U.S. railroads risk falling behind the rest of the world when it comes to incorporating innovations that would let them keep up with dramatic transformations in energy and digital technologies. Once industry leaders, they find themselves today behind counterparts in Europe and China, as well as rivals in the trucking industry, because they need to invest more in new technologies and move faster to adopt them.

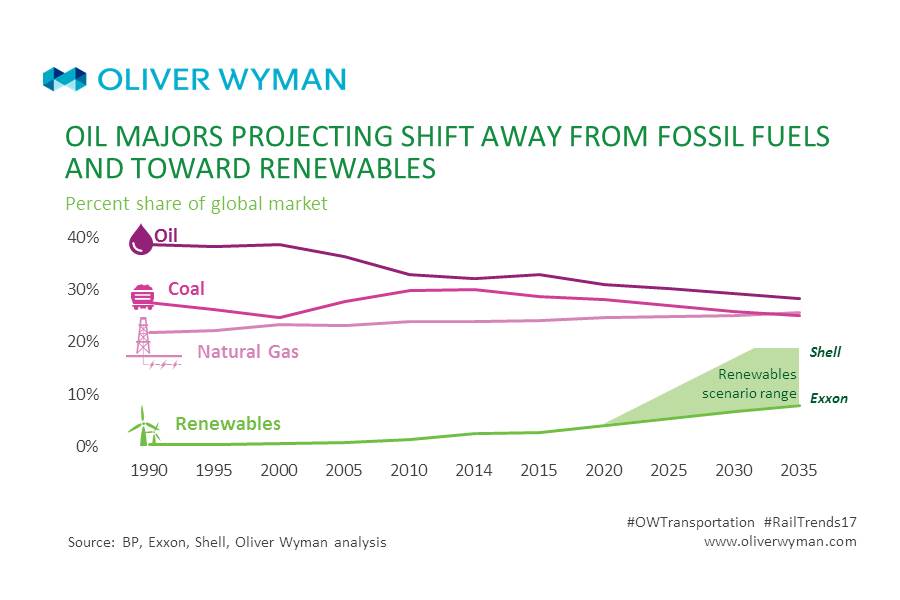

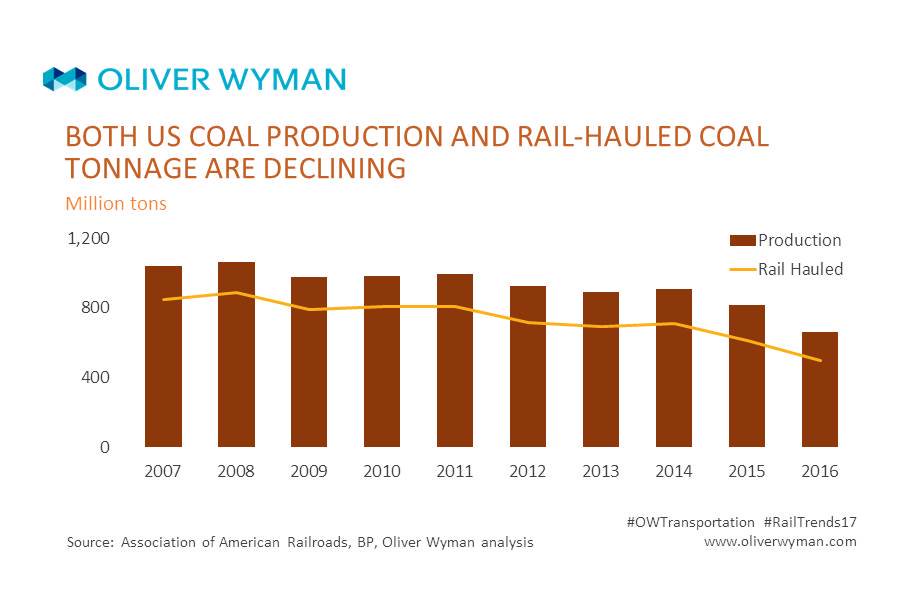

The disruption in rail started with the global move away from fossil fuels. Although it began gradually, the move to renewables has picked up speed in recent years and has started having an impact on rail. Take reduced coal usage. By 2016, the amount of coal hauled by railroads was already half of the one billion tons carried less than a decade before in 2008. And with one kilowatt hour of electricity produced by solar or wind power now costing less than three cents, the move away from fossil fuel will only accelerate. Even major oil companies like ExxonMobil, Shell, and BP are recognizing the trend in their projections.

Where more than one quarter of railroad revenue came from the shipment of coal in over a decade ago, that percent dropped to 13.6 percent in 2016. The steady decline appears structural and is unlikely to reverse or even plateau over time.

Besides advances in renewable technologies, the disruption in rail transport is also being driven by progress on a multitude of additional tech fronts, including improvements in battery storage, expanding Distributed Energy Resources (DERs), growing reliance on artificial intelligence, and the expansion of the Internet of Things, and development of distributed ledgers through blockchain technology.

Advances in battery technologies, for instance, provide a great example of progress U.S. railroads should seize upon but thus far haven’t. Just as the adoption of diesel over steam almost doubled the energy efficiency of locomotives, lithium batteries could nearly triple the progress diesel achieved. European light rail and commuter rail, in contrast, are already running trains on battery technology.

In the United States, railroads have 36,000 locomotives—only 12 percent of which represent the latest technology available when it comes to electronic devices that help guarantee maximum efficiency. The average age of the engine fleet is over 20 years old, with some from as far back as the 1950s, and still runs primarily on diesel. Compare that to the rest of the world with close to 217,000 locomotives where electrical power overwhelmingly dominates and new technologies have been much more widely adopted.

More critically for rail, the worldwide truck fleet—24 million units with a renewal rate of three to five years is pushing rapidly toward electric vehicles, with Tesla, Mercedes, and several Chinese manufacturers, among others, already introducing models. The federally subsidized SuperTruck program produced 21 new technologies for trucks, and SuperTruck II promises many more.

There’s no doubt that rail is at a tipping point with the current business model, where it’s a question of invest and innovate or retrench and shrink

Just as important, rail is increasingly disconnected from the trends spurring economic growth. Where e-commerce and increased customization and customer options are leading to increasingly smaller shipments with shorter delivery times, U.S. railroads are moving in the opposite direction—pushing for longer trains, bigger shipment sizes, and fewer scheduled departures per week, making it difficult for rail to compete for more service-sensitive offerings in the current retail environment.

Likewise, rail is also heavily dependent on certain commodities where tonnage has been on the decline, such as grains and of course coal.

There’s no doubt that rail is at a tipping point with the current business model, where it’s a question of invest and innovate or retrench and shrink. Like other industries, it faces major shifts in lifestyle, such as urbanization, global mobility, and manifestations of the sharing economy. While these are dramatic, they also could in fact work in the industry’s favor with the right strategies.

To date, the industry has been slower than other parts of transportation to embrace digitalization and artificial intelligence as well as new fuel technologies and autonomous functions. This contrasts to the past 20 years where technology adoption by rail led its competitors. It’s time for U.S. railroads to recognize the tech successes some of their counterparts and competitors in other parts of the world are achieving and either get on the train or get hit by a truck.