This is the second of our series Thinking Retail: A Hard Discounting Journey. This Oliver Wyman series presents a monthly snack-sized idea related to the overall theme of hard discounting in the US.

Aldi and Lidl have been successful at exporting their format in over 20 countries – a rare feat in retail where even the best retailers have failed entering mature grocery markets. How large a threat do they pose to US grocery retailers?

We have identified three dimensions of the threat in the US.

Loss of market share > Across the globe, Aldi and Lidl represent >40% (Germany) to <2% (US) of the grocery market in each country they serve. The low single digits of US market share are not a substantial threat, however, economic downturns trigger large gains for hard discounters, as Aldi and Lidl have demonstrated in the UK growing from 7.1% in 2014 to their current 10.8% share.

Loss of differentiation > Aldi and Lidl sell over 75% of their own, private label products, compared to many US grocers whose private label sales are between 10 to 25%. As Trader Joe’s and Costco’s strong private label models prove, Americans are open to trying and then preferring private label products including fresh and prepared foods.

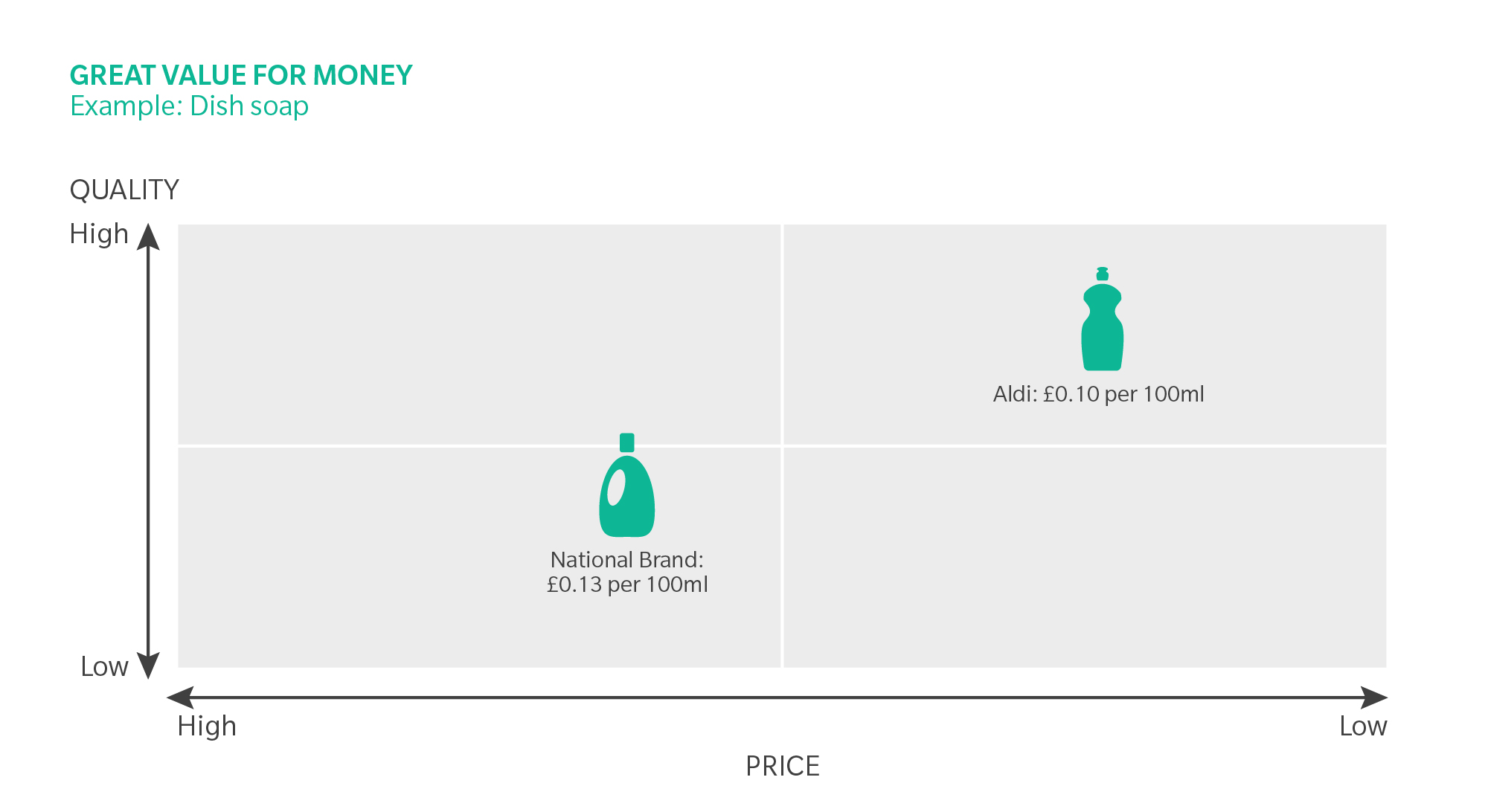

Re-shaping the grocery value proposition > Aldi and Lidl offer equivalent (or better) to national brand quality at considerable everyday low prices. By delivering great value for money, Aldi and Lidl turn their customers into “smart shoppers”. Aldi and Lidl are also innovating (non-GMO, gluten free, etc.) at a fast pace, creating a sense of food excitement.

Putting a sharp point on the risks for US grocers is Aldi and Lidl’s long-term growth objections. Aldi operates 1,500 stores across the country with stated plans for 500 more and Lidl’s US beachhead will be in the Mid-Atlantic and Coastal states, with an opening ambition of 200 stores.

With clearly stated US growth goals and a history of wreaking havoc on national grocery markets, we thought it would be timely to explore next, Why do incumbents fail to defend their markets?