This is the first of our series Thinking Retail: A Hard Discounting Journey. This Oliver Wyman series presents a monthly snack-sized idea related to the overall theme of hard discounting in the US.

The conventional industry wisdom is well established on who shops for food at hard discounters – it is the economically challenged consumers who need to make ends meet and feed themselves and their families. Unfortunately for food retailers, this is a myth, as it ignores the reality that a much broader range of retailer’s primary customers are already shopping at hard discounters.

The food shopper data Oliver Wyman have collected over the past several years reveals three aspects of those who shop at hard discounters.

Consumers are multi-shopping > shoppers have a demonstrated trend of shopping multiple locations to satisfy their food shopping needs. The close to monogamous customer loyalty supermarkets enjoyed decades ago has now morphed into a customer who chooses to shop on average at 4.5 different stores. When a hard discounter enters your catchment area, you can expect your shoppers will consider trialing their store.

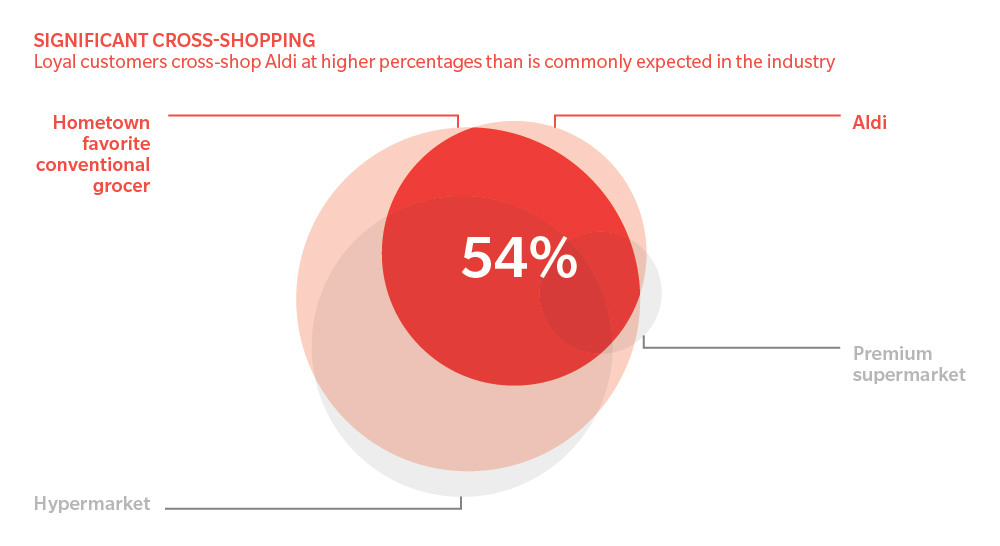

Beyond economically challenged > the image of jalopies filling the parking lot of hard discounters has given way to a variety of used and new cars adorning these same spaces. We are measuring cross-shopping rates of over 50% for an established supermarket’s customers. (see figure) This disproves the assumption that hard discounters only serve the economically challenged.

One-way and growing flow of spend away from incumbents > hard discounters have a powerful offer (which will be explored in several of the emails in this series) which has proven to both lure customers to trial their stores and create a set of reasons for them to return. Over time, consumers have consistently shown an increase in their spending at hard discounters.

How much of a threat to incumbent grocers does this shift in consumer spending represent? We will take up that question in the next email in the series, What are the dimensions of the hard discounter threat?