This article was first published on May 29, 2020.

COVID-19 is expected to wipe out US$60 BN of the largest global apparel market this year

That COVID-19 has an enormous impact on the global fashion industry is well-known, the full year magnitude of this impact and the road of recovery however is still unknown. As China is leading the recovery with all stores open again and very few local cases, we asked Chinese consumers about their shopping expectations for the rest of the year to predict the full year recovery path.

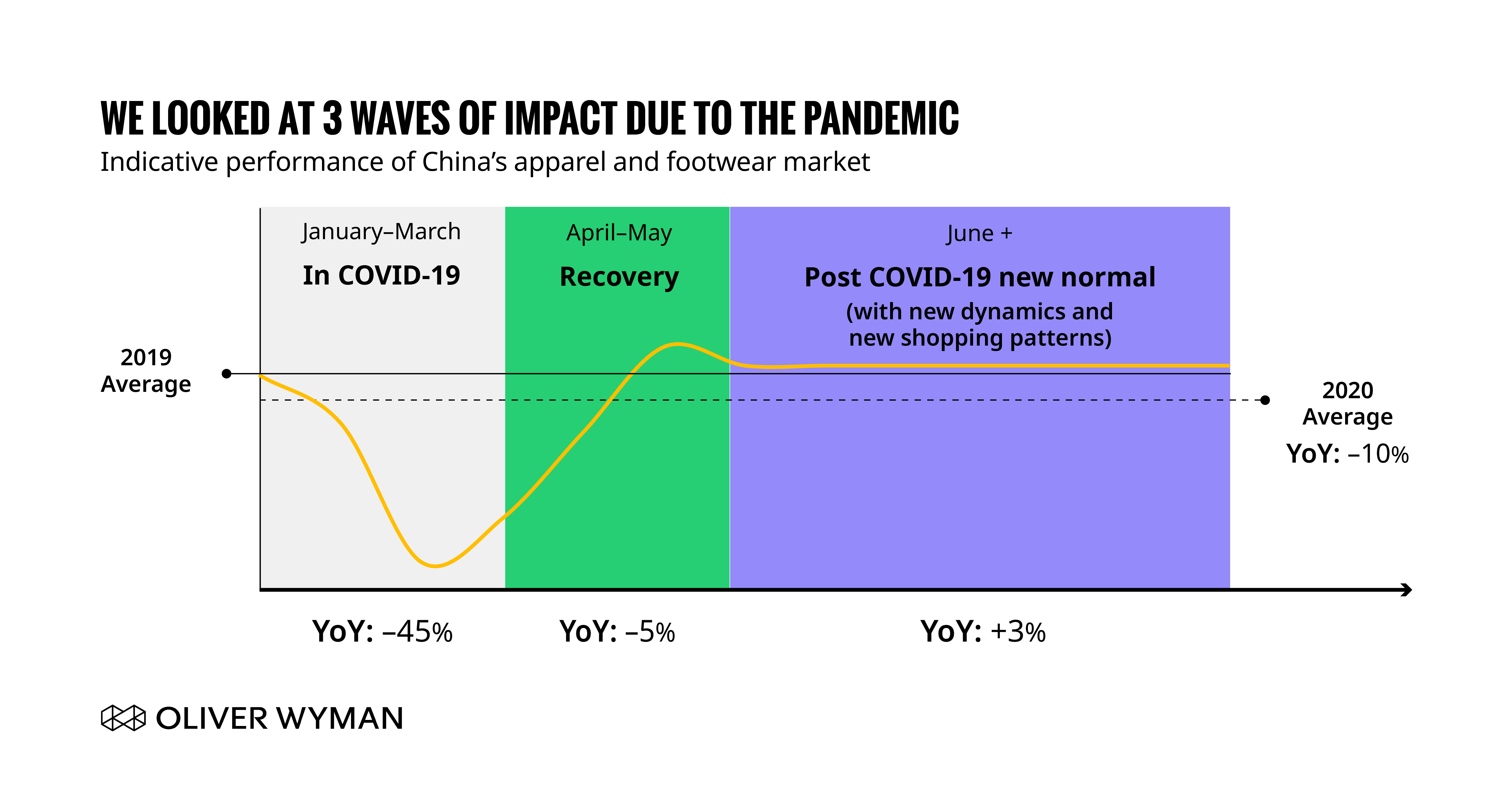

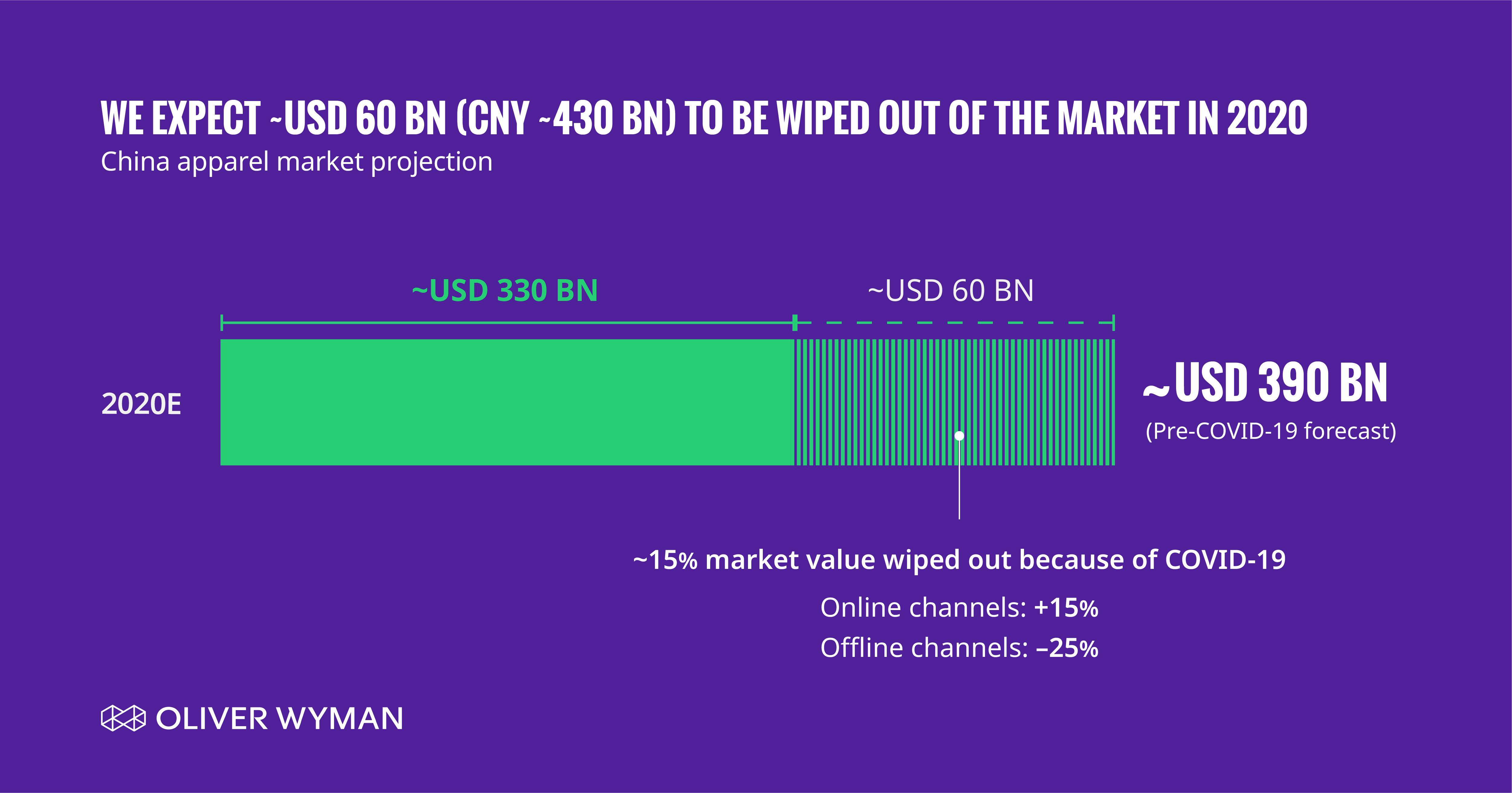

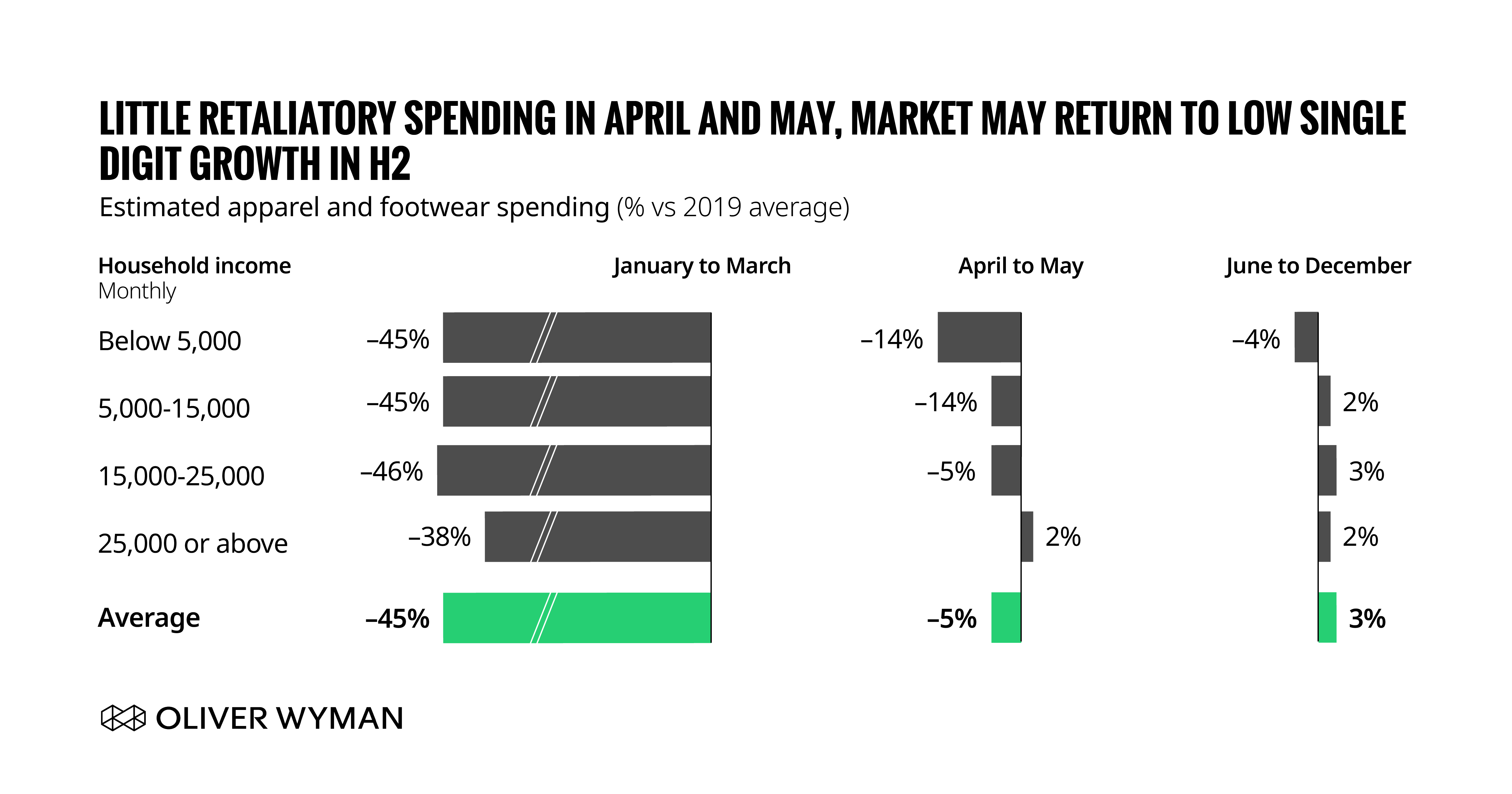

Recovery but no real rebound

The good news is that it will get better, and the largest global apparel market is expected to go back to some growth in the second half of the year. But, as rebound is very limited, full year impact is still very significant after a 45 percent decrease in spending in the first quarter, and we expect US$ 60 BN to be wiped out for the full year (US$ 330 BN instead of the pre-COVID forecast of US$ 390 BN). May is showing the first signs of a real recovery with a small rebound, and for the remainder of the year consumers expect to spend slightly above what they spent in 2019.

