines must train at present is much larger than the historical norm.

The supply of new commercial pilots is expected to pick up over the next few years. But under current conditions, it doesn’t look like this will be enough to cover increasing demand and the bow wave of retirements the industry will face over the next decade. As a result, we expect that North America will be short nearly 30,000 pilots by 2032.

The pilot shortage in North America is expected to hit regional airlines the hardest, especially those not affiliated with mainline carriers and flying smaller 50-seat aircraft. While regionals normally supply pilots to mainline carriers, they are now experiencing unsustainable attrition levels — after bearing the costs and time of training. Regionals are also paying higher salaries to keep pilots — a blow to their smaller operating budgets and thinner margins. If regionals are unable to recruit and retain enough pilots, they may face the need to ground aircraft and fly reduced schedules or routes, with the most impact felt by smaller communities.

Other Regional Trends

We expect the Middle East to be the region affected soonest by the shortage outside of North America, driven by a projected sharp increase in air travel demand over the next few years. The region could face a shortage of 3,000 pilots by 2023 and 18,000 by 2032.

Europe currently is in surplus and we expect it to remain so until the middle of the decade, but then forecast a shortage of 19,000 pilots by 2032, driven predominately by increased demand.

Asia currently has a surplus of pilots as well, mainly due to the impacts of COVID-19 restrictions on demand, but we anticipate that Asia will begin to see a shortage of pilots toward the end of the decade as demand growth resumes.

Only two regions are unlikely to see a growing shortage of pilots over the decade: Demand is not expected to outpace supply in Latin America, and a small shortage of pilots in Africa is expected to shrink over the decade, as pilot availability increases.

Special thanks to contributors: Daniel Rye, Jeff Green, and Lindsay Grant.