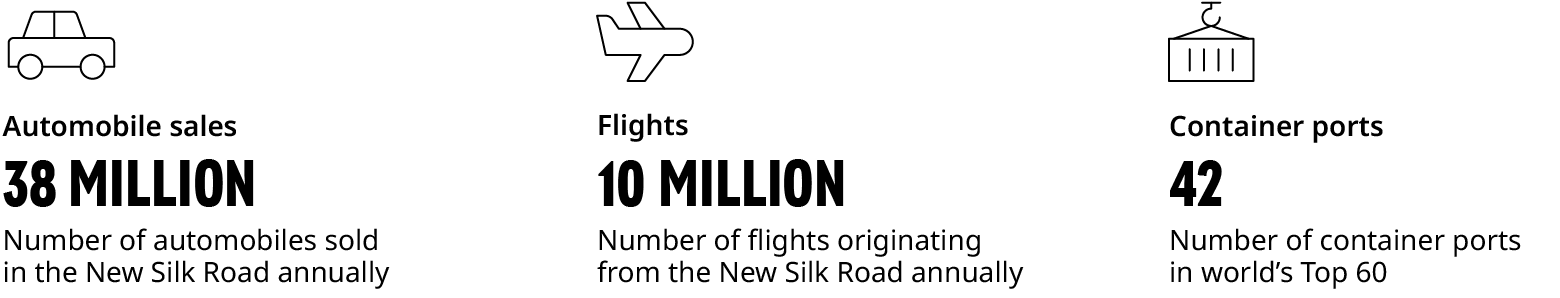

Mobility and transport are central to the growth trajectory of the New Silk Road in the coming years. Cumulatively, Asia and the Middle East have more than 700 cities with populations greater than half a million people. They are also home to half of the world’s busiest airports, and 42 of the world’s 60 largest container ports.

Moving people and goods, whether by rail, road, or air, is a pressing challenge for governments and an opportunity for investors. Fortunately, the region is a mobility innovator, from electric vehicles (EVs) to ride-hailing services. It also has a robust track record with regard to disrupting transportation, from aviation to high-speed rail networks.

However, densely populated cities, shortfalls in government funding, and weak policymaking could result in widening gaps between countries and cities that are quick to adapt, and those that react more slowly. For the latter group, the impact on economic growth could be significant.

Four exciting opportunities in mobility and transport sector

High aviation ambitions

The New Silk Road is investing heavily in new airlines and airports. Opportunities abound, but consolidation is also a possibility.

The pandemic has challenged aviation globally, and the focus is currently on adding flights and improving operational efficiency. In the first half of 2023, the region’s international flights were at about 82% of the levels recorded in 2019. However, opportunities exist for tighter collaboration, as companies seek to capitalize on intra-regional connectivity and growing passenger numbers. More than 78% of the region’s international flights are destined for other New Silk Road countries, and the competition is fierce.

Consolidation opportunities may also present themselves if, in certain cases, capacity has grown too fast and financial positions are now stressed. Saudi Arabia’s ambitions as an international aviation hub, together with increased investment by India’s private airlines, is illustrative of the pressures, especially given that the aviation routes between India and the GCC countries already see significant amounts of travel. Asia's busy intra-regional routes are another point of pressure.

A global EV trendsetter

The region’s scale and ambitions will shape the global EV sector, from scooters to cars, and China and India are in the driving seat.

The EV sector is growing globally. However, the New Silk Road is unique, in part, because of its scale. China’s EV brands and exports have reshaped the global automotive industry. The rapid growth of two and three-wheel EVs in India promises a different revolution, uniquely suited to many of the region’s more congested cities. Indonesia’s ambitions may have a similarly outsized impact on the region given the country’s scale, from batteries to EVs.

The GCC countries’ EV strategies are ambitious, but also aligned with Asia’s aspirations. Without a local automotive sector to protect, the region is more open to both imports and investments from Asia. The Middle East may even capture small parts of the supply chain, particularly with regard to the export of products to the rest of the region or Europe. Look for the Middle East’s connectivity with Asia’s supply chain to be especially strong.

Mobility services and innovation

The New Silk Road will be a source of local innovation in mobility services, providing an attractive alternative to capital-expenditure-heavy public transit investments.

The need for resilience is driving the relocation of supply chains to countries such as Vietnam, Indonesia, Morocco, and Turkey. However, this requires significant investment in the region’s transport infrastructure, especially ports. At the same time, the GCC countries are investing heavily in the expansion of their rail networks and ports, with participation from Asian players, to support the localization of the region’s manufacturing and supply chains.

The private sector will play a key role in the financing and construction of such investments, such as the participation of DP World in Indonesia. Public-private partnership (PPP) laws have improved steadily over the past decade in many New Silk Road countries, particularly since the COVID-19 pandemic, with these countries’ governments being unable to fully fund new infrastructure projects. Private capital will fill this gap, with pan-regional players, alongside global ones, being well-positioned to capture the rising opportunities.

Freight infrastructure in growth markets

The relocation of supply chains outside of China will require heavy investment in air, rail, and sea transport infrastructure across the rest of Asia and the Middle East.

Building public transit infrastructure in the region’s high-density cities will be challenging. Subway systems cannot be constructed fast enough to keep up with the rising demand. Therefore, it is more likely that we will see explosive growth in mobility services, from ride-hailing and ridesharing, to docked e-scooters, to on-demand bus pooling. None are fixes for already-congested cities. However, they provide easier solutions for cash-strapped governments seeking to transport large numbers of people.

China, India, and Indonesia are countries to watch. Nevertheless, there will be no single template for the region, as each country faces unique conditions. Cities such as London and New York are likely to grab media headlines but watch out for innovation in unexpected places across the New Silk Road’s more than 700 large-sized cities. Micro-mobility solutions, for instance, already exist regionwide, from Cairo to Bangkok, and Dhaka to Manila, but often fly below the radar.

This article is part of our New Silk Road series