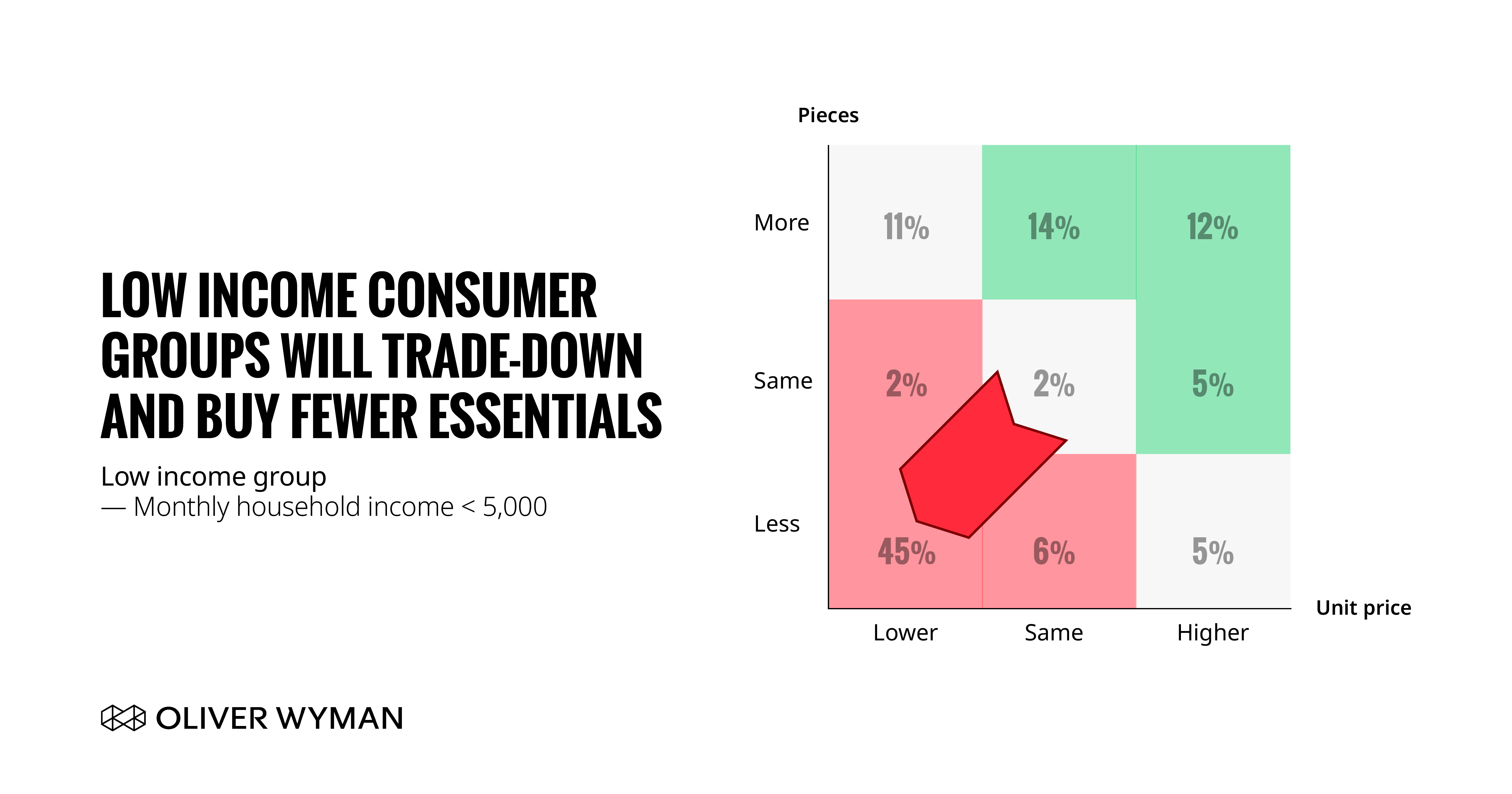

Spending gap between lower and higher income groups is widening

The lowest income group will continue to spend less on apparel and footwear for the rest of the year, as they plan to buy less items for lower prices. More than 70 percent of them prefers to buy products which are of high value-for-money and more than 60 percent prefers to buy essentials only. Brands catering to this group will need to review their assortment focusing more on basics and core products against attractive prices. In the high-income group on the other hand, we still see trading up with as many respondents going for higher quality and functionality as for higher value for money.

