Top-line revenue growth is such an important value creation lever for financial sponsors throughout the holding period of an investment. We have found that pricing can often drive double the impact on profitability, as much as 2-5 points of incremental EBITDA in many cases, when compared to similar cost reduction efforts. And given that valuations continue to rise in some sectors, sponsors are looking for additional certainty around growth prospects and justification to support higher bids. This is why so much effort is spent thinking deeply about potential growth during due diligence of a potential target company. Commercial due diligence will typically include assessing the size of the addressable market, industry growth trends, the competitive landscape, the target's positioning in the market, and other factors influencing the market opportunity's attractiveness. Sponsors also dissect the target's management growth plan and will build their growth and cash flow models with their own underlying assumptions. But what is often missed or examined less closely is the target's commercial engine, which is critical to driving the expected growth or the potential upside from addressing any cracks in the commercial foundation.

While there are many growth-related levers for most businesses, sponsors often find significant value in more deeply understanding the existing capabilities and potential upside around the go-to-market model and pricing – two levers that are critical to capturing market opportunities and driving profitable top-line growth. This involves answering a number of key questions.

Go-to-Market Model Related: Does the target have the right go-to-market model and capabilities necessary to capture the market growth opportunities? Is there a clear, reasonable commercial strategy, for example, target segments and customers, in place? And how well does the existing go-to-market strategy and organization align with identified opportunities? How effective is the business at further penetrating existing customers and winning new ones? How does this differ by segment and offering? Does the target have the right institutional capabilities, such as processes, tools, data, and reporting, enablement functions, including lead generation and marketing, and sales management required to realize identified opportunities? Does it have the ability to scale up its commercial team, for example, recruiting, hiring, and onboarding, to better capture market opportunities? What is the potential upside from closing the go-to-market related gaps and improving the commercial team's performance?

Pricing Related: How much pricing headroom exists, and what is the level of confidence in its ability to capture the upside based on current pricing capabilities such as, pricing strategy, process, organization, tools, controls, and measurement? What is the current pricing model? How much pricing power does the target have in the market? What role does price play in the buying process? How is the target positioned relative to the competition on key buying factors, including price? How much pricing headroom and upside exists for the target based on industry pricing trends, competitive positioning, perceived pricing power in the market, current price points, and historical pricing performance?

Why is this deep exploration of the commercial engine so important in diligence? There are at least four primary benefits.

Despite the continuing impact of COVID-19 on the economy, valuations remain high, and sponsors are looking for justification to support higher bids. There is growing comfort around incorporating pricing upside into an investment thesis as one such form of justification.

The “peek under the hood” of the commercial engine can provide the needed confidence in the target’s management team and commercial organization to execute against the identified market opportunities and growth plan.

A byproduct of the high valuations is that deals are, by definition, priced to perfection. This means that it is critical to start addressing the growth opportunities early in the holding period and not waiting for a disappointment in year two or three. Identifying the opportunities in diligence allows sponsors to incorporate them into the value creation plans and start addressing on day one.

When it comes to growth, time can be both a friend and a foe. Early actions allow for maximum time to implement and to capture growth. While delays only limit the options. Some growth levers such as geographic expansion or transforming the go-to-market model become more difficult to address later in the holding period. The delayed growth also impacts valuations at exit.

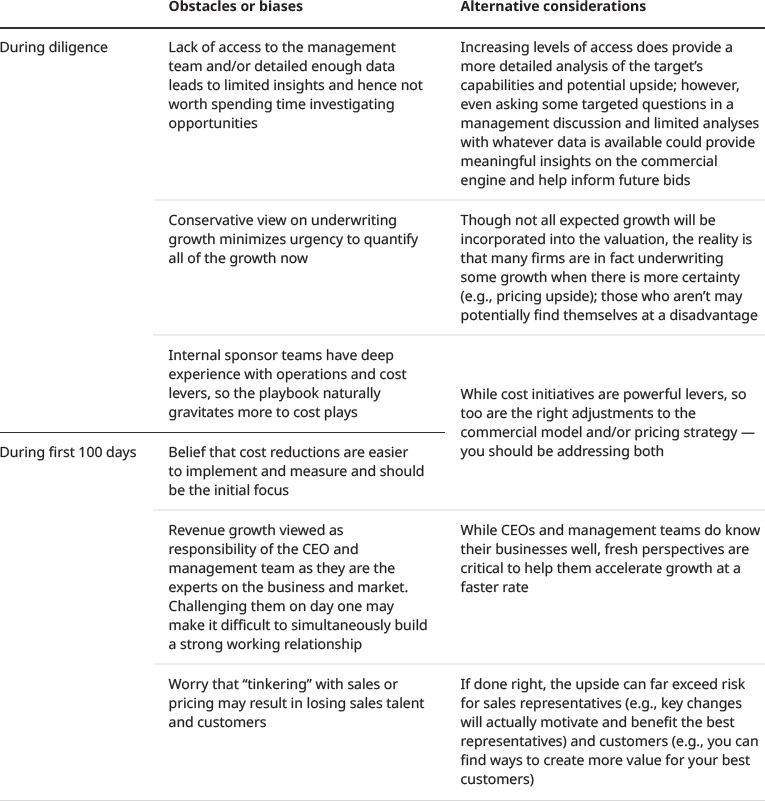

So if revenue growth is so important and it is often top of mind for financial sponsors, why isn’t more time spent addressing it earlier in the process or investment? The answer is a combination of real and perceived obstacles as well as inherent biases.

Exhibit 1: Why isn’t more time spent addressing revenue growth earlier in the investment process?

Every financial sponsor may have a slightly different playbook for how and when they uncover and address top-line revenue growth opportunities. Some will incorporate this as part of their standard diligence process and routine input into their investment committee decisions. Others may opt to wait until the deal has been finalized before beginning to identify potential growth opportunities. What is most important is to start early and be disciplined in ensuring maximum value creation throughout the holding period and maximizing exit multiples and valuations.