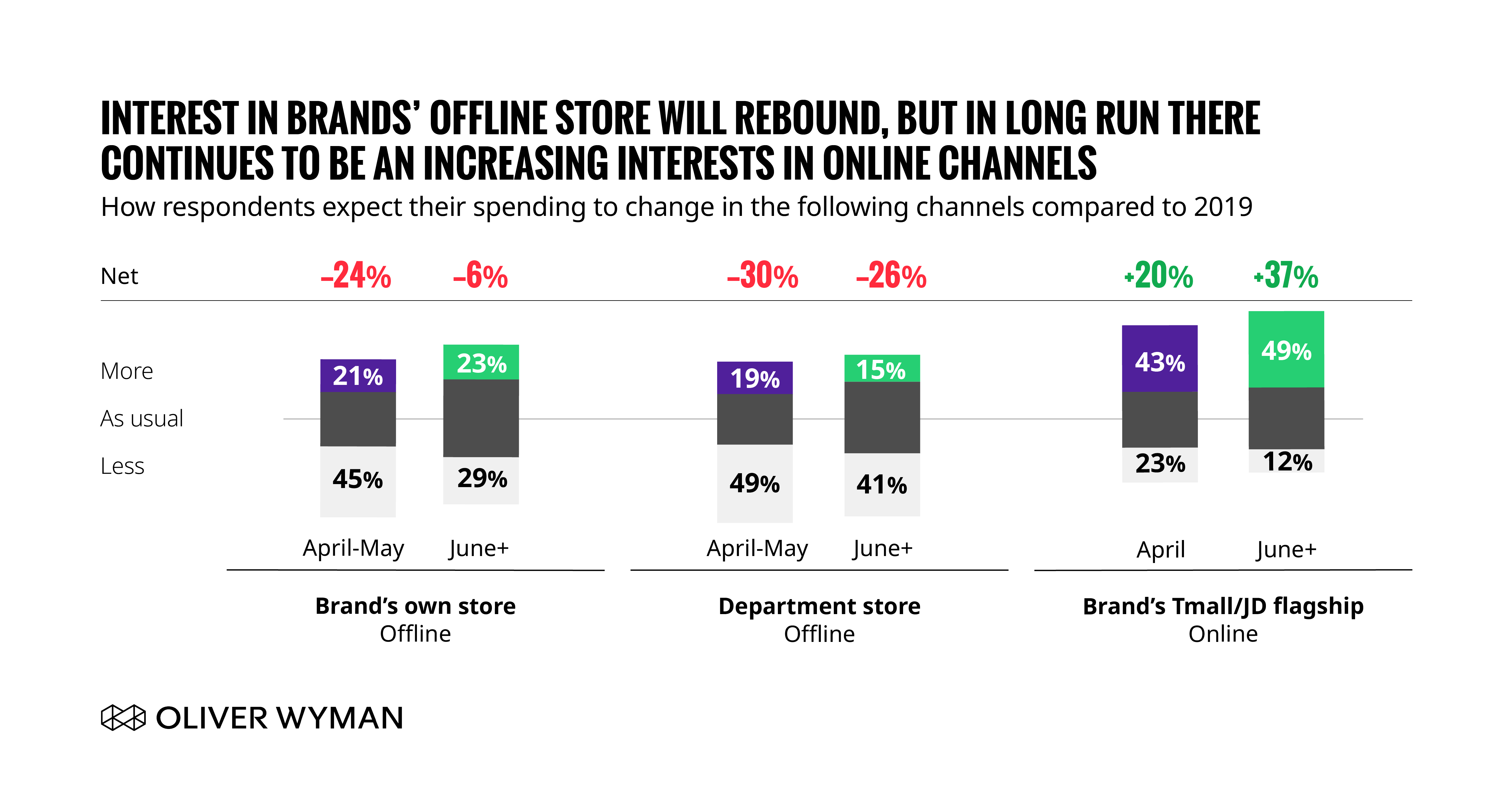

Offline is getting a double hit

Offline was already suffering from the increasing share of online, growing only at 2% from 2017 to 2019, and this trend has only been accelerated because of COVID-19. For the full year we expect a 25 percent decline in the offline channel while we still expect a growth of 15 percent for online. The biggest shift will be with the high-income group, which jumped from the lowest to the highest online spending during the outbreak, with 64 percent of their spending made online.

A quarter of offline sales lost will have a tremendous impact on store profitability and retailers will need to make significant changes to their store footprint. Department stores will continue to struggle the most with less and less consumers going to department stores to shop. Brands need to decide whether they still see a role for department stores going forward.

Offline will continue to play a role but needs to be re-invented

The fashion journey remains a multichannel journey and although we have seen more pure online shoppers during the outbreak, their share will remain low at less than 10% going forward. Brand’s own stores have a clear role to play but the bar to draw in traffic has increased. Not surprisingly, being able to feel, touch, and try on products as well as quality assurance are the key reasons for shopping offline. But, that won’t be enough to continue to draw in traffic as consumers become more interested in expanded retail experiences based on technologies, exclusive projects and personalized services. Personalization is an often-used buzz word so we asked consumers what personalized services they are expecting in an offline store, and almost 40% of them said they want personalized fashion advice, even more so in lower tier cities. Consumers want to have what they can’t get online, and retailers will need to treat stores more as a fashion service hub than a sales channel.

General apparel players can look at the leading sportswear brands for inspiration as their offline channel has been and will continue to be more resilient. Uniqlo, Nike, and Adidas are seen as having the best offline store experience, and store service levels are a key driver of that.

Apparel players should protect 2020 while preparing to come out as a winner

It will be a rough year for the global apparel industry and also for China, but to come out of it as a winner, apparel players need to act now. Minimize the losses for 2020 while preparing to start 2021 much stronger. Make the much-needed short term changes to store networks keeping the future plan in mind. Optimize the assortment for the short term to protect sales and margins, while rethinking the what the distinct proposition will be for the future. Manage short term cash, while redesigning the operating model for the future.